Financial Statements December 31, 2019

CONTENTS Independent Auditors’ Report ........................................................................... 1 Balance Sheet .............................................................................................. 2 Statement of Income ...................................................................................... 3 Statement of Stockholders’ Equity ..................................................................... 4 Statement of Cash Flows ................................................................................. 5 Notes to the Financial Statements .................................................................. 6-16 Independent Auditors’ Report on Supplementary Financial Data ............................... 17 Supplemental Schedule of Cost of Goods Sold .................................................... 18 Supplemental Schedule of Operating Expenses .................................................... 19

1 INDEPENDENT AUDITORS’ REPORT To the Stockholders of Arcadia, Inc. We have audited the accompanying financial statements of Arcadia, Inc. (a California corporation), which comprise the balance sheet as of December 31, 2019, and the related statements of income, stockholders’ equity, and cash flows for the year then ended, and the related notes to the financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of the financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditors consider internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Arcadia, Inc. as of December 31, 2019, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Emphasis of Matter As discussed in Note 2, beginning January 1, 2019, Arcadia, Inc. adopted Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606) and its related amendments. Our opinion is not modified with respect to this matter. Long Beach, California April 27, 2020 Long Beach | Irvine | Los Angeles www.windes.com 844.4WINDES

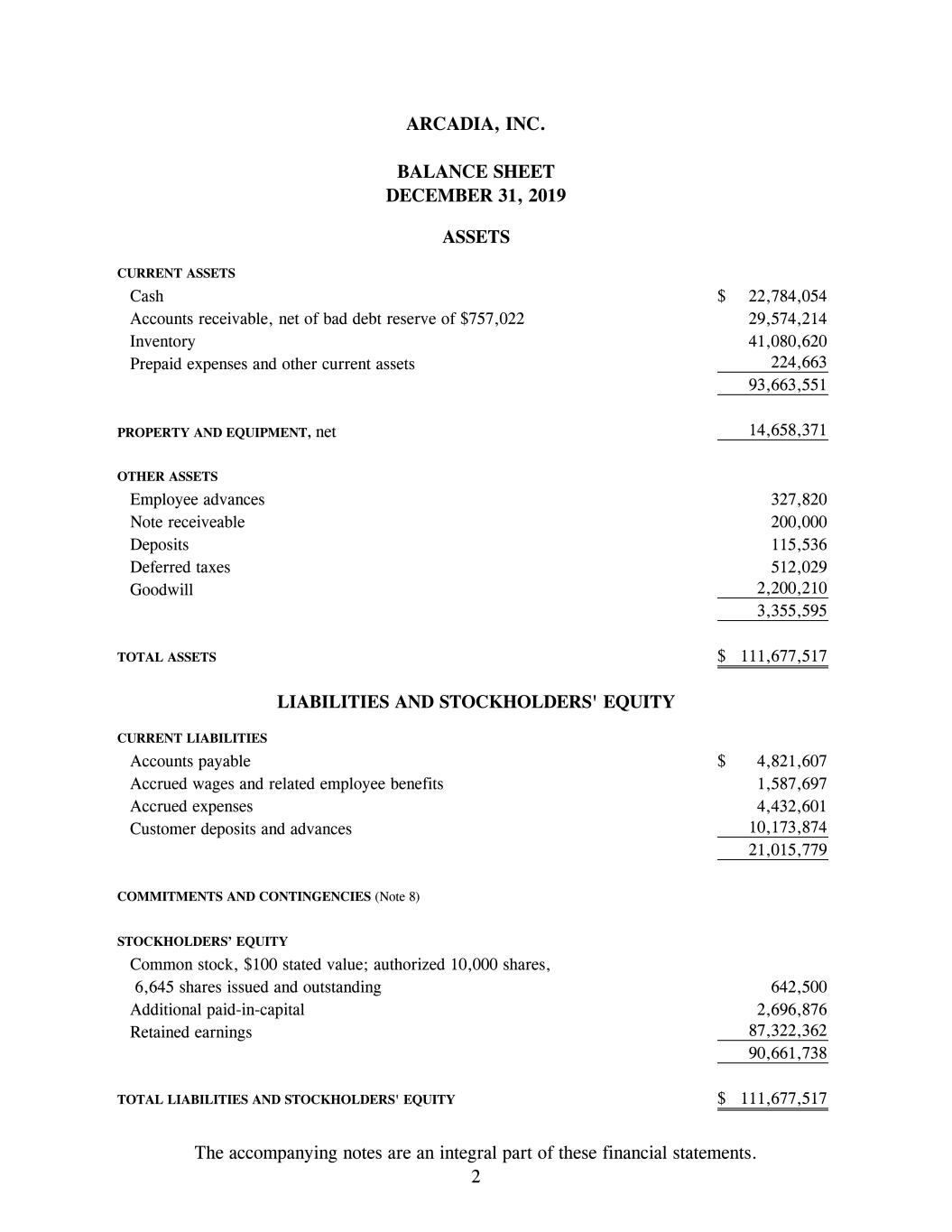

ARCADIA, INC. BALANCE SHEET DECEMBER 31, 2019 CURRENT ASSETS Cash 22,784,054$ Accounts receivable, net of bad debt reserve of $757,022 29,574,214 Inventory 41,080,620 Prepaid expenses and other current assets 224,663 93,663,551 PROPERTY AND EQUIPMENT, net 14,658,371 OTHER ASSETS Employee advances 327,820 Note receiveable 200,000 Deposits 115,536 Deferred taxes 512,029 Goodwill 2,200,210 3,355,595 TOTAL ASSETS 111,677,517$ CURRENT LIABILITIES Accounts payable 4,821,607$ Accrued wages and related employee benefits 1,587,697 Accrued expenses 4,432,601 Customer deposits and advances 10,173,874 21,015,779 COMMITMENTS AND CONTINGENCIES (Note 8) STOCKHOLDERS’ EQUITY Common stock, $100 stated value; authorized 10,000 shares, 6,645 shares issued and outstanding 642,500 Additional paid-in-capital 2,696,876 Retained earnings 87,322,362 90,661,738 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 111,677,517$ LIABILITIES AND STOCKHOLDERS' EQUITY ASSETS The accompanying notes are an integral part of these financial statements. 2

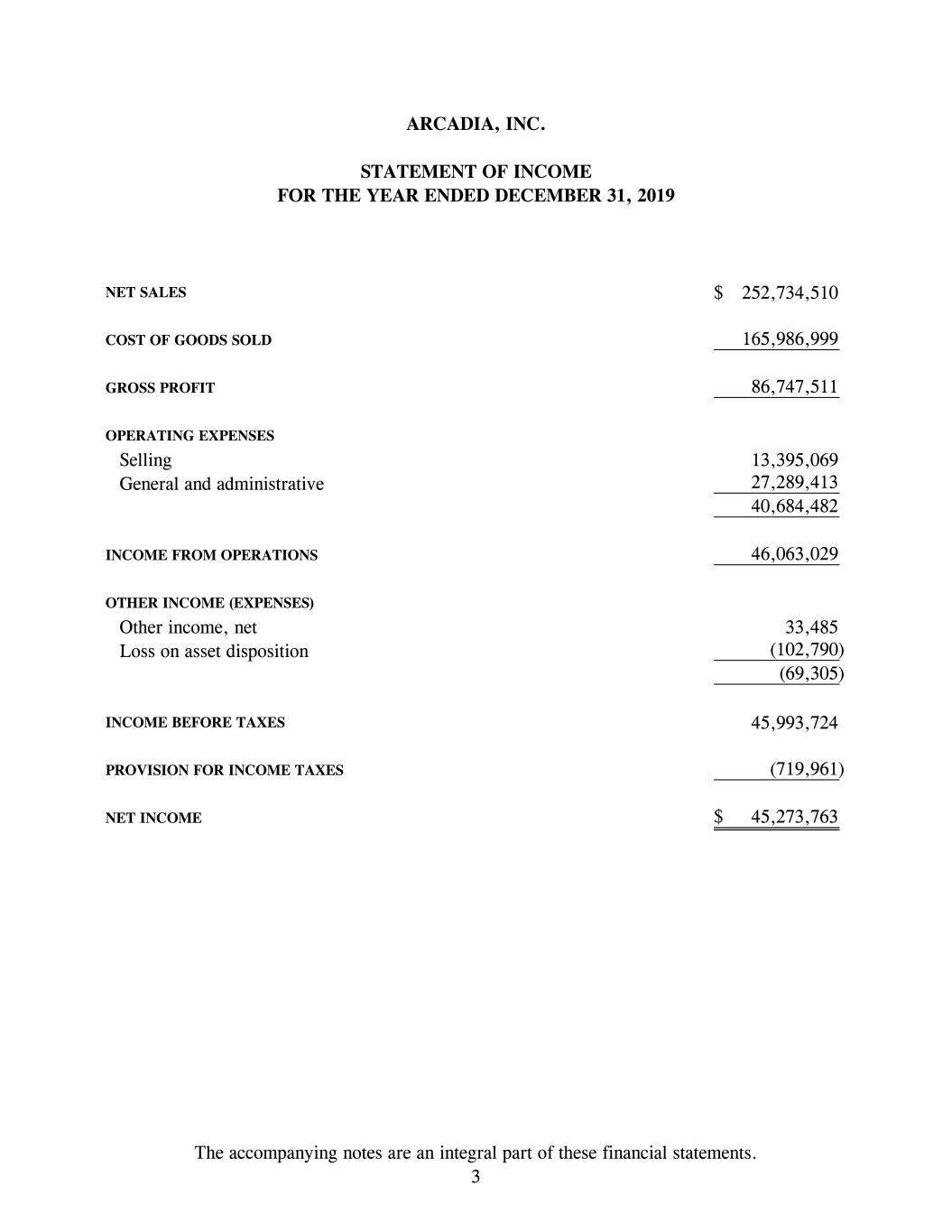

ARCADIA, INC. STATEMENT OF INCOME FOR THE YEAR ENDED DECEMBER 31, 2019 NET SALES 252,734,510$ COST OF GOODS SOLD 165,986,999 GROSS PROFIT 86,747,511 OPERATING EXPENSES Selling 13,395,069 General and administrative 27,289,413 40,684,482 INCOME FROM OPERATIONS 46,063,029 OTHER INCOME (EXPENSES) Other income, net 33,485 Loss on asset disposition (102,790) (69,305) INCOME BEFORE TAXES 45,993,724 PROVISION FOR INCOME TAXES (719,961) NET INCOME 45,273,763$ The accompanying notes are an integral part of these financial statements. 3

