00000340672020FYfalseus-gaap:AccountingStandardsUpdate201613Memberboom:AccountingStandardsUpdate201616Memberus-gaap:OtherAssetsus-gaap:OtherAssetsus-gaap:OtherLiabilitiesCurrentus-gaap:OtherLiabilitiesCurrentus-gaap:OtherLiabilitiesNoncurrentus-gaap:OtherLiabilitiesNoncurrent0.33330.33330.333300000340672020-01-012020-12-31iso4217:USD00000340672020-06-30xbrli:shares00000340672021-02-1900000340672020-12-3100000340672019-12-31iso4217:USDxbrli:shares00000340672019-01-012019-12-3100000340672018-01-012018-12-310000034067us-gaap:CommonStockMember2017-12-310000034067us-gaap:AdditionalPaidInCapitalMember2017-12-310000034067us-gaap:RetainedEarningsMember2017-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000034067us-gaap:TreasuryStockMember2017-12-3100000340672017-12-310000034067us-gaap:RetainedEarningsMember2018-01-012018-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000034067us-gaap:CommonStockMember2018-01-012018-12-310000034067us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000034067srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-12-310000034067srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000034067us-gaap:TreasuryStockMember2018-01-012018-12-310000034067us-gaap:CommonStockMember2018-12-310000034067us-gaap:AdditionalPaidInCapitalMember2018-12-310000034067us-gaap:RetainedEarningsMember2018-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000034067us-gaap:TreasuryStockMember2018-12-3100000340672018-12-310000034067us-gaap:RetainedEarningsMember2019-01-012019-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000034067us-gaap:CommonStockMember2019-01-012019-12-310000034067us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000034067us-gaap:TreasuryStockMember2019-01-012019-12-310000034067us-gaap:CommonStockMember2019-12-310000034067us-gaap:AdditionalPaidInCapitalMember2019-12-310000034067us-gaap:RetainedEarningsMember2019-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000034067us-gaap:TreasuryStockMember2019-12-310000034067us-gaap:RetainedEarningsMember2020-01-012020-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000034067us-gaap:CommonStockMember2020-01-012020-12-310000034067us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000034067srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-12-310000034067srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310000034067us-gaap:TreasuryStockMember2020-01-012020-12-310000034067us-gaap:CommonStockMember2020-12-310000034067us-gaap:AdditionalPaidInCapitalMember2020-12-310000034067us-gaap:RetainedEarningsMember2020-12-310000034067us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000034067us-gaap:TreasuryStockMember2020-12-3100000340672017-01-012017-12-31boom:segment0000034067boom:DynaEnergeticsSegmentMember2019-12-310000034067boom:NobelCladSegmentMember2019-12-310000034067boom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067boom:NobelCladSegmentMember2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMember2020-12-310000034067boom:NobelCladSegmentMember2020-12-310000034067us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2020-01-012020-12-310000034067srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2020-01-012020-12-310000034067us-gaap:ToolsDiesAndMoldsMembersrt:MinimumMember2020-01-012020-12-310000034067srt:MaximumMemberus-gaap:ToolsDiesAndMoldsMember2020-01-012020-12-310000034067boom:FurnitureFixturesAndComputerEquipmentMembersrt:MinimumMember2020-01-012020-12-310000034067srt:MaximumMemberboom:FurnitureFixturesAndComputerEquipmentMember2020-01-012020-12-310000034067us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MinimumMember2020-01-012020-12-310000034067srt:MaximumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2020-01-012020-12-310000034067us-gaap:LandMember2020-12-310000034067us-gaap:LandMember2019-12-310000034067us-gaap:BuildingAndBuildingImprovementsMember2020-12-310000034067us-gaap:BuildingAndBuildingImprovementsMember2019-12-310000034067us-gaap:ToolsDiesAndMoldsMember2020-12-310000034067us-gaap:ToolsDiesAndMoldsMember2019-12-310000034067boom:FurnitureFixturesAndComputerEquipmentMember2020-12-310000034067boom:FurnitureFixturesAndComputerEquipmentMember2019-12-310000034067us-gaap:PropertyPlantAndEquipmentOtherTypesMember2020-12-310000034067us-gaap:PropertyPlantAndEquipmentOtherTypesMember2019-12-310000034067us-gaap:ConstructionInProgressMember2020-12-310000034067us-gaap:ConstructionInProgressMember2019-12-310000034067boom:DynaEnergeticsSegmentMemberboom:RestructuringExpenseMember2020-01-012020-12-3100000340672020-04-012020-06-300000034067boom:DynaEnergeticsSegmentMemberboom:RestructuringExpenseMember2019-01-012019-12-310000034067us-gaap:DevelopedTechnologyRightsMember2020-01-012020-12-310000034067us-gaap:DevelopedTechnologyRightsMember2020-12-310000034067us-gaap:CustomerRelationshipsMember2020-12-310000034067us-gaap:TrademarksAndTradeNamesMember2020-12-310000034067us-gaap:DevelopedTechnologyRightsMember2019-12-310000034067us-gaap:CustomerRelationshipsMember2019-12-310000034067us-gaap:TrademarksAndTradeNamesMember2019-12-31xbrli:pure0000034067srt:MinimumMember2020-01-012020-12-310000034067srt:MaximumMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMember2018-01-012018-12-310000034067us-gaap:FairValueInputsLevel2Member2020-12-310000034067us-gaap:FairValueInputsLevel2Member2019-12-310000034067boom:CapitalExpenditureFacilityMember2020-12-310000034067boom:CapitalExpenditureFacilityMember2019-12-310000034067us-gaap:LineOfCreditMember2018-03-082018-03-080000034067boom:SyndicatedCreditFacility2018Memberus-gaap:LineOfCreditMember2018-03-080000034067boom:RevolvingCreditFacilityUSDollarsMemberus-gaap:LineOfCreditMember2018-03-080000034067us-gaap:LineOfCreditMemberboom:RevolvingCreditFacilityAlternateCurrenciesMember2018-03-080000034067us-gaap:LineOfCreditMemberboom:CapitalExpenditureFacilityMember2018-03-0800000340672018-03-082018-03-080000034067us-gaap:LineOfCreditMemberboom:CapitalExpenditureFacilityMember2019-01-012019-12-31boom:bank0000034067boom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-12-310000034067srt:MaximumMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-12-310000034067us-gaap:BaseRateMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMembersrt:MinimumMember2020-01-012020-12-310000034067us-gaap:BaseRateMembersrt:MaximumMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMember2020-01-012020-12-310000034067boom:SyndicatedCreditFacilityAmendmentMembersrt:MinimumMember2020-04-012020-06-300000034067boom:SyndicatedCreditFacilityAmendmentMemberus-gaap:LineOfCreditMember2020-06-250000034067boom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-06-252020-06-250000034067us-gaap:BaseRateMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMember2020-06-252020-06-250000034067boom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-06-252020-06-250000034067srt:MaximumMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-06-252020-06-250000034067us-gaap:BaseRateMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMembersrt:MinimumMember2020-06-252020-06-250000034067us-gaap:BaseRateMembersrt:MaximumMemberboom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMember2020-06-252020-06-250000034067boom:RevolvingCreditFacilityAlternateCurrenciesMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-06-2500000340672020-10-22iso4217:EUR0000034067us-gaap:LineOfCreditMemberboom:GermanBankLineOfCreditMember2020-06-300000034067us-gaap:LineOfCreditMemberboom:GermanBankLineOfCreditMember2020-07-310000034067boom:CommerzbankLineOfCreditMemberus-gaap:LineOfCreditMember2020-12-310000034067boom:CommerzbankLineOfCreditMemberus-gaap:LineOfCreditMemberus-gaap:EurodollarMember2020-12-3100000340672020-10-222020-10-220000034067us-gaap:CostOfSalesMember2020-01-012020-12-310000034067us-gaap:CostOfSalesMember2019-01-012019-12-310000034067us-gaap:CostOfSalesMember2018-01-012018-12-310000034067us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310000034067us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310000034067us-gaap:GeneralAndAdministrativeExpenseMember2018-01-012018-12-310000034067boom:SellingandDistributionExpenseMember2020-01-012020-12-310000034067boom:SellingandDistributionExpenseMember2019-01-012019-12-310000034067boom:SellingandDistributionExpenseMember2018-01-012018-12-3100000340672016-11-040000034067boom:RestrictedStockAwardsAndRestrictedStockUnitsRSUMember2006-01-012016-09-2100000340672016-09-210000034067boom:RestrictedStockAwardsRestrictedStockUnitsAndPerformanceSharesUnitsMember2016-11-042020-12-310000034067us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000034067us-gaap:PerformanceSharesMembersrt:MinimumMember2020-01-012020