UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-14775

DYNAMIC MATERIALS CORPORATION

(Exact name of Registrant as Specified in its Charter)

|

| | |

Delaware | | 84-0608431 |

(State of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

5405 Spine Road, Boulder, Colorado 80301

(Address of principal executive offices, including zip code)

(303) 665-5700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $.05 Par Value | | The Nasdaq National Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act from their obligations under those sections. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer o | | Accelerated filer x |

| | |

Non-accelerated filer o (Do not check if smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 under the Act). Yes o No x

The approximate aggregate market value of the voting stock held by non-affiliates of the registrant was $292,888,226 as of June 30, 2014.

The number of shares of Common Stock outstanding was 14,146,109 as of March 13, 2015.

Certain information required by Items 10, 11, 12, 13 and 14 of Form 10-K is incorporated by reference into Part III hereof from the registrant’s proxy statement for its 2014 Annual Meeting of Shareholders, which is expected to be filed with the Securities and Exchange Commission (“SEC”) within 120 days of the close of the registrant’s fiscal year ended December 31, 2014.

TABLE OF CONTENTS

Explanatory Note Regarding Restatement

In this Annual Report on Form 10-K for our fiscal year ended December 31, 2014, we are restating audited financial statements, including the consolidated financial position as of December 31, 2013 and the consolidated results of our operations, comprehensive income (loss), stockholders' equity and our cash flows for each of the two years in the period ended December 31, 2013. Additionally, the Company has included in Note 13 “Selected Quarterly Financial Data (unaudited),” restated interim financial information for the four quarters included in the fiscal year ended December 31, 2013 and the first three quarters included in the fiscal year ended December 31, 2014, along with reconciliations of the previously issued annual and quarterly financial information to the restated information.

We are restating our financial statements and related disclosures to correct non-cash errors reported in our historical consolidated financial statements related to income tax expense and related deferred tax assets and liabilities at our business entities in Germany as well as other adjustments, which were immaterial. In November 15, 2007, we acquired DynaEnergetics under a newly created German subsidiary DynaEnergetics Holding GmbH (“Holding Co”). Subsequent to the acquisition we recognized income tax expense or benefits for German federal and local income tax purposes and paid cash taxes accordingly for Holding Co. However, we incorrectly had been deferring the recognition of the income tax expense or benefit in our calculation of net income for purposes of U.S. GAAP reporting.

The non-cash impact of the restatement and other adjustments decreased income from continuing operations by $1,036 thousand in 2013 and $919 thousand in 2012. The cumulative effect of the errors increased shareholders’ equity by $237 thousand as of December 31, 2013. The restatement only impacted the income tax provision (benefit) line item in our consolidated statements of operations for the years ended December 31, 2013 and 2012, respectively. The restatement had no impact on the Company’s revenues, did not affect the Company’s cash balances and has no effect on the Company’s future operations.

We also concluded that a material weakness in internal control over financial reporting existed for deficiencies due to insufficient processes and controls around income tax accounting, and that our disclosure controls were not effective solely because of this material weakness. As such, we have modified our discussion of disclosure controls and procedures included in Item 9A and our report on internal control over financial reporting contained in this annual report on Form 10-K to disclose how the restatement affected our chief executive officer’s and chief financial officer’s assessment of internal controls over financial reporting.

We have not amended our previously-filed Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q for the periods affected by the restatement. The financial information that has been previously filed or otherwise reported for these periods is superseded by the information in this Form 10-K, and the financial statements and related financial information contained in such previously-filed reports should no longer be relied upon.

Additional information on the restatement can be found in this report in:

| |

• | Item 1A. "Risk Factors"; |

| |

• | Item 6. "Selected Financial Data"; |

| |

• | Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| |

• | Item 8. “Financial Statements and Supplementary Data”, Note 3 “Restatement of Previously-Issued Financial Statements”; and Note 13 “Selected Quarterly Financial Data (unaudited)”; |

| |

• | Item 9A. “Controls and Procedures” |

PART I

ITEM 1. Business

References made in this Annual Report on Form 10-K to “we”, “our”, “us”, “DMC” and the “Company” refer to Dynamic Materials Corporation and its consolidated subsidiaries.

Overview

Dynamic Materials Corporation operates a diversified family of technical product and process businesses serving the energy, industrial and infrastructure markets. Our businesses operate globally through an international network of manufacturing, distribution and sales facilities.

Today, our business segments consist of NobelClad (48% of 2014 net sales) and DynaEnergetics (52% of 2014 net sales).

NobelClad is a global leader in the production of explosion-welded clad metal plates for use in the construction of corrosion resistant industrial processing equipment and specialized transition joints. DynaEnergetics manufactures and distributes products utilized by the global oil and gas industry principally for the perforation of oil and gas wells.

Our Strategy

Our diversified business segments each provide a suite of unique technical products to niche segments of the global energy, industrial and infrastructure markets; and each of our businesses has established a strong or leading position in the markets in which it participates. With an underlying focus on free-cash flow generation, our objective is to sustain and grow the market share of our businesses through geographic expansion, development of new applications, and research and development of new and adjacent products that can be sold across our global network of sales and distribution facilities. We also intend to explore potential acquisitions of complementary businesses that could strengthen or add to our existing product and service portfolio, or expand our geographic footprint and market presence.

Business Segments

NobelClad

Clad metal plates are typically used in the construction of heavy, corrosion resistant pressure vessels and heat exchangers. Clad metal plates consist of a thin layer of an expensive, corrosion resistant cladder metal, such as titanium or stainless steel, which is metallurgically combined with a less expensive structural backing metal, such as carbon steel. For heavy equipment, clad plates generally provide an economical alternative to building the equipment solely of a corrosion resistant alloy.

There are three major industrial clad plate manufacturing technologies: Explosion Welding, Hot Rollbonding and Weld Overlay. Explosion welding, the technology utilized by NobelClad, is the most versatile of the clad plate manufacturing methods. Created using a robust cold welding technology, explosion-welded clad products exhibit high bond strength combining the corrosion resistance and mechanical properties of the cladder material with the backer material respectively. The explosion-welded clad process is suitable for joining virtually any combination of common engineering metals. This represents a competitive advantage versus the hot rollbonding and weld overlay processes, which generally can only clad compatible metals such as nickel alloys and stainless steels.

Explosion-welded clad metal is produced as flat plates or concentric cylinders, which can be further formed and fabricated into a broad range of industrial processing equipment or specialized transition joints. When fabricated properly, the two metals will not come apart, as the bond zone is generally stronger than the parent metals. The dimensional capabilities of the process are broad: cladding metal layers can range from a few thousandths of an inch to several inches and base metal thickness and lateral dimensions are primarily limited by the size capabilities of the world’s metal production mills. Explosion welding is used to clad a broad range of metals to steel, including aluminum, titanium, zirconium, nickel alloys and stainless steels.

Clad Metal End Use Markets

Explosion-welded clad metal is primarily used in the construction of large industrial processing equipment that is subject to high pressures and temperatures and/or corrosive processes. Explosion welded clad plates also can be cut into transition joints, which are used to facilitate conventional welding of dissimilar metals. The eight broad industrial sectors discussed below comprise the bulk of demand for NobelClad’s products. This demand is driven by the underlying need for both new equipment and facility maintenance in these primary market sectors.

Oil and Gas: Oil and gas end use markets include both oil and gas production and petroleum refining. Oil and gas production covers a broad scope of operations related to recovering oil and/or gas for subsequent processing in refineries. Clad metal is used in separators, glycol contactors, piping, heat exchangers and other related equipment. The increase in oil and gas production from deep, hot, and more corrosive fields has increased the demand for clad equipment. Many non-traditional energy production methods are potentially commercially viable for bringing natural gas to the market. Clad is commonly used in these facilities. The primary clad metals for this market are stainless steel and nickel alloys clad to steel, with some use of reactive metals, such as titanium and zirconium.