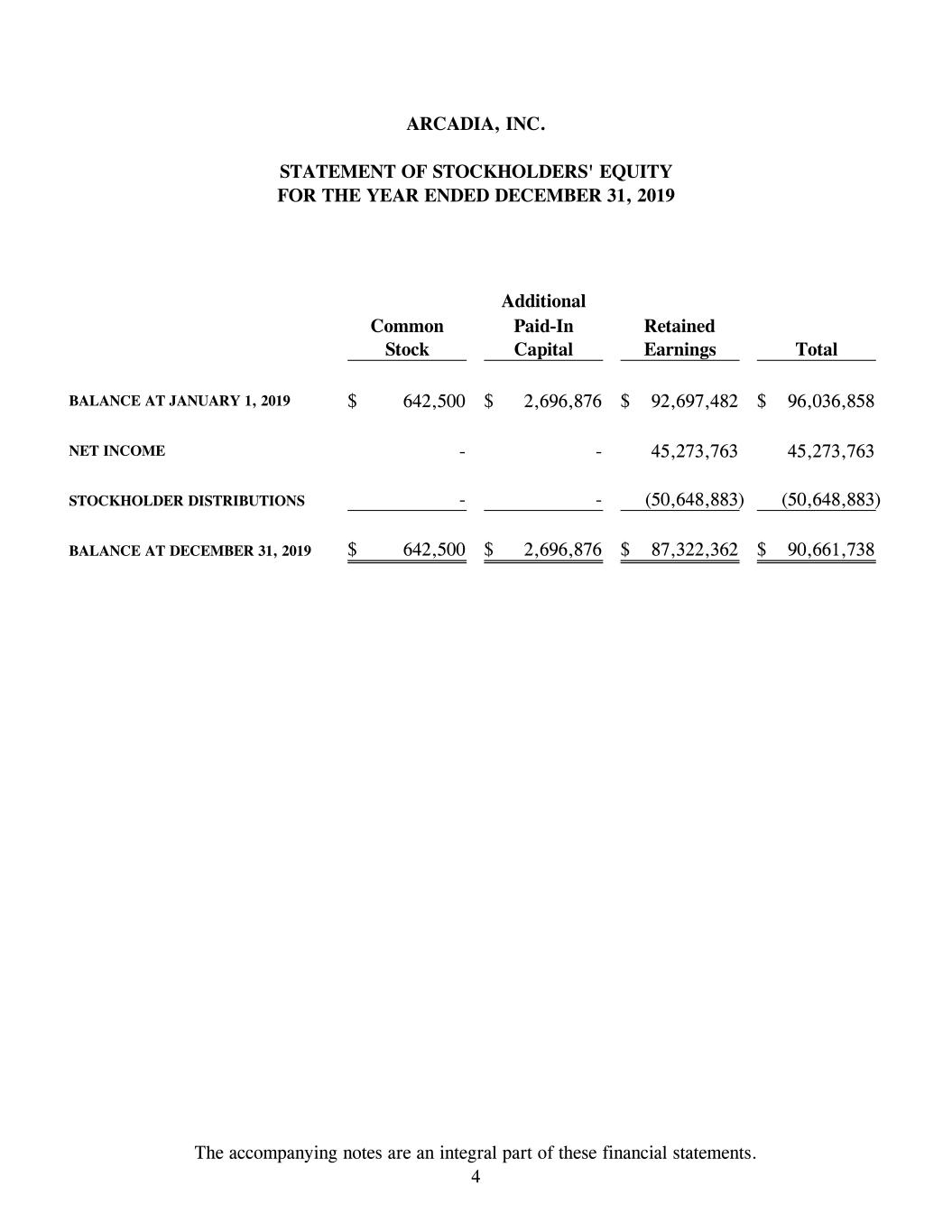

ARCADIA, INC. STATEMENT OF STOCKHOLDERS' EQUITY FOR THE YEAR ENDED DECEMBER 31, 2019 Additional Common Paid-In Retained Stock Capital Earnings Total BALANCE AT JANUARY 1, 2019 642,500$ 2,696,876$ 92,697,482$ 96,036,858$ NET INCOME - - 45,273,763 45,273,763 STOCKHOLDER DISTRIBUTIONS - - (50,648,883) (50,648,883) BALANCE AT DECEMBER 31, 2019 642,500$ 2,696,876$ 87,322,362$ 90,661,738$ The accompanying notes are an integral part of these financial statements. 4

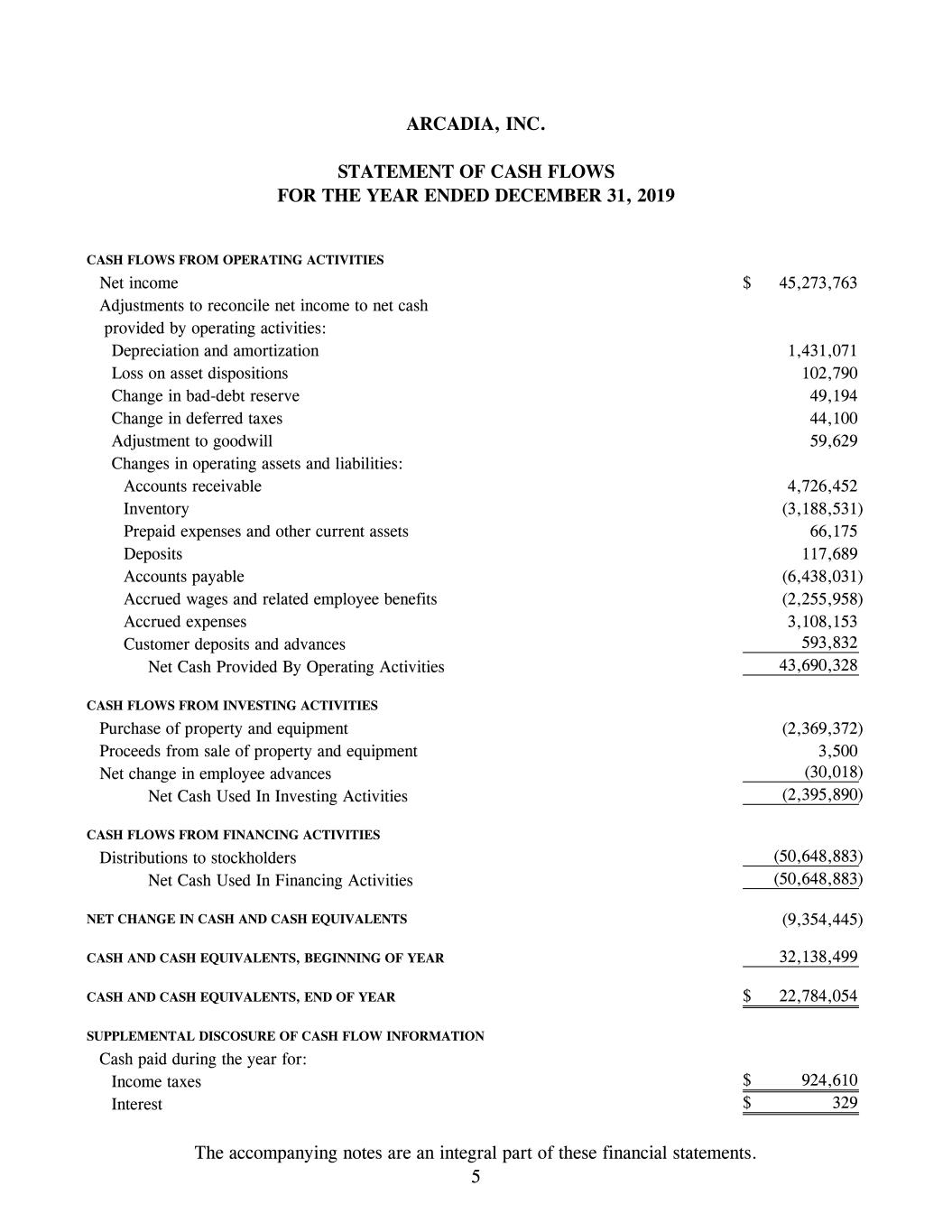

ARCADIA, INC. STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2019 CASH FLOWS FROM OPERATING ACTIVITIES Net income 45,273,763$ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 1,431,071 Loss on asset dispositions 102,790 Change in bad-debt reserve 49,194 Change in deferred taxes 44,100 Adjustment to goodwill 59,629 Changes in operating assets and liabilities: Accounts receivable 4,726,452 Inventory (3,188,531) Prepaid expenses and other current assets 66,175 Deposits 117,689 Accounts payable (6,438,031) Accrued wages and related employee benefits (2,255,958) Accrued expenses 3,108,153 Customer deposits and advances 593,832 Net Cash Provided By Operating Activities 43,690,328 CASH FLOWS FROM INVESTING ACTIVITIES Purchase of property and equipment (2,369,372) Proceeds from sale of property and equipment 3,500 Net change in employee advances (30,018) Net Cash Used In Investing Activities (2,395,890) CASH FLOWS FROM FINANCING ACTIVITIES Distributions to stockholders (50,648,883) Net Cash Used In Financing Activities (50,648,883) NET CHANGE IN CASH AND CASH EQUIVALENTS (9,354,445) CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 32,138,499 CASH AND CASH EQUIVALENTS, END OF YEAR 22,784,054$ SUPPLEMENTAL DISCOSURE OF CASH FLOW INFORMATION Cash paid during the year for: Income taxes 924,610$ Interest 329$ The accompanying notes are an integral part of these financial statements. 5

