LEASE AGREEMENT

(Triple Net)

by and between

SEMAHO, INC.,

a Colorado corporation

as Landlord

and

DMC GLOBAL INC.,

a Delaware corporation

as Tenant

SUMMARY OF BASIC LEASE INFORMATION

The parties hereto agree to the following terms of this Summary of Basic Lease Information (the “Summary”). This Summary is hereby incorporated into and made a part of the attached Lease Agreement – Triple Net (this Summary and the Lease Agreement – Triple Net to be known collectively as the “Lease”) which pertains to the office building located at 11800 Ridge Parkway, Broomfield, Colorado known as The Views I. Each reference in this Lease to any term of this Summary shall have the meaning as set forth in this Summary for such term. In the event of a conflict between the terms of this Summary and the Lease, the terms of the Lease shall prevail. Any capitalized terms used herein and not otherwise defined herein shall have the meaning as set forth in the Lease.

|

| | | | | |

TERMS OF LEASE

(References are to the Lease Agreement) | DESCRIPTION |

1. Date: | August 20, 2018. |

2. Landlord: |

SEMAHO, INC.,

a Colorado corporation

|

3. Address of Landlord

(Section 30.11): | 1777 NE Loop 410 Suite 928 San Antonio, TX 78217 Attn: Andres Sevilla |

4. Tenant: | DMC Global Inc.,

a Delaware corporation |

5. Address of Tenant

(Section 30.11): | Prior to Lease Commencement Date:

DMC Global Inc. 5405 Spine Road Boulder, CO 80301 Attn: Chief Legal Officer

After Lease Commencement Date:

