ĎēĆēĈĎĆđęĆęĊĒĊēęĘ ĊĕęĊĒćĊė͛͘ǡ͚͚͙͘

CONTENTS Independent Accountants’ Review Report ............................................................ 1 Balance Sheet .............................................................................................. 2 Statement of Income ...................................................................................... 3 Statement of Stockholders’ Equity ..................................................................... 4 Statement of Cash Flows ................................................................................. 5 Notes to the Financial Statements .................................................................. 6-15 Supplemental Schedule of Cost of Goods Sold .................................................... 16 Supplemental Schedule of Operating Expenses .................................................... 17

1 INDEPENDENT ACCOUNTANTS’ REVIEW REPORT To the Stockholders of Arcadia, Inc. We have reviewed the accompanying financial statements of Arcadia, Inc., which comprise the balance sheet as of September 30, 2021, and the related statements of income, stockholders’ equity, and cash flows for the period January 1, 2021 to September 30, 2021, and the related notes to the financial statements. A review includes primarily applying analytical procedures to management’s financial data and making inquiries of company management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole. Accordingly, we do not express such an opinion. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Accountants’ Responsibility Our responsibility is to conduct the review engagement in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis for our conclusion. We are required to be independent of Arcadia, Inc. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our review. Accountants’ Conclusion Based on our review, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance with accounting principles generally accepted in the United States of America. Supplementary Information The supplementary information included in the supplementary financial data is presented for purposes of additional analysis and is not a required part of the basic financial statements. The supplementary information is the representation of management, and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. The supplementary information has been subjected to the review procedures applied in our review of the basic financial statements. We are not aware of any material modifications that should be made to the information. We have not audited the information and, accordingly, do not express an opinion on such information. Long Beach, California February 18, 2022 Long Beach | Irvine | Los Angeles www.windes.com 844.4WINDES

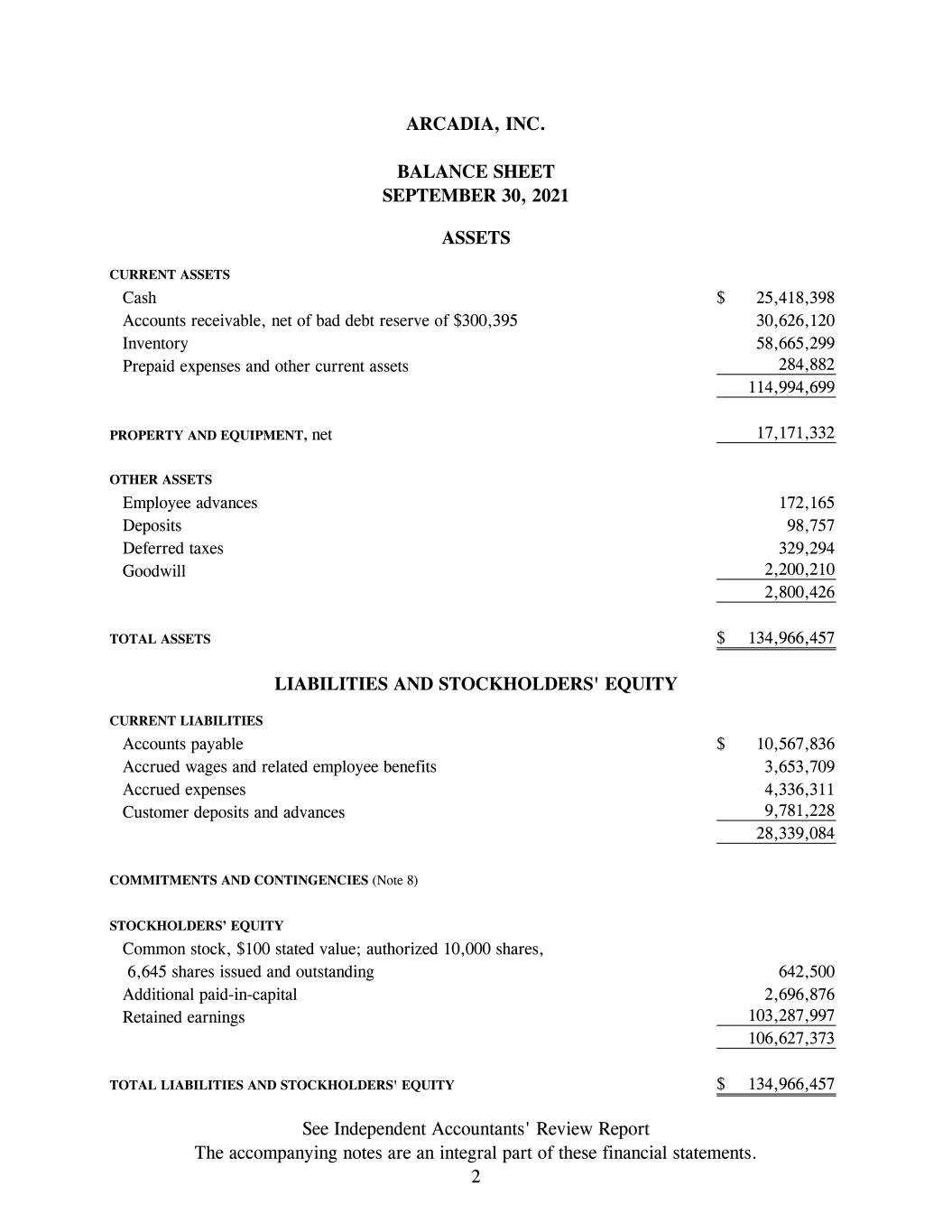

ARCADIA, INC. BALANCE SHEET SEPTEMBER 30, 2021 CURRENT ASSETS Cash 25,418,398$ Accounts receivable, net of bad debt reserve of $300,395 30,626,120 Inventory 58,665,299 Prepaid expenses and other current assets 284,882 114,994,699 PROPERTY AND EQUIPMENT, net 17,171,332 OTHER ASSETS Employee advances 172,165 Deposits 98,757 Deferred taxes 329,294 Goodwill 2,200,210 2,800,426 TOTAL ASSETS 134,966,457$ CURRENT LIABILITIES Accounts payable 10,567,836$ Accrued wages and related employee benefits 3,653,709 Accrued expenses 4,336,311 Customer deposits and advances 9,781,228 28,339,084 COMMITMENTS AND CONTINGENCIES (Note 8) STOCKHOLDERS’ EQUITY Common stock, $100 stated value; authorized 10,000 shares, 6,645 shares issued and outstanding 642,500 Additional paid-in-capital 2,696,876 Retained earnings 103,287,997 106,627,373 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 134,966,457$ ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY See Independent Accountants' Review Report The accompanying notes are an integral part of these financial statements. 2