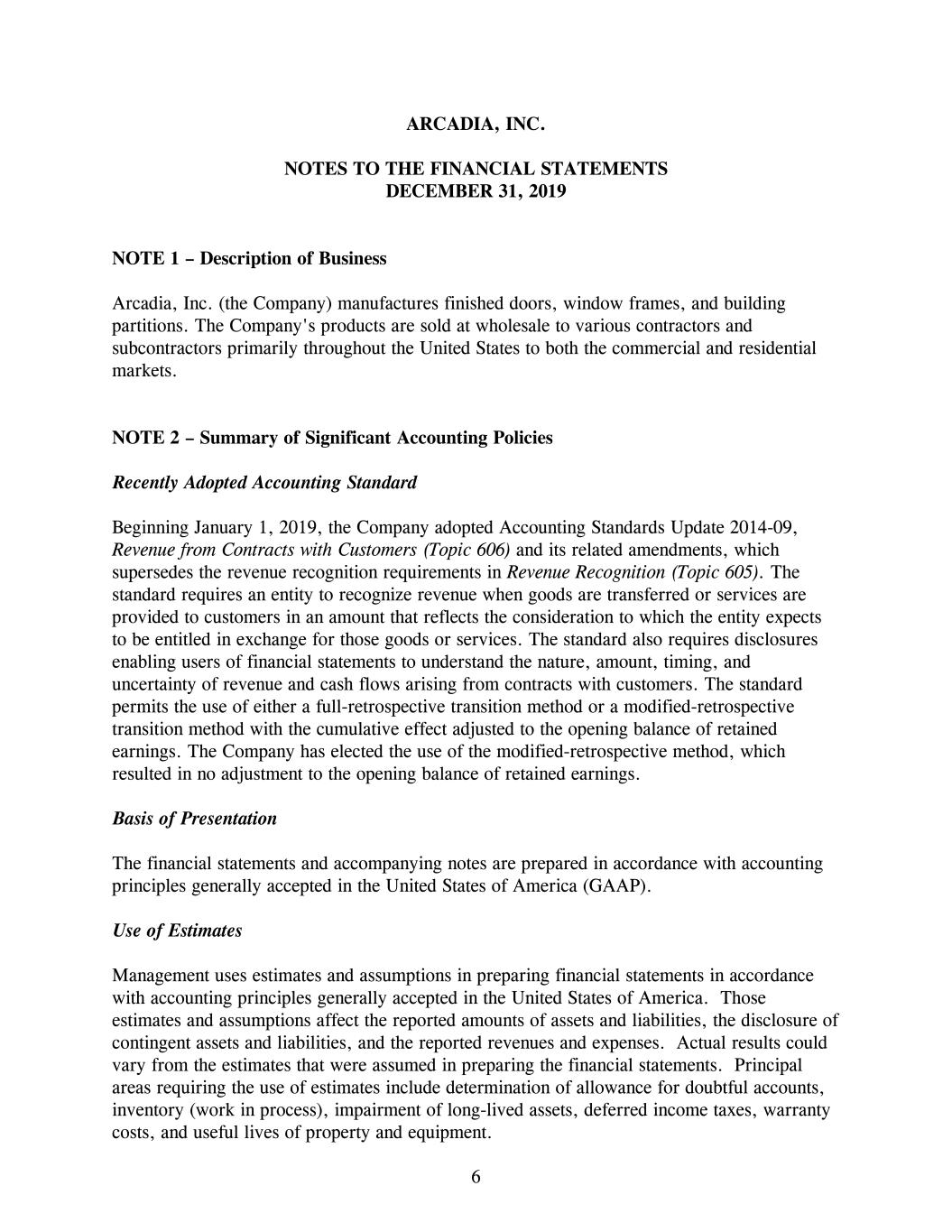

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 6 NOTE 1 – Description of Business Arcadia, Inc. (the Company) manufactures finished doors, window frames, and building partitions. The Company's products are sold at wholesale to various contractors and subcontractors primarily throughout the United States to both the commercial and residential markets. NOTE 2 – Summary of Significant Accounting Policies Recently Adopted Accounting Standard Beginning January 1, 2019, the Company adopted Accounting Standards Update 2014-09, Revenue from Contracts with Customers (Topic 606) and its related amendments, which supersedes the revenue recognition requirements in Revenue Recognition (Topic 605). The standard requires an entity to recognize revenue when goods are transferred or services are provided to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard also requires disclosures enabling users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The standard permits the use of either a full-retrospective transition method or a modified-retrospective transition method with the cumulative effect adjusted to the opening balance of retained earnings. The Company has elected the use of the modified-retrospective method, which resulted in no adjustment to the opening balance of retained earnings. Basis of Presentation The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). Use of Estimates Management uses estimates and assumptions in preparing financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing the financial statements. Principal areas requiring the use of estimates include determination of allowance for doubtful accounts, inventory (work in process), impairment of long-lived assets, deferred income taxes, warranty costs, and useful lives of property and equipment.

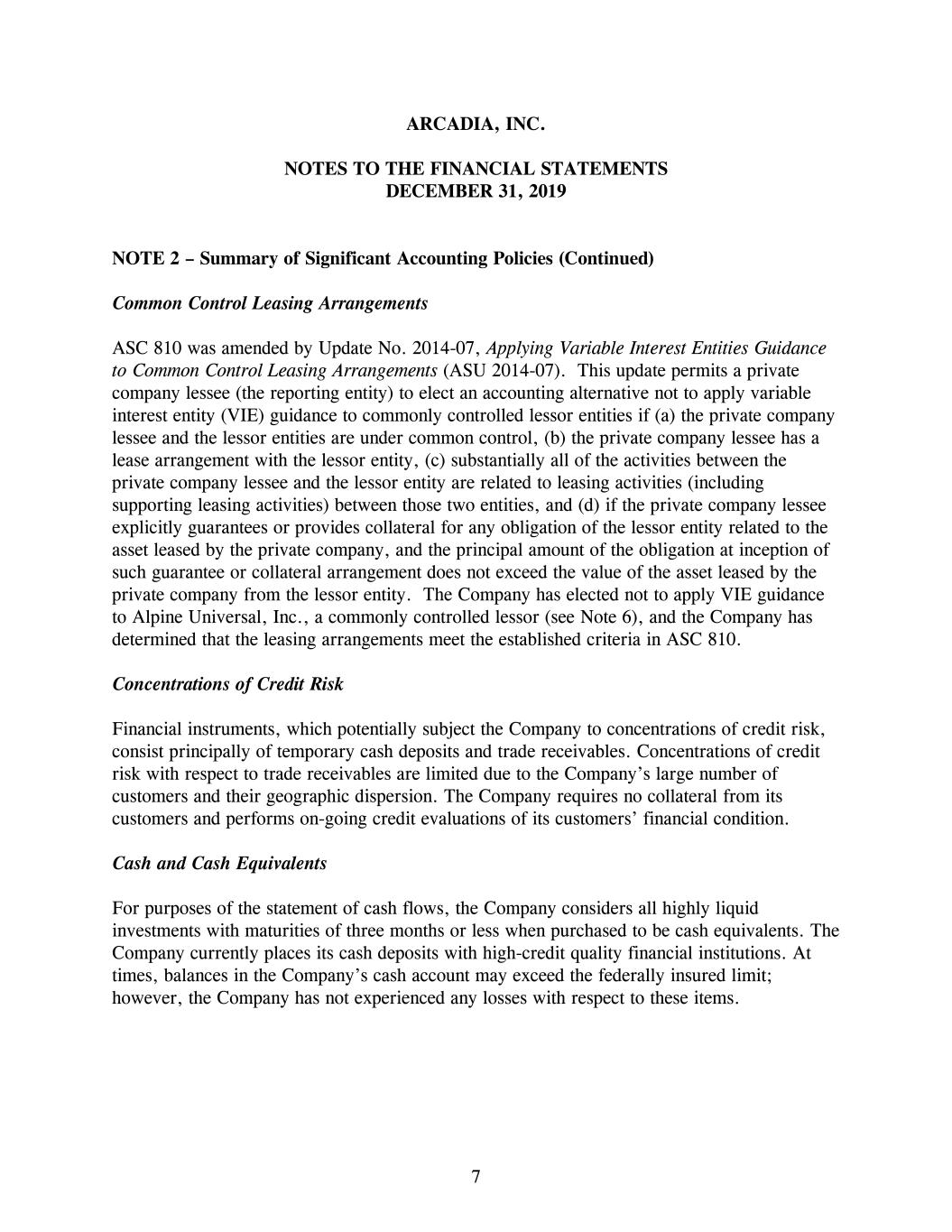

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 7 NOTE 2 – Summary of Significant Accounting Policies (Continued) Common Control Leasing Arrangements ASC 810 was amended by Update No. 2014-07, Applying Variable Interest Entities Guidance to Common Control Leasing Arrangements (ASU 2014-07). This update permits a private company lessee (the reporting entity) to elect an accounting alternative not to apply variable interest entity (VIE) guidance to commonly controlled lessor entities if (a) the private company lessee and the lessor entities are under common control, (b) the private company lessee has a lease arrangement with the lessor entity, (c) substantially all of the activities between the private company lessee and the lessor entity are related to leasing activities (including supporting leasing activities) between those two entities, and (d) if the private company lessee explicitly guarantees or provides collateral for any obligation of the lessor entity related to the asset leased by the private company, and the principal amount of the obligation at inception of such guarantee or collateral arrangement does not exceed the value of the asset leased by the private company from the lessor entity. The Company has elected not to apply VIE guidance to Alpine Universal, Inc., a commonly controlled lessor (see Note 6), and the Company has determined that the leasing arrangements meet the established criteria in ASC 810. Concentrations of Credit Risk Financial instruments, which potentially subject the Company to concentrations of credit risk, consist principally of temporary cash deposits and trade receivables. Concentrations of credit risk with respect to trade receivables are limited due to the Company’s large number of customers and their geographic dispersion. The Company requires no collateral from its customers and performs on-going credit evaluations of its customers’ financial condition. Cash and Cash Equivalents For purposes of the statement of cash flows, the Company considers all highly liquid investments with maturities of three months or less when purchased to be cash equivalents. The Company currently places its cash deposits with high-credit quality financial institutions. At times, balances in the Company’s cash account may exceed the federally insured limit; however, the Company has not experienced any losses with respect to these items.