-12-310000034067srt:MaximumMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310000034067boom:AchievementOfTargetedAdjustedEBITDAMemberboom:PhantomShareUnitsGrantedIn2020Member2020-01-012020-12-310000034067boom:PhantomShareUnitsGrantedIn2020Memberboom:AchievementOfRelativeTSRPerformanceMember2020-01-012020-12-310000034067boom:AchievementOfTargetedAdjustedEBITDAMemberboom:PhantomShareUnitsGrantedPriorTo2020Member2019-01-012019-12-310000034067boom:PhantomShareUnitsGrantedPriorTo2020Memberboom:AchievementOfRelativeTSRPerformanceMember2019-01-012019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2018-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockMember2018-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2019-01-012019-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockMember2019-01-012019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2019-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockMember2019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2020-01-012020-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockMember2020-01-012020-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2020-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockMember2020-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2018-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2018-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-12-310000034067boom:A2006StockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:PerformanceSharesMember2018-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:PerformanceSharesMember2019-01-012019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:PerformanceSharesMember2019-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310000034067boom:A2016OmnibusIncentivePlanMemberus-gaap:PerformanceSharesMember2020-12-310000034067us-gaap:RestrictedStockMember2020-12-310000034067us-gaap:RestrictedStockMember2020-01-012020-12-310000034067us-gaap:RestrictedStockUnitsRSUMember2020-12-310000034067us-gaap:PerformanceSharesMember2020-12-310000034067us-gaap:PerformanceSharesMember2020-01-012020-12-310000034067us-gaap:EmployeeStockMember2020-12-310000034067srt:MaximumMemberus-gaap:EmployeeStockMember2020-01-012020-12-310000034067us-gaap:EmployeeStockMember2020-01-012020-12-310000034067us-gaap:EmployeeStockMember2019-01-012019-12-310000034067us-gaap:EmployeeStockMember2018-01-012018-12-310000034067us-gaap:OtherNoncurrentAssetsMember2020-12-310000034067us-gaap:OtherNoncurrentAssetsMember2019-12-310000034067us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310000034067us-gaap:OtherNoncurrentLiabilitiesMember2019-12-310000034067us-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2020-10-012020-12-310000034067srt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2020-10-012020-12-310000034067us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310000034067us-gaap:ShareBasedCompensationAwardTrancheOneMemberboom:RestrictedStockAwardsandRestrictedStockUnitsTimeBasedMember2020-01-012020-12-310000034067us-gaap:ShareBasedCompensationAwardTrancheTwoMemberboom:RestrictedStockAwardsandRestrictedStockUnitsTimeBasedMember2020-01-012020-12-310000034067boom:RestrictedStockAwardsandRestrictedStockUnitsTimeBasedMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-01-012020-12-310000034067us-gaap:ForeignCountryMember2020-12-310000034067us-gaap:DomesticCountryMember2020-12-310000034067us-gaap:FederalMinistryOfFinanceGermanyMember2020-01-012020-12-310000034067us-gaap:FederalMinistryOfFinanceGermanyMember2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:NobelCladSegmentMember2019-01-012019-12-310000034067boom:NobelCladSegmentMember2018-01-012018-12-310000034067us-gaap:OperatingSegmentsMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMember2018-01-012018-12-310000034067us-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310000034067us-gaap:MaterialReconcilingItemsMember2019-01-012019-12-310000034067us-gaap:MaterialReconcilingItemsMember2018-01-012018-12-310000034067us-gaap:CorporateNonSegmentMember2020-01-012020-12-310000034067us-gaap:CorporateNonSegmentMember2019-01-012019-12-310000034067us-gaap:CorporateNonSegmentMember2018-01-012018-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMember2020-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMember2019-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMember2020-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMember2019-12-310000034067us-gaap:OperatingSegmentsMember2020-12-310000034067us-gaap:OperatingSegmentsMember2019-12-310000034067us-gaap:MaterialReconcilingItemsMember2020-12-310000034067us-gaap:MaterialReconcilingItemsMember2019-12-310000034067us-gaap:CorporateNonSegmentMember2020-12-310000034067us-gaap:CorporateNonSegmentMember2019-12-310000034067country:US2020-12-310000034067country:US2019-12-310000034067country:DE2020-12-310000034067country:DE2019-12-310000034067country:RU2020-12-310000034067country:RU2019-12-310000034067country:CA2020-12-310000034067country:CA2019-12-310000034067country:FR2020-12-310000034067country:FR2019-12-310000034067boom:RestOfTheWorldMember2020-12-310000034067boom:RestOfTheWorldMember2019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:US2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:US2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:US2018-01-012018-12-310000034067country:INboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:INboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:INboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:DynaEnergeticsSegmentMembercountry:CA2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:CA2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:CA2018-01-012018-12-310000034067country:EGboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:EGboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:EGboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:DynaEnergeticsSegmentMembercountry:IQ2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:IQ2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:IQ2018-01-012018-12-310000034067boom:DynaEnergeticsSegmentMembercountry:OM2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:OM2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:OM2018-01-012018-12-310000034067boom:DynaEnergeticsSegmentMembercountry:ID2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:ID2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:ID2018-01-012018-12-310000034067country:KWboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:KWboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:KWboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:DynaEnergeticsSegmentMembercountry:UA2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:UA2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:UA2018-01-012018-12-310000034067country:AUboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:AUboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:AUboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067country:DZboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:DZboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:DZboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067country:MYboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:MYboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:MYboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:DynaEnergeticsSegmentMembercountry:PK2020-01-012020-12-310000034067boom:DynaEnergeticsSegmentMembercountry:PK2019-01-012019-12-310000034067boom:DynaEnergeticsSegmentMembercountry:PK2018-01-012018-12-310000034067country:AEboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:AEboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:AEboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067country:DEboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067country:DEboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067country:DEboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:RestOfTheWorldMemberboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067boom:RestOfTheWorldMemberboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067boom:RestOfTheWorldMemberboom:DynaEnergeticsSegmentMember2018-01-012018-12-310000034067boom:NobelCladSegmentMembercountry:US2020-01-012020-12-310000034067boom:NobelCladSegmentMembercountry:US2019-01-012019-12-310000034067boom:NobelCladSegmentMembercountry:US2018-01-012018-12-310000034067country:CAboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:CAboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:CAboom:NobelCladSegmentMember2018-01-012018-12-310000034067boom:NobelCladSegmentMembercountry:CN2020-01-012020-12-310000034067boom:NobelCladSegmentMembercountry:CN2019-01-012019-12-310000034067boom:NobelCladSegmentMembercountry:CN2018-01-012018-12-310000034067country:DEboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:DEboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:DEboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:AEboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:AEboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:AEboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:FRboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:FRboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:FRboom:NobelCladSegmentMember2018-01-012018-12-310000034067boom:NobelCladSegmentMembercountry:ES2020-01-012020-12-310000034067boom:NobelCladSegmentMembercountry:ES2019-01-012019-12-310000034067boom:NobelCladSegmentMembercountry:ES2018-01-012018-12-310000034067boom:NobelCladSegmentMembercountry:NO2020-01-012020-12-310000034067boom:NobelCladSegmentMembercountry:NO2019-01-012019-12-310000034067boom:NobelCladSegmentMembercountry:NO2018-01-012018-12-310000034067boom:NobelCladSegmentMembercountry:KR2020-01-012020-12-310000034067boom:NobelCladSegmentMembercountry:KR2019-01-012019-12-310000034067boom:NobelCladSegmentMembercountry:KR2018-01-012018-12-310000034067country:NLboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:NLboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:NLboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:SEboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:SEboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:SEboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:AUboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:AUboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:AUboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:INboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:INboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:INboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:ITboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:ITboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:ITboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:BEboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:BEboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:BEboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:ZAboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:ZAboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:ZAboom:NobelCladSegmentMember2018-01-012018-12-310000034067country:BHboom:NobelCladSegmentMember2020-01-012020-12-310000034067country:BHboom:NobelCladSegmentMember2019-01-012019-12-310000034067country:BHboom:NobelCladSegmentMember2018-01-012018-12-310000034067boom:RestOfTheWorldMemberboom:NobelCladSegmentMember2020-01-012020-12-310000034067boom:RestOfTheWorldMemberboom:NobelCladSegmentMember2019-01-012019-12-310000034067boom:RestOfTheWorldMemberboom:NobelCladSegmentMember2018-01-012018-12-310000034067boom:OneCustomerMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000034067us-gaap:ForeignExchangeForwardMember2020-12-310000034067us-gaap:ForeignExchangeForwardMember2019-12-310000034067us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2020-01-012020-12-310000034067us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2019-01-012019-12-310000034067us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2018-01-012018-12-3100000340672018-10-012018-10-310000034067us-gaap:UnfavorableRegulatoryActionMemberboom:USCustomsNoticeofActionMember2019-04-012019-06-3000000340672020-11-300000034067boom:DynaEnergeticsSegmentMember2020-01-012020-03-310000034067boom:AssetImpairmentMemberboom:DynaEnergeticsSegmentMember2020-04-012020-06-3000000340672020-07-012020-09-300000034067boom:AssetImpairmentMemberboom:DynaEnergeticsSegmentMember2019-07-012019-12-310000034067boom:DynaEnergeticsSegmentMemberus-gaap:EmployeeSeveranceMember2019-07-012019-12-310000034067us-gaap:OtherRestructuringMemberboom:DynaEnergeticsSegmentMember2019-07-012019-12-310000034067boom:DynaEnergeticsSegmentMemberboom:InventoryWriteDownMember2019-07-012019-12-310000034067boom:DynaEnergeticsSegmentMemberboom:AccountsReceivableWriteDownMember2019-07-012019-12-3100000340672019-10-012019-12-310000034067boom:AssetImpairmentMemberboom:NobelCladSegmentMember2020-10-012020-12-310000034067boom:AssetImpairmentMemberboom:NobelCladSegmentMember2019-04-012019-06-300000034067boom:NobelCladSegmentMemberus-gaap:EmployeeSeveranceMember2019-04-012019-06-300000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMemberus-gaap:EmployeeSeveranceMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:AssetImpairmentMemberboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMemberus-gaap:ContractTerminationMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMemberus-gaap:FacilityClosingMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:OtherRestructuringMemberboom:DynaEnergeticsSegmentMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMemberus-gaap:EmployeeSeveranceMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:AssetImpairmentMemberboom:NobelCladSegmentMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:NobelCladSegmentMemberus-gaap:ContractTerminationMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:FacilityClosingMemberboom:NobelCladSegmentMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:OtherRestructuringMemberboom:NobelCladSegmentMember2020-01-012020-12-310000034067us-gaap:EmployeeSeveranceMemberus-gaap:CorporateNonSegmentMember2020-01-012020-12-310000034067boom:AssetImpairmentMemberus-gaap:CorporateNonSegmentMember2020-01-012020-12-310000034067us-gaap:CorporateNonSegmentMemberus-gaap:ContractTerminationMember2020-01-012020-12-310000034067us-gaap:FacilityClosingMemberus-gaap:CorporateNonSegmentMember2020-01-012020-12-310000034067us-gaap:OtherRestructuringMemberus-gaap:CorporateNonSegmentMember2020-01-012020-12-310000034067us-gaap:EmployeeSeveranceMember2020-01-012020-12-310000034067boom:AssetImpairmentMember2020-01-012020-12-310000034067us-gaap:ContractTerminationMember2020-01-012020-12-310000034067us-gaap:FacilityClosingMember2020-01-012020-12-310000034067us-gaap:OtherRestructuringMember2020-01-012020-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMemberus-gaap:EmployeeSeveranceMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberboom:AssetImpairmentMemberboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMemberus-gaap:ContractTerminationMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberboom:DynaEnergeticsSegmentMemberus-gaap:FacilityClosingMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:OtherRestructuringMemberboom:DynaEnergeticsSegmentMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:EmployeeSeveranceMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberboom:AssetImpairmentMemberboom:NobelCladSegmentMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:ContractTerminationMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:FacilityClosingMember2019-01-012019-12-310000034067us-gaap:OperatingSegmentsMemberus-gaap:OtherRestructuringMember2019-01-012019-12-310000034067us-gaap:EmployeeSeveranceMember2019-01-012019-12-310000034067boom:AssetImpairmentMember2019-01-012019-12-310000034067us-gaap:ContractTerminationMember2019-01-012019-12-310000034067us-gaap:FacilityClosingMember2019-01-012019-12-310000034067us-gaap:OtherRestructuringMember2019-01-012019-12-310000034067us-gaap:EmployeeSeveranceMember2018-01-012018-12-310000034067us-gaap:ContractTerminationMember2018-01-012018-12-310000034067us-gaap:FacilityClosingMember2018-01-012018-12-310000034067us-gaap:OtherRestructuringMember2018-01-012018-12-310000034067us-gaap:EmployeeSeveranceMember2019-12-310000034067us-gaap:EmployeeSeveranceMember2020-12-310000034067us-gaap:ContractTerminationMember2019-12-310000034067us-gaap:ContractTerminationMember2020-12-310000034067us-gaap:FacilityClosingMember2019-12-310000034067us-gaap:FacilityClosingMember2020-12-310000034067us-gaap:OtherRestructuringMember2019-12-310000034067us-gaap:OtherRestructuringMember2020-12-3100000340672020-01-012020-03-3100000340672020-10-012020-12-3100000340672019-01-012019-03-3100000340672019-04-012019-06-3000000340672019-07-012019-09-300000034067us-gaap:AllowanceForCreditLossMember2017-12-310000034067us-gaap:AllowanceForCreditLossMember2018-01-012018-12-310000034067us-gaap:AllowanceForCreditLossMember2018-12-310000034067us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310000034067us-gaap:AllowanceForCreditLossMember2019-12-310000034067us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000034067us-gaap:AllowanceForCreditLossMember2020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-14775