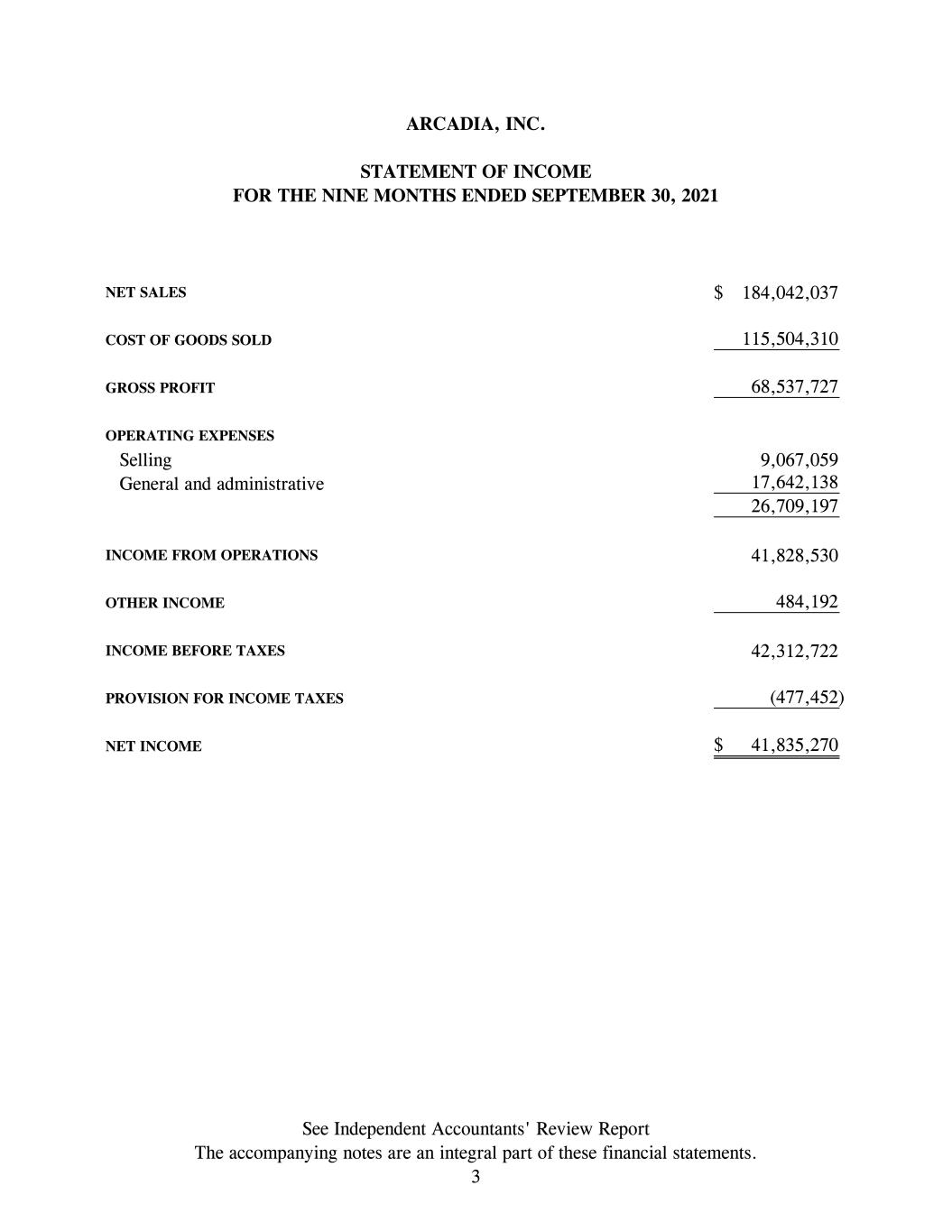

ARCADIA, INC. STATEMENT OF INCOME FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021 NET SALES 184,042,037$ COST OF GOODS SOLD 115,504,310 GROSS PROFIT 68,537,727 OPERATING EXPENSES Selling 9,067,059 General and administrative 17,642,138 26,709,197 INCOME FROM OPERATIONS 41,828,530 OTHER INCOME 484,192 INCOME BEFORE TAXES 42,312,722 PROVISION FOR INCOME TAXES (477,452) NET INCOME 41,835,270$ See Independent Accountants' Review Report The accompanying notes are an integral part of these financial statements. 3

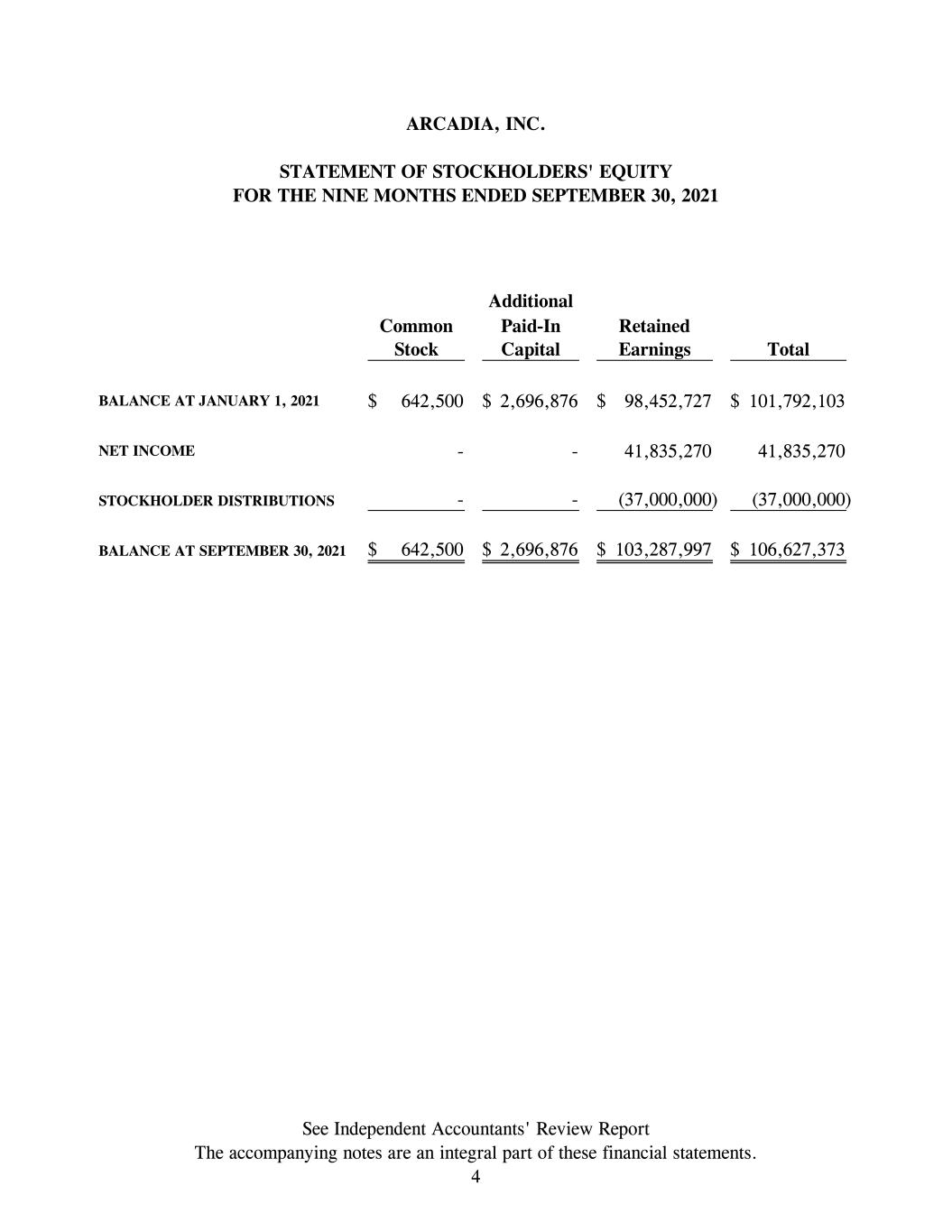

ARCADIA, INC. STATEMENT OF STOCKHOLDERS' EQUITY FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021 Additional Common Paid-In Retained Stock Capital Earnings Total BALANCE AT JANUARY 1, 2021 642,500$ 2,696,876$ 98,452,727$ 101,792,103$ NET INCOME - - 41,835,270 41,835,270 STOCKHOLDER DISTRIBUTIONS - - (37,000,000) (37,000,000) BALANCE AT SEPTEMBER 30, 2021 642,500$ 2,696,876$ 103,287,997$ 106,627,373$ See Independent Accountants' Review Report The accompanying notes are an integral part of these financial statements. 4