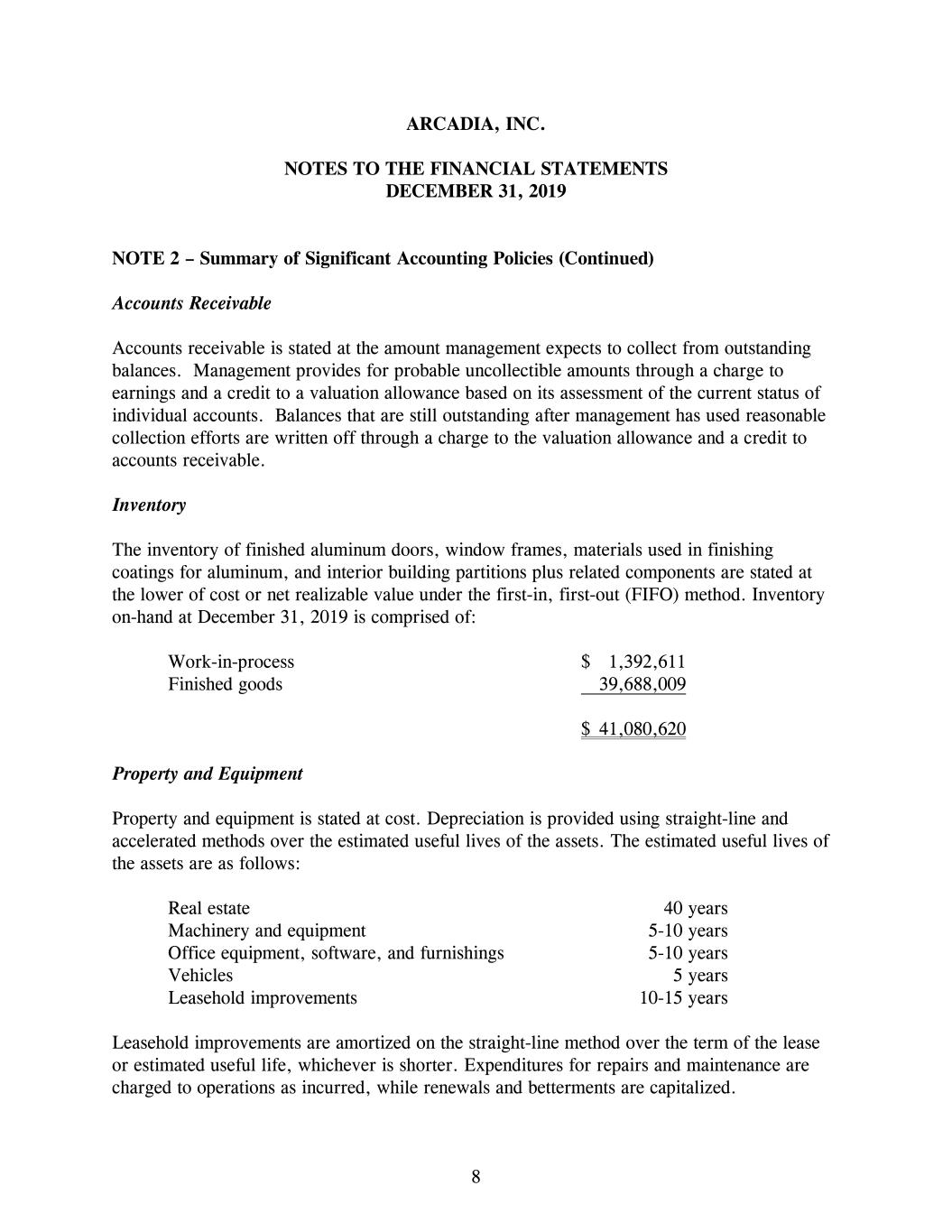

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 8 NOTE 2 – Summary of Significant Accounting Policies (Continued) Accounts Receivable Accounts receivable is stated at the amount management expects to collect from outstanding balances. Management provides for probable uncollectible amounts through a charge to earnings and a credit to a valuation allowance based on its assessment of the current status of individual accounts. Balances that are still outstanding after management has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable. Inventory The inventory of finished aluminum doors, window frames, materials used in finishing coatings for aluminum, and interior building partitions plus related components are stated at the lower of cost or net realizable value under the first-in, first-out (FIFO) method. Inventory on-hand at December 31, 2019 is comprised of: Work-in-process $ 1,392,611 Finished goods 39,688,009 $ 41,080,620 Property and Equipment Property and equipment is stated at cost. Depreciation is provided using straight-line and accelerated methods over the estimated useful lives of the assets. The estimated useful lives of the assets are as follows: Real estate 40 years Machinery and equipment 5-10 years Office equipment, software, and furnishings 5-10 years Vehicles 5 years Leasehold improvements 10-15 years Leasehold improvements are amortized on the straight-line method over the term of the lease or estimated useful life, whichever is shorter. Expenditures for repairs and maintenance are charged to operations as incurred, while renewals and betterments are capitalized.

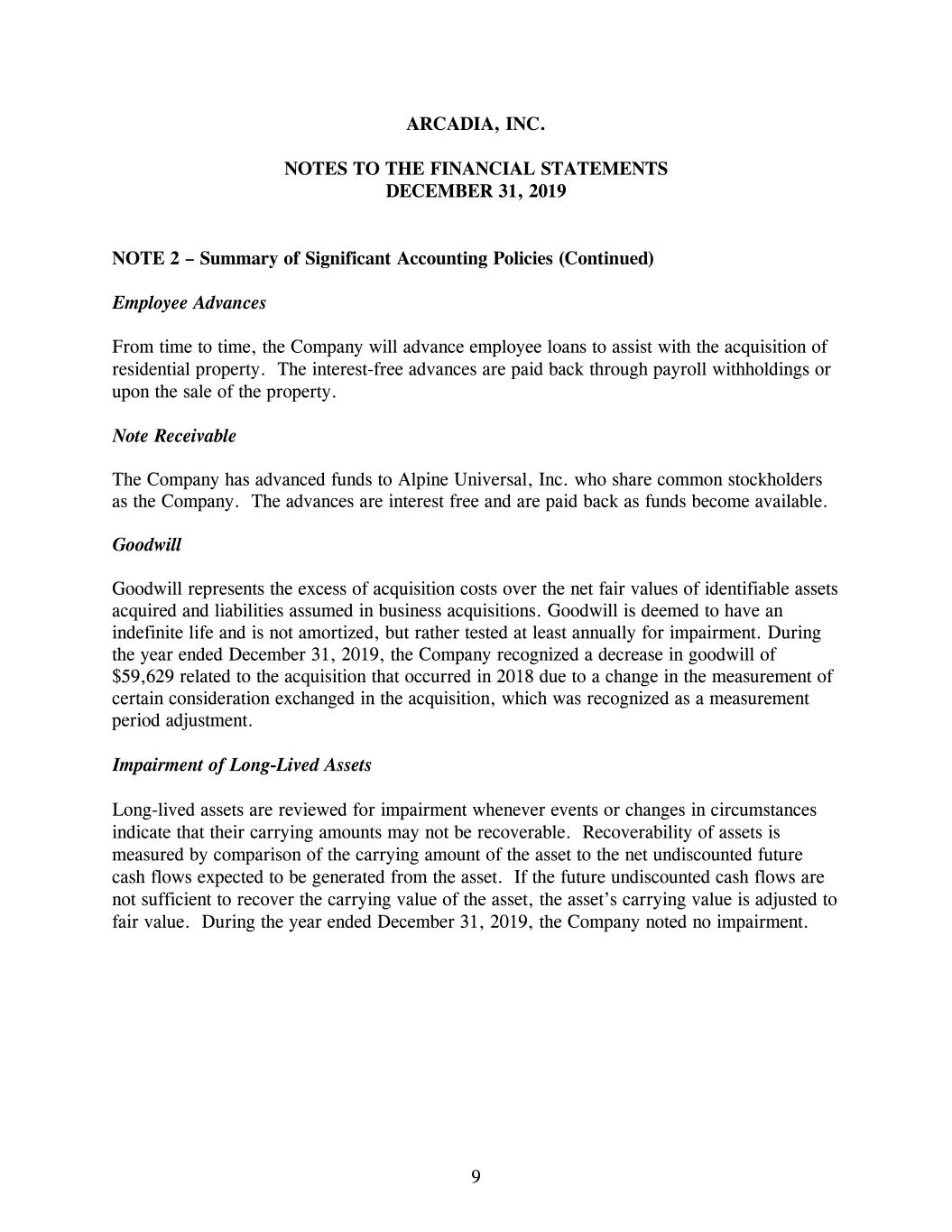

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 9 NOTE 2 – Summary of Significant Accounting Policies (Continued) Employee Advances From time to time, the Company will advance employee loans to assist with the acquisition of residential property. The interest-free advances are paid back through payroll withholdings or upon the sale of the property. Note Receivable The Company has advanced funds to Alpine Universal, Inc. who share common stockholders as the Company. The advances are interest free and are paid back as funds become available. Goodwill Goodwill represents the excess of acquisition costs over the net fair values of identifiable assets acquired and liabilities assumed in business acquisitions. Goodwill is deemed to have an indefinite life and is not amortized, but rather tested at least annually for impairment. During the year ended December 31, 2019, the Company recognized a decrease in goodwill of $59,629 related to the acquisition that occurred in 2018 due to a change in the measurement of certain consideration exchanged in the acquisition, which was recognized as a measurement period adjustment. Impairment of Long-Lived Assets Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Recoverability of assets is measured by comparison of the carrying amount of the asset to the net undiscounted future cash flows expected to be generated from the asset. If the future undiscounted cash flows are not sufficient to recover the carrying value of the asset, the asset’s carrying value is adjusted to fair value. During the year ended December 31, 2019, the Company noted no impairment.