DMC Global Inc.

(Exact name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | | 84-0608431 |

| (State of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021

(Address of principal executive offices, including zip code)

(303) 665-5700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $.05 Par Value | | BOOM | | The Nasdaq Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act from their obligations under those sections. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer o | | Accelerated filer x |

| | | |

Non-accelerated filer o | | Smaller reporting company ☐ |

| | |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 under the Act). Yes ☐ No x

The approximate aggregate market value of the voting stock held by non-affiliates of the registrant was $264,854,982 as of June 30, 2020.

The number of shares of Common Stock outstanding was 15,389,285 as of February 19, 2021.

Certain information required by Items 10, 11, 12, 13 and 14 of Form 10-K is incorporated by reference into Part III hereof from the registrant’s proxy statement for its 2021 Annual Meeting of Stockholders, which is expected to be filed with the Securities and Exchange Commission (“SEC”) within 120 days of the close of the registrant’s fiscal year ended December 31, 2020.

TABLE OF CONTENTS

PART I

ITEM 1. Business

References made in this Annual Report on Form 10-K to “we”, “our”, “us”, “DMC”, "DMC Global" and the “Company” refer to DMC Global Inc. and its consolidated subsidiaries. Unless stated otherwise, all dollar figures in this report are presented in thousands (000s).

Overview

DMC Global Inc. (“DMC”, "we", "us", "our", or the "Company") is a diversified holding company. Today, DMC’s portfolio consists of DynaEnergetics and NobelClad, which collectively address the energy, industrial processing and transportation markets. DynaEnergetics designs, manufactures and distributes products utilized by the global oil and gas industry principally for the perforation of oil and gas wells. NobelClad is a leader in the production of explosion-welded clad metal plates for use in the construction of corrosion resistant industrial processing equipment and specialized transition joints. Both DynaEnergetics and NobelClad operate globally through an international network of manufacturing, distribution and sales facilities. See Note 7 within Item 8 — Financial Statements and Supplementary Data for net sales, operating income, and total assets for each of our segments.

Our Strategy

Our diversified segments each provide a suite of unique technical products to niche sectors of the global energy, industrial and infrastructure markets, and each has established a strong position in the markets in which it participates. DMC’s objective is to identify well-run businesses and strong management teams and support them with long-term capital and strategic, legal, technology and operating resources. Our approach helps our portfolio companies grow core businesses, launch new initiatives, upgrade technologies and systems to support their long-term strategy, and make acquisitions that improve their competitive positions and expand their markets. DMC’s culture is to foster local innovation versus centralized control and to stand behind our businesses in ways that truly add value.

Business Segments

DynaEnergetics

DynaEnergetics designs, manufactures, markets and sells perforating systems and associated hardware for the global oil and gas industry. During the well drilling process, steel casing is inserted into the well and cemented in place to isolate and support the integrity of the wellbore. A perforating system, which contains a series of specialized explosive shaped charges, is used to punch holes through the casing and cement liner of the well and into the geologic formation surrounding the well bore. The channels created by the shaped charges allow hydrocarbons to flow back into the well bore. When hydraulic fracturing is employed, the perforations and channels also provide a path for the fracturing fluid to enter and return from the formation.

In unconventional wells, multiple perforating systems, which generally range from seven inches to three feet in length, are connected end-to-end into a perforating “string.” The string is lowered into the well and then pumped by fluid across the horizontal lateral to the target location within the shale formation. When the perforating system is initiated via an electronic or digital signal from the surface, the shaped charges detonate.

DynaEnergetics designs, manufactures and sells all five primary components of a perforating system. These components are: 1. the initiation system, 2. shaped charges, 3. detonating cord, 4. gun hardware, and 5. a control panel.

In North America’s well-completion industry, perforating components traditionally have been assembled by highly trained personnel at the well site or nearby assembly facility. In 2015, DynaEnergetics began assembling its perforating systems in a controlled environment at its manufacturing facilities. The systems, marketed as DynaStage® (DS) Factory-Assembled, Performance-Assured™ perforating systems, are shipped directly to the customers’ well-site or remote shop. Since 2015, DynaEnergetics has added several new DS lines to accommodate evolving industry conditions and needs.

Perforating systems such as those manufactured by DynaEnergetics are essential to oil and gas recovery. DynaEnergetics’ systems are sold directly to oilfield service companies around the world. DynaEnergetics also promotes its systems technologies and value directly to end-user exploration and production (“E&P”) companies who typically own and operate the wells being perforated.

The level of market activity for perforating products generally corresponds to the level of oil and gas exploration and production activity. Advancements in well designs have led to increasingly complex well completion operations, which in turn have increased the demand for high-quality and technically advanced perforating products.

Operations

The DynaEnergetics segment seeks to build on its products and technologies, as well as its sales, supply chain and distribution network. During the three years ended December 31, 2020, 2019 and 2018, the DynaEnergetics segment represented approximately 64%, 78% and 73% of our consolidated net sales, respectively. The decrease in 2020 is primarily due to the COVID-19 pandemic-related collapse in oil and gas demand and the related downturn in unconventional well completions in North America and demand for DynaEnergetics’ products.

DynaEnergetics has a long and successful history of designing and producing components such as initiators, detonating cord, bi-directional boosters, shaped charges and hardware systems used in perforating systems in oil and gas, and to a lesser extent, for seismic exploration. DynaEnergetics has significantly increased its research and development investments in recent years and is focused on further development of innovative perforating products and systems.

DynaEnergetics’ manufacturing facilities are located in Germany and the United States. In 2020, DynaEnergetics added two additional automated IS2TM detonator lines for a total of six lines at its facility in Troisdorf, Germany. This followed the completion in the fourth quarter of 2018 of 74,000-square feet of new manufacturing, assembly and administrative space on its existing site in Blum, Texas and the commissioning of an additional shaped charge manufacturing line at the Blum facility in

2019, for a total of three shaped charge lines. These investments expanded our global capacity for shaped charge and perforating gun production and improved our delivery and customer service capabilities in our key markets.

The capacity added by DynaEnergetics throughout 2018 and 2019 in Germany and the U.S. improved our operating efficiencies and enabled us to more effectively serve our global customer base. Capitalizing on our more efficient manufacturing footprint, DynaEnergetics ceased its operations in Tyumen, Siberia in September 2019, and during the third quarter of 2020, DynaEnergetics sold the land and buildings in Tyumen, Siberia to a third-party for $448, which was equal to the carrying value of the assets held for sale.

Products

IS2: DynaEnergetics has been focused on the advancement of safe and selective perforating products for use in North America’s shale, or onshore, unconventional, oil and gas industry. Among these products are the IS2™ Intrinsically Safe Initiating Systems, which include the IS2TM Customer Assembled (CA) detonator and the wire-free IS2 Top Fire (TF) detonator. The IS2 TF detonator is the key enabling technology in DynaEnergetics’ family of DS Factory-Assembled, Performance-Assured DynaStageTM perforating systems. The IS2 detonators require a specific digital code for firing and are immune from induced currents and voltages, static electricity and high-frequency irradiation. These safety features substantially reduce the risk of unintentional detonation and enable concurrent perforating and hydraulic fracturing operations at well sites with multiple wellbores, improving operating efficiencies for customers.

Our fully integrated detonators incorporate advanced software controls and are significantly smaller than a traditional detonator and switch assembly. The IS2 CA detonator reduces by 40% the number of electrical wire connections required within each perforating gun versus traditional selective initiation systems. This reduces set-up times and significantly increases reliability.

DS Systems: Our DS InfinityTM Factory-Assembled, Performance-Assured perforating systems combine all of our advanced technologies into a preassembled perforating gun that is armed at the well site with our Plug-and-Go™ IS2 TF detonator. The IS2 TF detonator is completely wire-free, and eliminates the customary process of wiring the detonator into the perforating system at the well site. All DS systems are operated using our in-house designed InfinityTM Control Panel. The Infinity Panel is highly intuitive and allows the gun string to be safely tested and monitored throughout the pump-down operation. The system also incorporates a shot detection function resulting in significant time and cost savings. Recent design advancements to the IS2 line of initiation products enable customers to safely and reliably fire up to 100 systems and set a plug in a single run. All DS systems can be tested before going down hole using our Infinity Surface Tester, reducing the risk of lost time, mishaps, misruns and misfires due to a system fault.