At the Premises Attn: Chief Legal Officer

|

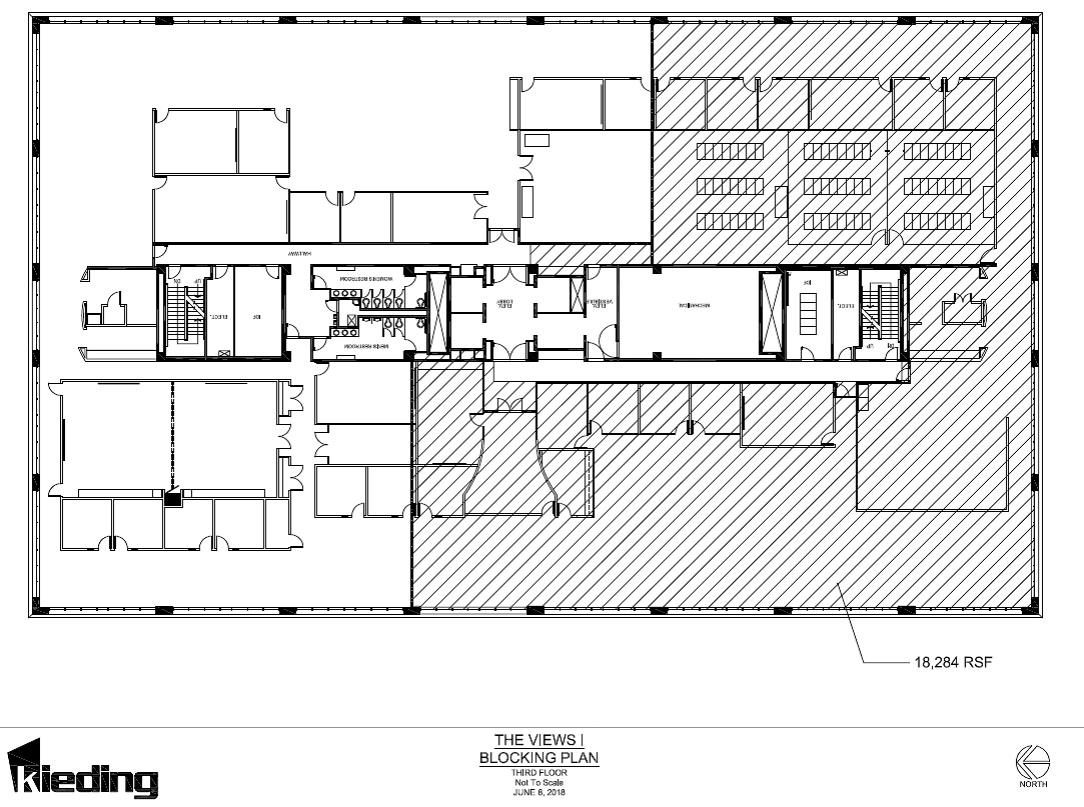

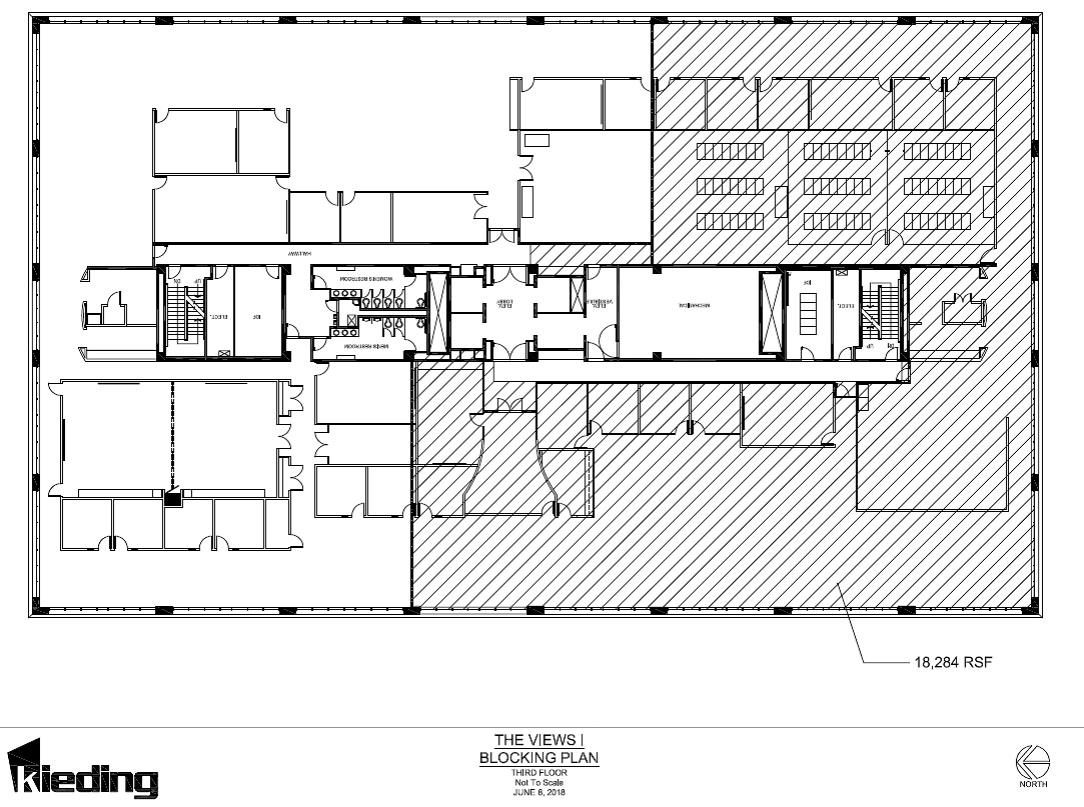

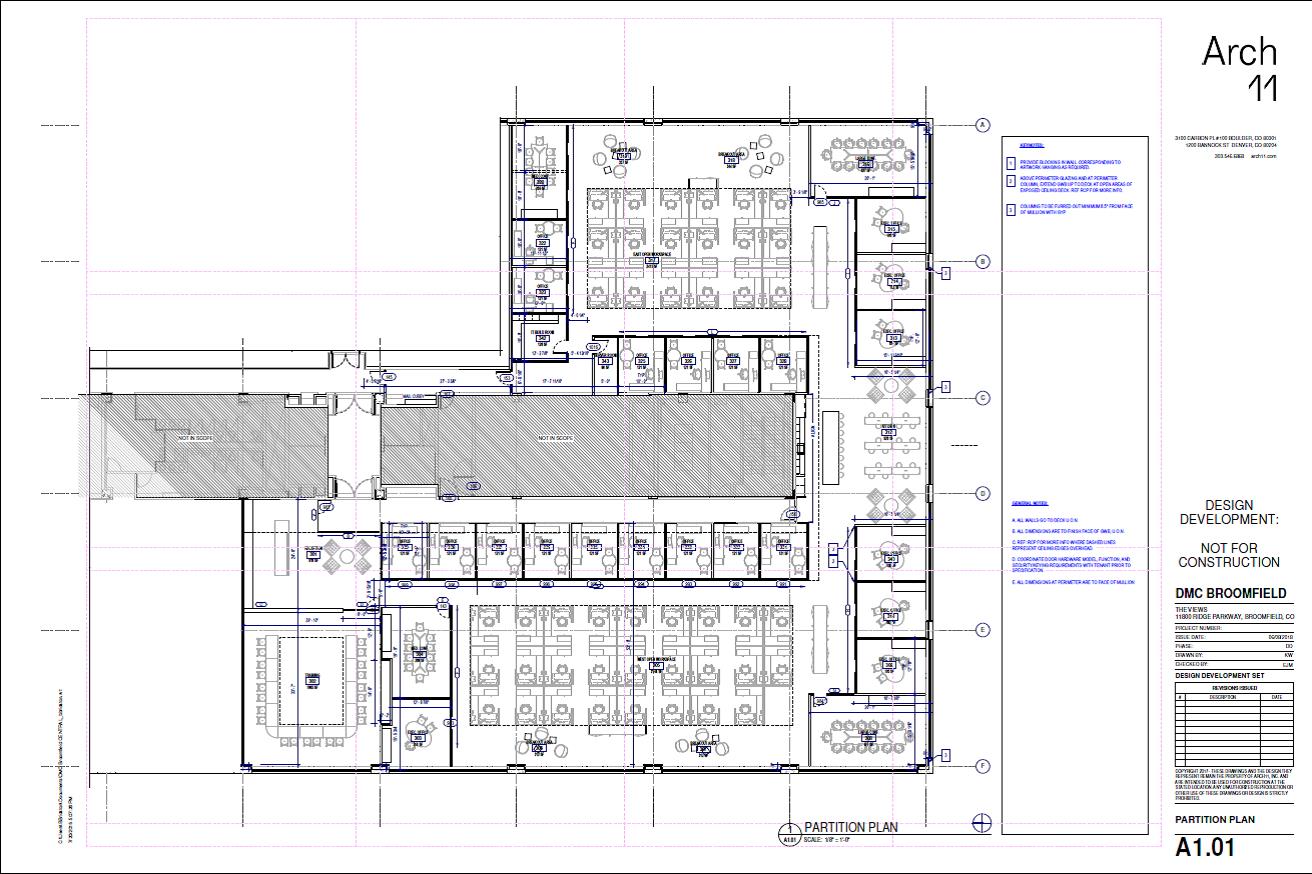

6. Premises (Article 1): | Approximately 18,284 rentable square feet of space identified as Suite 300 on the third floor of the building known as The Views I located at 11800 Ridge Parkway, Broomfield, Colorado (the “Building”), as generally depicted on Exhibit A attached hereto. |

7. Term (Article 2). | |

7.1 Lease Term: | One hundred twenty-six (126) months. If the Lease Commencement Date occurs on a day other than the first day of the month, then the foregoing time period shall be measured from the first day of the following month. |

7.2 Lease Commencement

Date: | The later of (a) January 1, 2019, or (b) the date that is the earlier of (i) Substantial Completion of the Improvements (as such terms are defined in the Work Letter attached hereto as Exhibit B and incorporated herein by this reference (the “Work Letter”)), or (ii) the date Substantial Completion would have occurred but for the occurrence of any Tenant Delay Days (as defined in the Work Letter). |

7.3 Option to Extend: | One (1) option period of five (5) years. |

|

| | | | | |

8. Base Rent (Article 3): | |

| Period | Monthly

Installment of Base Rent | Annual

Rental Rate

per Rentable Square Foot |

| Months 1 – 18* | $23,616.83* | $15.50 |

| Months 19 – 30 | $24,378.67 | $16.00 |

| Months 31 – 42 | $25,140.50 | $16.50 |

| Months 43 – 54 | $25,902.33 | $17.00 |

| Months 55 – 66 | $26,664.17 | $17.50 |

| Months 67 – 78 | $27,426.00 | $18.00 |

| Months 79 – 90 | $28,187.83 | $18.50 |

| Months 91 – 102 | $28,949.67 | $19.00 |

| Months 103 – 114 | $29,711.50 | $19.50 |

| Months 115 – 126 | $30,473.33 | $20.00 |

*Subject to the abatement described in Article 3 below. 9. Tenant’s Share: |

Approximately 10.71%. Tenant’s Share is calculated by dividing the number of rentable square feet of the Premises by the total rentable square feet in the Building, which is 170,660 (subject to adjustment pursuant to Section 1.3 of the Lease). |

10. Prepaid Base Rent

(Article 3) | $23,616.83 for the first (1st) full month of the Lease Term. |

11. Security Deposit

(Article 22): | $38,365.92. |

12. Parking Pass Ratio

(Article 28): 13. Brokers

(Section 30.21): | Four (4) parking passes for every 1,000 rentable square feet of the Premises, free of charge during the initial Lease Term. Jones Lang LaSalle Americas, Inc. (Joe Heath and Don Misner), for Landlord, and

The Colorado Group, Inc. (Neil Littman and W. Scott Reichenberg), for Tenant. |

TABLE OF CONTENTS

|

| | | |

1. | REAL PROPERTY, BUILDING AND PREMISES | 1 |

|

2. | LEASE TERM | 1 |

|

3. | BASE RENT | 2 |

|

4. | ADDITIONAL RENT | 3 |

|

5. | USE OF PREMISES | 5 |

|

6. | SERVICES AND UTILITIES | 6 |

|

7. | REPAIRS AND MAINTENANCE | 7 |

|

8. | ADDITIONS AND ALTERATIONS | 7 |

|

9. | COVENANT AGAINST LIENS | 8 |

|

10. | INDEMNITY AND INSURANCE | 8 |

|

11. | DAMAGE AND DESTRUCTION | 9 |

|

12. | NONWAIVER | 10 |

|

13. | CONDEMNATION | 10 |

|

14. | ASSIGNMENT AND SUBLETTING | 10 |

|

15. | SURRENDER OF PREMISES AND REMOVAL OF TENANT’S PROPERTY | 12 |

|

16. | HOLDING OVER | 12 |

|

17. | ESTOPPEL CERTIFICATES | 12 |

|

18. | SUBORDINATION | 12 |

|

19. | DEFAULTS; REMEDIES | 12 |

|

20. | LANDLORD REMEDIES | 13 |

|

21. | COVENANT OF QUIET ENJOYMENT | 14 |

|

22. | SECURITY DEPOSIT | 15 |

|

23. | SUBSTITUTION OF OTHER PREMISES | 15 |

|

24. | SIGNS | 15 |

|

25. | LATE CHARGES | 15 |

|

26. | LANDLORD’S RIGHT TO CURE DEFAULT | 15 |

|

27. | ENTRY BY LANDLORD | 15 |

|

28. | PARKING | 16 |

|

29. | HAZARDOUS MATERIALS | 16 |

|

30. | MISCELLANEOUS PROVISIONS | 16 |

|

31. | RIGHT OF FIRST REFUSAL | 19 |

|

EXHIBITS

| |

EXHIBIT A | FLOOR PLAN OF PREMISES |

| |

EXHIBIT C | RULES AND REGULATIONS |

LEASE AGREEMENT

This Lease Agreement (“Lease”, including the preceding Summary of Basic Lease Information referred to herein as the “Summary”), is made by and between SEMAHO, INC., a Colorado corporation (“Landlord”), and DMC GLOBAL INC., a Delaware corporation (“Tenant”) as of the date set forth in Section 1 of the Summary.

1. REAL PROPERTY, BUILDING AND PREMISES

1.1 Premises, Building and Real Property. Upon and subject to the terms, covenants and conditions hereinafter set forth in this Lease, Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the premises set forth in Section 6 of the Summary (the “Premises”), which Premises are located in the Building (as hereinafter defined). The outline of the floor plan of the Premises is set forth in Exhibit A attached hereto. The Premises are a part of the building known as The Views I located and addressed at 11800 Ridge Parkway, Broomfield, Colorado (collectively, the “Building”). The Building, the parking facilities serving the Building from time to time (“Parking Facilities”), the outside plaza areas, land and other improvements surrounding the Building which are designated from time to time by Landlord as common areas appurtenant to or servicing the Building, and the land upon which any of the foregoing are situated, are herein sometimes collectively referred to as the “Real Property.” Tenant is hereby granted the right to the nonexclusive use of the common corridors and hallways, stairwells, elevators, restrooms and other public or common areas located within the Building and on the Real Property (“Common Areas”). Landlord reserves the right to make alterations or additions to, or to change the location of elements of, the Commons Areas and the Real Property, provided in no event shall such alterations or additions materially and adversely interfere with Tenant’s use or enjoyment of, or access to, the Premises. Landlord agrees to use commercially reasonable efforts to ensure that that the Common Areas shall include throughout the Lease Term a fully-operational café serving prepared hot and cold food options during normal business hours of the Building, consistent with the standards maintained in other first-class office buildings in the Interlocken area of Broomfield, Colorado.

1.2 Condition of the Premises. Except as specifically set forth in this Lease and in the Work Letter, Landlord shall not be obligated to provide or pay for any improvement work or services related to the improvement of the Premises. Tenant also acknowledges that Landlord has made no representation or warranty (express or implied) regarding (a) the condition of the Premises, the Building or the Real Property, except as specifically set forth in this Lease and the Work Letter, if applicable or (b) the suitability or fitness of the Premises, the Building or the Real Property for the conduct of Tenant’s business. Notwithstanding the foregoing, Landlord agrees that on the Delivery Date (as defined in Section 2.2 below), (i) the Premises shall be delivered in a clean and orderly fashion; and (ii) all Building systems serving the Premises (including HVAC (as defined in Section 6.1.1 below), electricity, roof and lighting) shall be in good working order. Landlord represents that to Landlord’s actual knowledge as of the Date of this Lease, the Premises, Building, and Real Property are in compliance with all applicable Laws (as defined in Section 5.2 below). Any upgrades to Building systems required by Tenant’s specific use shall be deducted from the Construction Allowance (as defined in the Work Letter).