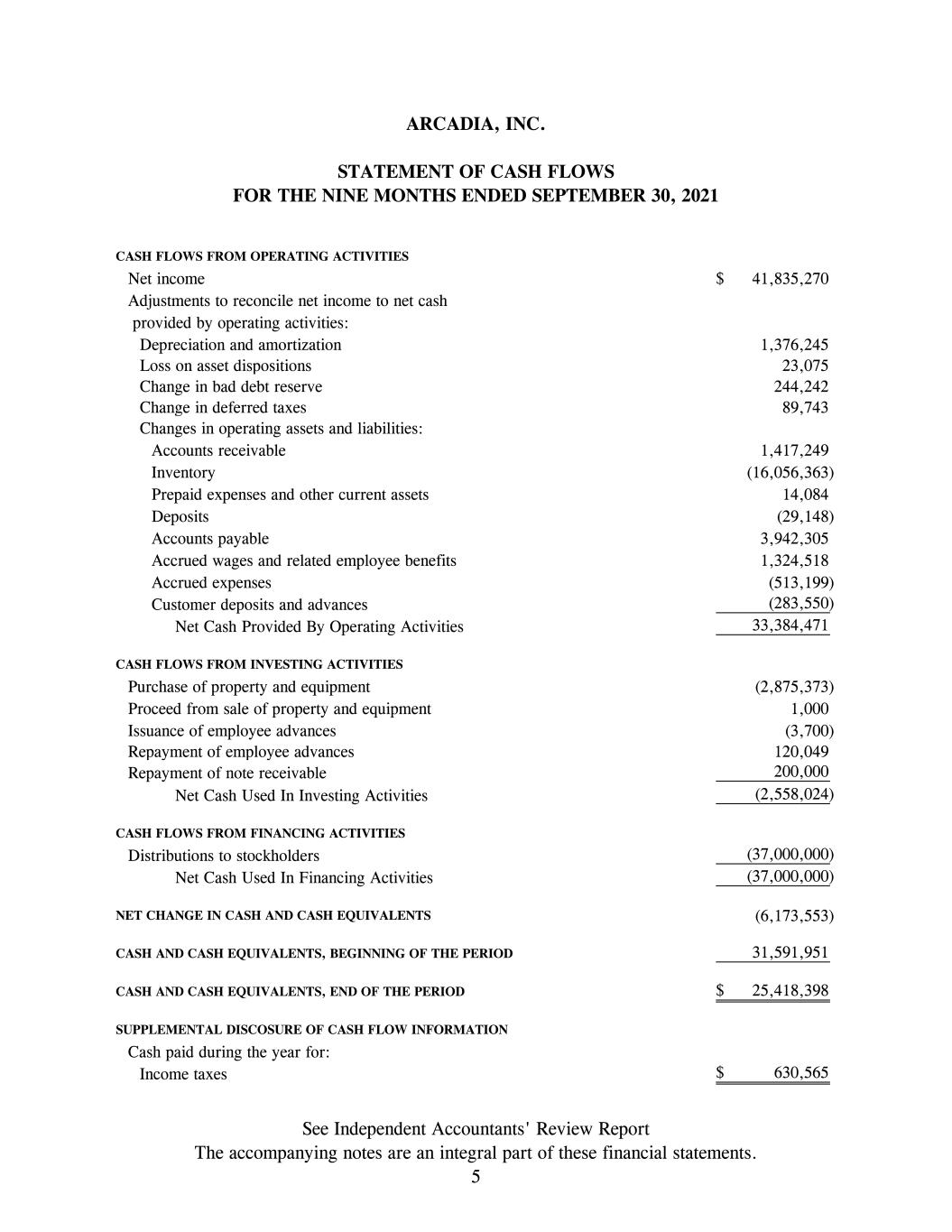

ARCADIA, INC. STATEMENT OF CASH FLOWS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021 CASH FLOWS FROM OPERATING ACTIVITIES Net income 41,835,270$ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 1,376,245 Loss on asset dispositions 23,075 Change in bad debt reserve 244,242 Change in deferred taxes 89,743 Changes in operating assets and liabilities: Accounts receivable 1,417,249 Inventory (16,056,363) Prepaid expenses and other current assets 14,084 Deposits (29,148) Accounts payable 3,942,305 Accrued wages and related employee benefits 1,324,518 Accrued expenses (513,199) Customer deposits and advances (283,550) Net Cash Provided By Operating Activities 33,384,471 CASH FLOWS FROM INVESTING ACTIVITIES Purchase of property and equipment (2,875,373) Proceed from sale of property and equipment 1,000 Issuance of employee advances (3,700) Repayment of employee advances 120,049 Repayment of note receivable 200,000 Net Cash Used In Investing Activities (2,558,024) CASH FLOWS FROM FINANCING ACTIVITIES Distributions to stockholders (37,000,000) Net Cash Used In Financing Activities (37,000,000) NET CHANGE IN CASH AND CASH EQUIVALENTS (6,173,553) CASH AND CASH EQUIVALENTS, BEGINNING OF THE PERIOD 31,591,951 CASH AND CASH EQUIVALENTS, END OF THE PERIOD 25,418,398$ SUPPLEMENTAL DISCOSURE OF CASH FLOW INFORMATION Cash paid during the year for: Income taxes 630,565$ See Independent Accountants' Review Report The accompanying notes are an integral part of these financial statements. 5

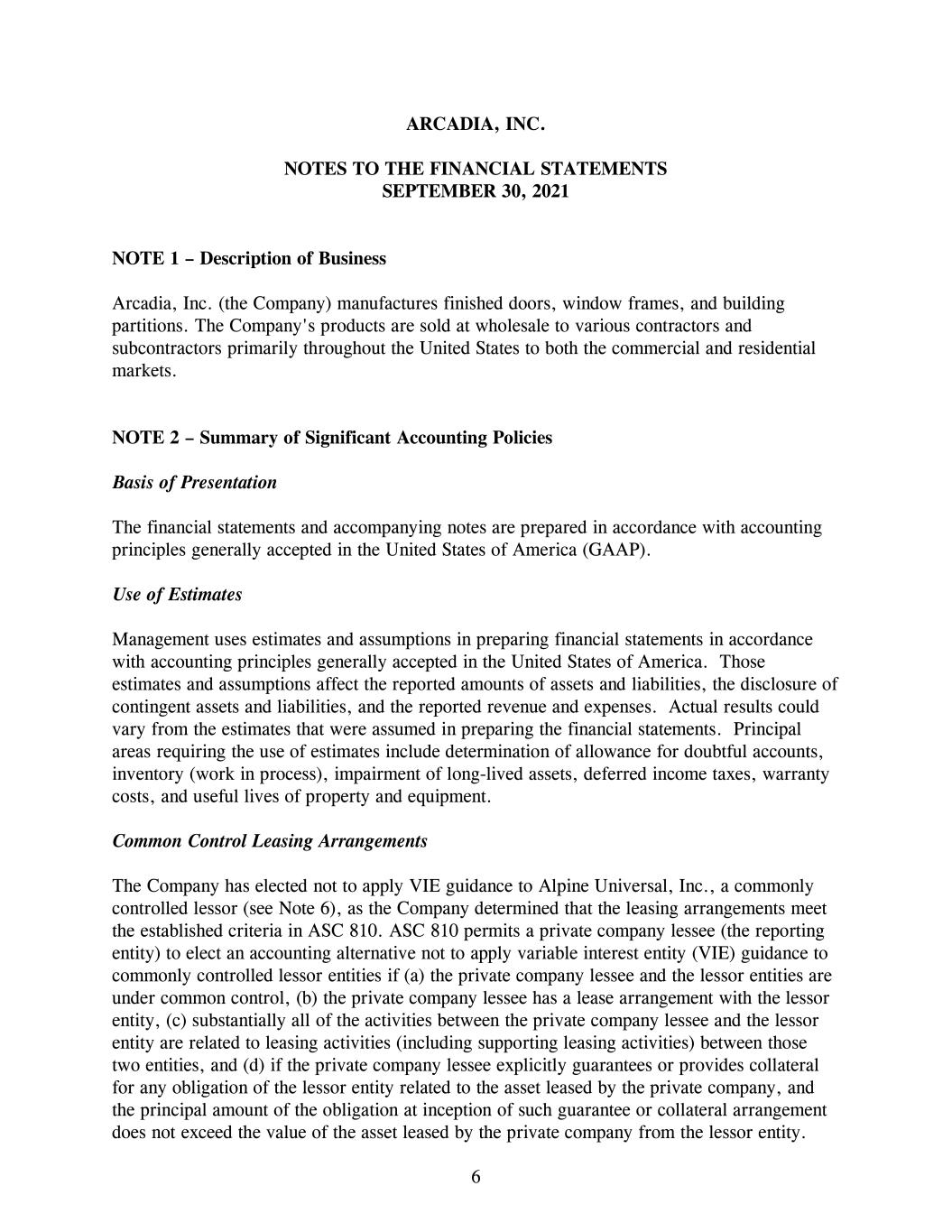

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 6 NOTE 1 – Description of Business Arcadia, Inc. (the Company) manufactures finished doors, window frames, and building partitions. The Company's products are sold at wholesale to various contractors and subcontractors primarily throughout the United States to both the commercial and residential markets. NOTE 2 – Summary of Significant Accounting Policies Basis of Presentation The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). Use of Estimates Management uses estimates and assumptions in preparing financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenue and expenses. Actual results could vary from the estimates that were assumed in preparing the financial statements. Principal areas requiring the use of estimates include determination of allowance for doubtful accounts, inventory (work in process), impairment of long-lived assets, deferred income taxes, warranty costs, and useful lives of property and equipment. Common Control Leasing Arrangements The Company has elected not to apply VIE guidance to Alpine Universal, Inc., a commonly controlled lessor (see Note 6), as the Company determined that the leasing arrangements meet the established criteria in ASC 810. ASC 810 permits a private company lessee (the reporting entity) to elect an accounting alternative not to apply variable interest entity (VIE) guidance to commonly controlled lessor entities if (a) the private company lessee and the lessor entities are under common control, (b) the private company lessee has a lease arrangement with the lessor entity, (c) substantially all of the activities between the private company lessee and the lessor entity are related to leasing activities (including supporting leasing activities) between those two entities, and (d) if the private company lessee explicitly guarantees or provides collateral for any obligation of the lessor entity related to the asset leased by the private company, and the principal amount of the obligation at inception of such guarantee or collateral arrangement does not exceed the value of the asset leased by the private company from the lessor entity.