During 2020, DynaEnergetics expanded the family of DS perforating systems with three new models: DS Echo™, for re-frac applications; DS Gravity™, a self-orienting system for oriented perforating; and DS LoneStar™, a single-shot system that delivers large, ultra-consistent entry holes. These added to the two DS models introduced during 2019: DS Trinity™, an ultra-compact system that features three explosive shaped charges on a single radial plane, now also available in a dual plane version providing six explosive shaped charges on two planes; and DS NLine™, an oriented systems that features several shaped charges on a lateral plane.

Shaped Charges: DynaEnergetics develops and sells a wide range of shaped charges for use in its perforating systems. Additions in 2020 included the LoneStar and EchoFrac™ charges specifically designed for sale in their respective systems. LoneStar charges deliver extreme reservoir contact and ultra-uniform entry holes, while EchoFrac charges are used in re-frac operations and have enough perforating power to penetrate two layers of casing with consistent entry hole sizes. DynaEnergetics also sells HaloFrac™ charges, which incorporate advancements in liner materials and shaped charge geometry designed to improve hydraulic fracturing performance through lower and more consistent breakdown pressures, uniform proppant placement, uniform frac clusters and higher well productivity ratios. Another line, the FracTune™ family of shaped charges, delivers uniform hole diameter in the well casing independent of shot phasing and gun positioning within the well bore. DynaEnergetics also sells the DPEX™ family of charges, which feature energetic liners. All three lines can be used with the DynaStage perforating system as well as conventional perforating gun systems across a range of gun diameters.

TCP Systems: DynaEnergetics Tubing Conveyed Perforating ("TCP") systems are customized for individual customer needs and well applications. TCP enables perforating of conventional vertical wells, as well as highly deviated and horizontal wells. These types of wells are increasingly being drilled by the off-shore industry and in applications outside the U.S. TCP tools also perforate long intervals in a single trip, which significantly improves rig efficiency. Our TCP tool range includes mechanical and hydraulic firing systems, gun releases, redundant firing heads, under-balancing devices and auxiliary

components. Our tools are designed to withstand downhole temperatures of up to 260 degrees Celsius (500 degrees Fahrenheit) for safe and quick assembly at the well site and to allow unrestricted total system length.

Setting and Ballistic Release Tools: In 2020, DynaEnergetics introduced two new products that perform critical downhole functions associated with the perforating process. DS MicroSet™ is a compact, disposable setting tool used to install the frac plugs that isolate stages in a multi-stage, unconventional oil or gas well. DS Liberator™ is a ballistic release tool that enables the wireline service company to disengage from a perforating string that has become stuck in the well bore. Collectively, these products expand DynaEnergetics’ addressable market by an estimated 20%.

Plug and Abandonment: Our DynaSlotTM perforating system is designed for plug and abandonment (P&A) operations. During well abandonment, the wellbore is encased and permanently sealed so that layers of sedimentary rock, and in particular freshwater aquifers, are pressure isolated from each other and the wellbore. The DynaSlot perforating system facilitates this process by creating access to a full 360-degree area between the rock formations and the tubing and/or casing. Customers use the unique helical perforation pattern created by DynaSlot to perform cement squeeze operations that seal off the wellbore. In the fourth quarter of 2020, DynaEnergetics introduced its DPU and XPU shaped charge lines, which were designed for P&A and well remediation applications and enable perforating through two or more layers of casing and into the formation.

Mining Applications: In 2020, introduced Igneo™, a specialized initiating system for use in high-temperature mining applications. Igneo incorporates the same intrinsically safe features found in the IS2 initiating system used by the oil and gas industry.

Suppliers and Raw Materials

DynaEnergetics' product offering consists of complex components that require numerous high-end inputs. DynaEnergetics utilizes a variety of raw materials for the production of oilfield perforating and seismic products, including high-quality steel tubes, steel and copper, explosives, granulates, plastics and ancillary plastic product components. DynaEnergetics obtains its raw materials primarily from a number of different producers in Germany, other European countries, and the U.S., but also purchases materials from other international suppliers.

Competition

DynaEnergetics faces competition from independent manufacturers of perforating products and from the industry's three largest oil and gas service companies, which produce perforating systems for their own use but also buy systems and other perforating components and specialty products from independent suppliers such as DynaEnergetics. We compete for sales primarily on customer service, product quality, reliability, safety, performance, price and, in North America, our ability to provide customers with a Factory-Assembled, Performance-Assured perforating system, versus a series of components that must be assembled at a well site or nearby staging facility.

Customer Profile

DynaEnergetics' perforating and seismic products are purchased by international and U.S. oilfield service companies of all sizes working in both onshore and offshore oil and gas fields. Our customers select perforating products based on their leading performance, system compatibility and ability to address a broad spectrum of factors, including pressures and temperatures in the wellbore and geological characteristics of the targeted formation.

The customers for our energy products can be divided into five broad categories: purchasing centers of large service companies, international service companies, independent international and North America-based service companies (often referred to as “wireline” companies), E&P companies with and without their own service companies, and local resellers.

Marketing, Sales, Distribution

DynaEnergetics’ worldwide marketing and sales efforts for its oilfield and seismic products are located in Troisdorf, Germany and Houston, Texas. DynaEnergetics’ sales strategy focuses on direct selling, distribution through licensed distributors and independent sales representatives, education of current and prospective service-company customers about our products and technologies, and education of E&P companies about the benefits of our products and technologies in an effort to generate pull-through demand. Currently, DynaEnergetics sells its oilfield and seismic products through wholly owned affiliates in Germany, the U.S., and Canada, and through independent sales agents in other parts of the world. DynaEnergetics serves the Americas region through its network of sales and distribution centers in the United States and Canada.

DynaEnergetics also designs and manufactures customized perforating products for third-party customers according to their designs and requirements.

Research and Development

DynaEnergetics devotes substantial resources to its research and development (R&D) programs. Based predominantly in Troisdorf, Germany, the R&D team works closely with sales, product management, and operations management teams to establish priorities and effectively manage individual projects. Through its ongoing involvement in oil and gas industry trade shows and conferences, DynaEnergetics has increased its profile in the oil and gas industry. In addition to its existing shaped charge test facility, which can simulate downhole, wellbore, and reservoir pressure conditions to develop and test high performance perforating charges for both oil companies and service providers, the R&D group has a purpose-built pressure vessel which can reach 30,000 psi test pressures and be heated to up to 200 degrees Celsius (392 degrees F). This enables the R&D group to support the oil and gas industry with test methods for new products that realistically simulate potentially difficult downhole conditions. An R&D plan, which focuses on new technology, products, process support and contracted projects, is prepared and reviewed at least quarterly. R&D costs are included in our cost of products sold and were $6,335, $7,057, and $5,932 for the years ended December 31, 2020, 2019 and 2018, respectively.

NobelClad

Explosion-welded cladding technology is a method for welding metals that cannot be joined using conventional welding processes, such as titanium-steel, aluminum-steel, and aluminum-copper. Explosion welding also can be used to weld compatible metals, such as stainless steels and nickel alloys to steel. The cladding metals are typically titanium, stainless steel, aluminum, copper alloys, nickel alloys, tantalum, and zirconium. The base metals are typically carbon steel, alloy steel, stainless steel and aluminum.

Clad metal plates are typically used in the construction of heavy, corrosion resistant pressure vessels and heat exchangers. Clad metal plates consist of a thin layer of an expensive, corrosion-resistant cladder metal, such as titanium or nickel alloy, which is metallurgically welded to a less expensive structural backing metal, such as carbon steel. For heavy equipment, clad plates generally provide an economical alternative to building the equipment solely of a corrosion-resistant alloy. While a significant portion of the demand for our clad metal products is driven by maintenance and retrofit projects at existing chemical processing, petrochemical processing, oil refining, and aluminum smelting facilities, new plant construction and large plant expansion projects also account for a significant portion of total demand. These industries tend to be cyclical in nature, and timing of new order inflow remains difficult to predict.