Petroleum refining processes frequently are corrosive, hot, and operate at high pressures. Clad metal is extensively used in a broad range of equipment including desulfurization hydrotreaters, coke drums, distillation columns, separators and heat exchangers. In the United States, refinery capacity utilization is high; and adding capacity and reducing costly down-time are a high priority. The increasing reliance upon low quality, high sulfur crude further drives additional demand for new corrosion

resistant equipment. Worldwide trends in regulatory control of sulfur emissions in gas, diesel and jet fuel are also increasing the need for clad equipment. Like the upstream oil and gas sector, the clad metals are primarily stainless steel and nickel alloys.

Alternative Energy: Some alternative energy technologies involve conditions that necessitate clad metals. Solar panels predominantly incorporate high purity silicon. Processes for manufacturing high purity silicon utilize a broad range of highly corrosion resistant clad alloys. Many geothermal fields are corrosive, requiring high alloy clad separators to clean the hot steam. Cellulosic ethanol technologies may require corrosion resistant metals such as titanium and zirconium.

Chemical and Petrochemical: Many common products, ranging from plastics to drugs to electronic materials, are produced by chemical processes. Because the production of these items often involves corrosive agents and is conducted under high pressures or temperatures, corrosion resistant equipment is needed. One of the larger applications for clad equipment is in the manufacture of Purified Terephthalic Acid (“PTA”), a precursor product for polyester, which is used in everything from carpets to plastic bottles. This market requires extensive use of stainless steel and nickel alloys, but also uses titanium and, to a lesser extent, zirconium and tantalum.

Hydrometallurgy: The processes for production of nickel, gold, and copper involve acids, high pressures, and high temperatures; and titanium-clad plates are used extensively for construction of associated autoclaves and peripheral equipment.

Aluminum Production: Aluminum is reduced from its oxide in large electric smelters called potlines. The electric current is carried via aluminum conductors. The electricity must be transmitted into steel components for the high temperature smelting operations. Aluminum cannot be welded to steel conventionally. Explosion-welded aluminum-steel transition joints provide an energy efficient and highly durable solution for making these connections. Modern potlines use a large number of transition joints, which are typically replaced after approximately five years in service. Although aluminum production is the major electrochemical application for NobelClad products, there are a number of other electrochemical applications including production of magnesium, chlorine and chlorate.

Shipbuilding: The combined problems of corrosion and top-side weight drive demand for our aluminum-steel transition joints, which serve as the juncture between a ship's upper and lower structures. Top-side weight is often a significant problem with tall ships, including cruise ships, naval vessels, ferries and yachts. Use of aluminum in the upper structure and steel in the lower structure provides stability. Since aluminum cannot be welded directly to steel using traditional welding processes, and since bolted joints between aluminum and steel corrode quickly in seawater, explosion welded transition joints are a common solution. NobelClad's transition joints have been used in the construction of many well-known ships, including the QE II and modern U.S. Navy aircraft carriers.

Power Generation: Fossil fuel and nuclear power generation plants require extensive use of heat exchangers, many of which require corrosion resistant alloys to handle low quality cooling water. Our clad plates are used extensively for heat exchanger tubesheets. The largest clad tubesheets are used in the final low-pressure condensers. For most coastal and brackish water-cooled plants, titanium is the metal of choice technically, and titanium-clad tubesheets are the low-cost solution for power plant condensers.

Industrial Refrigeration: Heat exchangers are a core component of refrigeration systems. When the cooling fluid is seawater, brackish, or even slightly polluted, corrosion resistant metals are necessary. Metal selection can range from stainless steel to copper alloy to titanium. Explosion-welded clad metal is often the low cost solution for making the tubesheets. Applications range from refrigeration chillers on fishing boats to massive air conditioning units for skyscrapers, airports, and deep underground mines.

Operations

The NobelClad segment seeks to build on its leadership position in its markets. During the three years ended December 31, 2012, 2013 and 2014, the NobelClad segment represented approximately 60%, 59% and 48% of our revenue, respectively. The three manufacturing plants and their respective shooting sites in Pennsylvania, Germany and France provide the production capacity to address concurrent projects for NobelClad’s North American and international customer base.

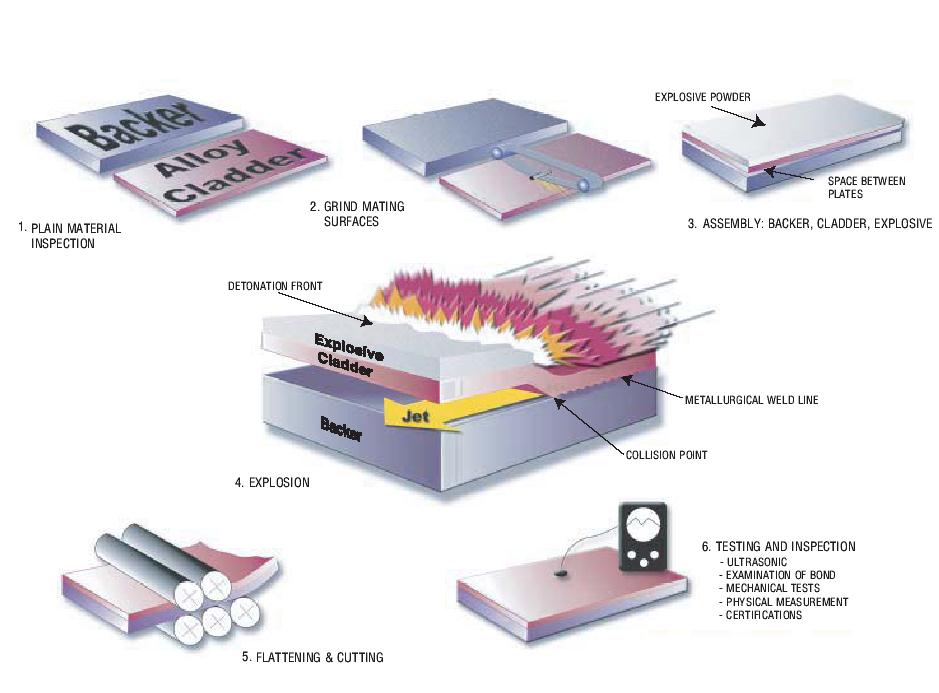

The principal product of metal cladding, regardless of the process used, is a metal plate composed of two or more dissimilar metals, usually a corrosion resistant metal, or "cladder," bonded to a steel backing plate. Prior to the explosion-welding process, the materials are inspected, the mating surfaces are ground, and the metal plates are assembled for cladding. The process involves placing a sheet of the cladder over a parallel plate of backer material and then covering the cladder with a layer of specifically formulated explosive. A small gap or “standoff space” is maintained between the cladder and backer using small metal spacers. The explosion is then initiated on one side of the cladder and travels across the surface of the cladder forcing it down onto the backer. The explosion happens in approximately one-thousandth of a second. The collision conditions cause a thin layer of the mating surfaces, as well as the spacers, to be spalled away in a jet. This action removes oxides and surface contaminants immediately

ahead of the collision point. The extreme pressures force the two metal components together, creating a metallurgical bond between them. The explosion-welded clad process produces a strong, ductile, continuous metallurgical weld over the clad surface. After the explosion is completed, the resulting clad plates are flattened and cut, and then undergo testing and inspection to assure conformance with internationally accepted product specifications.

EXPLOSION-WELDING PROCESS

Explosion-welded cladding technology is a method for welding metals that cannot be joined using conventional welding processes, such as titanium-steel, aluminum-steel, and aluminum-copper. Explosion welding also can be used to weld compatible metals, such as stainless steels and nickel alloys to steel. The cladding metals are typically titanium, stainless steel, aluminum, copper alloys, nickel alloys, tantalum, and zirconium. The base metals are typically carbon steel, alloy steel, stainless steel and aluminum. Although the patents for the explosion-welded cladding process have expired, NobelClad has proprietary knowledge that distinguishes it from its competitors. The entire explosion-welding process involves significant precision in all stages, and any errors can be extremely costly as they often result in the discarding of the expensive raw material metals. NobelClad’s technological expertise is a significant advantage in preventing costly waste.