1.3 Verification of Rentable Square Feet of Premises and Building. For purposes of this Lease, “rentable square feet” shall mean “rentable area” calculated pursuant to the Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1 – 2010 Method B (the “BOMA Standard”). As of the Date of this Lease, the Building contains 169,692 rentable square feet. During the period commencing on the Delivery Date and ending forty-five (45) days thereafter, Tenant shall have the right to have Tenant’s architect verify the rentable square footage of the Premises set forth in Section 6 of the Summary using the BOMA Standard. If the Tenant’s architect disagrees with Landlord’s space measurement as set forth in Section 6 of the Summary, Tenant shall have the right to notify Landlord in writing of the disagreement within fifteen (15) days after expiration of the 45-day period specified above, and then, for a period of thirty (30) days following written notice from Tenant to Landlord of such disagreement, Landlord and Tenant shall cause their respective space measurement consultants to meet and confer in good faith toward a resolution of such disagreement. If during such 30-day period the respective space measurement consultants agree on a final measurement of the Premises, then Landlord and Tenant shall memorialize such final measurement of the rentable square footage of the Premises in writing and such final measurement shall be binding on Landlord and Tenant for purposes of this Section 1.3. If the respective space measurement consultants are unable to agree on a final measurement of the Premises during such 30-day period, then the Landlord and Tenant shall jointly engage a third-party architect who has not previously worked for either of them and each party shall submit their calculation of the rentable square footage of the Premises to the third-party architect. The third-party architect shall be asked to select which calculation, Landlord or Tenant’s, more accurately measures the rentable square footage of the Premises, and such determination shall thereafter be binding on Landlord and Tenant for purposes of this Section 1.3. The cost of the third-party architect shall be borne equally by Landlord and Tenant. If the final measurement of the rentable square footage of the Premises as determined pursuant to this Section 1.3 is different from the square footage set forth in Section 6 of the Summary, then Landlord and Tenant shall enter into an amendment to this Lease modifying all amounts, percentages and figures appearing or referred to in this Lease to conform to such corrected rentable square footage (including, without limitation, the amount of the “Rent” (as defined in Section 4.1 below). At any time after the initial Lease Term, Landlord’s discretion, the number of rentable square feet of the Premises and the Building shall be subject to verification from time to time by Landlord’s space measurement consultant in accordance with the BOMA Standard.

2. LEASE TERM

2.1 Initial Term. The terms and provisions of this Lease shall be effective as of the Date of this Lease except for the provisions of this Lease relating to the payment of Rent. The term of this Lease (the “Lease Term”) shall be for the period of time set forth in Section 7.1 of the Summary and shall commence on the date (the “Lease Commencement Date”) set forth in Section 7.2 of the Summary, and shall terminate upon the expiration of the Lease Term, unless this Lease is sooner terminated as hereinafter provided. For purposes of this Lease, the term “Lease Year” shall mean each consecutive twelve (12) month period during the Lease Term; provided, however, that if the Lease Commencement Date is not the first day of the month, then the first Lease Year shall commence on the Lease Commencement Date and end on the last day of the twelfth full calendar month thereafter and the second and each succeeding Lease Year shall commence on the first day of the next calendar month; and further provided that the last Lease Year shall end on the last day of the Lease Term (for example, if the Lease Commencement Date is April 15, the first Lease Year will be April 15 through April 30 of the following year, and each succeeding Lease Year will be May 1 through April 30).

2.2 Delivery Date; Delays and Notice of Lease Term Dates. Landlord shall deliver possession of the Premises to Tenant upon Substantial Completion of the Improvements, which Landlord estimates to be January 1, 2019 (the “Estimated Delivery Date”). If the Delivery Date (as hereinafter defined) has not occurred on or before the date that is thirty (30) days after the Estimated Delivery Date and such delay is within Landlord’s reasonable control, then Tenant shall be entitled to a day for day abatement of Rent for each day accruing between the day following expiration of such 30-day period and the actual Delivery Date, which abatement shall be applied against Rent first due hereunder. If the Delivery Date has not occurred by the date that is ninety (90) days following the Estimated Delivery Date and such delay is within Landlord’s reasonable control, then, in addition to the remedy set forth in the preceding sentence, Tenant shall have the right to terminate this Lease by written noticed delivered to Landlord at any time thereafter but prior to the actual Delivery Date. The remedies set forth in this Section 2.2 shall be Tenant’s sole remedies for a delay in the Delivery Date beyond the Estimated Delivery Date. The date upon which Landlord delivers possession of the Premises to Tenant with the Improvements Substantially Complete pursuant to the terms of the Work Letter is be referred to herein as the “Delivery Date”. At any time during the Lease Term, Landlord may deliver to Tenant a notice of Lease Term dates, confirming, among other things, the Lease Commencement Date and the expiration date of this Lease, which notice, if accurate, Tenant shall execute and return to Landlord within ten (10) days of receipt thereof; if Tenant fails to execute and return such notice within such time period, the information contained in such notice shall be deemed correct and binding upon Tenant.

2.3 Option Term. Landlord hereby grants to Tenant, the option to extend the Lease Term for one period of five (5) years (the “Option Term”), which option shall be exercisable only by written notice (an “Option Notice”) delivered by Tenant to Landlord as provided in Section 2.3.2 below. Tenant shall not have the rights contained in this Section 2.3 if, (i) as of the date of the Option Notice or, at Landlord’s option, at any time between the delivery of the Option Notice and the commencement of the applicable Option Term, a Default (as defined in Section 19.1) by Tenant is continuing beyond all applicable notice and cure periods; or (ii) as of the date of the Option Notice, Tenant does not physically occupy substantially the entire Premises or Tenant has assigned this Lease or sublet more than 25% of the Premises pursuant to Article 14 below, other than in connection with a Permitted Transfer (as defined in Section 14.7 below).

2.3.1 Option Rent. The Base Rent (as defined in Section 3 below) payable by Tenant during each Option Term shall be equal to the fair market rent for the Premises and the parking passes, if applicable, as of the commencement date of the applicable Option Term (the “Option Rent”). The fair market rent shall be the rental rate, including all escalations, at which renewing tenants, as of the commencement of the applicable Option Term, are leasing non-sublease, non-encumbered space comparable in size, location and quality to the Premises for a similar term, which comparable space is located in other first-class office buildings in the Interlocken area of Broomfield, Colorado.

2.3.2 Exercise of Option. The option contained in this Section 2.3 shall be exercised by Tenant, if at all, only in the following manner: (a) Tenant shall deliver an Option Notice to Landlord no later than six (6) months, and not earlier than nine (9) months, prior to the expiration of the initial Lease Term, stating that Tenant wishes to exercise its option; and (b) Landlord, after receipt of the Option Notice, shall deliver written notice (the “Option Rent Notice”) to Tenant setting forth Landlord’s good faith determination of the Option Rent for the Option Term. If Tenant disagrees with the Option Rent set forth in Landlord’s Option Rent Notice, then the Landlord and Tenant shall promptly meet and confer in good faith to determine the Option Rent. If Landlord and Tenant cannot agree on Option Rent within thirty (30) days after their initial meeting pursuant to the preceding sentence, then Option Rent shall be determined as set forth in Section 2.3.3 below. Failure of Tenant to timely deliver an Option Notice to Landlord shall be deemed to constitute Tenant’s failure to exercise its option to extend and Tenant shall have no further right to extend the Lease Term. If Tenant timely and properly exercises its option to extend, the Lease Term, subject to Section 2.3.3 below, shall be extended for the Option Term upon all of the terms and conditions set forth in this Lease, except that the Base Rent shall be as indicated in the Option Rent Notice or as determined in accordance with Section 2.3.3, as applicable, and all references herein to the Lease Term shall include the Option Term.

2.3.3 Determination of Option Rent. In the event Tenant exercises its option to extend but objects to Landlord’s determination of the Option Rent as provided in Section 2.3.2 above, then Landlord and Tenant shall attempt to agree in good faith upon the Option Rent. If Landlord and Tenant fail to reach agreement within the 30-day period set forth in Section 2.3.2 above, then within five (5) days thereafter, Landlord and Tenant shall each simultaneously submit to the other in a sealed envelope its good faith estimate of the Option Rent. If the higher of such estimates does not exceed the lower estimate by more than five percent (5%), then the Option Rent shall be the average of the two. Otherwise, within ten (10) days after the simultaneous submission of good faith estimates, the parties shall select an independent licensed commercial real estate broker with at least ten (10) years of experience in negotiating the leasing of office space in the metropolitan area in which the Building is located (a “Qualified Broker”). The Qualified Broker shall not have previously been engaged by either party within the previous five (5) years. If the parties cannot agree on a Qualified Broker, then within a second period of five (5) days, each shall select a Qualified Broker and within five (5) days thereafter the two appointed Qualified Brokers shall select a third Qualified Broker and the third Qualified Broker shall determine the Option Rent. If one party shall fail to select a Qualified Broker within the second five (5)-day period, then the Qualified Broker chosen by the other party shall determine the Option Rent. Within twenty (20) days after submission of the matter, the Qualified Broker shall determine the Option Rent by choosing whichever of the estimates submitted by Landlord and Tenant the Qualified Broker judges to be more accurate. The Qualified Broker shall notify Landlord and Tenant of its decision, which shall be final and binding. The fees of the Qualified Broker shall be borne equally by the parties. Each party shall pay the fees of its respective counsel.