There are three major industrial clad plate manufacturing technologies: explosion welding, hot roll bonding and weld overlay. DetaCladTM, NobelClad’s process-controlled explosion clad, uses explosion welding, the most versatile of the clad plate manufacturing methods. Created using a robust cold-welding technology, explosion-welded clad products exhibit high bond strength and combine the corrosion resistance or other favorable quality of the cladder material with the mechanical properties and structural strength of the lower cost backer material. The explosion welding process is suitable for joining virtually any combination of common engineered metals.

Explosion-welded clad metal is produced as flat plates or concentric cylinders, which can be further formed and fabricated into a broad range of industrial processing equipment or specialized transition joints. When fabricated properly, the two metals will not come apart, as the bond zone is generally stronger than the parent metals. The dimensional capabilities of the process are broad: cladding metal layers can range from a few thousandths of an inch to several inches in thickness and base metal thickness and lateral dimensions are primarily limited by the capabilities of the world’s metal production mills.

Clad Metal End-Use Markets

Explosion-welded clad metal is primarily used in the construction of large industrial processing equipment that is subject to high pressures and temperatures and/or corrosive processes. Explosion-welded clad plates also can be cut into transition joints, which are used to facilitate conventional welding of dissimilar metals. The eight broad industrial sectors discussed below comprise the bulk of demand for NobelClad’s products, with oil and gas and chemical and petrochemical constituting approximately 60% of NobelClad sales in 2020. This demand is driven by the underlying need for both new equipment and facility maintenance in these primary market sectors.

Oil and Gas: Oil and gas end use markets include both oil and gas production and petroleum refining. Oil and gas production covers a broad scope of operations related to recovering oil and/or gas for subsequent processing in refineries. Clad

metal is used in separators, glycol contractors, pipelines, heat exchangers and other related equipment. Clad equipment is also advantageous for oil and gas production from deep, hot, and more corrosive fields. The primary clad metals for the oil and gas production market are stainless steel and nickel alloys clad to steel, with some use of reactive metals such as titanium.

Petroleum refining processes frequently are corrosive and operate at high temperatures and pressures. Clad metal is extensively used in a broad range of equipment including desulfurization hydrotreaters, coke drums, distillation columns, separators and heat exchangers. Reliance upon low-quality, high-sulfur crude drives demand for new corrosion resistant equipment. Regulatory controls of sulfur emissions in gas, diesel and jet fuel also impact the need for clad equipment. Like the upstream oil and gas sector, the clad metals are primarily stainless steel and nickel alloys.

Chemical and Petrochemical: Many common products, ranging from plastics to prescription drugs to electronic materials, are produced by chemical processes. Because the production of these items often involves corrosive agents and is conducted under high pressures or temperatures, corrosion resistant equipment is needed. One of the larger applications for clad equipment is in the manufacture of purified terephthalic acid (PTA), a precursor product for polyester, which is used in products as diverse as carpets and plastic bottles. The chemical market requires extensive use of stainless steel and nickel alloys, but also uses titanium, zirconium and tantalum.

Alternative Energy: Some alternative energy technologies involve conditions that necessitate clad metals. Solar panels predominantly incorporate high purity polysilicon. Processes for manufacturing high purity silicon utilize a broad range of highly corrosion-resistant clad alloys. Many geothermal fields are corrosive, requiring high alloy clad separators to handle the hot steam. In addition, some ethanol technologies and concentrating solar power technologies may require corrosion resistant metals at thicknesses where clad is an attractive alternative.

Hydrometallurgy: The processes for production of nickel, gold, and copper involve acids, high pressures, and high temperatures, and titanium-clad plates are used extensively for construction of associated leaching and peripheral equipment such as autoclaves.

Aluminum Production: Primary aluminum is reduced from its oxide in large electric smelters called potlines. The electric current is carried via aluminum conductors. The electricity must be transmitted into steel components for the high temperature smelting operations. Aluminum cannot be welded to steel conventionally. Explosion-welded aluminum-steel transition joints provide an energy efficient and highly durable solution for making these connections. Modern potlines use a large number of transition joints, which are typically replaced after approximately five years in service. Although primary aluminum production is the major electrochemical application for NobelClad products, there are a number of other electrochemical applications including production of zinc, magnesium, chlorine and chlorate. We are seeing an increase for equipment related to processing biomass feedstocks and biofuel end products, mostly stainless and nickel alloy clad.

Shipbuilding: The combined problems of corrosion and top-side weight drive demand for our aluminum-steel transition joints, which serve as the juncture between a ship's upper and lower structures. Top-side weight is often a significant problem with tall ships, including cruise ships, naval vessels, ferries and yachts. Use of aluminum in the upper structure and steel in the lower structure provides stability. Since aluminum cannot be welded directly to steel using conventional welding processes, and since bolted joints between aluminum and steel corrode quickly in seawater, explosion-welded transition joints are a common solution.

Power Generation: Fossil fuel and nuclear power generation plants require extensive use of heat exchangers, many of which require corrosion resistant alloys to handle low quality cooling water. Our clad plates are used for heat exchanger tube sheets, and the largest clad tube sheets are used in the final low-pressure condensers. For most coastal and brackish water-cooled plants, titanium is the metal of choice, and titanium-clad tube sheets are the low-cost solution for power plant condensers.

Industrial Refrigeration: Heat exchangers are a core component of refrigeration systems. When the cooling fluid is seawater, brackish, or even slightly polluted, corrosion-resistant metals are necessary. Metal selection can range from stainless steel to copper alloy to titanium. Explosion-welded clad metal is often the low-cost solution for making the tube sheets. Applications range from refrigeration chillers on fishing boats to massive air conditioning units for skyscrapers, airports, and deep underground mines.

New Applications/Industry Development

NobelClad continues its efforts in applications and materials innovations, with the goal of expanding NobelClad’s end-use markets and customer base. Examples of these efforts include the development of a new application of clad in the

production of engineered wood, development of improved electrical transition joints for smelting applications, and structural transitions joints for automotive applications. NobelClad is also engaged in research efforts related to using clad products in concentrating solar power production facilities.

Operations

NobelClad seeks to build on its leadership position in its markets. During the three years ended December 31, 2020, 2019 and 2018, the NobelClad segment represented approximately 36%, 22% and 27% of our consolidated net sales, respectively. Our manufacturing plants and their respective shooting sites in Pennsylvania and Germany provide the production capacity to address projects for NobelClad’s global customer base.