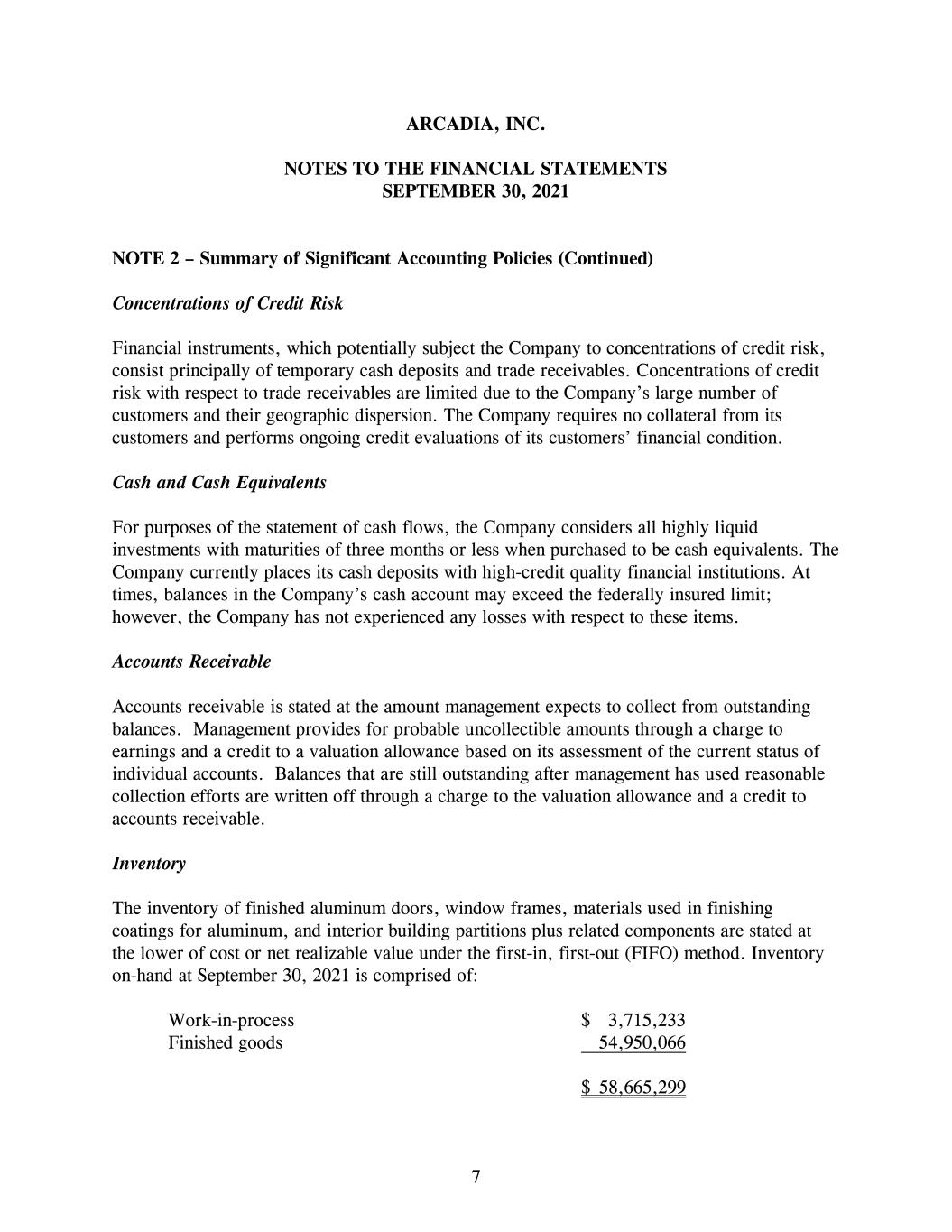

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 7 NOTE 2 – Summary of Significant Accounting Policies (Continued) Concentrations of Credit Risk Financial instruments, which potentially subject the Company to concentrations of credit risk, consist principally of temporary cash deposits and trade receivables. Concentrations of credit risk with respect to trade receivables are limited due to the Company’s large number of customers and their geographic dispersion. The Company requires no collateral from its customers and performs ongoing credit evaluations of its customers’ financial condition. Cash and Cash Equivalents For purposes of the statement of cash flows, the Company considers all highly liquid investments with maturities of three months or less when purchased to be cash equivalents. The Company currently places its cash deposits with high-credit quality financial institutions. At times, balances in the Company’s cash account may exceed the federally insured limit; however, the Company has not experienced any losses with respect to these items. Accounts Receivable Accounts receivable is stated at the amount management expects to collect from outstanding balances. Management provides for probable uncollectible amounts through a charge to earnings and a credit to a valuation allowance based on its assessment of the current status of individual accounts. Balances that are still outstanding after management has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable. Inventory The inventory of finished aluminum doors, window frames, materials used in finishing coatings for aluminum, and interior building partitions plus related components are stated at the lower of cost or net realizable value under the first-in, first-out (FIFO) method. Inventory on-hand at September 30, 2021 is comprised of: Work-in-process $ 3,715,233 Finished goods 54,950,066 $ 58,665,299