NobelClad’s metal products are primarily produced for custom projects and conform to requirements set forth in customers’ purchase orders. Upon receipt of an order, NobelClad obtains the component materials from a variety of sources based on quality, availability and cost and then produces the order in one of its three manufacturing plants. Final products are processed to meet contract specific requirements for product configuration and quality/inspection level.

Suppliers and Raw Materials

NobelClad's operations involve a range of alloys, steels and other materials, such as stainless steel, copper alloys, nickel alloys, titanium, zirconium, tantalum, aluminum and other metals. NobelClad sources its raw materials from a number of different producers and suppliers. It holds a limited metal inventory and purchases its raw materials based on contract specifications. Under

most contracts, any raw material price increases are passed on to NobelClad’s customers. NobelClad closely monitors the quality of its supplies and inspects the type, dimensions, markings, and certification of all incoming metals to ensure that the materials will satisfy applicable construction codes. NobelClad also manufactures a majority of its own explosives from standard raw materials, thus achieving higher quality and lower cost.

Competition

Metal Cladding. NobelClad faces competition from two primary alternative cladding technologies: Hot-Rollbonding and Weld Overlay. Usually the three processes do not compete directly, as each has its own preferential domain of application relating to metal used and thicknesses required. However, due to specific project considerations such as technical specifications, price and delivery time, explosion-welding may have the opportunity to compete successfully against these technologies. Rollbond is only produced by a few steel mills in the world. In this process, the clad metal and base metal are bonded during the hot rolling operation in which the metal slab is converted to plate. Being a high temperature process, hot rollbond is limited to joining similar metals, such as stainless steel and nickel alloys to steel. Rollbond’s niche is production of large quantities of light to medium gauge clad plates; it is frequently lower cost than explosion clad when total metal thickness is under 1 to 2 inches (dependent upon alloy and a number of other factors). Rollbond products are generally suitable for most pressure vessel applications but have lower bond shear strength and may have inferior corrosion resistance.

The weld overlay process, which is produced by the many vessel fabricators that are often also NobelClad customers, is a slow and labor-intensive process that requires a large amount of floor space for the equipment. In weld overlay cladding, the clad metal layer is deposited on the base metal using arc-welding type processes. Weld overlay is a cost-effective technology for complicated shapes, for field service jobs, and for production of heavy-wall pressure vessel reactors. During overlay welding, the cladding metal and base metal are melted together at their interface. The resulting dilution of the cladding metal chemistry may compromise corrosion performance and limit use in certain applications. Weld metal shrinkage during cooling potentially causes distortion when the base layer is thin; consequently, overlay is rarely the technically preferred solution for construction of new equipment when thicknesses are under thee to four inches. As with rollbond, weld overlay is limited to metallurgically similar metals, primarily stainless steels and nickel alloys joined to steel. Weld overlay is typically performed in conventional metal fabrication shops.

Explosion-Welded Metal Cladding. Competition in the explosion-welded clad metal business is fragmented. NobelClad holds a strong market position in the clad metal industry. It is the leading producer of explosion-welded clad products in North America, and has a strong position in Europe against smaller competitors. NobelClad’s main competitor in Asia is a division of Asahi Kasei, which has competitive technology and a recognized local brand name. There are several explosion-welded clad producers in Korea and China, most of which have been technically limited and have offered limited exports outside of their domestic markets. A number of additional small explosion-welding competitors operate throughout the world. To remain competitive, NobelClad intends to continue developing and providing technologically advanced manufacturing services, maintaining quality levels, offering flexible delivery schedules, delivering finished products on a reliable basis and competing favorably on the basis of price.

Customer Profile

NobelClad’s products are used in critical applications in a variety of industries, including upstream oil and gas, oil refinery, chemical and petrochemical, hydrometallurgy, aluminum production, shipbuilding, power generation, industrial refrigeration and other similar industries. NobelClad’s customers in these industries require metal products that can withstand exposure to corrosive materials, high temperatures and high pressures. NobelClad’s customers can be divided into three tiers: the product end users (e.g., operators of chemical processing plants), the engineering contractors that design and construct plants for end users, and the metal fabricators that manufacture the products or equipment that utilize NobelClad’s metal products. It is typically the fabricator that places the purchase order with NobelClad and pays the corresponding invoice. NobelClad has developed strong relationships over the years with the engineering contractors (relatively large companies) that sometimes act as prescriptor to fabricators.

Marketing, Sales, Distribution

NobelClad conducts its selling efforts by marketing its services to potential customers' senior management, direct sales personnel, program managers, and independent sales representatives. Prospective customers in specific industries are identified through networking in the industry, cooperative relationships with suppliers, public relations, customer references, inquiries from technical articles and seminars and trade shows. NobelClad’s sales office in the United States covers the Americas and East Asia. Its sales offices in Europe cover the full European continent, Africa, the Middle East, India, and Southeast Asia. During 2012 and 2013 NobelClad opened direct sales offices in South Korea and China to address these markets. These sales teams are further supported by local sales offices in the Middle East and India, with contract agents in most other developed countries, including

Russia and Brazil. Contract agents typically work under multi-year agreements which are subject to sales performance as well as compliance with NobelClad quality and customer service expectations. Members of the global sales team may be called to work on projects located outside their usual territory. By maintaining relationships with its existing customers, developing new relationship with prospective customers, and educating all its customers as to the technical benefits of NobelClad’s products, NobelClad endeavors to have its products specified as early as possible in the design process.

NobelClad’s sales are generally shipped from its manufacturing locations in the United States, Germany and France. Generally, any shipping costs or duties for which NobelClad is responsible will be included in the price paid by the customer. Regardless of where the sale is booked (in Europe or the U.S.), NobelClad will produce it, capacity permitting, at the location closest to the delivery place. In the event that there is a short-term capacity issue, NobelClad produces the order at any of its production sites, prioritizing timing. The various production sites allow NobelClad to meet customer production needs in a timely manner.

Research and Development

We prepare a formal research and development plan annually. It is implemented at our French, German, and U.S. cladding sites and is supervised by a Technical Committee that reviews progress quarterly and meets once a year to establish the plan for the following 12 months. The research and development projects concern process support, new products, and special customer-paid projects.