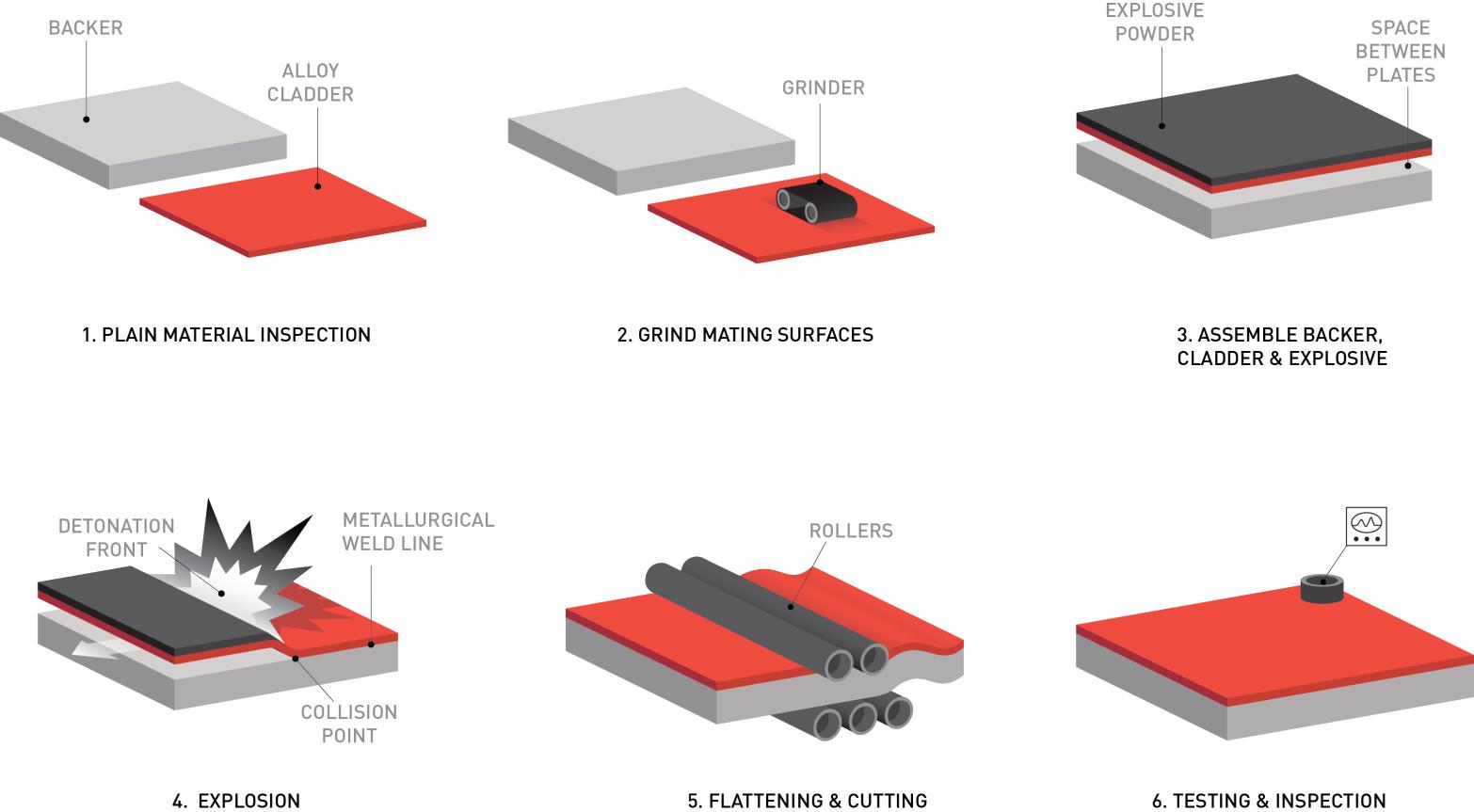

The principal product of metal cladding, regardless of the process used, is a metal plate composed of two or more dissimilar metals, usually a corrosion resistant metal (the "cladder") bonded to a steel backing plate. Prior to the explosion-welding process, the materials are inspected, the mating surfaces are ground, and the metal plates are assembled for cladding. The process involves placing a sheet of the cladder over a parallel plate of backer material and then covering the cladder with a layer of specifically formulated explosive powder. A small gap or “standoff space” is maintained between the cladder and backer using small spacers. The explosion is then initiated on one side of the cladder and travels across the surface of the cladder forcing it onto the backer. The explosion happens in approximately one-thousandth of a second. The collision conditions cause a thin layer of the mating surfaces, as well as the spacers, to be spalled away in a jet. This action removes oxides and surface contaminants immediately ahead of the collision point. The extreme pressures force the two metal components together, creating a metallurgical bond between them. The explosion welding process produces a strong, ductile, continuous metallurgical weld over the clad surface. After the explosion is completed, the resulting clad plates are flattened and cut, and then undergo testing and inspection to assure conformity with product specifications.

EXPLOSION-WELDING PROCESS

NobelClad uses proprietary processes and technology to produce high quality clad metal products and limit re-work costs. The entire explosion-welding process involves significant precision in all stages, and any errors can be extremely costly as they often result in the discarding of the expensive raw material metals. NobelClad’s technological expertise helps ensure precision, minimize errors, and prevent costly waste.

NobelClad’s metal products are primarily produced for custom projects and conform to requirements set forth in customers’ purchase orders. Upon receipt of an order, NobelClad obtains the component materials from a variety of sources

based on quality, availability and cost and then produces the order in one of its manufacturing plants. Final products are processed to meet contract specific requirements for product configuration and quality/inspection level.

Suppliers and Raw Materials

NobelClad's operations involve a range of alloys, steels and other materials, such as stainless steel, copper alloys, nickel alloys, titanium, zirconium, tantalum, aluminum and other metals. NobelClad sources its raw materials from a number of different producers and suppliers. It holds a limited metal inventory and purchases its raw materials based on contract specifications. Under most contracts, any raw material price increases are passed on to NobelClad’s customers. NobelClad closely monitors the quality of its supplies and inspects the type, dimensions, markings, and certification of all incoming metals to ensure that the materials will satisfy applicable construction codes. NobelClad also manufactures a majority of its own explosives from standard raw materials, and we believe that this allows us to achieve higher quality and lower cost.

Competition

Hot Roll Bonding and Weld Overlay. NobelClad faces competition from two primary alternative cladding technologies: hot roll bonding and weld overlay. Usually the three processes do not compete directly, as each has its own preferential domain of application relating to metal used and thicknesses required. However, specific project considerations such as technical specifications, price and delivery time, may allow these technologies to compete more directly with explosion-welding. Roll bond is only produced by a few steel mills in the world. In this process, the clad metal and base metal are bonded during the hot rolling operation in which the metal slab is converted to plate. Being a high temperature process that yields the formation of detrimental intermetallic compounds, hot roll bond is limited to joining similar metals, such as stainless steel and nickel alloys to steel. Roll bond’s niche is production of large quantities of light to medium gauge clad plates. Roll bond products are generally suitable for most pressure vessel applications but have lower bond shear strength and may have inferior corrosion resistance.

The weld overlay process is used by the many vessel fabricators that are often also NobelClad customers. In weld overlay cladding, the clad metal layer is deposited on the base metal using arc-welding type processes. Weld overlay is a cost-effective technology for complicated shapes, for field service jobs, and for production of some very heavy-wall pressure vessel reactors. During overlay welding, the cladding metal and base metal are melted together at their interface. The resulting dilution of the cladding metal chemistry may compromise corrosion performance and limit use in certain applications. Weld metal shrinkage during cooling potentially causes distortion when the base layer is thin. As with roll bond, weld overlay is limited to metallurgically similar metals, primarily stainless steels and nickel alloys joined to steel. Weld overlay is typically performed in conventional metal fabrication shops.

Explosion-Welded Metal Cladding. Worldwide competition in the explosion-welded clad metal business is fragmented, and we believe that NobelClad holds a strong market position in the industry. Within North America, NobelClad is one of the largest producers of explosion-welded clad products. In Europe, its manufacturing capacity gives NobelClad a strong position against smaller competitors. In Asia, NobelClad has mixed competition ranging from competitors with strong brand names and competitive technology to other producers that are technically limited and offer minimal exports outside of their domestic markets. To remain competitive, NobelClad intends to continue developing and providing technologically advanced manufacturing services, maintaining quality levels, offering flexible delivery schedules, delivering finished products on a reliable basis and competing favorably on the basis of price.

Customer Profile

NobelClad’s customers can be divided into three tiers: the product end users (e.g., operators of chemical processing plants, aluminum smelting plants), the engineering contractors that design and construct plants for end users, and the metal fabricators that manufacture the products or equipment that utilize NobelClad’s metal products. It is typically the fabricator that places the purchase order with NobelClad and pays the corresponding invoice. NobelClad has developed strong relationships over the years with the engineering contractors, process licensors, and equipment operating companies that frequently act as buying agents for fabricators.