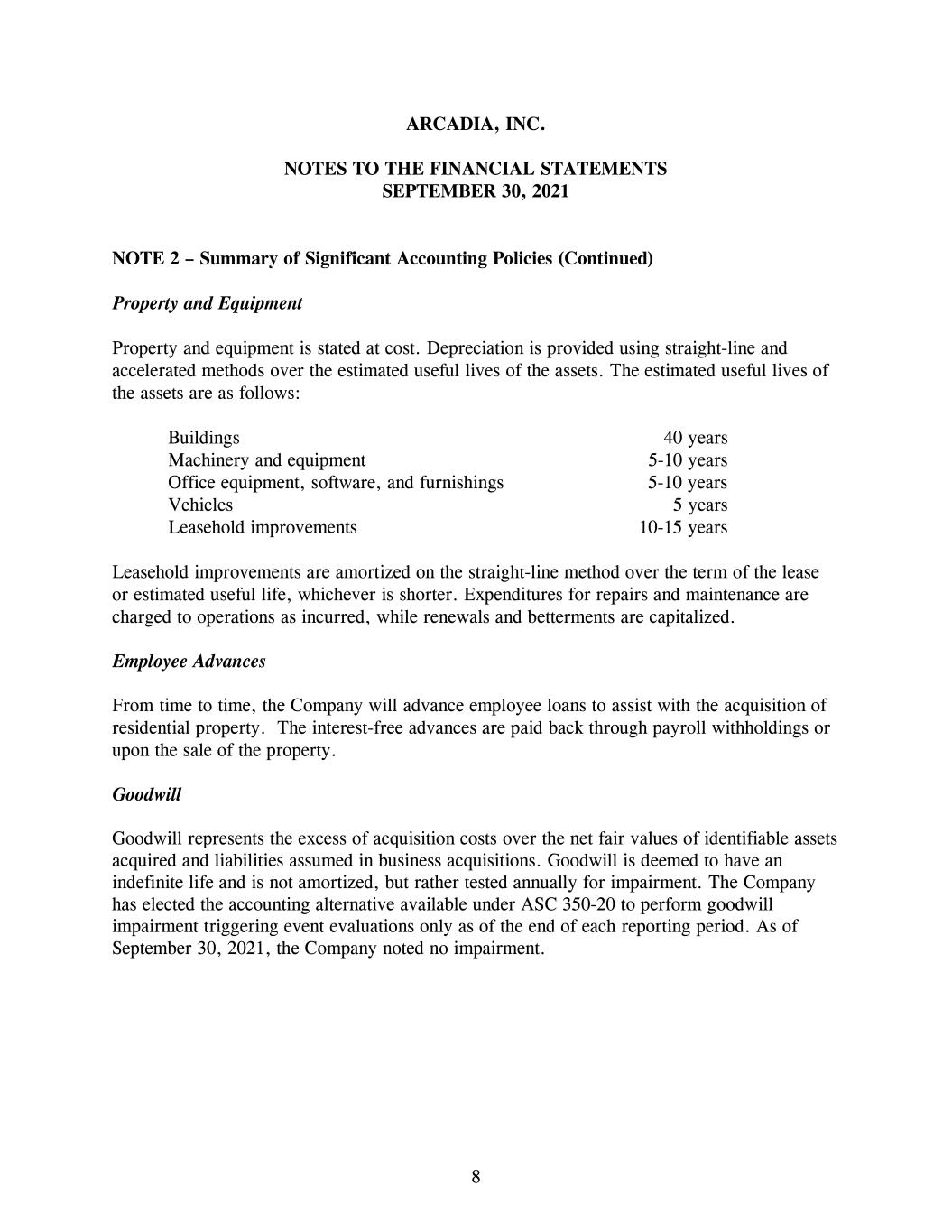

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 8 NOTE 2 – Summary of Significant Accounting Policies (Continued) Property and Equipment Property and equipment is stated at cost. Depreciation is provided using straight-line and accelerated methods over the estimated useful lives of the assets. The estimated useful lives of the assets are as follows: Buildings 40 years Machinery and equipment 5-10 years Office equipment, software, and furnishings 5-10 years Vehicles 5 years Leasehold improvements 10-15 years Leasehold improvements are amortized on the straight-line method over the term of the lease or estimated useful life, whichever is shorter. Expenditures for repairs and maintenance are charged to operations as incurred, while renewals and betterments are capitalized. Employee Advances From time to time, the Company will advance employee loans to assist with the acquisition of residential property. The interest-free advances are paid back through payroll withholdings or upon the sale of the property. Goodwill Goodwill represents the excess of acquisition costs over the net fair values of identifiable assets acquired and liabilities assumed in business acquisitions. Goodwill is deemed to have an indefinite life and is not amortized, but rather tested annually for impairment. The Company has elected the accounting alternative available under ASC 350-20 to perform goodwill impairment triggering event evaluations only as of the end of each reporting period. As of September 30, 2021, the Company noted no impairment.

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 9 NOTE 2 – Summary of Significant Accounting Policies (Continued) Impairment of Long-Lived Assets Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Recoverability of assets is measured by comparison of the carrying amount of the asset to the net undiscounted future cash flows expected to be generated from the asset. If the future undiscounted cash flows are not sufficient to recover the carrying value of the asset, the asset’s carrying value is adjusted to fair value. For the period January 1, 2021 to September 30, 2021, the Company noted no impairment. Revenue Recognition Revenue is recognized when a contractual promise to a customer has been fulfilled by transferring control over the promised goods or services, principally at the time of shipment to or receipt of the products by the customer. The Company’s contractual promises generally represent one performance obligation. However, if a contract includes more than one performance obligation, the consideration is allocated based on the standalone selling prices of the individual performance obligations. Such determination does not require significant judgment. The amount of revenue recognized is based on the expected consideration in exchange for the goods, taking into account contractually defined terms (e.g. trade discounts, cash discounts, and volume rebates) and excluding taxes or duty. The following table presents disaggregated revenue recognized by service line for the period January 1, 2021 to September 30, 2021: Large painted/anodized – commercial projects $ 64,560,254 Painted/anodized – aluminum storefronts 49,848,078 Painted/anodized – residential projects 28,229,147 Painted/anodized – interior partition products 17,276,765 Painted/anodized – doors and frames 8,902,220 Vinyl products 3,647,886 Painted/anodized – commercial sliding products 2,810,465 Painted/anodized – aluminum windows 2,284,348 Hardware 2,141,997 Scrap sales 1,802,050 Finishing services 1,252,787 Wood 1,215,041 Painted/anodized – non-aluminum windows/doors 70,999 $ 184,042,037

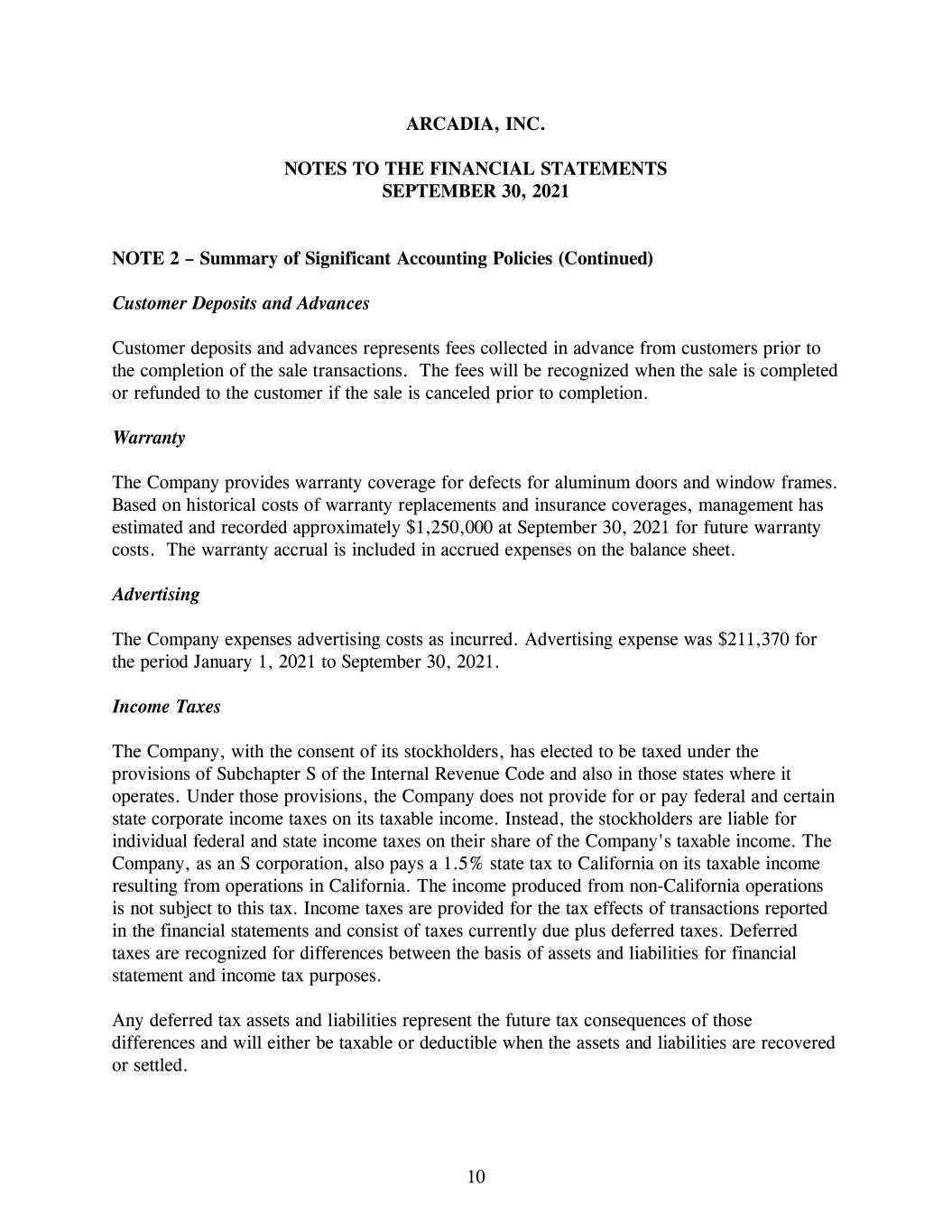

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 10 NOTE 2 – Summary of Significant Accounting Policies (Continued) Customer Deposits and Advances Customer deposits and advances represents fees collected in advance from customers prior to the completion of the sale transactions. The fees will be recognized when the sale is completed or refunded to the customer if the sale is canceled prior to completion. Warranty The Company provides warranty coverage for defects for aluminum doors and window frames. Based on historical costs of warranty replacements and insurance coverages, management has estimated and recorded approximately $1,250,000 at September 30, 2021 for future warranty costs. The warranty accrual is included in accrued expenses on the balance sheet. Advertising The Company expenses advertising costs as incurred. Advertising expense was $211,370 for the period January 1, 2021 to September 30, 2021. Income Taxes The Company, with the consent of its stockholders, has elected to be taxed under the provisions of Subchapter S of the Internal Revenue Code and also in those states where it operates. Under those provisions, the Company does not provide for or pay federal and certain state corporate income taxes on its taxable income. Instead, the stockholders are liable for individual federal and state income taxes on their share of the Company's taxable income. The Company, as an S corporation, also pays a 1.5% state tax to California on its taxable income resulting from operations in California. The income produced from non-California operations is not subject to this tax. Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes. Deferred taxes are recognized for differences between the basis of assets and liabilities for financial statement and income tax purposes. Any deferred tax assets and liabilities represent the future tax consequences of those differences and will either be taxable or deductible when the assets and liabilities are recovered or settled.