DynaEnergetics

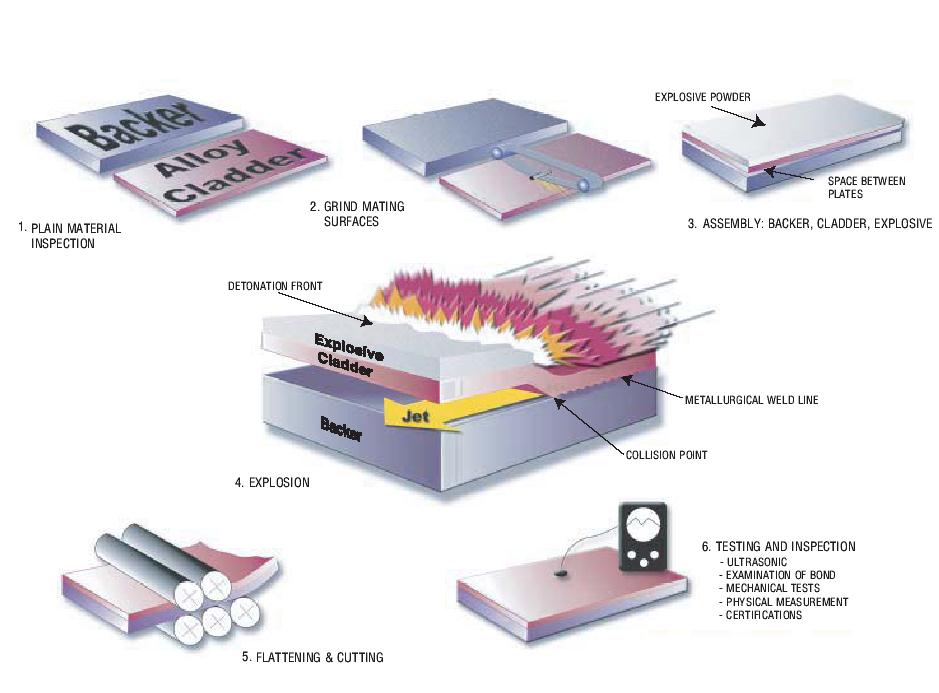

DynaEnergetics manufactures, markets, and sells perforating explosives and associated hardware, as well as seismic explosives, for the international oil and gas industry. The oil and gas industry uses perforating products to punch holes in the casing or liner of wells to connect them to the surrounding reservoir. During the drilling process, steel casing and cement are inserted into the well to isolate and support the wellbore. As part of the well completion process, the perforating guns, which contain a series of specialized shaped charges, are lowered into the well to the desired area of the targeted formation. Once fired, the shaped charges shoot a plasma jet through the casing and cement and into the formation. The resulting channels in the formation allow hydrocarbons to flow into the wellbore.

DynaEnergetics manufactures and sells the five primary components of a perforating system, which are: 1) carrier tubes and charge tubes, 2) shaped charges, 3) detonating cord, 4) detonators, and 5) control panels.

PRIMARY COMPONENTS OF A PERFORATING GUN

The perforating products manufactured by DynaEnergetics are essential to certain types of modern oil and gas recovery. These products are sold to large, mid-sized, and small oilfield service companies in the U.S., Europe, Canada, South America, Africa, the Middle East, and Asia, including direct sales to end users. The market for perforating products has grown in recent years. Rising worldwide demand for oil and gas increases the demand for perforating products used in exploration and recovery. High levels of exploration (seismic prospecting) and increased production activities in both conventional and unconventional oil and gas fields around the globe are expected to continue. Expanding exploration activity has led to increasingly complex well completion operations, which in turn, has increased the demand for high quality and technically advanced perforating products.

Operations

The DynaEnergetics segment seeks to build on its products and technologies, as well as its sales, supply chain and distribution network. During the three years ended December 31, 2012, 2013 and 2014, the DynaEnergetics segment represented approximately 40%, 41% and 52% of our revenue, respectively.

DynaEnergetics has been producing detonating cord and detonators and selling these and seismic explosives systems for decades. Since 1994 significant emphasis has been placed on enhancing its oilfield product offerings by improving existing products and adding new products through research and development, as well as acquisitions. In recent years, various types of detonating cord and detonators have been added as well as bi-directional boosters, a wide range of shaped charges, and corresponding gun systems.

In recent years, DynaEnergetics has introduced a number of new technologies designed for safe and selective perforating. Our Radio Frequency-Safe Detonator Systems require a specific electronic code for firing and are immune to induced currents and voltages, static electricity and high-frequency irradiation. This eliminates the risk of oilfield accidents from unintentional

firing. This safety feature enables concurrent perforating and fracturing processes at drilling sites with multiple wellbores, improving operating efficiencies for our customers.

With selective technologies the operator can sequentially initiate multiple perforating guns in a single run, resulting in significant time and cost savings. DynaEnergetics’ Selectronic Switches provide high reliability through a microprocessor based switch design. The Selectronic switch and software operate in conjunction with our RF-Safe Detonators, Multitronic Firing Panels and a standard PC to enable up to 12 initiation devices per run. DynaEnergetics’ Mulitronic Firing Panels are installed in our customer’s service fleet vehicles to control and sequence perforating operations. The control panels and switches provide uninterrupted communication with all detonators in the gun assembly and enable positive indication of gun firing along with selective control.

Our DynaSelect products combine our Selectronic Switches and RF-Safe Detonator technologies in a one-piece system for improved well site efficiency, reliability, simplicity and service quality. The fully integrated design incorporates advanced software controls and reduces the size of the detonator and switch assembly. DynaSelect reduces by 40% the number of electrical connections required within each perforating gun versus prior detonator models. This improves set-up times and reliability. The DynaSelect switch detonator is controlled by our Multronic IV Firing Panel. This system enables safe and reliable firing of up to 20 guns in a single run and incorporates a signal output function to monitor the movement and position of the tool string.

Our DynaSlot system is designed for well abandonment. During abandonment the wellbore is shut in and permanently sealed so that layers of sedimentary rock, and in particular freshwater aquifers, are pressure isolated. DynaSlot creates complete 360 degree access behind the tubing and casing, which is preferred for plug and abandonment cement squeeze operations.

DynaEnergetics Tubing Conveyed Perforating, or TCP, systems are customized for individual customer needs and well applications. TCP enables perforating of more complex highly deviated and horizontal wells. These types of wells are being increasingly drilled by the industry. TCP tools also perforate long intervals in a single trip, which significantly improves rig efficiency. Our TCP tool range includes mechanical and hydraulic firing systems, gun releases, under-balancing devices and auxiliary components. Our tools are designed to withstand down hole temperatures of up to 260 degrees Celsius, for safe and quick assembly at the well site, and to allow unrestricted total system length.

DynaEnergetics’s manufacturing facilities are located in Germany, Canada, the United States and Russia. During 2013 DynaEnergetics completed a new shaped charge manufacturing facility in Blum, Texas and a perforating gun manufacturing facility in Tyumen, Siberia. A new shaped charge manufacturing facility is under construction in Tyumen, Siberia and is scheduled to be operational in late 2015. These investments have significantly expanded our global capacity for shaped charge and perforating gun production and improve our delivery and customer service capabilities.

Suppliers and Raw Materials

DynaEnergetics' product offering consists of complex components that require numerous high-end inputs. DynaEnergetics utilizes a variety of raw materials for the production of oilfield perforating and seismic products, including high-quality steel tubes, steel and copper, explosives (RDX, HMX, HNS), granulates, plastics and ancillary plastic product components. DynaEnergetics obtains its raw materials primarily from a number of different producers in Germany and other European countries, but also purchases materials from North American, Chinese, and other international suppliers.

Competition

DynaEnergetics faces competition from independent producers of perforating products and from each of the industry's three largest oil and gas service companies, which produce most of their own shaped charges but also buy other perforating components and specialty products from independent suppliers such as DynaEnergetics. DynaEnergetics competes for sales primarily on customer service, product quality, reliability, product performance, price and, in North America, proximity of distribution centers to oilfield drilling activity.

Customer Profile

DynaEnergetics' perforating and seismic products are purchased by large, mid-sized and small oilfield service companies working in both onshore and offshore oil and gas fields. Our customers select perforating products based on their ability to address a broad spectrum of factors, including pressures and temperatures in the borehole and geological characteristics of the targeted formation. We believe that our customers must balance costs, productivity and risks for every job.

The customers for our oilfield products can be divided into four broad categories: purchasing centers of large service companies, service companies worldwide, oil companies with and without their own service companies, and local resellers.

Marketing, Sales, Distribution

DynaEnergetics’ worldwide marketing and sales efforts for its oilfield and seismic products are based in Troisdorf, Germany, with regional sales headquarters in Austin, Texas for the Americas and Tyumen, Siberia for the CIS. DynaEnergetics’ sales strategy focuses on direct selling, distribution through licensed distributors and independent sales representatives, the establishment of international distribution centers to better service our customers, and educating current and potential customers about our products and technologies. Currently, DynaEnergetics sells its oilfield and seismic products through wholly owned affiliates in the U.S., Canada, Colombia, Russia and Kazakhstan; and through independent sales agents in other parts of the world. DynaEnergetics serves the Americas region through its network of sales and distributions centers in the United States, Canada and Colombia.