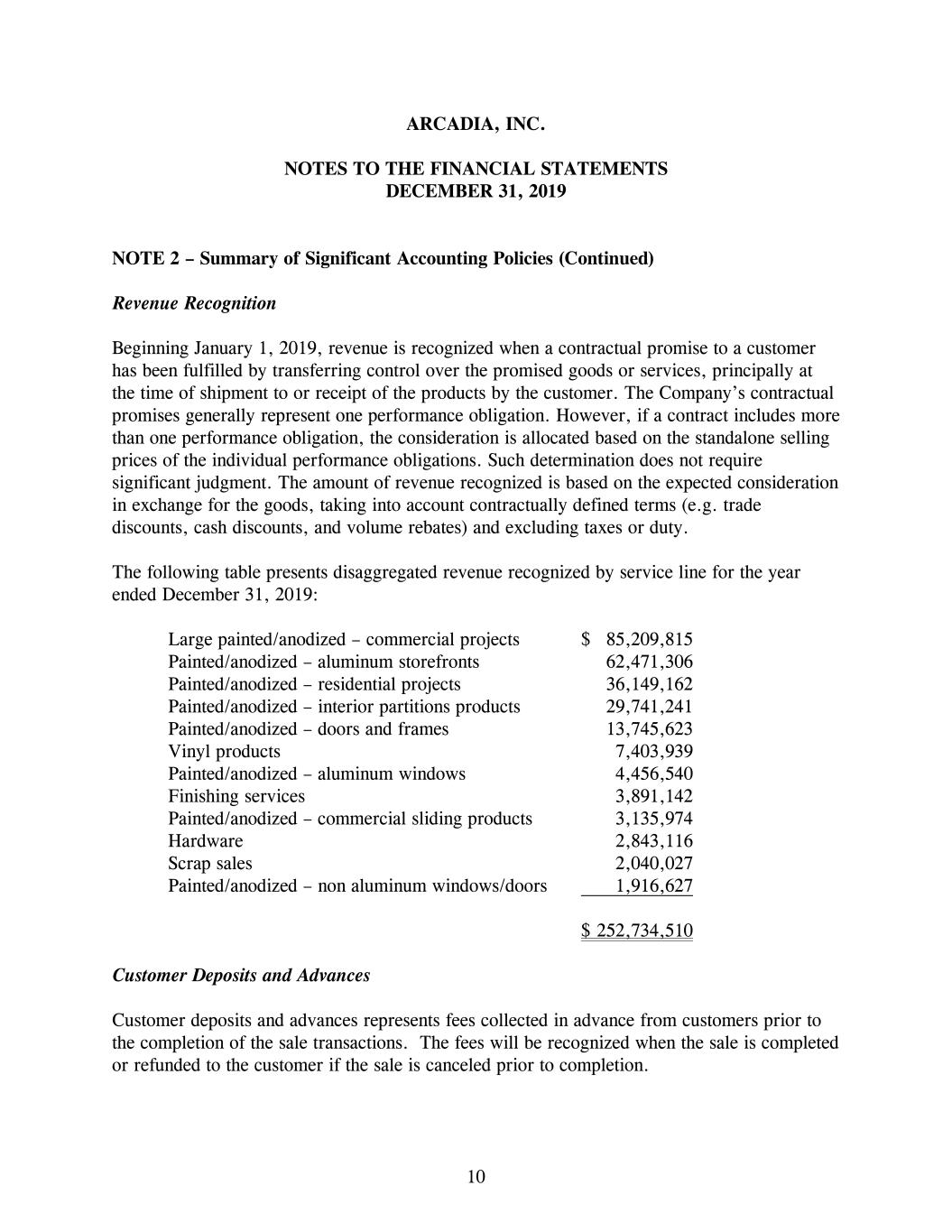

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 10 NOTE 2 – Summary of Significant Accounting Policies (Continued) Revenue Recognition Beginning January 1, 2019, revenue is recognized when a contractual promise to a customer has been fulfilled by transferring control over the promised goods or services, principally at the time of shipment to or receipt of the products by the customer. The Company’s contractual promises generally represent one performance obligation. However, if a contract includes more than one performance obligation, the consideration is allocated based on the standalone selling prices of the individual performance obligations. Such determination does not require significant judgment. The amount of revenue recognized is based on the expected consideration in exchange for the goods, taking into account contractually defined terms (e.g. trade discounts, cash discounts, and volume rebates) and excluding taxes or duty. The following table presents disaggregated revenue recognized by service line for the year ended December 31, 2019: Large painted/anodized – commercial projects $ 85,209,815 Painted/anodized – aluminum storefronts 62,471,306 Painted/anodized – residential projects 36,149,162 Painted/anodized – interior partitions products 29,741,241 Painted/anodized – doors and frames 13,745,623 Vinyl products 7,403,939 Painted/anodized – aluminum windows 4,456,540 Finishing services 3,891,142 Painted/anodized – commercial sliding products 3,135,974 Hardware 2,843,116 Scrap sales 2,040,027 Painted/anodized – non aluminum windows/doors 1,916,627 $ 252,734,510 Customer Deposits and Advances Customer deposits and advances represents fees collected in advance from customers prior to the completion of the sale transactions. The fees will be recognized when the sale is completed or refunded to the customer if the sale is canceled prior to completion.

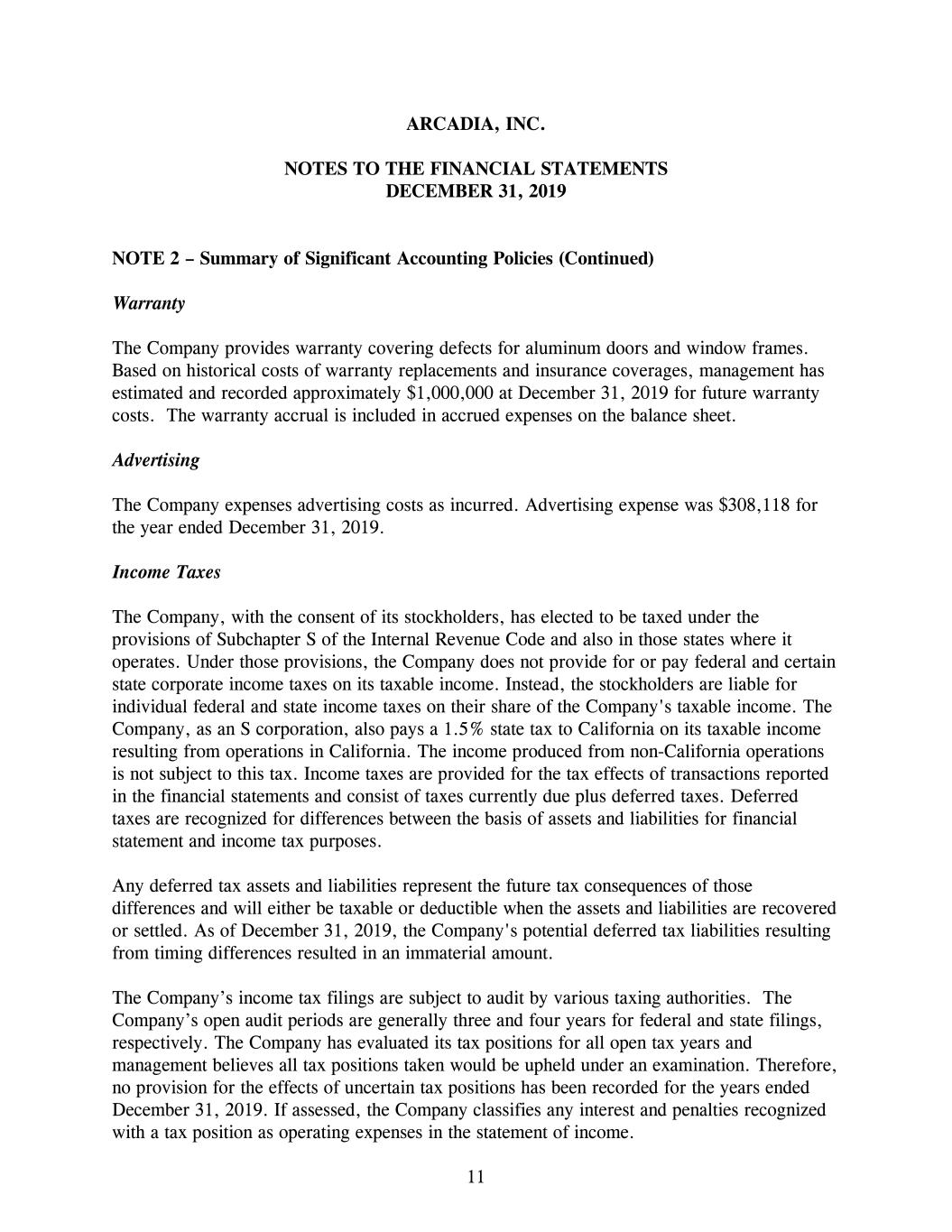

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 11 NOTE 2 – Summary of Significant Accounting Policies (Continued) Warranty The Company provides warranty covering defects for aluminum doors and window frames. Based on historical costs of warranty replacements and insurance coverages, management has estimated and recorded approximately $1,000,000 at December 31, 2019 for future warranty costs. The warranty accrual is included in accrued expenses on the balance sheet. Advertising The Company expenses advertising costs as incurred. Advertising expense was $308,118 for the year ended December 31, 2019. Income Taxes The Company, with the consent of its stockholders, has elected to be taxed under the provisions of Subchapter S of the Internal Revenue Code and also in those states where it operates. Under those provisions, the Company does not provide for or pay federal and certain state corporate income taxes on its taxable income. Instead, the stockholders are liable for individual federal and state income taxes on their share of the Company's taxable income. The Company, as an S corporation, also pays a 1.5% state tax to California on its taxable income resulting from operations in California. The income produced from non-California operations is not subject to this tax. Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes. Deferred taxes are recognized for differences between the basis of assets and liabilities for financial statement and income tax purposes. Any deferred tax assets and liabilities represent the future tax consequences of those differences and will either be taxable or deductible when the assets and liabilities are recovered or settled. As of December 31, 2019, the Company's potential deferred tax liabilities resulting from timing differences resulted in an immaterial amount. The Company’s income tax filings are subject to audit by various taxing authorities. The Company’s open audit periods are generally three and four years for federal and state filings, respectively. The Company has evaluated its tax positions for all open tax years and management believes all tax positions taken would be upheld under an examination. Therefore, no provision for the effects of uncertain tax positions has been recorded for the years ended December 31, 2019. If assessed, the Company classifies any interest and penalties recognized with a tax position as operating expenses in the statement of income.