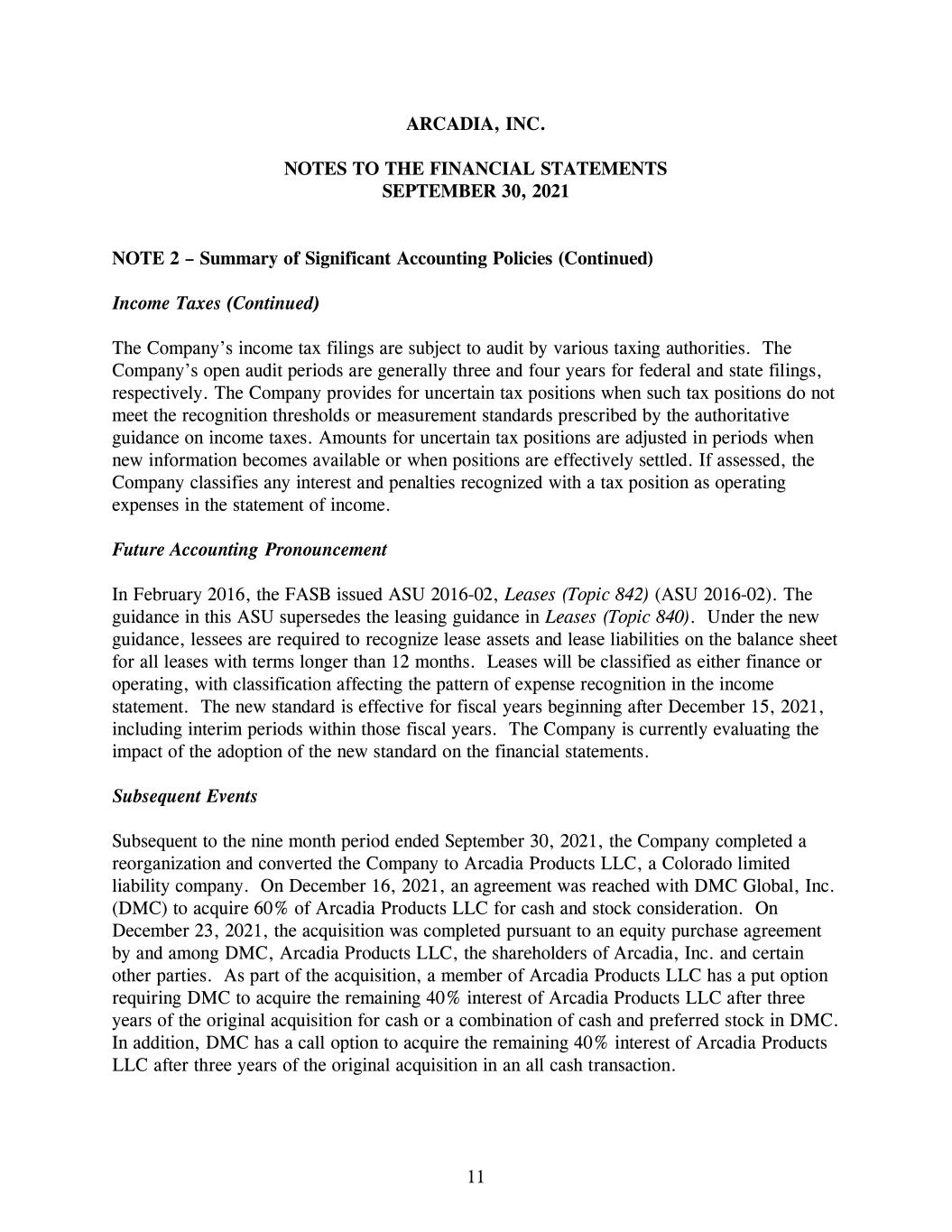

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 11 NOTE 2 – Summary of Significant Accounting Policies (Continued) Income Taxes (Continued) The Company’s income tax filings are subject to audit by various taxing authorities. The Company’s open audit periods are generally three and four years for federal and state filings, respectively. The Company provides for uncertain tax positions when such tax positions do not meet the recognition thresholds or measurement standards prescribed by the authoritative guidance on income taxes. Amounts for uncertain tax positions are adjusted in periods when new information becomes available or when positions are effectively settled. If assessed, the Company classifies any interest and penalties recognized with a tax position as operating expenses in the statement of income. Future Accounting Pronouncement In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) (ASU 2016-02). The guidance in this ASU supersedes the leasing guidance in Leases (Topic 840). Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. The Company is currently evaluating the impact of the adoption of the new standard on the financial statements. Subsequent Events Subsequent to the nine month period ended September 30, 2021, the Company completed a reorganization and converted the Company to Arcadia Products LLC, a Colorado limited liability company. On December 16, 2021, an agreement was reached with DMC Global, Inc. (DMC) to acquire 60% of Arcadia Products LLC for cash and stock consideration. On December 23, 2021, the acquisition was completed pursuant to an equity purchase agreement by and among DMC, Arcadia Products LLC, the shareholders of Arcadia, Inc. and certain other parties. As part of the acquisition, a member of Arcadia Products LLC has a put option requiring DMC to acquire the remaining 40% interest of Arcadia Products LLC after three years of the original acquisition for cash or a combination of cash and preferred stock in DMC. In addition, DMC has a call option to acquire the remaining 40% interest of Arcadia Products LLC after three years of the original acquisition in an all cash transaction.