3. BASE RENT

Tenant shall pay, without notice or demand, to Landlord or Landlord’s agent at the management office of the Building (if applicable), or at such other place as Landlord may from time to time designate in writing, monthly installments of base rent as set forth in Section 8 of the Summary (“Base Rent”), in advance on or before the first day of each and every month during the Lease Term, without any setoff or deduction whatsoever, except to the extent expressly provided for in this Lease; provided, however, Landlord hereby abates Base Rent (but not Additional Rent, as defined in Section 4.1 below) for the Premises for the first six (6) full months of the Lease Term. In the event Tenant is in Default under this Lease beyond any applicable period of notice and cure, such abatement shall cease as of the date of such default, and, in the event Landlord exercises its remedy to terminate this Lease or terminate Tenant’s possession of the Premises for such Default as provided in Section, 20 below, Tenant shall immediately repay to Landlord all unamortized sums previously abated hereunder. The Base Rent for the seventh (7th) full month of the Lease Term, and Tenant’s Share of NNN Charges (as defined in

Section 4.1 below) for the first (1st) full month of the Lease Term, shall be paid at the time of Tenant’s execution of this Lease. If any rental or other payment date (including the Lease Commencement Date) falls on a day of the month other than the first day of such month or if any rental or other payment is for a period which is shorter than one month, then the rental or other payment for any such fractional month shall be prorated based on the actual number of days contained in such month.

4. ADDITIONAL RENT

4.1 Additional Rent. In addition to paying the Base Rent specified in Article 3 of this Lease, beginning on the Lease Commencement Date, Tenant shall pay as additional rent during the Lease Term Tenant’s Share of the annual Operating Expenses, Insurance Expenses, Utility Expenses and Tax Expenses allocated to the Building (the “NNN Charges”). Such additional rent, together with any and all other amounts payable by Tenant to Landlord pursuant to the terms of this Lease, shall be hereinafter collectively referred to as “Additional Rent.” The Base Rent and Additional Rent are herein collectively referred to as the “Rent.” All amounts due under this Article 4 as Additional Rent shall be payable for the same periods and in the same manner, time and place as the Base Rent. In the event the Building is part of a multi-building project, Landlord may allocate Operating Expenses, Insurance Expenses, Utility Expenses and Tax Expenses applicable to the project as a whole among the buildings within such project on an equitable basis, consistently applied, as reasonably determined by Landlord. Without limitation on other obligations of Tenant which shall survive the expiration of the Lease Term, the obligations of Tenant to pay the Additional Rent provided for in this Article 4 shall survive the expiration of the Lease Term or earlier termination of this Lease. Landlord hereby represents that the estimated NNN Charges for 2018 are $9.68 per rentable square foot, but such amount is an estimate only and is not a cap on NNN Charges for 2018 or binding on Landlord.

4.2 Definitions. As used in this Article 4, the following terms shall have the meanings hereinafter set forth:

4.2.1 “Expense Year” shall mean each calendar year in which any portion of the Lease Term falls, through and including the calendar year in which the Lease Term expires.

4.2.2 “Insurance Expenses” shall mean the cost of insurance carried by Landlord as required under this Lease or otherwise in such amounts as Landlord may reasonably determine or as may be required by any mortgagees or the lessor of any underlying or ground lease affecting the Real Property, including any deductibles thereunder.

4.2.3 “Operating Expenses” shall mean all actual and reasonable expenses, costs and amounts of every kind and nature which Landlord incurs or which accrues during any Expense Year because of or in connection with the ownership, management, maintenance, repair, restoration or operation of the Real Property (other than Insurance Expenses, Tax Expenses and Utility Expenses), and the cost of any capital improvements or other costs (A) which are intended as a labor-saving device or to effect other economies in the operation or maintenance of the Real Property, or (B) made to the Real Property after the Lease Commencement Date that are required under any governmental law or regulation enacted or applicable to the Real Property after the Date of this Lease; provided, however, that if any such cost described in (A) or (B) above is a capital expenditure (“Included Capital Items”), such cost shall be amortized (including interest on the unamortized cost) over its useful life as Landlord shall reasonably determine in accordance with sound accounting and management principles, consistently applied. If the Building is not fully occupied during any portion of any Expense Year, Landlord shall make an appropriate adjustment to the variable components of Operating Expenses or Utility Expenses (as defined below) for such Expense Year, employing sound accounting and management principles, consistently applied, to determine the amount of Operating Expenses or Utility Expenses that would have been paid had the Building been fully occupied. Notwithstanding anything to the contrary in the Lease, the following items shall be excluded from Operating Expenses:

4.2.3.1 Costs of capital repairs, capital replacements, or capital improvements, other than Included Capital Items;

4.2.3.2 Costs of repair or replacement of the foundation, structural elements, exterior walls and the underground utilities of or serving the Premises or the Building;

4.2.3.3 Costs of the design and construction of tenant improvements to the Premises or the premises of other tenants;

4.2.3.4 Depreciation, interest and principal payments on mortgages and other debt costs, if any, and amounts paid as ground rental or as rental for the Building by Landlord;

4.2.3.5 Marketing costs, legal fees, space planners’ fees and advertising and promotional expenses, and brokerage fees incurred in connection with the original development, subsequent improvement, or original or future leasing of the Building;

4.2.3.6 Costs for which any tenant directly contracts with local providers, costs for which Landlord is reimbursed by any tenant or occupant of the Building or by insurance by its carrier or any tenant’s carrier or by anyone else and expenses in connection with services or other benefits which are not offered to the Tenant or for which the Tenant is charged directly but which are provided to another tenant or occupant of the Building without a separate charge;

4.2.3.7 Any bad debt loss, rent loss, or reserves for bad debts or rent loss;

4.2.3.8 Landlord’s general corporate overhead and general and administrative expenses and other costs associated with the operation of the business of the entity which constitutes the Landlord, as the same are distinguished from the costs of operation of the Real Property, including partnership or corporate accounting and legal matters, costs of defending any lawsuits with any mortgagee (except as the actions of the Tenant may be in issue), costs of selling, syndicating, financing, mortgaging or hypothecating any of the Landlord’s interest in the Building, and costs incurred in connection with any disputes, including but not limited to any disputes between Landlord and its employees, between Landlord and Building management, or between Landlord and other tenants or occupants;

4.2.3.9 The wages and benefits of any employee who does not devote substantially all of his or her employed time to the Building unless such wages and benefits are prorated to reflect time spent on operating and managing the Building vis-à-vis time spent on matters unrelated to operating and managing the Building;

4.2.3.10 Costs, including permit, license and inspection costs, incurred with respect to the installation of tenant improvements made for new tenants in the Building or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Building (excluding, however, such costs relating to any Common Areas of the Building or Parking Facilities);

4.2.3.11 Overhead and profit increment paid to the Landlord or to subsidiaries or affiliates of the Landlord for services in the Building to the extent the same exceeds the costs of such services rendered by qualified, first-class unaffiliated third parties on a competitive basis, and then only such excess shall be excluded from Operating Expenses;

4.2.3.12 Costs, other than those incurred in ordinary maintenance and repair, for sculpture, paintings, fountains or other objects of art;

4.2.3.13 Fees and reimbursements payable to Landlord (including its affiliates) for management of the Building which would ordinarily be included in a management fee, in excess of a commercially reasonable management fee that a landlord would have been required to pay to comparable independent established management companies operating other comparable buildings in comparable locations;

4.2.3.14 Costs to repair or rebuild after casualty loss (excluding deductibles under insurance policies carried by Landlord, which deductibles shall be included in Operating Expenses);

4.2.3.15 Any costs expressly excluded from Operating Expenses elsewhere in the Lease;

4.2.3.16 Costs arising from the negligence or willful misconduct of Landlord or its agents, employees, vendors, contractors, or providers of materials or services;

4.2.3.17 Costs incurred to comply with Laws in effect as of the Lease Commencement Date, including but not limited to laws and regulations relating to handicap access or the removal of Hazardous Material (as defined in Section 29.3 below), which Hazardous Material is in existence in the Building or on the Real Property prior to the Lease Commencement Date or is brought into the Building or onto the Project after the Date of this Lease by Landlord or any other tenant of the Building (excluding Tenant), and is of such a nature that a federal, state or municipal government governmental authority, if it had knowledge of the presence of such Hazardous Material in the state and under the conditions that it then exists in the Building or on the Real Property, would require the removal of such Hazardous Material or would require other remedial or containment action with respect thereto pursuant to Laws in effect as of the Lease Commencement Date (in the event that such costs of compliance are not paid by Landlord and are instead charged to Tenant directly by a governmental authority, Landlord agrees that it will reimburse Tenant for such charges);

4.2.3.18 Costs arising from Landlord’s charitable or political contributions; and

4.2.3.19 Interests, fine, late fees, collection costs, legal fees or penalties assessed as a result of Landlord’s failure to make payments in a timely manner or to comply with applicable Laws, including regarding the payment of taxes, or to comply with the terms of any lease, mortgage, deed of trust, ground lease, private restriction or other agreement.