DynaEnergetics also designs and manufactures custom-ordered perforating products for third-party customers according to their designs and specifications.

Research and Development

DynaEnergetics attaches great importance to its research and development capabilities and has devoted substantial resources to its R&D programs. The R&D staff works closely with sales and operations management teams to establish priorities and effectively manage individual projects. Through its ongoing involvement in oil and gas industry trade shows and conferences, DynaEnergetics has increased its profile in the oil and gas industry. An R&D Plan, which focuses on new technology, products, process support and contracted projects, is prepared and reviewed at least annually.

Corporate History and Recent Developments

The genesis of the Company was an unincorporated business called “Explosive Fabricators,” which was formed in Colorado in 1965. The business was incorporated in Colorado in 1971 under the name “E. F. Industries, Inc.,” which was later changed to “Explosive Fabricators, Inc.” The Company became a public company in 1976. In 1994, it changed its name to “Dynamic Materials Corporation.” The Company reincorporated in Delaware in 1997.

In 1976, the Company became a licensee of Detaclad®, the explosion-welded clad process developed by DuPont in 1959. In 1996, the Company purchased the Detaclad® operating business from Dupont.

In 2001, the Company acquired substantially all of the stock of Nobelclad Europe SA, a French company (“Nobelclad France”). Early in its history, Nobelclad France was a licensee of the Detaclad® technology. The acquisition of Nobelclad France expanded the Company’s explosive metalworking operations to Europe.

In 2007, the Company acquired the German company DYNAenergetics GmbH and Co. KG (“DYNAenergetics”) and certain affiliates. DYNAenergetics was comprised of two primary businesses: explosive metalworking and oilfield products. This acquisition expanded the Company’s explosive metalworking operations in Europe and added a complimentary business segment, oilfield products.

In 2009, the Company acquired all of the stock of Alberta Canada based LRI Oil Tools Inc. (“LRI”) which is produces and distributes perforating equipment for use by the oil and gas exploration and production industry.

In 2010, the Company purchased the outstanding minority-owned interests in its two Russian joint ventures, which produces and sells perforating gun systems. In 2010, the Company also completed its acquisition of Texas-based Austin Explosives Company (Austin Explosives), which is now part of the Company’s DynaEnergetics business segment.

In 2012, the Company acquired the assets and operating business of Texas-based TRX Industries, Inc., (“TRX”), a manufacturer of perforating guns and one of DynaEnergetic’s suppliers. This business is now part of the Company’s DynaEnergetics business segment.

In 2013, the Company branded its explosive metalworking operations under the single name NobelClad. The NobelClad segment is comprised of the Company’s U.S. Clad operations as well as the explosion metalworking assets and operations purchased in the Nobelclad France and DYNAenergetics acquisitions. Also in 2013, the Company branded the oilfield products segment as DynaEnergetics, which is comprised entirely of DYNAenergetics (other than its explosion metalworking operations), its subsidiaries and sister companies.

In 2014, the Company sold its specialty welding business, AMK Technical Services ("AMK"), which was acquired in 1997 and in recent years contributed approximately 5% of the Company's consolidated annual revenue. Also in 2014, the Company acquired a modern manufacturing and office complex in Liebenscheid, Germany. The facility is designed to enhance NobelClad's manufacturing capabilities and is expected to ultimately serve as a state-of-the-art production and administrative resource for NobelClad's European operations.

Employees

As of December 31, 2014, we employed 503 employees (226 U.S. employees and 277 foreign employees), the majority of whom are engaged in manufacturing operations, with the remainder being engaged in sales and marketing or corporate functions. The majority of our manufacturing employees are not unionized. In addition, we also use a number of temporary workers at any given time, depending on the workload.

In the last three years, the Company has experienced two work stoppages, which lasted for three days in November 2014 and 8 days in December 2014, respectively, at NobelClad's production facility in Rivesaltes, France. The stoppages related to a consolidation program of NobelClad's European explosion welding operations. A restructuring agreement with the labor union at Rivesaltes was reached in January 2015, at which point work was restarted. We currently believe that employee relations are good.

Insurance

Our operations expose us to potential liabilities for personal injury or death as a result of the failure of a component that has been designed, manufactured, or serviced by us, or the irregularity or failure of products we have processed or distributed. We maintain liability insurance that we believe adequately protects us from potential product liability claims.

Proprietary Knowledge, Permits and Patents

Protection of Proprietary Information. We hold patents related to the business of explosive metalworking and metallic processes and also own certain registered trademarks, including Detaclad®, Detacouple®, EFTEK®, ETJ 2000® and NOBELCLAD®. Although the patents for the explosion-welded cladding process have expired, our current product application patents expire on various dates through 2020. Since individual patents relate to specific product applications and not to core technology, we do not believe that such patents are material to our business, and the expiration of any single patent is not expected to have a material adverse effect on our operations. Much of the manufacturing expertise lies in the knowledge of the factors that affect the quality of the finished clad product, including the types of metals to be explosion-welded, the setting of the explosion, the composition of the explosive, and the preparation of the plates to be bonded. We have developed this specialized knowledge over our 40 years of experience in the explosive metalworking business. We are very careful in protecting our proprietary know-how and manufacturing expertise, and we have implemented measures and procedures to ensure that the information remains confidential. We hold various patents and licenses through our DynaEnergetics perforating business, but some of the patents are not yet registered. As with the explosive metalworking business segment, since individual patents relate to specific product applications and not to core technology, we do not believe that such patents are material to our business, and the expiration of any single patent is not expected to have a material adverse effect on our current operations.

Permits. Explosive metalworking and the production of perforation products involve the use of explosives, making safety a critical factor in our operations. In addition, explosive metalworking and the production of oilfield products are highly regulated industries for which detailed permits are required. These permits require renewal every three or four years, depending on the permit. See Item 1A — Risk Factors — Risk Factors Related to the Dynamic Materials Corporation — We are subject to extensive government regulation and failure to comply could subject us to future liabilities and could adversely affect our ability to conduct or to expand our business for a more detailed discussion of these permits.

Foreign and Domestic Operations and Export Sales

All of our sales are shipped from our manufacturing facilities and distribution centers located in the United States, Germany, France, Canada, Russia and Kazakhstan. The following chart represents our net sales based on the geographic location to where we shipped the product, regardless of the country of the actual end user. NobelClad products are usually shipped to the fabricator before being passed on to the end user.

|

| | | | | | | | | | | | |

| | (Dollars in Thousands) |

| | For the years ended December 31, |

| | 2014 | | 2013 | | 2012 |

United States | | $ | 91,009 |

| | $ | 88,532 |

| | $ | 71,155 |

|

Canada | | 23,532 |

| | 18,142 |

| | 21,083 |

|

Iraq | | 11,348 |

| | 4,243 |

| | 1,756 |

|

Russia | | 7,992 |

| | 5,992 |

| | 6,472 |

|

Germany | | 7,721 |

| | 9,208 |

| | 13,992 |

|

India | | 7,617 |

| | 8,888 |

| | 3,874 |

|

South Korea | | 7,362 |

| | 11,642 |

| | 9,469 |

|

France | | 5,478 |

| | 3,756 |

| | 6,249 |

|

China | | 1,800 |

| | 606 |

| | 7,986 |

|

Kazakhstan | | 1,551 |

| | 2,513 |

| | 2,359 |

|

Rest of the world | | 37,151 |

| | 48,538 |

| | 48,342 |

|

| | | | | | |

Total | | $ | 202,561 |

| | $ | 202,060 |

| | $ | 192,737 |

|

Company Information

We are subject to the informational requirements of the Securities Exchange Act of 1934. We therefore file periodic reports, proxy statements and other information with the Securities Exchange Commission (the “SEC”). Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

Our Internet address is www.dmcglobal.com. Information contained on our website does not constitute part of this Annual Report on Form 10-K. Our annual report on SEC Form 10-K, quarterly reports on Forms 10-Q, current reports on Forms 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge on our website as soon as reasonably practicable after we electronically file such material with or furnish it to the SEC. We also regularly post information about our Company on our website under the Investors tab.