Marketing, Sales, Distribution

NobelClad conducts its selling efforts by marketing its services to potential customers' senior management, direct sales personnel, program managers, and independent sales representatives. Prospective customers in specific industries are identified through networking in the industry, cooperative relationships with suppliers, public relations, customer references, inquiries from technical articles and seminars, website inquiries, webinars, and trade shows. NobelClad’s sales office in the United States

covers the Americas and Asia. Its sales offices in Europe cover the full European continent, Africa, the Middle East, India, Asia, and Russia. NobelClad also has sales offices in South Korea, Singapore and China to address these markets and uses contract agents to cover various other countries. Contract agents typically work under multi-year agreements which are subject to sales performance targets as well as compliance with NobelClad quality, customer service and compliance expectations. By maintaining relationships with its existing customers, developing new relationships with prospective customers, and educating all its customers as to the technical benefits of NobelClad’s products, NobelClad endeavors to assist in setting standard specifications, both by our customers and the American Society of Mechanical Engineers and ASTM, to ensure that the highest quality and reliability are achieved.

NobelClad’s products are generally shipped from its manufacturing locations in the United States and Germany. Any shipping costs or duties for which NobelClad is responsible typically will be included in the price paid by the customer. Regardless of where the sale is booked, NobelClad will produce it, capacity permitting, at the location closest to the delivery place. In the event that there is a short-term capacity issue at one facility, NobelClad can produce the order at its other production site, prioritizing timing. The two production sites allow NobelClad to meet customer production needs in a timely manner.

Research and Development

We prepare a formal research and development plan annually. It is implemented at our cladding sites and is supervised by a technical committee that reviews progress quarterly and meets once a year to establish the plan for the following 12 months. The research and development projects concern process support, new products, new applications, and special customer-paid projects.

Corporate History and Recent Developments

The genesis of the Company was an unincorporated business called “Explosive Fabricators,” which was formed in Colorado in 1965. The business was incorporated in Colorado in 1971 under the name “E. F. Industries, Inc.,” which was later changed to “Explosive Fabricators, Inc.” The Company became publicly traded in 1976. In 1994, it changed its name to “Dynamic Materials Corporation.” The Company reincorporated in Delaware in 1997.

From 1976, the Company operated as a licensee of DetaClad, the explosion-welded clad process developed by DuPont in 1959. In 1996, the Company purchased the DetaClad operating business from DuPont.

In 2001, the Company acquired substantially all of the stock of NobelClad Europe SA, a French company (“NobelClad Europe”), which had also been a licensee of the DetaClad technology. The acquisition of NobelClad Europe expanded the Company’s explosive metalworking operations to Europe.

In 2007, the Company acquired the German company DynaEnergetics GmbH and Co. KG (“DynaEnergetics”) and certain affiliates. DynaEnergetics was comprised of two primary businesses: explosive metalworking and energy products. This acquisition expanded the Company’s explosive metalworking operations in Europe and added a complementary energy products business.

In 2013, the Company branded its explosive metalworking operations under the single name NobelClad. The NobelClad segment is comprised of the Company’s U.S. clad operations as well as the explosion metalworking assets and operations purchased in the NobelClad Europe and DynaEnergetics acquisitions. In 2014, the Company re-branded the energy products segment as DynaEnergetics.

In 2014, the Company acquired a modern manufacturing and office complex in Liebenscheid, Germany. The facility enhances NobelClad's manufacturing capabilities and serves as a state-of-the-art production and administrative resource for NobelClad's European operations and also serves as a production resource for DynaEnergetics.

In 2016, the Company changed its name to DMC Global Inc. to reflect that we are a diversified portfolio of technical product and process businesses serving niche markets around the world.

In 2018, NobelClad completed the consolidation of its European explosion-welding operations into its manufacturing facility in Liebenscheid, Germany. DynaEnergetics expanded its North American operations, adding 74,000 square feet of manufacturing, assembly and administrative space on its Blum, Texas campus.

In 2019, DynaEnergetics completed a series of capacity expansion initiatives at its manufacturing facilities in North America and Germany. Capitalizing on its more efficient manufacturing footprint, DynaEnergetics ceased its operations in Tyumen, Siberia, and during the third quarter of 2020, DynaEnergetics sold the land and buildings in Tyumen, Siberia to a third-party. Additionally in 2019, the Company internally restructured its European entities and simplified its legal structure. The new structure took effect on January 1, 2020, and reduces the number of legal entities, minimizes complexity and enables the Company to reduce its annual compliance and administration costs and manage global tax reform more effectively.

Human Capital

DMC empowers its people and organizations by institutionalizing entrepreneurship and celebrating ingenuity. We seek to foster local innovation versus centralized control, and stand behind our businesses in ways that truly add value. Our culture is based on four core values:

•Integrity - We stand by our word and own our decisions. We are fair in how we treat customers, peers, partners and the communities we work in. We treat our company like it’s our own.

•Courage - We are entrepreneurs, with the courage to act when we see something that needs doing. We believe in pursuing the right path forward, even if it’s the most difficult one.

•Teamwork - We believe being a part of one team, one community. We count on each other to do our part. We stand by one another when things are tough, learning from our failures and celebrating together when we get the job done.

•Humility - We believe that inspiration can come from anywhere and remain open to new ideas. We are proud of our work and how it helps our customers, but are never boastful.

DMC aligns to provide all employees with a supportive work environment and the opportunity to improve their skills and advance their careers. Our culture is reflected in our inclusive and thriving workplace. We believe every employee deserves an environment in which they are treated with dignity and respect, and their voices are heard. We support diversity within our workforce, and respect and embrace the different backgrounds, experiences, cultures and perspectives our employees bring to DMC.

As of December 31, 2020, we had 531 permanent and part-time employees (320 U.S. and 211 non-U.S.), the majority of whom are engaged in manufacturing operations, with the remainder primarily in sales, marketing and administrative functions. None of our manufacturing employees are unionized. In addition, we use a number of temporary workers at any given time, depending on the workload. We currently believe that employee relations are good.

Compensation and Benefits. Our compensation and benefits teams strive to develop and implement policies and programs that are fair to employees, support our business goals, maintain competitiveness, and promote shared fiscal responsibility among the Company and our employees. We offer employees benefits that vary by country and are designed to meet or exceed local laws and to be competitive in the marketplace. Examples of benefits offered in the U.S. include traditional and Roth 401(k) plans with matching employer contributions; health benefits; life and disability insurance; additional voluntary insurance; paid counseling assistance; paid time off and parental leave; and a tuition reimbursement program. We also sponsor an employee stock purchase plan to encourage employees to acquire an ownership stake in DMC.

Health and Safety. The health and safety of our employees is fundamental to our success. Our occupational health and safety ("OH&S") management system is focused on maintaining a strong safety culture, stringent risk management and effective leadership. DMC’s occupational health and safety management system covers all employees regardless of employment type, and is aligned with standards requirements of ISO 45001:2018. During the COVID-19 pandemic, the health and safety of our employees remained our top priority. Steps we have taken to ensure employee safety include regular deep cleaning our facilities, providing personal protective equipment to our employees, restricting business travel and site visitors, redesigning our office and manufacturing layouts and workspaces and encouraging hygiene and quarantine practices advised by health authorities. We continue to monitor and adjust our policies and practices to remain aligned with federal, state, local and international regulations and guidelines.

Diversity and Inclusion. We believe that we will be most successful with a diverse employee population and encourage hiring and promotion practices that focus on the best talent and the most effective performers. Because we operate a global business across multiple business segments, products and service areas, we believe it is especially important that we attract employees with diverse backgrounds and the capability to address customer needs across the numerous cultures in the countries

in which we operate. Our commitment to diversity and inclusion starts at the top with a highly skilled and diverse Board of Directors. We plan to develop and adopt a formal diversity and inclusion program in 2021.

Employee Development. DMC strives to identify top talent within the Company, and to provide opportunities for employees to progress to higher levels within the organization. We seek to maximize each employee’s developmental potential through a combination of training and experience.