4.2.4 “Systems and Equipment” shall mean any plant, machinery, transformers, duct work, cable, wires, and other equipment, facilities, and systems designed to supply heat, ventilation, air conditioning and humidity or any other services or utilities, or comprising or serving as any component or portion of the electrical, gas, steam, plumbing, sprinkler, communications, alarm, security, or fire/life safety systems or equipment, or any other mechanical, electrical, electronic, computer or other systems or equipment which serve the Real Property in whole or in part.

4.2.5 “Tax Expenses” shall mean all federal, state, county, or local governmental or municipal taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary, (including, without limitation, real estate taxes, general and special assessments, transit taxes, leasehold taxes or taxes based upon the receipt of rent, including gross receipts, transaction privilege or any sales taxes applicable to the receipt of rent, unless required to be paid by Tenant, personal property taxes imposed upon the fixtures, machinery, equipment, apparatus, systems and equipment, appurtenances, furniture and other personal property used in connection with the Real Property), which Landlord shall pay during any Expense Year because of or in connection with the ownership, leasing and operation of the Real Property or Landlord’s interest therein. Tax Expenses shall also include all franchise taxes, and similar taxes, including taxes payable by Landlord and attributable to amounts payable by Tenant under this Lease, including all Base Rent, Additional Rent, operating expense reimbursements and similar amounts. Tax Expenses shall not include any federal or state inheritance, general income, gift or estate taxes. All assessments which are not specifically charged to Tenant because of what Tenant has done, which can be paid by Landlord in installments, shall be paid by Landlord in the maximum number of installments permitted by Law (except to the extent inconsistent with the general practice of the Building or comparable buildings) and shall be included in Tax Expenses in the year in which the installment is actually paid.

4.2.6 “Utility Expenses” shall mean the cost of supplying all utilities to the Real Property (other than utilities for which tenants of the Building are separately metered or are otherwise paid separately by tenants of the Building), including utilities for the heating, ventilation and air conditioning system for the Building and Common Areas.

4.2.7 “Tenant’s Share” shall mean the percentage set forth in Section 9 of the Summary.

4.3 Payment of Additional Rent.

4.3.1 Statement of Estimated Expenses. Landlord shall endeavor to give Tenant a yearly expense estimate statement (the “Estimate Statement”) which shall set forth Landlord’s reasonable estimate (the “Estimate”) of what the total amount of Operating Expenses, Insurance Expenses, Utility Expenses and Tax Expenses for the then-current or upcoming Expense Year shall be (the “Estimated NNN Charges”). Tenant shall pay, with its next installment of Base Rent due, a fraction of the Estimated NNN Charges for the then-current Expense Year (reduced by any amounts paid pursuant to the last sentence of this Section 4.3.1). Such fraction shall have as its numerator the number of months which have elapsed in such current Expense Year to the month of such payment, both months inclusive, and shall have twelve (12) as its denominator. Until a new Estimate Statement is furnished, Tenant shall pay monthly, with the monthly Base Rent installments, an amount equal to one-twelfth (1/12) of the total Estimated NNN Charges set forth in the previous Estimate Statement delivered by Landlord to Tenant.

4.3.2 Statement of Actual Expenses and Payment by Tenant. Landlord shall give to Tenant following the end of each Expense Year, a statement (the “Statement“) which shall state the Operating Expenses, Insurance Expenses, Utility Expenses and Tax Expenses incurred or accrued for such preceding Expense Year, and which shall indicate the amount of the NNN Charges. Upon receipt of the Statement for each Expense Year during the Lease Term, Tenant shall pay, with its next installment of Base Rent due (or within thirty (30) days of receipt if the Lease Term has expired prior to Tenant’s receipt of the Statement), the full amount of Tenant’s Share of the NNN Charges for such Expense Year, less the amounts, if any, already paid by Tenant during such Expense Year as Estimated NNN Charges. In the event an overpayment is by Tenant is reflected in the Statement, such overpayment will be credited against the next installments of NNN Charges due, or in the event the Lease Term has expired, then any overpayment will be refunded to Tenant within thirty (30) days after the issuance of the Statement. The failure of Landlord to timely furnish the Statement or the Estimated Statement for any Expense Year shall not prejudice Landlord from enforcing its rights under this Article 4. The provisions of this Section 4.3.2 shall survive the expiration or earlier termination of the Lease Term.

4.3.3 Tenant Audit. Notwithstanding anything to the contrary in this Lease, if the amount of NNN Charges as reflected on a Statement increases by more than 2% from those of the immediately preceding calendar year, Tenant may review Landlord’s records of the NNN Charges reflected on such Statement, provided that (a) Tenant notifies Landlord of its intent to conduct an audit of such NNN Charges within sixty (60) days after Tenant’s receipt of a Statement pursuant to Section 4.3.2 above (the “Audit Election Period”); (b) there is no uncured Default under this Lease then in existence; (c) the audit shall be prepared by a reputable, independent certified public accounting firm selected by Tenant and approved by Landlord in its reasonable discretion, who shall not be compensated on a contingency fee basis; (d) the audit shall commence within thirty (30) days after Landlord makes Landlord’s books and records available to Tenant’s auditor and shall conclude within sixty (60) days after commencement; (e) the audit shall be conducted during Landlord’s normal business hours at the location where Landlord maintains its books and records, and shall not unreasonably interfere with the conduct of Landlord’s business; (f) Tenant and its audit firm shall treat any audit in a confidential manner and shall each execute a commercially reasonable confidentiality agreement for Landlord’s benefit prior to commencing the audit; (g) the audit firm’s audit report shall, at no charge to Landlord, be submitted in draft form for Landlord’s review and comment before the final approved audit report is delivered to Landlord (which review and comment shall be within fifteen (15) days of Landlord’s receipt of the same), and Landlord shall have the right to point out errors or make suggestions with respect to such audit report, and any appropriate comments or clarifications by Landlord which are accepted by Tenant’s auditor shall be incorporated into the final audit report, it being the intention of the parties that Landlord’s right to review is intended to prevent errors and avoid disputes and not to unduly influence Tenant’s auditor in the preparation of the final audit report; and (h) at the conclusion of any audit, Tenant and its employees, auditors and agents shall return all copies of supporting documentation made in connection with such audit. In the event that any final audit report reflects that Landlord has overstated NNN Charges by more than 5%, Landlord shall reimburse Tenant for the reasonable costs of such audit, not to exceed $2,500.00. This paragraph shall not be construed to limit, suspend, or abate Tenant’s obligation to pay Rent when due. Landlord shall credit any overpayment determined by the audit report against the next Rent due and owing by Tenant or, if no further Rent is due, refund such overpayment directly to Tenant within thirty (30) days of determination. Likewise, Tenant shall pay Landlord any underpayment determined by the final approved audit report within thirty (30) days of determination. The foregoing obligations shall survive the expiration or termination of this Lease. If Tenant does not give written notice of its election to audit during the Audit Election Period, Landlord’s NNN Charges for the applicable calendar year as set forth in the applicable Statement shall be deemed approved for all purposes, and Tenant shall have no further right to review or contest the same. The right to audit granted hereunder shall not be available to any subtenant under a sublease of the Premises.

4.4 Taxes and Other Charges for Which Tenant Is Directly Responsible. Tenant shall reimburse Landlord upon demand for any and all taxes or assessments required to be paid by Landlord (except to the extent included in Tax Expenses by Landlord), excluding state, local and federal personal or corporate income taxes measured by the net income of Landlord from all sources and estate and inheritance taxes, whether or not now customary or within the contemplation of the parties hereto, when: (a) said taxes are measured by or reasonably attributable to the cost or value of Tenant’s equipment, furniture, fixtures and other personal property located in the Premises, or by the cost or value of any leasehold improvements made in or to the Premises by or for Tenant, to the extent the cost or value of such leasehold improvements exceeds the cost or value of a building standard build-out as determined by Landlord regardless of whether title to such improvements shall be vested in Tenant or Landlord; (b) said taxes are assessed upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Real Property (including the Parking Facilities); or (c) said taxes are assessed upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises.

5. USE OF PREMISES

5.1 Permitted Use. Tenant shall use the Premises solely for general office purposes consistent with the character of the Building, and Tenant shall not use or permit the Premises to be used for any other purpose or purposes whatsoever without Landlord’s prior consent, not to be unreasonably withheld.

5.2 Prohibited Uses. Tenant further covenants and agrees that it shall not use, or suffer or permit any person or persons to use, the Premises, the Building, the Parking Facilities or any other Common Areas, the Real Property or any part thereof for any use or purpose contrary to the rules and regulations reasonably established by Landlord for the Real Property (the “Rules and Regulations”), or in violation of any federal, state or local laws, statute, ordinances, rules or regulations, or any recorded covenants, conditions and

restrictions or ground or underlying leases affecting the Real Property (collectively, “Laws”). The current Rules and Regulations are attached hereto as Exhibit C and made a part hereof. Tenant shall not use or allow Tenant Parties (as defined in Section 10.1 below) to use any part of the Premises, the Building or the Real Property for the storage, use, treatment, manufacture or sale of any Hazardous Material (as defined in Section 29.3 below).