ITEM 1A. Risk Factors

Risk Factors Related to our NobelClad Segment

NobelClad operates a cyclical business and its sales are down significantly from its 2008 peak.

NobelClad operates a somewhat cyclical business. Beginning in late 2008 and continuing through 2010, NobelClad's sales in some of its markets slowed down, resulting in declines of 31.2% and 26.5% in 2009 and 2010 sales respectively. While NobelClad's sales increased in 2011, its annual sales for 2012 and 2013 were 40.9% and 39.3%, respectively, below the amount of its peak sales in 2008. Its 2014 annual sales (50.2% below peak sales) were the lowest since the 2008 peak. At December 31, 2007 and 2008, order backlog was $100.0 million and $97.2 million, respectively. Year-end backlog was $46.4 million, $36.9 million and $41.2 million, respectively, in 2012, 2013 and 2014. The explosion-welded cladding market is dependent upon sales of products for use by customers in a limited number of heavy industries, including oil and gas, alternative energy, chemicals and petrochemicals, hydrometallurgy, aluminum production, shipbuilding, power generation, and industrial refrigeration. These industries tend to be cyclical in nature and an economic slowdown in one or all of these industries-whether due to traditional cyclicality, general economic conditions or other factors-could impact capital expenditures within that industry. If demand from such industries were to decline or to experience reduced growth rates, our sales would be expected to be affected proportionately, which may have a material adverse effect on our business, financial condition, and results of operations.

Our backlog figures may not accurately predict future sales.

We define “backlog” at any given point in time to consist of all firm, unfulfilled purchase orders and commitments at that time. Generally speaking, we expect to fill most items of backlog within the following 12 months. However, since orders may be rescheduled or canceled and a significant portion of our net sales is derived from a small number of customers, backlog is not

necessarily indicative of future sales levels. Moreover, we cannot be sure of when during the future 12-month period we will be able to recognize revenue corresponding to our backlog nor can we be certain that revenues corresponding to our backlog will not fall into periods beyond the 12-month horizon. The percentage increase or decrease in NobelClad's annual sales may be substantially greater or less than the change in backlog at the previous year-end.

There is a limited availability of sites suitable for cladding operations.

Our cladding process involves the detonation of large amounts of explosives. As a result, the sites where we perform cladding must meet certain criteria, including lack of proximity to a densely populated area, the specific geological characteristics of the site, and the ability to comply with local noise and vibration abatement regulations in conducting the process. In addition, our primary U.S. shooting site is subleased under an arrangement pursuant to which we provide certain contractual services to the sub-landlord. The efforts to identify suitable sites and obtain permits for using the sites from local government agencies can be time-consuming and may not be successful. In addition, we could experience difficulty in obtaining or renewing permits because of resistance from residents in the vicinity of proposed sites. The failure to obtain required governmental approvals or permits could limit our ability to expand our cladding business in the future, and the failure to maintain such permits or satisfy other conditions to use the sites would have a material adverse effect on our business, financial condition and results of operations.

The use of explosives subjects us to additional regulation, and any accidents or injuries could subject us to significant liabilities.

Our operations involve the detonation of large amounts of explosives. As a result, we are required to use specific safety precautions under U.S. Occupational Safety and Health Administration guidelines and guidelines of similar entities in Germany and France. These include precautions which must be taken to protect employees from exposure to sound and ground vibration or falling debris associated with the detonation of explosives. There is a risk that an accident or death could occur in one of our facilities. Any accident could result in significant manufacturing delays, disruption of operations or claims for damages resulting from death or injuries, which could result in decreased sales and increased expenses. To date, we have not incurred any significant delays, disruptions or claims resulting from accidents at our facilities. The potential liability resulting from any accident or death, to the extent not covered by insurance, may require us to use other funds to satisfy our obligations and could cause our business to suffer. See “Our use of explosives is an inherently dangerous activity that could lead to temporary or permanent closure of our NobelClad shooting sites or DynaEnergetics manufacturing facilities” under "Risk Factors Related to Dynamic Materials Corporation" below.

Certain raw materials we use are subject to supply shortages due to general economic conditions.

Although we generally use standard metals and other materials in manufacturing our products, certain materials such as specific grades of carbon steel, titanium, zirconium and nickel can be subject to supply shortages due to general economic conditions or problems with individual suppliers. While we seek to maintain sufficient alternative supply sources for these materials, we may not always be able to obtain sufficient supplies or obtain supplies at acceptable prices without production delays, additional costs, or a loss of product quality. If we were to fail to obtain sufficient supplies on a timely basis or at acceptable prices, such loss or failure could have a material adverse effect on our business, financial condition, and results of operations.

Certain raw materials NobelClad uses are subject to price increases due to general economic conditions.

The markets for certain metals and other raw materials used by NobelClad are highly variable and are characterized by periods of increasing prices. While prices for much of the raw materials we use have recently decreased, we may again experience increasing prices. We generally do not hedge commodity prices or enter into forward supply contracts; instead we endeavor to pass along price variations to our customers. We may see a general downturn in business if the price of raw materials increases enough for our customers to delay planned projects or use alternative materials to complete their projects.

Risk Factors Related to DynaEnergetics

Prices and pricing trends of oil and natural gas affect the level of exploration, development, and production activity of DynaEnergetics’ customers, which could materially adversely affect DynaEnergetics’ sales and economic performance.

The oil and gas industry is unpredictable and has historically been subject to occasional downturns. Demand for DynaEnergetics’ products is linked to the level of exploration, development, and production activity of, and the corresponding capital spending by, oil and natural gas companies and oilfield services companies. Prices for oil and natural gas are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty,

and a variety of other economic factors that are beyond our control. Any prolonged reduction in oil and natural gas prices or expectations about lower future prices will depress the immediate levels of exploration, development, and production activity, which could negatively impact DynaEnergetics’ sale of products and economic performance.

The adoption of any future laws or regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could cause a decrease in natural gas and oil well perforating and could materially adversely affect DynaEnergetics’ sales and economic performance.

DynaEnergetic’s perforating products are used for oil and gas well hydraulic fracturing processes, among other uses. Various federal, state and local legislative and regulatory initiatives have been undertaken which could result in additional requirements or restrictions being imposed on hydraulic fracturing operations. The adoption of these or other laws or implementing regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could make it more difficult to use hydraulic fracking for natural gas and oil well development, which would reduce the demand for some of DynaEnergetic’s products and could have a material adverse effect on its sales and financial performance.

The manufacturing of explosives subjects DynaEnergetics to various environmental, health and safety laws.

DynaEnergetics is subject to a number of environmental, health, and safety laws and regulations, the violation of which could result in significant penalties. DynaEnergetics’ continued success depends on continued compliance with applicable laws and regulations. In addition, new environmental, health and safety laws and regulations could be passed which could create costly compliance issues. While DynaEnergetics endeavors to comply with all applicable laws and regulations, compliance with future laws and regulations may not be economically feasible or even possible.

If DynaEnergetics is unable to obtain all required permits from governmental agencies it will be unable to begin operations at the manufacturing facility it is constructing in Russia.