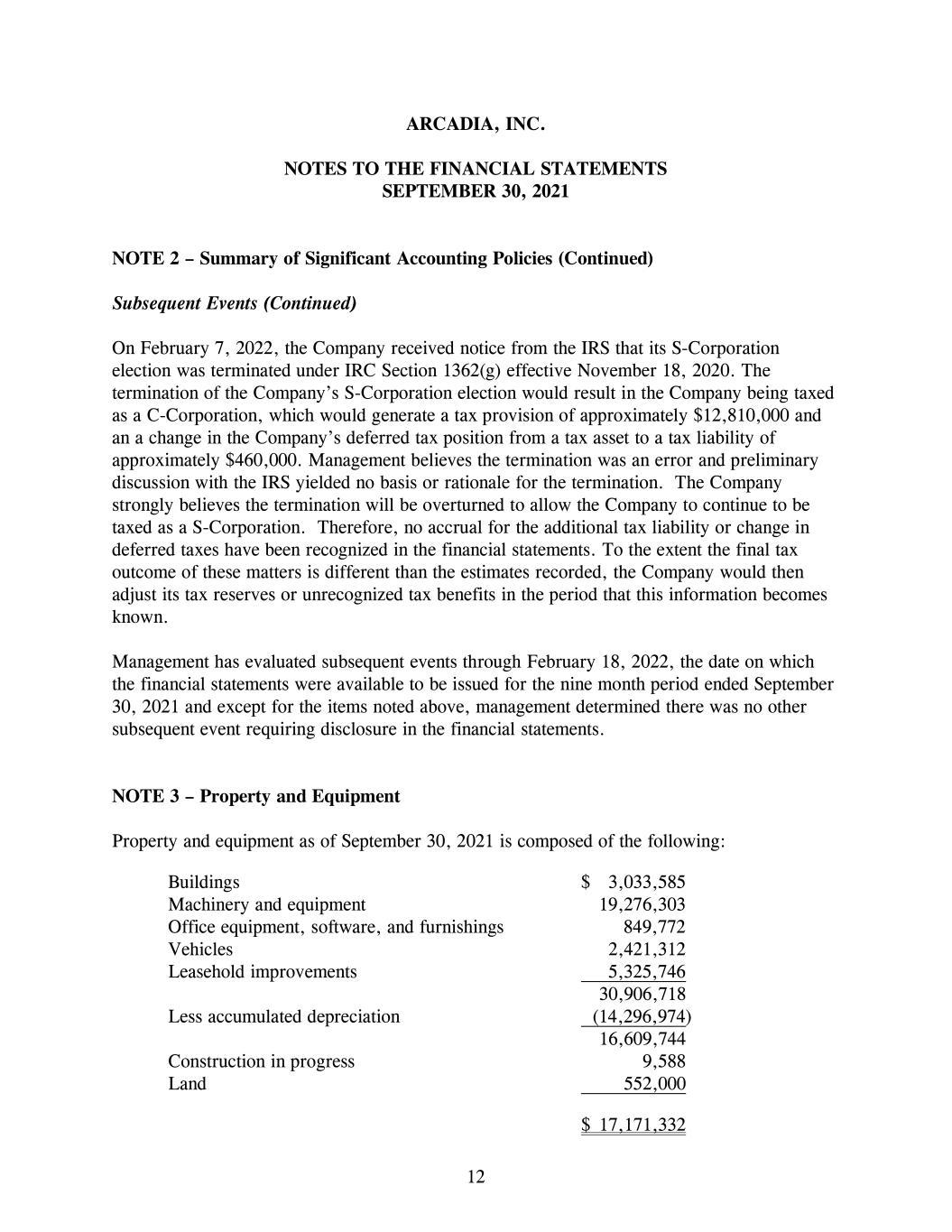

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 12 NOTE 2 – Summary of Significant Accounting Policies (Continued) Subsequent Events (Continued) On February 7, 2022, the Company received notice from the IRS that its S-Corporation election was terminated under IRC Section 1362(g) effective November 18, 2020. The termination of the Company’s S-Corporation election would result in the Company being taxed as a C-Corporation, which would generate a tax provision of approximately $12,810,000 and an a change in the Company’s deferred tax position from a tax asset to a tax liability of approximately $460,000. Management believes the termination was an error and preliminary discussion with the IRS yielded no basis or rationale for the termination. The Company strongly believes the termination will be overturned to allow the Company to continue to be taxed as a S-Corporation. Therefore, no accrual for the additional tax liability or change in deferred taxes have been recognized in the financial statements. To the extent the final tax outcome of these matters is different than the estimates recorded, the Company would then adjust its tax reserves or unrecognized tax benefits in the period that this information becomes known. Management has evaluated subsequent events through February 18, 2022, the date on which the financial statements were available to be issued for the nine month period ended September 30, 2021 and except for the items noted above, management determined there was no other subsequent event requiring disclosure in the financial statements. NOTE 3 – Property and Equipment Property and equipment as of September 30, 2021 is composed of the following: Buildings $ 3,033,585 Machinery and equipment 19,276,303 Office equipment, software, and furnishings 849,772 Vehicles 2,421,312 Leasehold improvements 5,325,746 30,906,718 Less accumulated depreciation (14,296,974) 16,609,744 Construction in progress 9,588 Land 552,000 $ 17,171,332

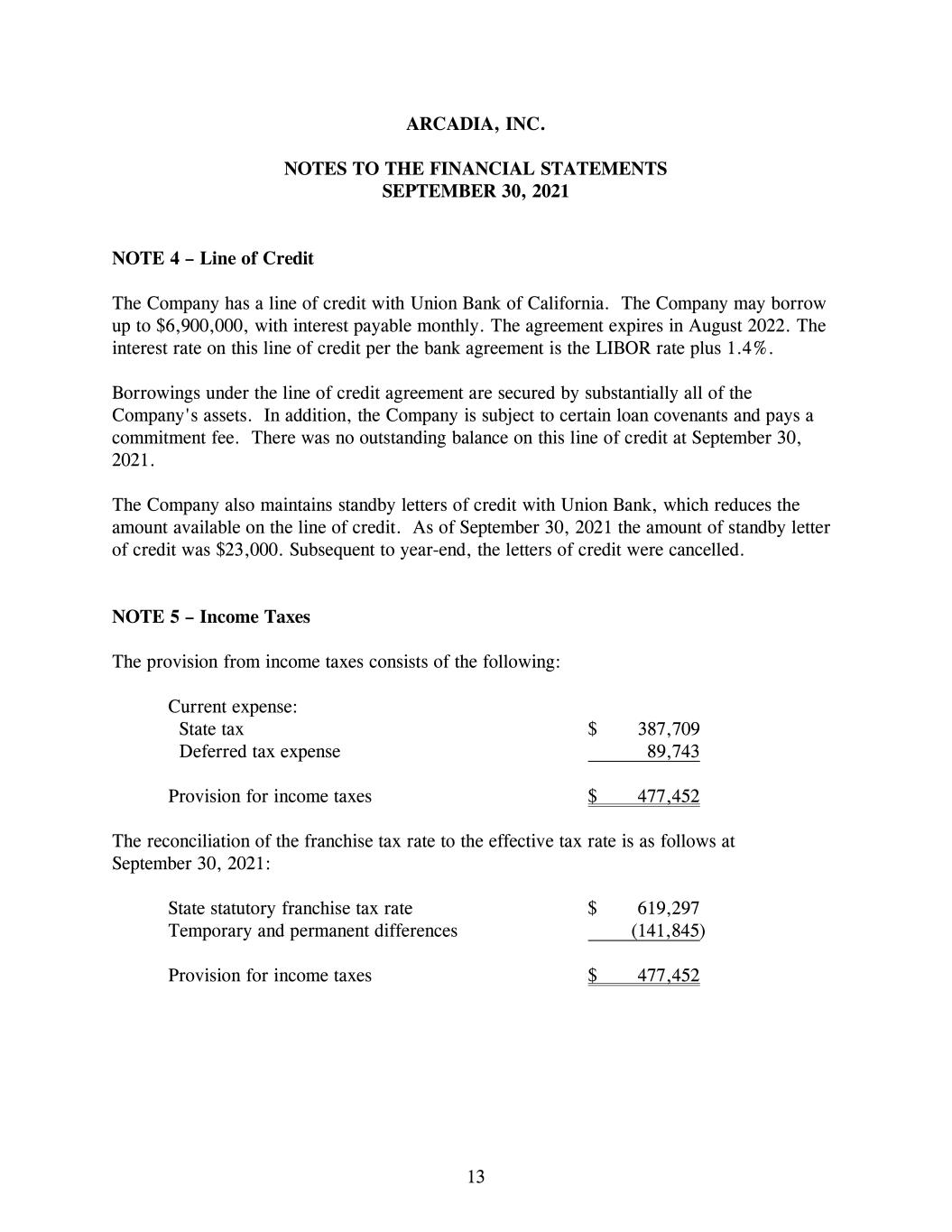

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 13 NOTE 4 – Line of Credit The Company has a line of credit with Union Bank of California. The Company may borrow up to $6,900,000, with interest payable monthly. The agreement expires in August 2022. The interest rate on this line of credit per the bank agreement is the LIBOR rate plus 1.4%. Borrowings under the line of credit agreement are secured by substantially all of the Company's assets. In addition, the Company is subject to certain loan covenants and pays a commitment fee. There was no outstanding balance on this line of credit at September 30, 2021. The Company also maintains standby letters of credit with Union Bank, which reduces the amount available on the line of credit. As of September 30, 2021 the amount of standby letter of credit was $23,000. Subsequent to year-end, the letters of credit were cancelled. NOTE 5 – Income Taxes The provision from income taxes consists of the following: Current expense: State tax $ 387,709 Deferred tax expense 89,743 Provision for income taxes $ 477,452 The reconciliation of the franchise tax rate to the effective tax rate is as follows at September 30, 2021: State statutory franchise tax rate $ 619,297 Temporary and permanent differences (141,845) Provision for income taxes $ 477,452