5.3 Compliance With Laws. Tenant shall not do anything or suffer anything to be done in or about the Premises which will in any way conflict with any Law now in force or which may hereafter be enacted or promulgated. At its sole cost and expense, Tenant shall promptly comply with all Laws applicable to Tenant’s use and operation of the Premises (including without limitation the Americans With Disabilities Act), other than the making of structural changes or changes to the Systems and Equipment, the Building, or Common Areas, which changes will be made by Landlord at its expense, but subject to reimbursement as an Operating Expense to the extent permitted by Article 4; however, if such changes are required due to Tenant’s Alterations, the Improvements or the particular nature of Tenant’s use of the Premises, Tenant shall, as Additional Rent, reimburse Landlord for the actual cost thereof within thirty (30) days following receipt of an invoice therefor. Tenant shall comply with the Rules and Regulations of the Building and such other reasonable rules and regulations (or modifications thereto) adopted by Landlord from time to time. The Rules and Regulations will be applied in an equitable manner as determined by Landlord. Tenant shall also cause its agents, contractors, subcontractors, employees, customers, and subtenants to comply with all Rules and Regulations.

5.4 Tenant’s Security Responsibilities. Tenant shall (a) lock the doors to the Premises and take other reasonable steps to secure the Premises and the personal property of Tenant and any Tenant Parties in the Common Areas and Parking Facilities of the Building and Real Property, from unlawful intrusion, theft, fire and other hazards; (b) keep and maintain in good working order all security and safety devices installed in the Premises by or for the benefit of Tenant (such as locks, smoke detectors and burglar alarms); and (c) reasonably cooperate with Landlord and other tenants in the Building on Building safety matters. Tenant acknowledges that (i) any security or safety measures employed by Landlord are for the protection of Landlord’s own interests; (ii) Landlord is not a guarantor of the security or safety of the Tenant Parties or their property; (iii) such security and safety matters are the responsibility of Tenant and local law enforcement authorities; and (iv) in no event shall Landlord be liable for damages, losses, claims, injury to persons or property or causes of action arising out of any theft, burglary, trespass or other entry into the Premises, the Building or the Real Property, except to the extent a result of Landlord’s negligence or willful misconduct.

6. SERVICES AND UTILITIES

6.1 Standard Tenant Services. Landlord shall provide the following services on all days during the Lease Term, unless otherwise stated below.

6.1.1 Subject to all Laws and governmental guidelines applicable thereto, Landlord shall provide heating, ventilation and air conditioning (“HVAC”) when necessary for normal comfort for normal office use in the Premises, consistent with the standards maintained in other first-class office buildings in the Interlocken area of Broomfield, Colorado, from Monday through Friday, during the period from 7:00 a.m. to 6:00 p.m., and Saturday 9:00 a.m. to 1:00 p.m. Notwithstanding the foregoing, HVAC service will not be supplied on the date of observation of New Year’s Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day (and the Friday following Thanksgiving Day), Christmas Day and other locally or nationally recognized holidays (collectively, the “Holidays”).

6.1.2 Landlord shall provide adequate electrical wiring and facilities for normal general office use, and electricity at levels consistent with normal general office use, consistent with the standards maintained in other first-class office buildings in the Interlocken area of Broomfield, Colorado. Such electricity may, upon Tenant’s request, be separately metered at Tenant’s sole cost and expense and in such event, Tenant shall make payment directly to the entity providing such electricity. In the event the Premises is not separately metered, electricity (including for the HVAC System) shall be measured by a general meter and Tenant shall pay, as Additional Rent, upon billing by Landlord its pro rata portion of such metered charges based upon Landlord’s good faith allocation of such electrical costs, which allocation shall be based on Tenant’s Share. Such costs may be estimated monthly and reconciled promptly following the end of each Expense Year.

6.1.3 Landlord shall provide hot and cold city water from the regular Building outlets for drinking, lavatory and toilet purposes.

6.1.4 Landlord shall provide janitorial services in the Premises consistent with the standards maintained in other first-class office buildings in the Interlocken area of Broomfield, Colorado, except the date of observation of the Holidays, in and about the Premises and Common Areas.

6.1.5 Landlord shall provide nonexclusive automatic passenger elevator service, if the Building has an elevator, at all times, except in the event of an emergency.

6.1.6 Landlord shall provide window washing services for the exterior surface of the Building’s perimeter windows only, at intervals consistent with the standards maintained in other first-class office buildings in the Interlocken area of Broomfield (in no event less than biannually). Tenant shall be responsible for the cleaning of all other glass surfaces within the Premises.

6.1.7 Landlord shall provide nonexclusive freight elevator service subject to scheduling by Landlord.

6.2 Overstandard Tenant Use. Tenant shall not, without Landlord’s prior written consent, use heat-generating machines, machines other than normal fractional horsepower office machines, or equipment or lighting other than building standard lights in the Premises, which may affect the temperature otherwise maintained by the air conditioning system or increase the electricity or water normally furnished for the Premises by Landlord pursuant to the terms of Section 6.1 of this Lease. If Tenant uses electricity, water or heat or air conditioning in excess of that supplied by Landlord pursuant to Section 6.1 of this Lease, Tenant shall pay to Landlord, upon billing, the cost of such excess consumption, the cost of the installation, operation, and maintenance of equipment which is installed in

order to supply such excess consumption, and the cost of the increased wear and tear on existing equipment caused by such excess consumption, and Landlord may install devices to separately meter any increased use and in such event Tenant shall pay the increased cost directly to Landlord, on demand, including the cost of such additional metering devices. If Tenant desires to use HVAC during hours other than those for which Landlord is obligated to supply such utilities pursuant to the terms of Section 6.1 of this Lease, if any, Tenant shall give Landlord such prior notice, as Landlord shall from time to time establish as appropriate, of Tenant’s desired use and Landlord shall supply such utilities to Tenant at a reasonable hourly cost to Tenant, which cost may include Landlord’s reasonable allocation of the costs for electricity, water, sewage, water treatment, labor, metering, filtering, equipment depreciation, wear and tear and maintenance to provide such service. The current after-hours rate as of the Date of this Lease is $50.00 per hour. Amounts payable by Tenant to Landlord for such use of additional utilities shall be deemed Additional Rent hereunder and shall be billed on a monthly basis. Notwithstanding anything herein to the contrary, any HVAC or other service necessary to accommodate a computer server room will be deemed to constitute an overstandard use and will be subject to the provisions of this Section 6.2.

6.3 Interruption of Use. Tenant agrees that, except as expressly set forth herein, Landlord shall not be liable for any damages incurred by Tenant, by abatement of Rent or otherwise, for failure to furnish or delay in furnishing any utility or service (including telephone and telecommunication services), or for any diminution in the quality or quantity thereof (a “Service Failure”); and such failures or delays or diminution shall never be deemed to constitute an eviction or disturbance of Tenant’s use and possession of the Premises or relieve Tenant from paying Rent or performing any of its obligations under this Lease. However, if the Premises, or a material portion of the Premises, are made untenantable for a period in excess of five (5) consecutive days as a result of a Service Failure that is reasonably within the control of Landlord to correct, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period beginning on the 6th consecutive day of the Service Failure and ending on the day the service has been restored. If the entire Premises have not been rendered untenantable by the Service Failure, the amount of abatement shall be equitably prorated.

6.4 Additional Services. Landlord shall also have the exclusive right, but not the obligation, to provide any additional services which may be required by Tenant, including, without limitation, locksmithing, lamp replacement, additional janitorial service, and additional repairs and maintenance, provided that Tenant, as Additional Rent, shall pay to Landlord upon billing, the sum of all actual costs to Landlord of such additional services.

6.5 Access. Except in the event of an emergency, Tenant shall have access to the Building and the Parking Facilities twenty-four (24) hours per day, seven (7) days per week, subject to such card-key or other security system as Landlord may establish from time to time.

7. REPAIRS AND MAINTENANCE

Tenant shall, at Tenant’s own expense, keep the Premises, including all improvements, fixtures and furnishings therein, in good order, repair and condition at all times during the Lease Term; provided however, that, at Landlord’s option, or if Tenant fails to make such repairs within ten (10) days following written notice from Landlord, then Landlord may, but need not, make such repairs and replacements, and Tenant shall pay Landlord’s actual and reasonable costs or expenses, including Landlord’s overhead, arising from Landlord’s involvement with such repairs and replacements forthwith within thirty (30) days following receipt of an invoice for same. Tenant hereby waives and releases its right to make repairs at Landlord’s expense and/or terminate this Lease or vacate the Premises under any applicable Law now or hereafter in effect. Landlord shall be responsible for all structural, exterior, roof, Building systems, Common Areas and Parking Facilities repair and maintenance during the Lease Term consistent with the standards maintained in other first-class office buildings in the Interlocken area of Broomfield, Colorado, the cost of which may be included in Operating Expenses to the extent provided in Section 4 of this Lease.