DynaEnergetics currently imports shaped charges into Russia for sale to its customers and is subject to limitations on the quantities it can import into the country. As the quantities it may import are expected to be further reduced over the coming years, in 2012 DynaEnergetics acquired property and began constructing a shaped charge manufacturing facility in Tyumen, Siberia, Russia to serve its customers in Russia and neighboring countries. Construction of the manufacturing facility is nearly complete and DynaEnergetics plans for it to be operational by late 2015. Before the facility may begin manufacturing explosive shaped charges, however, the Company must receive a number of permits, licenses and other approval from a variety of governmental entities and agencies at the local, state and federal levels. Regulatory authorities often exercise considerable discretion in the enforcement and interpretation of applicable laws, regulations and standards as well as in approving and issuing permits, licenses and consents, and there can be no assurance that all of the necessary permits, licenses and approvals will be received in a timely manner to permit manufacturing to commence as planned. Russia is currently experiencing economic and political instability that could affect the functioning of its governmental agencies and regulatory authorities. If DynaEnergetics experiences a significant delay in commencing its operations, the delay will adversely affect its financial results and its planned strategy to increase sales in the Russian and neighboring countries’ oil and gas market. Failure to receive all of the necessary permits, licenses and approvals could result in an impairment of the investment in this new manufacturing facility.

DynaEnergetics’ continued economic success depends on remaining at the forefront of innovation in the perforating industry.

DynaEnergetics’ position in the perforation market depends in part on its ability to remain an innovative leader in the field. The ability to remain competitive depends in part on the retention of talented personnel. DynaEnergetics may be unable to remain an innovative leader in the perforation market segment or may be unable to retain top talent in the field.

Risk Factors Related to Dynamic Materials Corporation

Our use of explosives is an inherently dangerous activity that could lead to temporary or permanent closure of our NobelClad shooting sites and DynaEnergetics manufacturing facilities.

We use a large amount of explosives in connection with the creation of clad metals and manufacturing of perforating shaped charges and detonation cord. The use of explosives is an inherently dangerous activity. Explosions, even if occurring as intended, can lead to damage to the shooting site or manufacturing facility or to equipment used at the facility or injury to persons at the facility. If a person were injured or killed in connection with such explosives, or if equipment at the shooting site or manufacturing facility were damaged or destroyed, we might be required to suspend our operations for a period of time while an investigation is

undertaken or repairs are made. Such a delay might impact our ability to meet the demand for our products. In addition, if the mine were seriously damaged, we might not be able to locate a suitable replacement site to continue our operations.

Weakness in the general global economy may adversely affect certain segments of our end market customers and reduce our sales and results of operations.

NobelClad supplies products to customers that fabricate industrial equipment for various capital-intensive industries. Weakness in the general global economy may adversely affect our end market customers, causing them to cancel or postpone new plant or infrastructure construction, expansion, maintenance, or retrofitting projects that use our NobelClad products. Similarly, any decrease in oil and gas well drilling activities will reduce the sales of our DynaEnergetics products. The global general economic climate may lessen demand for our products and reduce our sales and results of operations.

Our operating results fluctuate from quarter to quarter.

We have experienced, and expect to continue to experience, fluctuations in annual and quarterly operating results caused by various factors, including the timing and size of significant orders by customers, customer inventory levels, shifts in product mix, acquisitions and divestitures, and general economic conditions. The upstream oil and gas, oil refinery, chemical and petrochemical, hydrometallurgy, aluminum production, shipbuilding, power generation, industrial refrigeration and other diversified industries to which we sell our products are, to varying degrees, cyclical and tend to decline in response to overall declines in industrial production. As a result, our business is also cyclical, and the demand for our products by these customers depends, in part, on overall levels of industrial production. Any future material weakness in demand in any of these industries could materially reduce our revenues and profitability. In addition, the threat of terrorism and other geopolitical uncertainty could have a negative impact on the global economy, the industries we serve and our operating results.

We typically do not obtain long-term volume purchase contracts from our customers. Quarterly sales and operating results, therefore, depend on the volume and timing of the orders in our backlog as well as bookings received during the quarter. Significant portions of our operating expenses are fixed, and planned expenditures are based primarily on sales forecasts and product development programs. If sales do not meet our expectations in any given period, the adverse impact on operating results may be magnified by our inability to adjust operating expenses sufficiently or quickly enough to compensate for such a shortfall. Results of operations in any period should not be considered indicative of the results for any future period. Fluctuations in operating results may also result in fluctuations in the price of our common stock. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

We are exposed to potentially volatile fluctuations of the U.S. dollar (our reporting currency) against the currencies of many of our operating subsidiaries.

Many of our operating subsidiaries conduct business in Euros or other foreign currency such as the Russian Ruble. Sales made in currencies other than U.S. dollars accounted for 32%, 36%, and 39% of total sales for the years ended 2014, 2013, and 2012, respectively. Any increase (decrease) in the value of the U.S. dollar against any foreign currency that is the functional currency of any of our operating subsidiaries will cause us to experience foreign currency translation losses (gains) with respect to amounts already invested in such foreign currencies. In addition, our company and our operating subsidiaries are exposed to foreign currency risk to the extent that we or they enter into transactions denominated in currencies other than our or their respective functional currencies. For example DYNAenergetics KG’s functional currency is Euros, but its sales often occur in U.S. dollars. Changes in exchange rates with respect to these items will result in unrealized (based upon period-end exchange rates) or realized foreign currency transaction gains and losses upon settlement of the transactions. In addition, we are exposed to foreign exchange rate fluctuations related to our operating subsidiaries’ assets and liabilities and to the financial results of foreign subsidiaries and affiliates when their respective financial statements are translated into U.S. dollars for inclusion in our consolidated financial statements. Cumulative translation adjustments are recorded in accumulated other comprehensive income (loss) as a separate component of equity. As a result of foreign currency risk, we may experience economic loss and a negative impact on earnings and equity with respect to our holdings solely as a result of foreign currency exchange rate fluctuations. Our primary exposure to foreign currency risk is the Euro due to the percentage of our U.S. dollar revenue that is derived from countries where the Euro is the functional currency and the Russian Ruble due to our greenfield investment in Tyumen, Siberia.

We are dependent on a relatively small number of customers for a significant portion of our net sales.

A significant portion of our net sales is derived from a relatively small number of customers; therefore, the failure to complete existing contracts on a timely basis, to receive payment for such services in a timely manner, or to enter into future contracts at projected volumes and profitability levels could adversely affect our ability to meet cash requirements exclusively through operating activities. We attempt to minimize the risk of losing customers or specific contracts by continually improving product quality,

delivering product on time and competing aggressively on the basis of price. We expect to continue to depend upon our principal customers for a significant portion of our sales, although our principal customers may not continue to purchase products and services from us at current levels, if at all. The loss of one or more major customers or a change in their buying patterns could have a material adverse effect on our business, financial condition, and results of operations.

In past years, the majority of NobelClad’s revenues have been derived from customers in the oil and gas, alternative energy, chemicals and petrochemicals, hydrometallurgy, aluminum production, shipbuilding, power generation and industrial refrigeration industries. Economic downturns in these industries could have a material adverse effect on our business, financial condition, and results of operations.

DynaEnergetics has customers throughout the world. Economic or political instability in certain regions of the world where DynaEnergetics conducts a significant volume of its business, such as Russia and other oil-producing countries with unsettled economic or political situations, could have a material adverse effect on DynaEnergetics’ business and operating results.

Customers have the right to change orders until products are completed.

Customers have the right to change orders after they have been placed. If orders are changed, the extra expenses associated with the change will be passed on to the customer. However, because a change in an order may delay completion of the project, recognition of income for the project may also be delayed.

There is no assurance that we will continue to compete successfully against other clad and perforating companies.

Our explosion-welded clad products compete with explosion-welded clad products made by other manufacturers in the clad metal business located throughout the world and with clad products manufactured using other technologies. Our combined North American and European operations typically supply explosion-welded clad to the worldwide market. There is one other well-known explosion-welded clad supplier worldwide, a division of Asahi-Kasei Corporation of Japan. There are also a number of smaller companies worldwide with explosion-welded clad manufacturing capability, including several companies in China and in South Korea that appear to be growing significantly in their domestic market. There are currently no other significant North American based explosion-welded clad suppliers. We focus strongly on reliability, product quality, on-time delivery performance, and low cost manufacturing to minimize the potential of future competitive threats. However, there is no guarantee we will be able to maintain our competitive position.