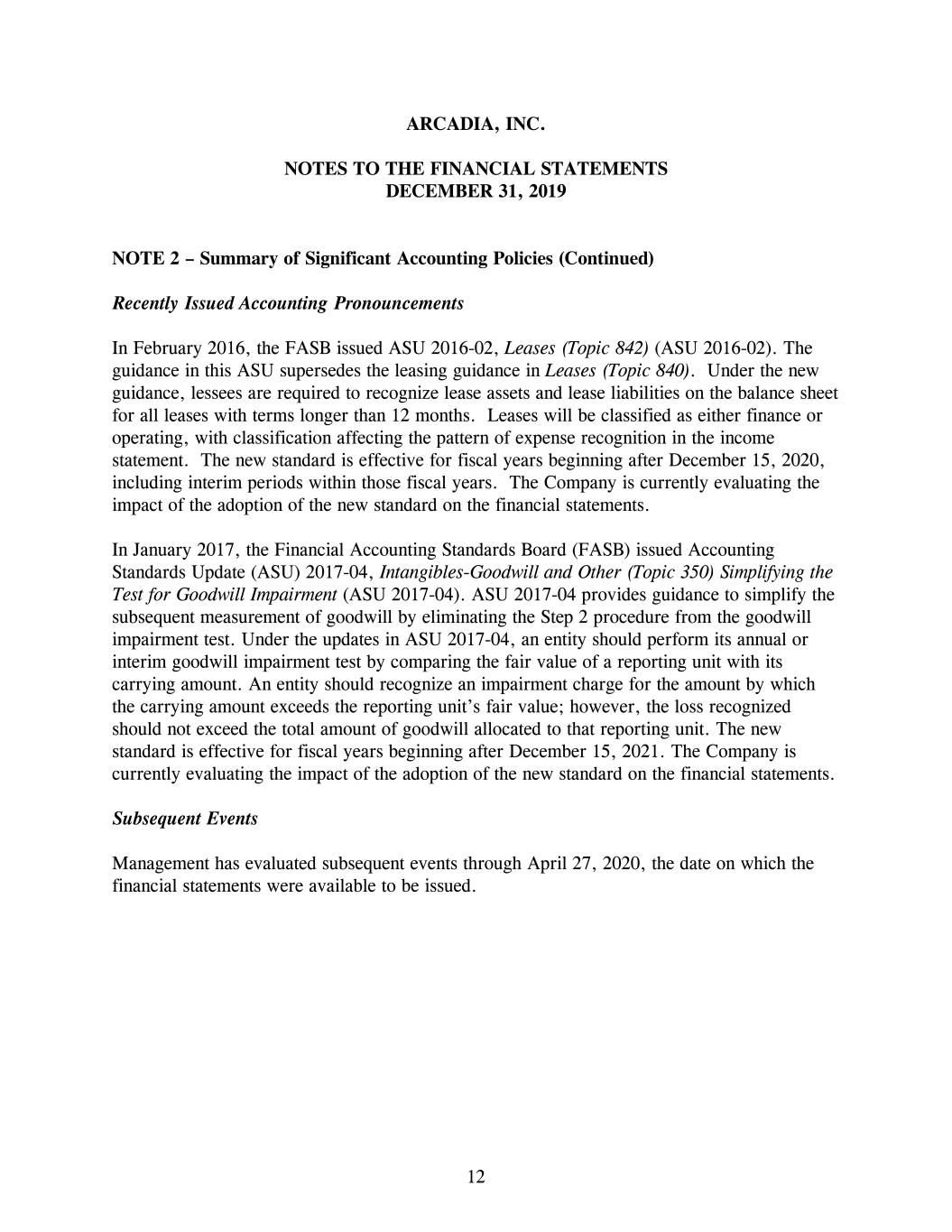

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 12 NOTE 2 – Summary of Significant Accounting Policies (Continued) Recently Issued Accounting Pronouncements In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) (ASU 2016-02). The guidance in this ASU supersedes the leasing guidance in Leases (Topic 840). Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The Company is currently evaluating the impact of the adoption of the new standard on the financial statements. In January 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2017-04, Intangibles-Goodwill and Other (Topic 350) Simplifying the Test for Goodwill Impairment (ASU 2017-04). ASU 2017-04 provides guidance to simplify the subsequent measurement of goodwill by eliminating the Step 2 procedure from the goodwill impairment test. Under the updates in ASU 2017-04, an entity should perform its annual or interim goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. An entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value; however, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. The new standard is effective for fiscal years beginning after December 15, 2021. The Company is currently evaluating the impact of the adoption of the new standard on the financial statements. Subsequent Events Management has evaluated subsequent events through April 27, 2020, the date on which the financial statements were available to be issued.

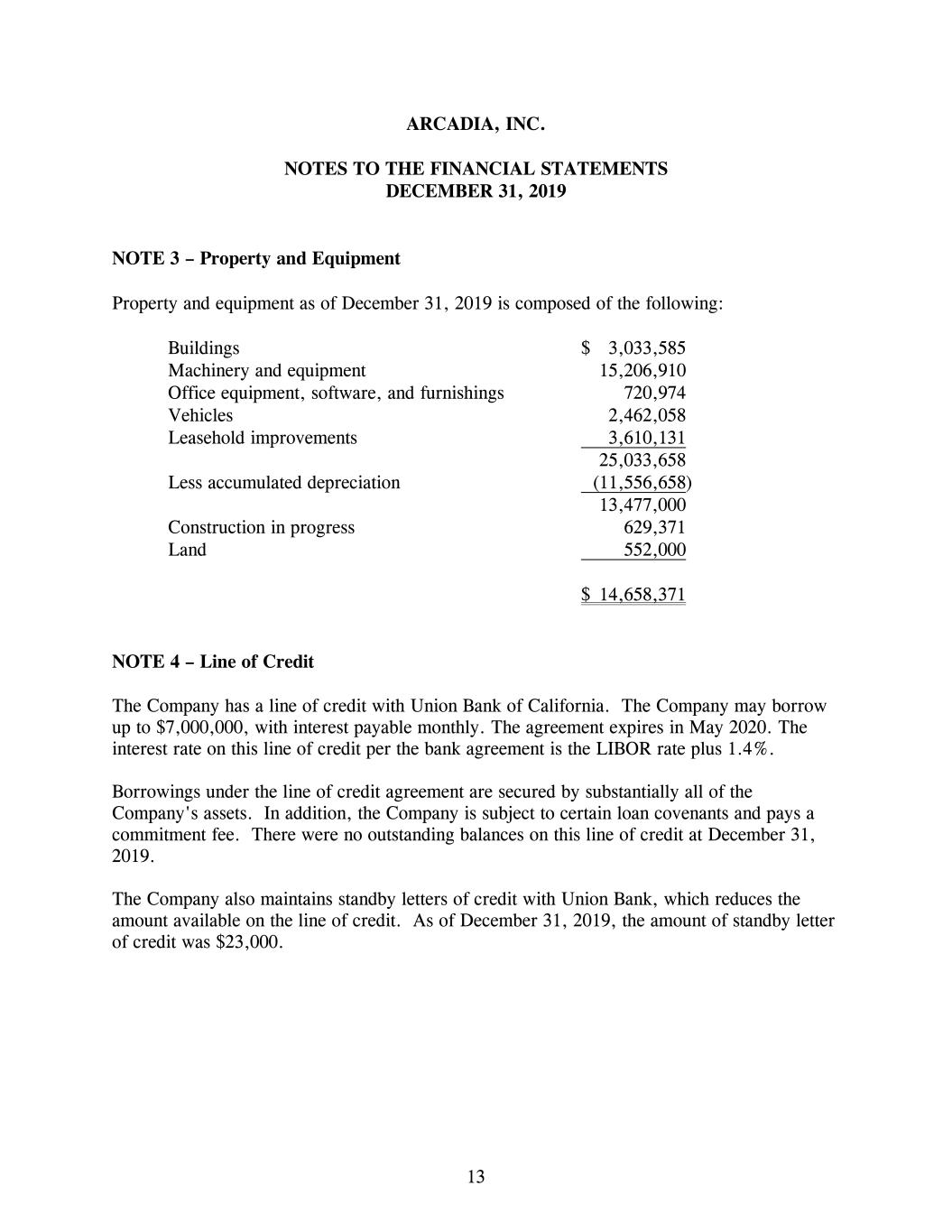

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 13 NOTE 3 – Property and Equipment Property and equipment as of December 31, 2019 is composed of the following: Buildings $ 3,033,585 Machinery and equipment 15,206,910 Office equipment, software, and furnishings 720,974 Vehicles 2,462,058 Leasehold improvements 3,610,131 25,033,658 Less accumulated depreciation (11,556,658) 13,477,000 Construction in progress 629,371 Land 552,000 $ 14,658,371 NOTE 4 – Line of Credit The Company has a line of credit with Union Bank of California. The Company may borrow up to $7,000,000, with interest payable monthly. The agreement expires in May 2020. The interest rate on this line of credit per the bank agreement is the LIBOR rate plus 1.4%. Borrowings under the line of credit agreement are secured by substantially all of the Company's assets. In addition, the Company is subject to certain loan covenants and pays a commitment fee. There were no outstanding balances on this line of credit at December 31, 2019. The Company also maintains standby letters of credit with Union Bank, which reduces the amount available on the line of credit. As of December 31, 2019, the amount of standby letter of credit was $23,000.