8. ADDITIONS AND ALTERATIONS

8.1 Landlord’s Consent to Alterations. Tenant may not make any improvements, alterations, additions or changes to the Premises (collectively, the “Alterations”) without first procuring the prior written consent of Landlord to such Alterations, which consent shall be requested by Tenant not less than thirty (30) days prior to the commencement thereof, and which consent shall not be unreasonably withheld, conditioned or delayed by Landlord. The construction of the initial Improvements to the Premises, if any, shall be governed by the terms of the Work Letter and not the terms of this Article 8. Notwithstanding the foregoing, Tenant shall have the right to perform non-structural, interior Alterations to the Premises without Landlord’s consent, provided that (a) the cost of such Alterations does not exceed $20,000.00 in any one instance, (b) such Alterations are cosmetic in nature and do not require a permit, and (c) such Alterations are not visible from the exterior of the Premises or the Building (“Minor Alterations”). Tenant shall notify Landlord in writing of any Minor Alterations not less than ten (10) days prior to commencement of the same.

8.2 Manner of Construction. Tenant shall have obtained Landlord’s approval of all plans, specifications, drawings, contractors and subcontractors prior to the commencement of Tenant’s construction of any Alterations; provided, however, a contractor of Landlord’s selection shall perform all mechanical, electrical, plumbing, structural, and heating, ventilation and air conditioning work, and such work shall be performed at Tenant’s cost, which cost shall not exceed a competitive market rate for such services. Tenant agrees to carry “Builder’s All Risk” insurance in a reasonable amount approved by Landlord covering the construction of such Alterations, and such other insurance as Landlord may reasonably require. Further, to the extent Landlord’s personnel is reasonably required to oversee Tenant Alterations, Tenant shall pay to Landlord or its agent an oversight fee of $150.00 per hour. Tenant shall construct such Alterations and perform such repairs in conformance with any and all applicable Laws and pursuant to a valid building permit (if applicable), issued by the appropriate governmental authorities, in conformance with Landlord’s construction rules and regulations and in a diligent, good and workmanlike manner. If such Alterations trigger a legal requirement upon Landlord to make any Alterations or improvements to the Building or Common Areas, then Landlord shall notify Tenant in writing of the cost of such Building or Common Area improvement. If, following such written notice, Tenant elects to proceed with the Alteration triggering such Building or Common Area improvement, then Tenant shall, as Additional Rent, reimburse Landlord for the actual cost thereof within thirty (30) days following receipt of an invoice therefor. Landlord’s approval of the plans, specifications and working drawings for Tenant’s Alterations shall create no responsibility or liability on the part of Landlord for their completeness, design sufficiency, or compliance with all laws, rules and regulations of

governmental agencies or authorities. Upon completion of any Alterations, Tenant agrees to cause a Notice of Completion (or equivalent) to be posted (if applicable) and recorded in the office of the Recorder of the County in which the Building is located in accordance with all applicable Laws, and Tenant shall deliver to the Building management office a reproducible copy of the “as built” drawings of the Alterations, to the extent applicable.

8.3 Landlord’s Property/Removal. All Alterations and fixtures which may be made, installed or placed in or about the Premises from time to time, shall be at the sole cost of Tenant and shall be and become the property of Landlord upon installation; however, Landlord may, by written notice to Tenant at the time of approval of such Alterations (or within ten (10) days after receipt of Tenant’s notice of any Minor Alterations) and the initial Improvements constructed and installed pursuant to the Work Letter, require Tenant at Tenant’s expense to remove any such Alterations (including Minor Alterations), initial Improvements or fixtures at the expiration or earlier termination of the Lease Term. If Tenant fails to complete such removal and/or to repair any damage caused by the required removal of any Alterations, Minor Alterations, initial Improvements or fixtures, Landlord may do so and may charge the actual cost thereof to Tenant. This Section 8.3 shall survive the expiration or earlier termination of this Lease.

8.4 Landlord’s Liability for Alterations. Landlord’s approval of any Alterations shall not be a representation by Landlord that the Alteration complies with applicable Laws or will be adequate for Tenant’s use. Tenant acknowledges that Landlord is not an architect or engineer, and that the Alterations will be designed and/or constructed using independent architects, engineers, and contractors. Accordingly, Landlord does not guarantee or warrant that the applicable construction documents will comply with Laws or be free from errors or omissions, or that the Alterations will be free from defects, and Landlord will have no liability therefor.

8.5 Transmitter and Cables. Subject to Landlord’s approval, not to be unreasonably withheld, Tenant at its sole expense may erect, maintain and operate a transmitter or antennae atop the Building; and install connecting cable, conduits and other electrical equipment within the shafts, ducts, and conduit in the Building. Tenant shall maintain all such equipment in good condition and repair at all times, shall remove it at the end of the Lease Term and shall repair any damage to the Building caused by such removal to Landlord’s reasonable satisfaction.

9. COVENANT AGAINST LIENS

Tenant covenants and agrees not to suffer or permit any lien of mechanics or materialmen or others to be placed against the Real Property, the Building or the Premises with respect to work or services claimed to have been performed for or materials claimed to have been furnished to Tenant or the Premises, and, in case of any such lien attaching or notice of any lien, Tenant covenants and agrees to cause it to be immediately released and removed of record. Notwithstanding anything to the contrary set forth in this Lease, in the event that such lien is not released and removed within twenty (20) days after the date on which Tenant receives notice of such lien, Landlord, at its sole option, may immediately take all action necessary to release and remove such lien, without any duty to investigate the validity thereof, and all sums, costs and expenses, including reasonable attorneys’ fees and costs, incurred by Landlord in connection with such lien shall be deemed Additional Rent under this Lease and shall immediately be due and payable by Tenant upon demand.

10. INDEMNITY AND INSURANCE

10.1 Indemnification and Waiver. Tenant shall be liable for, and shall indemnify, defend, protect and hold Landlord and Landlord’s partners, officers, directors, employees, agents, successors and assigns (collectively, “Landlord Indemnified Parties”) harmless from and against, any and all claims, damages, judgments, suits, causes of action, losses, liabilities and expenses, including reasonable attorneys’ fees and court costs (collectively, “Indemnified Claims”), arising or resulting from (a) any negligent or willful act or omission of Tenant or any of Tenant’s agents, employees, contractors, subtenants, assignees or licensees, in or about the Premises, the Building or the Real Property (collectively, “Tenant Parties”); (b) any occurrence within the Premises except to the extent caused by the negligence or willful misconduct of Landlord, its employees, agents or contractors; and/or (c) any default by Tenant of any obligations on Tenant’s part to be performed under the terms of this Lease. Tenant hereby assumes all risk of damage to property or injury to persons in or about the Premises, the Building or elsewhere on the Real Property from any cause, and Tenant hereby waives all claims in respect thereof against Landlord, except to the extent caused by the negligence or willful misconduct of Landlord, its employees, agents or contractors. The provisions of this Section 10.1 shall survive the expiration or earlier termination of this Lease with respect to any claims or liability occurring prior to such expiration or termination.

10.2 Tenant’s Insurance. During the Lease Term, Tenant shall maintain the following insurance coverages in the following amounts.

10.2.1 Commercial general liability (CGL) insurance and, if necessary, commercial umbrella insurance, on an occurrence basis, with a limit of not less than $3,000,000 each occurrence. CGL insurance shall be written on ISO occurrence form CG 00 01 01 96 (or a substitute form providing equivalent coverage) and shall cover liability arising from premises, operations, independent contractors, products-completed operations, personal injury and advertising injury, liability assumed under an insured contract and the performance by Tenant of the indemnity agreements set forth in Sections 10.1 and 29.2 of this Lease. Landlord shall be included as an insured under the CGL policy, using ISO additional insured endorsement CG 20 11 or a substitute providing equivalent coverage, and under the commercial umbrella, if any. This insurance shall apply as primary insurance with respect to any other insurance or self-insurance programs afforded to Landlord. There shall be no endorsement or modification of the CGL to make it excess over other available insurance; alternatively, if the CGL states that it is excess or pro rata, the policy shall be endorsed to be primary with respect to the additional insured. Tenant waives all rights against Landlord and its agents, officers, directors and employees for recovery of damages to the extent these damages are covered by the commercial general liability or commercial umbrella liability insurance maintained pursuant to this agreement.

10.2.2 Commercial property insurance covering (a) all office furniture, trade fixtures, office equipment, merchandise and all other items of Tenant’s property on the Premises installed by, for, or at the expense of Tenant, and (b) the Improvements and Alterations. Such insurance shall cover the perils insured under the ISO special causes of loss form (CP 10 30) and shall include coverage for vandalism and malicious mischief, terrorism coverage for both certified and non-certified acts of terrorism, water damage, sprinkler

leakage coverage, boiler and machinery (systems breakdown) and earthquake sprinkler leakage coverage. The amount insured shall equal the full replacement cost value new without deduction for depreciation of the covered items. Any coinsurance requirement in the policy shall be eliminated through the attachment of an agreed amount endorsement, the activation of an agreed value option, or as is otherwise appropriate under the particular policy form. In no event shall Landlord be liable for any damage to or loss of personal property sustained by Tenant, whether or not it is insured, even if such loss is caused by the negligence of Landlord, its employees, officers, directors or agents. Landlord and Tenant hereby waive any recovery of damages against each other (including their employees, officers, directors, agents, or representatives) for loss or damage to the Building, tenant improvements and betterments, fixtures, equipment, and any other personal property to the extent covered by the commercial property insurance required above. If the commercial property insurance purchased by Tenant as required above does not allow the insured to waive rights of recovery against others prior to loss, Tenant shall cause them to be endorsed with a waiver of subrogation as required above.