Explosion-welded clad products also compete with those manufactured by rollbond and weld overlay cladding processes. In rollbond technology, the clad and base metal are bonded together during a hot rolling process in which slab is converted to plate. In weld overlay, which is typically performed by our fabricator customers, the cladding layer is deposited on the base metal through a fusion welding process. The technical and commercial niches of each cladding process are well understood within the industry and vary from one world market location to another. Our products compete with weld overlay clad products manufactured by a significant number of our fabricator customers.

DynaEnergetics competes principally with perforating companies based in North America, South America, and Russia who produce and market perforating services and products. DynaEnergetics also competes with oil and gas service companies who are able to satisfy a portion of their perforating needs through in-house production. To remain competitive, DynaEnergetics must continue to provide innovative products and maintain an excellent reputation for quality, safety, and value. There can be no assurances that we will continue to compete successfully against these companies.

Failure to attract and retain key personnel could adversely affect our current operations.

Our continued success depends to a large extent upon the efforts and abilities of key managerial and technical employees. The loss of services of certain of these key personnel could have a material adverse effect on our business, results of operations, and financial condition. There can be no assurance that we will be able to attract and retain such individuals on acceptable terms, if at all; and the failure to do so could have a material adverse effect on our business, financial condition, and results of operations.

Liabilities under environmental and safety laws could result in restrictions or prohibitions on our facilities, substantial civil or criminal liabilities, as well as the assessment of strict liability and/or joint and several liability.

We are subject to extensive environmental and safety regulation in the countries where our manufacturing facilities are located. Any failure to comply with current and future environmental and safety regulations could subject us to significant liabilities. In particular, any failure to control the discharge of hazardous materials and wastes could subject us to significant liabilities, which could adversely affect our business, results of operations or financial condition.

We and all our activities in the United States are subject to federal, state and local environmental and safety laws and regulations, including but not limited to, noise abatement and air emissions regulations, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, regulations issued and laws enforced by the labor and employment departments of the U.S. and the states in which we conduct business, by the U.S. Department of Commerce, the U.S. Environmental Protection Agency, and by state and local health and safety agencies. In Germany, we and all our activities are subject to various safety and environmental regulations of the federal state which are enforced by the local authorities, including the Federal Act on Emission Control (Bundesimmissionsschutzgesetz). The Federal Act on Emission Control permits are held by companies jointly owned by DYNAenergetics and the other companies that are located at the Würgendorf and Troisdorf manufacturing sites and are for an indefinite period of time. In France, we and all our activities are subject to state environmental and safety regulations established by various departments of the French Government, including the Ministry of Labor, the Ministry of Ecology and the Ministry of Industry, and to local environmental and safety regulations and administrative procedures established by DRIRE (Direction Régionale de l’Industrie, de la Recherche et de l’Environnement) and the Préfecture des Pyrénées Orientales. In addition, our shooting operations in France may be particularly vulnerable to noise abatement regulations because these operations are primarily conducted outdoors. The Dillenburg, Germany facility is operated based on a mountain plan (“Bergplan”), which is a specific permit granted by the local mountain authority. This permit must be renewed every three years.

Changes in or compliance with environmental and safety laws and regulations could inhibit or interrupt our operations, or require modifications to our facilities. Any actual or alleged violations of environmental and safety laws could result in restrictions or prohibitions on our facilities, substantial civil or criminal sanctions, as well as the assessment of strict liability and/or joint and several liability under applicable law. Under certain environmental laws, we could be held responsible for all of the costs relating to any contamination at our or our predecessor’s past or present facilities and at third party waste disposal sites. We could also be held liable for any and all consequences arising out of human exposure to hazardous substances or other environmental damage. Accordingly, environmental, health or safety matters may result in significant unanticipated costs or liabilities.

We are subject to extensive government regulation and failure to comply could subject us to future liabilities and could adversely affect our ability to conduct or to expand our business.

We are subject to extensive government regulation in the United States, Germany, France, Canada, Russia and Kazakhstan, including guidelines and regulations for the safe manufacture, handling, transport and storage of explosives issued by the U.S. Bureau of Alcohol, Tobacco and Firearms; the Federal Motor Carrier Safety Regulations set forth by the U.S. Department of Transportation; the Safety Library Publications of the Institute of Makers of Explosive; and similar guidelines of their European counterparts. In Germany, the transport, storage and use of explosives is governed by a permit issued under the Explosives Act (Sprengstoffgesetz). In France, the manufacture and transportation of explosives is subcontracted to a third party which is responsible for compliance with regulations established by various State and local governmental agencies concerning the handling and transportation of explosives. Our French operations could be adversely affected if the third party does not comply with these regulations. We must comply with licensing and regulations for the purchase, transport, storage, manufacture, handling and use of explosives. In addition, while our shooting facilities in Tautavel, France are located outdoors, our shooting facilities located in Pennsylvania and in Dillenburg, Germany are located in mines, which subject us to certain regulations and oversight of governmental agencies that oversee mines.

We are also subject to extensive environmental and occupational safety regulation, as described below under “Liabilities under environmental and safety laws could result in restrictions or prohibitions on our facilities, substantial civil or criminal liabilities, as well as the assessment of strict liability and/or joint and several liability” and “The use of explosives subjects us to additional regulation, and any accidents or injuries could subject us to significant liabilities.”

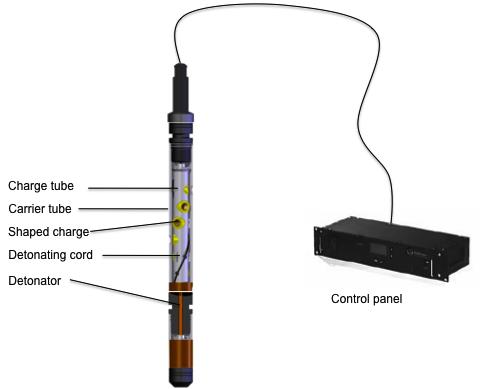

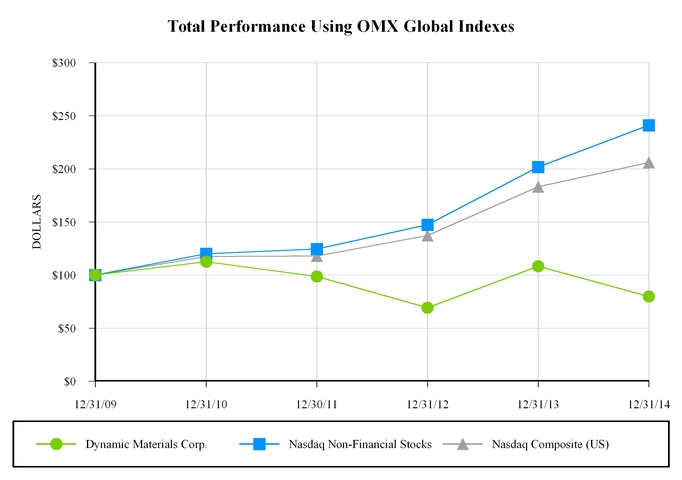

The export of certain products from the United States or from foreign subsidiaries of U.S. companies is restricted by U.S. and similar foreign export regulations. These regulations generally prevent the export of products that could be used by certain end users, such as those in the nuclear or biochemical industries. In addition, the use and handling of explosives may be subject to increased regulation due to heightened concerns about security and terrorism. Such regulations could restrict our ability to access and use explosives and increase costs associated with the use of such explosives, which could have a material adverse effect on our business, financial condition, and results of operations.