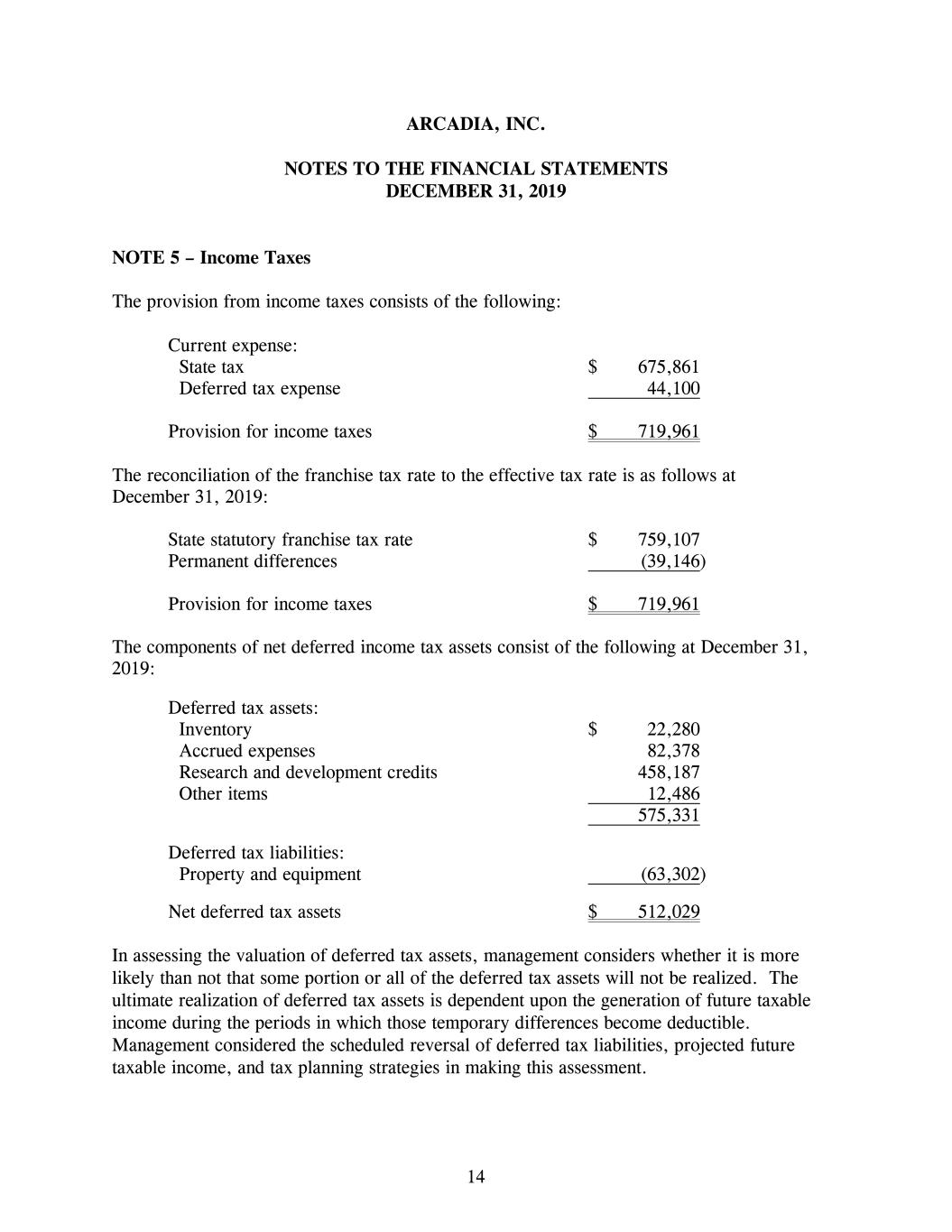

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 14 NOTE 5 – Income Taxes The provision from income taxes consists of the following: Current expense: State tax $ 675,861 Deferred tax expense 44,100 Provision for income taxes $ 719,961 The reconciliation of the franchise tax rate to the effective tax rate is as follows at December 31, 2019: State statutory franchise tax rate $ 759,107 Permanent differences (39,146) Provision for income taxes $ 719,961 The components of net deferred income tax assets consist of the following at December 31, 2019: Deferred tax assets: Inventory $ 22,280 Accrued expenses 82,378 Research and development credits 458,187 Other items 12,486 575,331 Deferred tax liabilities: Property and equipment (63,302) Net deferred tax assets $ 512,029 In assessing the valuation of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considered the scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning strategies in making this assessment.

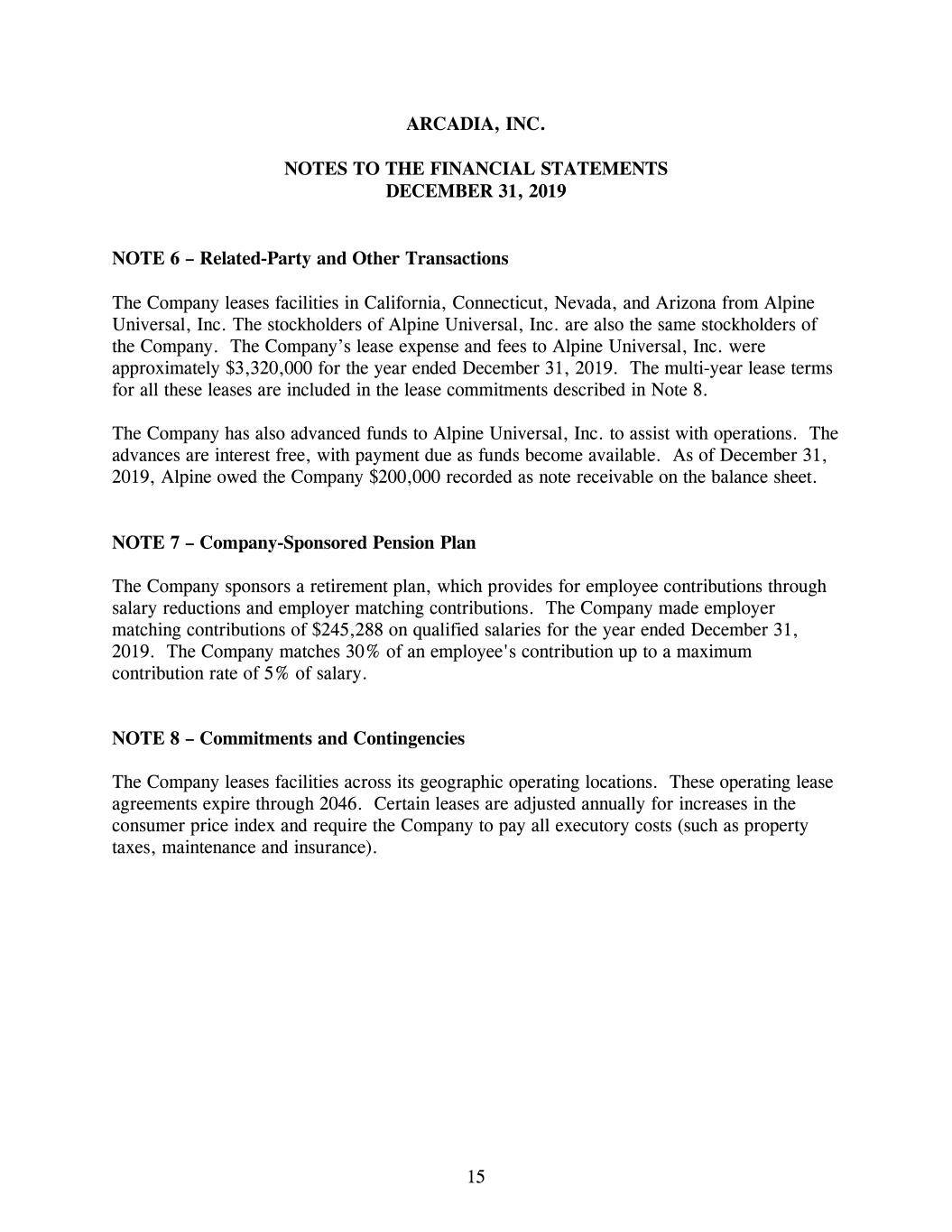

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 15 NOTE 6 – Related-Party and Other Transactions The Company leases facilities in California, Connecticut, Nevada, and Arizona from Alpine Universal, Inc. The stockholders of Alpine Universal, Inc. are also the same stockholders of the Company. The Company’s lease expense and fees to Alpine Universal, Inc. were approximately $3,320,000 for the year ended December 31, 2019. The multi-year lease terms for all these leases are included in the lease commitments described in Note 8. The Company has also advanced funds to Alpine Universal, Inc. to assist with operations. The advances are interest free, with payment due as funds become available. As of December 31, 2019, Alpine owed the Company $200,000 recorded as note receivable on the balance sheet. NOTE 7 – Company-Sponsored Pension Plan The Company sponsors a retirement plan, which provides for employee contributions through salary reductions and employer matching contributions. The Company made employer matching contributions of $245,288 on qualified salaries for the year ended December 31, 2019. The Company matches 30% of an employee's contribution up to a maximum contribution rate of 5% of salary. NOTE 8 – Commitments and Contingencies The Company leases facilities across its geographic operating locations. These operating lease agreements expire through 2046. Certain leases are adjusted annually for increases in the consumer price index and require the Company to pay all executory costs (such as property taxes, maintenance and insurance).

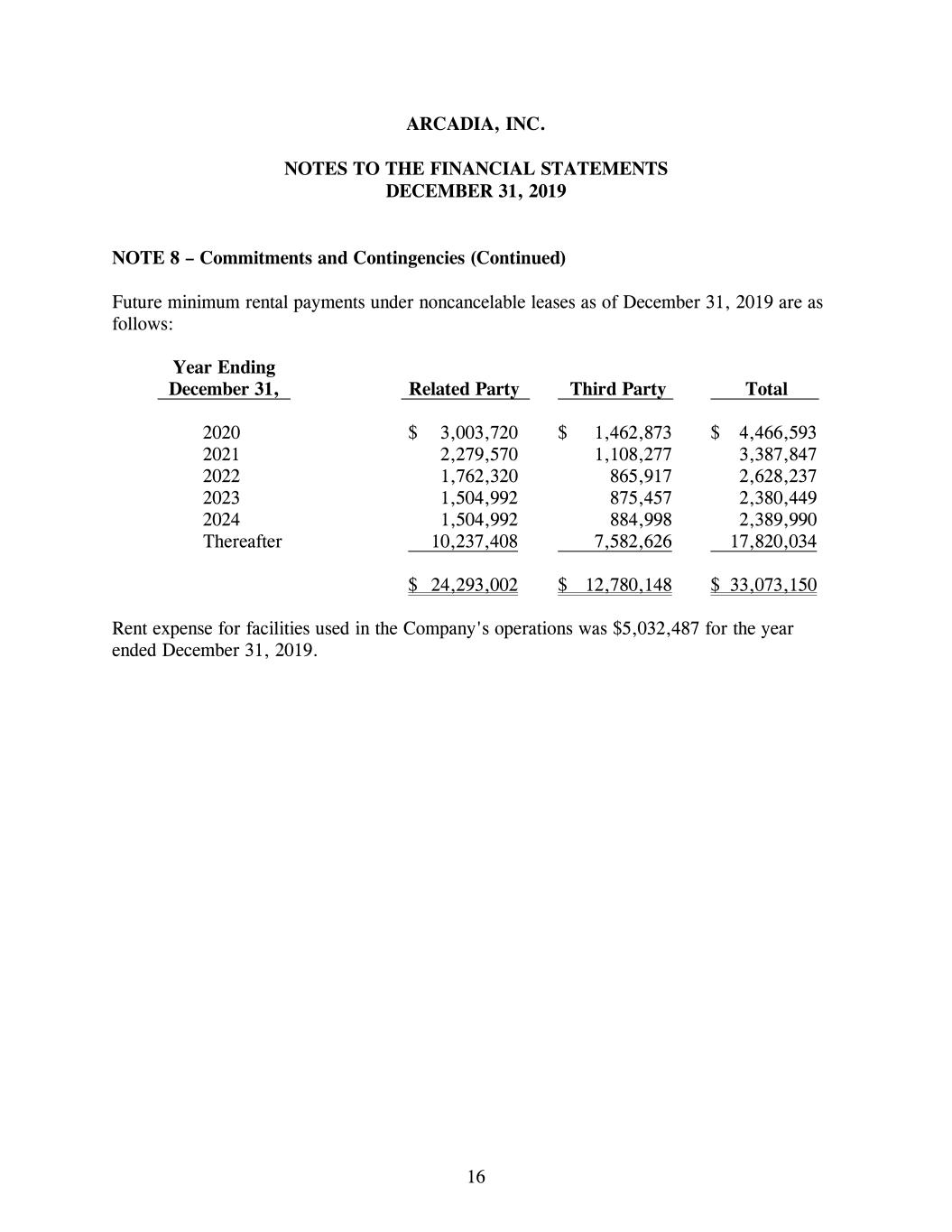

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS DECEMBER 31, 2019 16 NOTE 8 – Commitments and Contingencies (Continued) Future minimum rental payments under noncancelable leases as of December 31, 2019 are as follows: Year Ending December 31, Related Party Third Party Total 2020 $ 3,003,720 $ 1,462,873 $ 4,466,593 2021 2,279,570 1,108,277 3,387,847 2022 1,762,320 865,917 2,628,237 2023 1,504,992 875,457 2,380,449 2024 1,504,992 884,998 2,389,990 Thereafter 10,237,408 7,582,626 17,820,034 $ 24,293,002 $ 12,780,148 $ 33,073,150 Rent expense for facilities used in the Company's operations was $5,032,487 for the year ended December 31, 2019.