10.2.3 Business income, business interruption and extra expense insurance in such amounts as will reimburse Tenant for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent tenants or attributable to prevention of access to the Premises or to the Building as a result of such perils. In no event shall Landlord be liable for any business interruption or consequential loss sustained by Tenant, whether or not it is insured, even if such loss is caused by the negligence of Landlord, its agents, employees, directors officers or contractors.

10.2.4 Worker’s compensation insurance providing statutory benefits to Tenant’s employees, employers liability insurance with limits not less than $1,000,000 each accident for bodily injury by accident or $1,000,000 each employee for bodily injury by disease. Tenant waives all rights against Landlord and its agents, officers, directors, and employees for recovery of damages to the extent these damages are covered by the worker’s compensation and employers liability obtained by Tenant. Tenant shall obtain an endorsement to effect this waiver.

10.3 Form of Policies. The minimum limits of policies of insurance required of Tenant under this Lease shall in no event limit the liability of Tenant under this Lease and Landlord makes no representation or guaranty that the insurance required under this Lease shall be sufficient or adequate to protect Tenant. All insurance shall (a) be issued by an insurance company having a rating of not less than A-X in Best’s Insurance Guide or which is otherwise acceptable to Landlord and licensed to do business in the State where the Building is located; and (b) provide that said insurance shall not be canceled or coverage changed unless thirty (30) days’ prior written notice shall have been given to Landlord and the other additional insureds thereunder designated by Landlord. In addition, the insurance described in Section 10.2.1 above shall (i) name Landlord, any mortgage holder, and any other party specified by Landlord, as an additional insured; (ii) specifically cover the liability assumed by Tenant under this Lease including, but not limited to, Tenant’s obligations under Section 10.1 of this Lease; (iii) be primary insurance as to all claims thereunder and provide that any insurance required by Landlord is excess and is non-contributing with any insurance requirement of Tenant; and (iv) contain a cross-liability endorsement or severability of interest clause acceptable to Landlord. The insurance described in Section 10.2.2 shall name Landlord and any other party specified by Landlord as loss-payee as to all items referred to in clause (b) of Section 10.2.2 and the insurance described in Sections 10.2.2 and 10.2.3 shall have deductibles reasonably acceptable to Landlord. Tenant shall deliver all policies or certificates thereof to Landlord on or before Landlord’s delivery of the Premises to Tenant or the Lease Commencement Date, whichever first occurs, and at least thirty (30) days before the expiration dates thereof. All policies and certificates shall provide that Landlord will be given at least thirty (30) days’ prior written notice from the insurer of any cancellation, termination, non-renewal or any material change in coverage as required in this Lease. The words “endeavor to” and “but failure to mail such notice shall impose no obligation or liability of any kind upon the company, its agents or representatives” shall be deleted from the policy or certificate form’s cancellation provision. Failure of Landlord to demand such certificate or other evidence of full compliance with these insurance requirements or failure of Landlord to identify a deficiency from evidence that is provided shall not be construed as a waiver of Tenant’s obligation to maintain such insurance. In the event Tenant shall fail to procure such insurance, or to deliver such policies or certificate, Landlord may deny Tenant the right to occupy the Premises until such time as Tenant makes such deliveries (which denial shall have no effect upon the Lease Commencement Date) and/or procure such policies for the account of Tenant, and the cost thereof shall be paid to Landlord as Additional Rent within five (5) days after delivery to Tenant of the bills therefor.

10.4 Tenant’s Compliance with Landlord’s Insurance. Tenant shall, at Tenant’s expense, comply with all reasonable insurance company requirements pertaining to the use of the Premises to the extent notice of such requirements is specifically delivered in writing by Landlord to Tenant. If Tenant’s conduct or use of the Premises causes any increase in the premium for such insurance policies, and such conduct or use does not cease within two (2) business days after written notice is delivery by Landlord to Tenant, then Tenant shall promptly reimburse Landlord for any such increase. Landlord agrees to maintain property insurance coverage on the Building at full replacement cost during the Lease Term.

10.5 Subrogation. Landlord and Tenant agree to have their respective insurance companies issuing property damage, worker’s compensation insurance and loss of income and extra expense insurance waive any rights of subrogation that such companies may have against Landlord or Tenant, as the case may be. Notwithstanding anything in this lease to the contrary, Landlord and Tenant hereby waive any right that either may have against the other on account of any loss or damage if such loss or damage is insurable under the property damage or loss of income and extra expense insurance required to be maintained hereunder (this waiver extends to deductibles under such insurance).

11. DAMAGE AND DESTRUCTION

11.1 Repair of Damage to Premises by Landlord. Tenant shall promptly notify Landlord of any damage to the Premises resulting from fire or any other casualty. If the Premises or any Common Areas of the Building serving or providing access to the Premises shall be damaged by fire or other casualty, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, and subject to all other terms of this Article 11, restore the base, shell and core of such Common Areas and the Premises (collectively, the “Base, Shell and Core”) to substantially the same condition as existed prior to the casualty, except for modifications required by Law, the holder of a mortgage on the Real Property, the lessor of a ground or underlying lease, or any other modifications to the Common Areas reasonably deemed desirable by Landlord. Notwithstanding any other provision of this Lease, upon the occurrence of any damage to the Premises resulting from fire or other casualty, Tenant shall assign to

Landlord all insurance proceeds payable to Tenant as to items of property described in clause (b) of Section 10.2.2, and Landlord shall return the Improvements and Alterations to their original condition; provided that if the cost of such repair by Landlord exceeds the amount of insurance proceeds received by Landlord from Tenant’s insurance carrier, as assigned by Tenant, the cost of such repairs shall be paid by Tenant to Landlord prior to Landlord’s repair of the damage. In the event any damage to the Building or Common Area occurs as a result of the negligence or willful misconduct of any Tenant Parties, Tenant shall reimburse Landlord, promptly on demand, for the costs incurred by Landlord in repairing such damage and the provisions of Section 10.5 regarding Landlord’s deductible shall not apply to such reimbursement obligation. Landlord shall not be liable for any inconvenience or annoyance to Tenant or its visitors, or injury to Tenant’s business resulting in any way from damage resulting from fire or other casualty or Landlord’s repair thereof; provided however, that if such fire or other casualty shall have damaged the Premises or Common Areas necessary to Tenant’s occupancy, and if such damage is not the result of the negligence or willful misconduct of Tenant or any Tenant Parties, Landlord shall allow Tenant a proportionate abatement of Rent to the extent Landlord is reimbursed from the proceeds of rental interruption insurance purchased by Landlord as part of Operating Expenses, during the time and to the extent the Premises are unfit for occupancy for the purposes permitted under this Lease, and not occupied by Tenant as a result thereof.

11.2 Landlord’s Option to Repair. Notwithstanding the terms of Section 11.1 of this Lease, Landlord may elect not to rebuild and/or restore the Premises and/or Building and instead terminate this Lease by notifying Tenant in writing of such termination within sixty (60) days after the date Landlord learns of the necessity for repairs as the result of damage, such notice to include a termination date giving Tenant ninety (90) days to vacate the Premises, but Landlord may so elect only if the Building shall be damaged by fire or other casualty or cause, whether or not the Premises are affected, and one or more of the following conditions is present: (a) repairs cannot reasonably be completed within one hundred eighty (180) days after the date Landlord learns of the necessity for repairs as the result of damage (when such repairs are made without the payment of overtime or other premiums); (b) the holder of any mortgage on the Real Property or ground or underlying lessor with respect to the Real Property shall require that the insurance proceeds or any portion thereof be used to retire the mortgage debt, or shall terminate the ground or underlying lease, as the case may be; (c) the damage is not fully covered, except for deductible amounts, by Landlord’s insurance policies; or (d) such damage occurs during the last twelve (12) months of the Lease Term.

11.3 Tenant’s Option to Terminate. Notwithstanding the terms of Sections 11.1 and 11.2 of this Lease, Tenant may terminate this Lease by notifying Landlord in writing of such termination within sixty (60) days after the date Tenant learns of the necessity for repairs as the result of damage, such notice to include a termination date giving Tenant ninety (90) days to vacate the Premises, but Tenant may so elect only if the Premises shall be damaged by fire or other casualty or cause, and one or more of the following conditions is present: (a) repairs cannot reasonably be completed within one hundred eighty (180) days after the date of casualty; or (b) such damage occurs during the last twelve (12) months of the Lease Term.

11.4 Waiver of Statutory Provisions. The provisions of this Lease, including this Article 11, constitute an express agreement between Landlord and Tenant with respect to any and all damage to, or destruction of, all or any part of the Premises, the Building or any other portion of the Real Property, and any statute, regulation or case law of the State of Colorado with respect to termination rights arising from damage or destruction shall have no application to this Lease or any damage or destruction to all or any part of the Premises, the Building or any other portion of the Real Property.

12. NONWAIVER

No waiver of any provision of this Lease shall be implied by any failure of a party to enforce any remedy on account of the violation of such provision, even if such violation shall continue or be repeated subsequently. Any waiver by a party of any provision of this Lease may only be in writing, and no express waiver shall affect any provision other than the one specified in such waiver and then only for the time and in the manner specifically stated in such waiver. No receipt of monies by Landlord from Tenant after the termination of this Lease shall in any way alter the length of the Lease Term.

13. CONDEMNATION