17 INDEPENDENT AUDITORS’ REPORT ON SUPPLEMENTARY FINANCIAL DATA To the Stockholders of Arcadia, Inc. We have audited the financial statements of Arcadia, Inc. as of and for the year ended December 31, 2019, and our report thereon dated April 27, 2020, which expressed an unmodified opinion on those financial statements, appears on page 1. Our audit was conducted for the purpose of forming an opinion on the financial statements as a whole. The supplemental schedules shown on pages 18-19 are presented for purposes of additional analysis of the financial statements, and is not a required part of the financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. The supplemental information has been subjected to the auditing procedures applied in the audit of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. Long Beach, California April 27, 2020 Long Beach | Irvine | Los Angeles www.windes.com 844.4WINDES

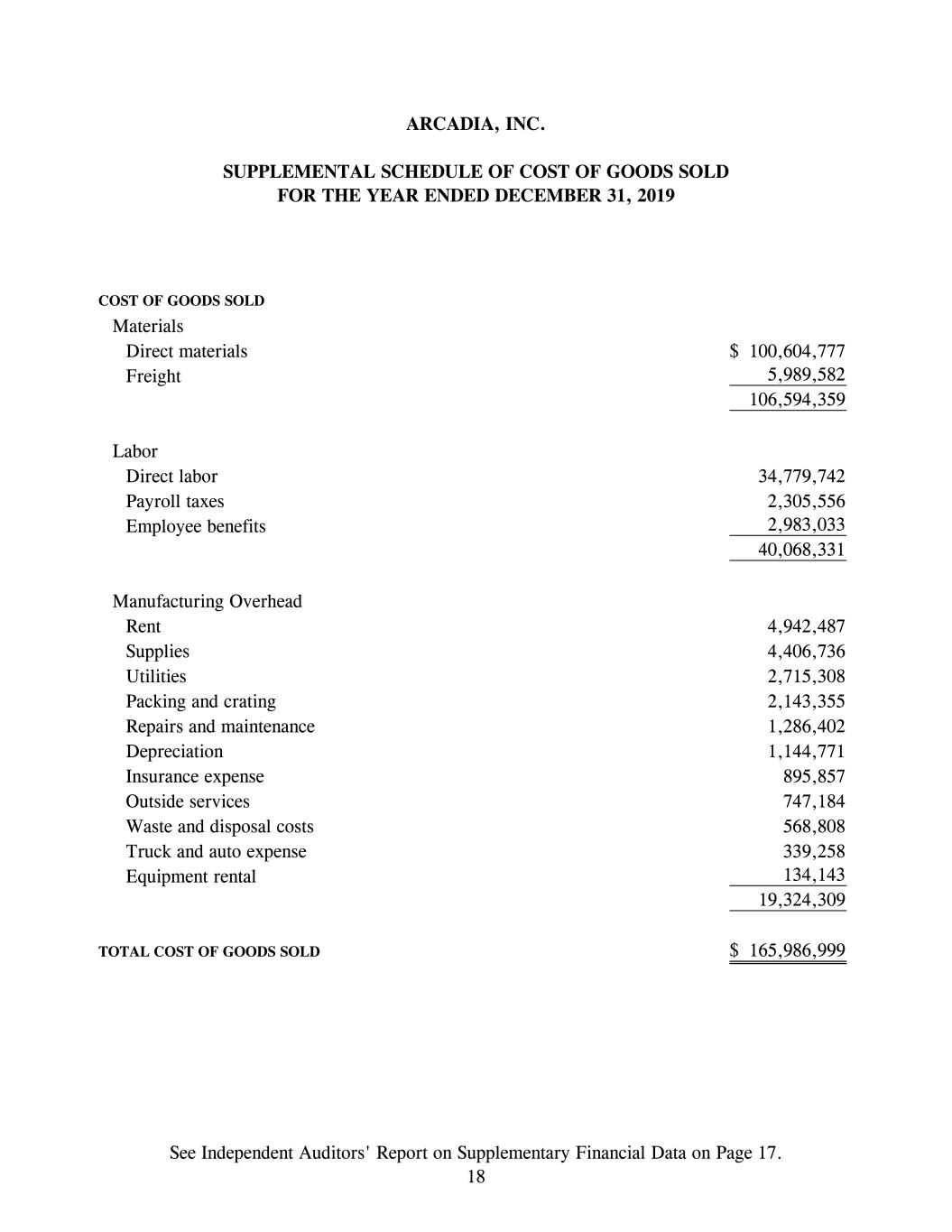

ARCADIA, INC. SUPPLEMENTAL SCHEDULE OF COST OF GOODS SOLD FOR THE YEAR ENDED DECEMBER 31, 2019 COST OF GOODS SOLD Materials Direct materials 100,604,777$ Freight 5,989,582 106,594,359 Labor Direct labor 34,779,742 Payroll taxes 2,305,556 Employee benefits 2,983,033 40,068,331 Manufacturing Overhead Rent 4,942,487 Supplies 4,406,736 Utilities 2,715,308 Packing and crating 2,143,355 Repairs and maintenance 1,286,402 Depreciation 1,144,771 Insurance expense 895,857 Outside services 747,184 Waste and disposal costs 568,808 Truck and auto expense 339,258 Equipment rental 134,143 19,324,309 TOTAL COST OF GOODS SOLD 165,986,999$ See Independent Auditors' Report on Supplementary Financial Data on Page 17. 18

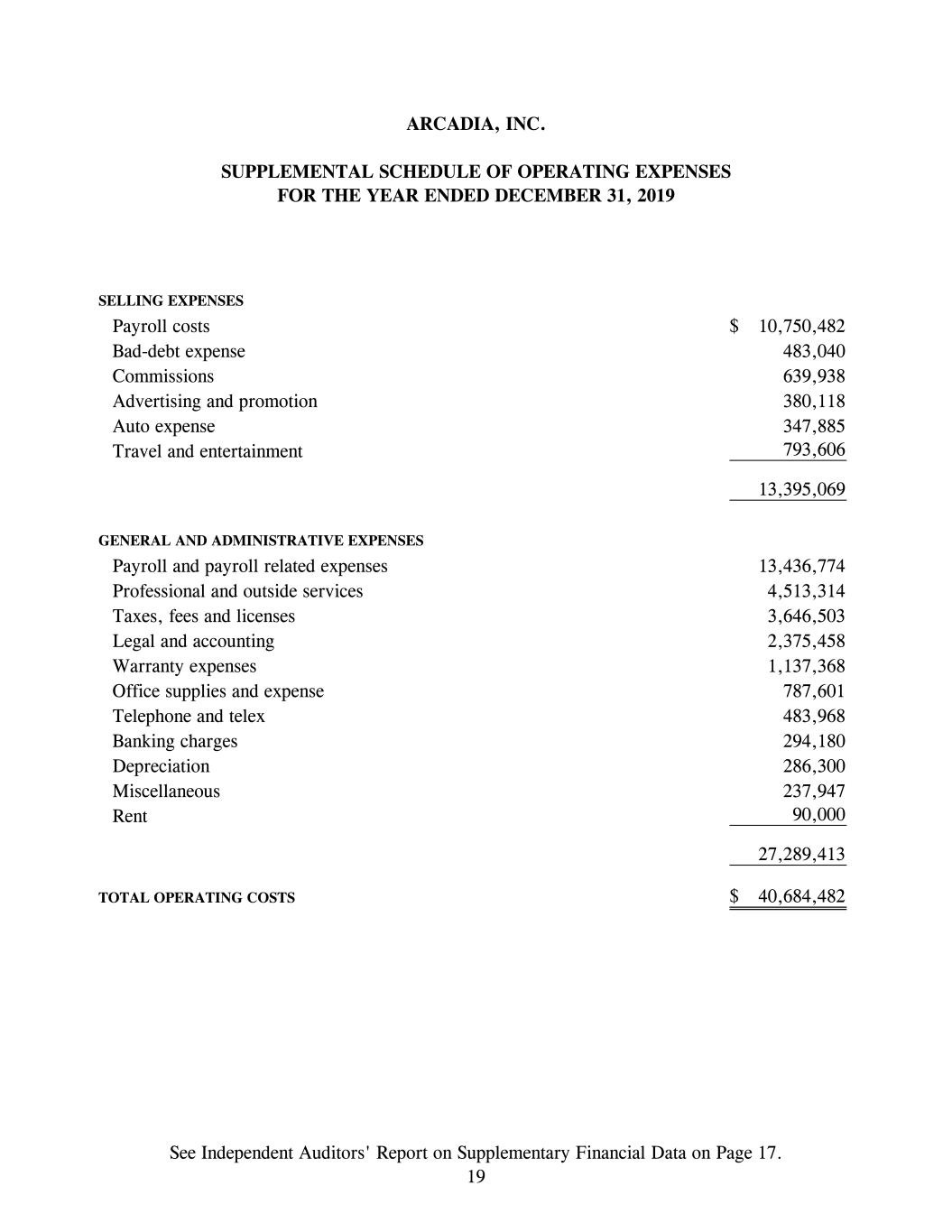

ARCADIA, INC. SUPPLEMENTAL SCHEDULE OF OPERATING EXPENSES FOR THE YEAR ENDED DECEMBER 31, 2019 SELLING EXPENSES Payroll costs 10,750,482$ Bad-debt expense 483,040 Commissions 639,938 Advertising and promotion 380,118 Auto expense 347,885 Travel and entertainment 793,606 13,395,069 GENERAL AND ADMINISTRATIVE EXPENSES Payroll and payroll related expenses 13,436,774 Professional and outside services 4,513,314 Taxes, fees and licenses 3,646,503 Legal and accounting 2,375,458 Warranty expenses 1,137,368 Office supplies and expense 787,601 Telephone and telex 483,968 Banking charges 294,180 Depreciation 286,300 Miscellaneous 237,947 Rent 90,000 27,289,413 TOTAL OPERATING COSTS 40,684,482$ See Independent Auditors' Report on Supplementary Financial Data on Page 17. 19