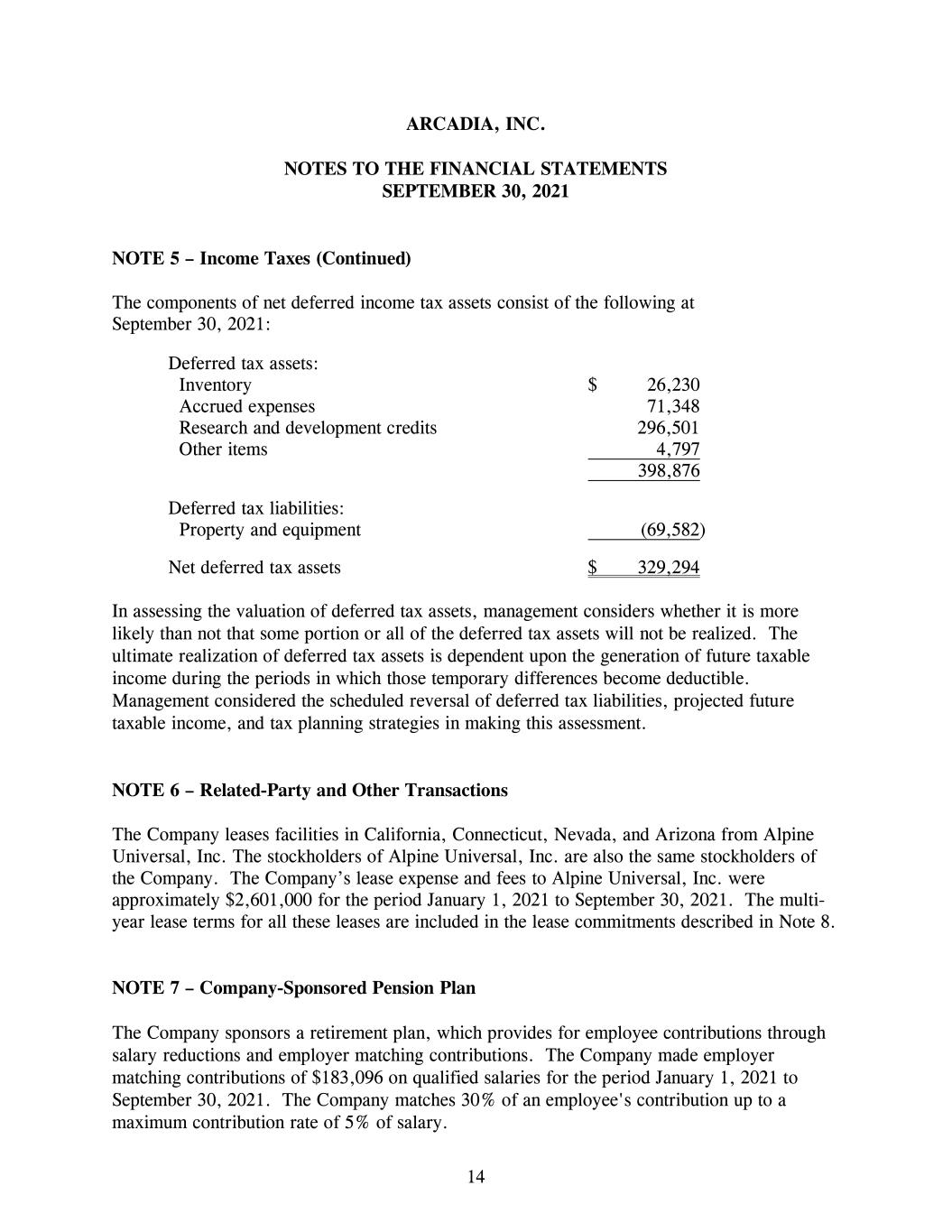

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 14 NOTE 5 – Income Taxes (Continued) The components of net deferred income tax assets consist of the following at September 30, 2021: Deferred tax assets: Inventory $ 26,230 Accrued expenses 71,348 Research and development credits 296,501 Other items 4,797 398,876 Deferred tax liabilities: Property and equipment (69,582) Net deferred tax assets $ 329,294 In assessing the valuation of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considered the scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning strategies in making this assessment. NOTE 6 – Related-Party and Other Transactions The Company leases facilities in California, Connecticut, Nevada, and Arizona from Alpine Universal, Inc. The stockholders of Alpine Universal, Inc. are also the same stockholders of the Company. The Company’s lease expense and fees to Alpine Universal, Inc. were approximately $2,601,000 for the period January 1, 2021 to September 30, 2021. The multi- year lease terms for all these leases are included in the lease commitments described in Note 8. NOTE 7 – Company-Sponsored Pension Plan The Company sponsors a retirement plan, which provides for employee contributions through salary reductions and employer matching contributions. The Company made employer matching contributions of $183,096 on qualified salaries for the period January 1, 2021 to September 30, 2021. The Company matches 30% of an employee's contribution up to a maximum contribution rate of 5% of salary.

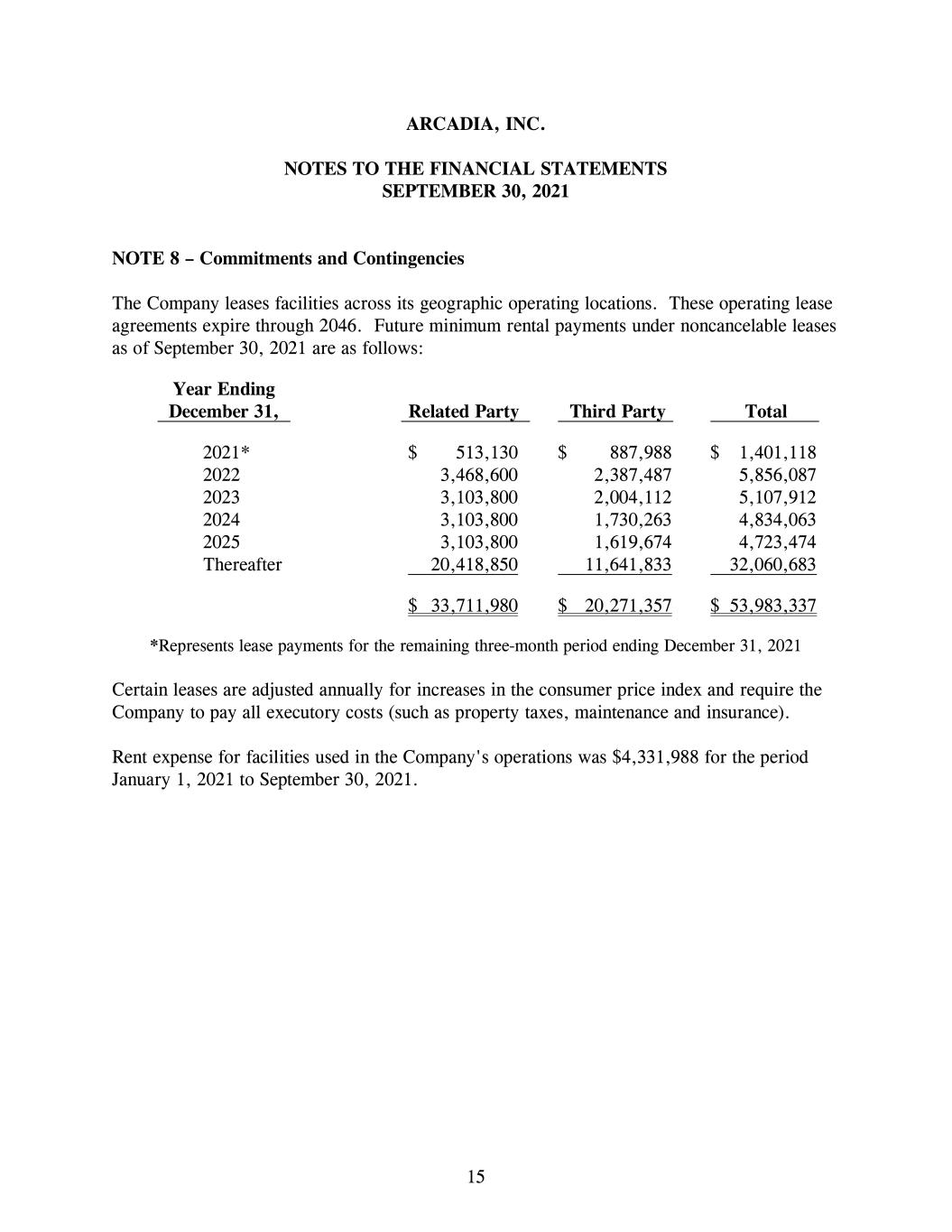

ARCADIA, INC. NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 15 NOTE 8 – Commitments and Contingencies The Company leases facilities across its geographic operating locations. These operating lease agreements expire through 2046. Future minimum rental payments under noncancelable leases as of September 30, 2021 are as follows: Year Ending December 31, Related Party Third Party Total 2021* $ 513,130 $ 887,988 $ 1,401,118 2022 3,468,600 2,387,487 5,856,087 2023 3,103,800 2,004,112 5,107,912 2024 3,103,800 1,730,263 4,834,063 2025 3,103,800 1,619,674 4,723,474 Thereafter 20,418,850 11,641,833 32,060,683 $ 33,711,980 $ 20,271,357 $ 53,983,337 *Represents lease payments for the remaining three-month period ending December 31, 2021 Certain leases are adjusted annually for increases in the consumer price index and require the Company to pay all executory costs (such as property taxes, maintenance and insurance). Rent expense for facilities used in the Company's operations was $4,331,988 for the period January 1, 2021 to September 30, 2021.

SUPPLEMENTARY FINANCIAL DATA

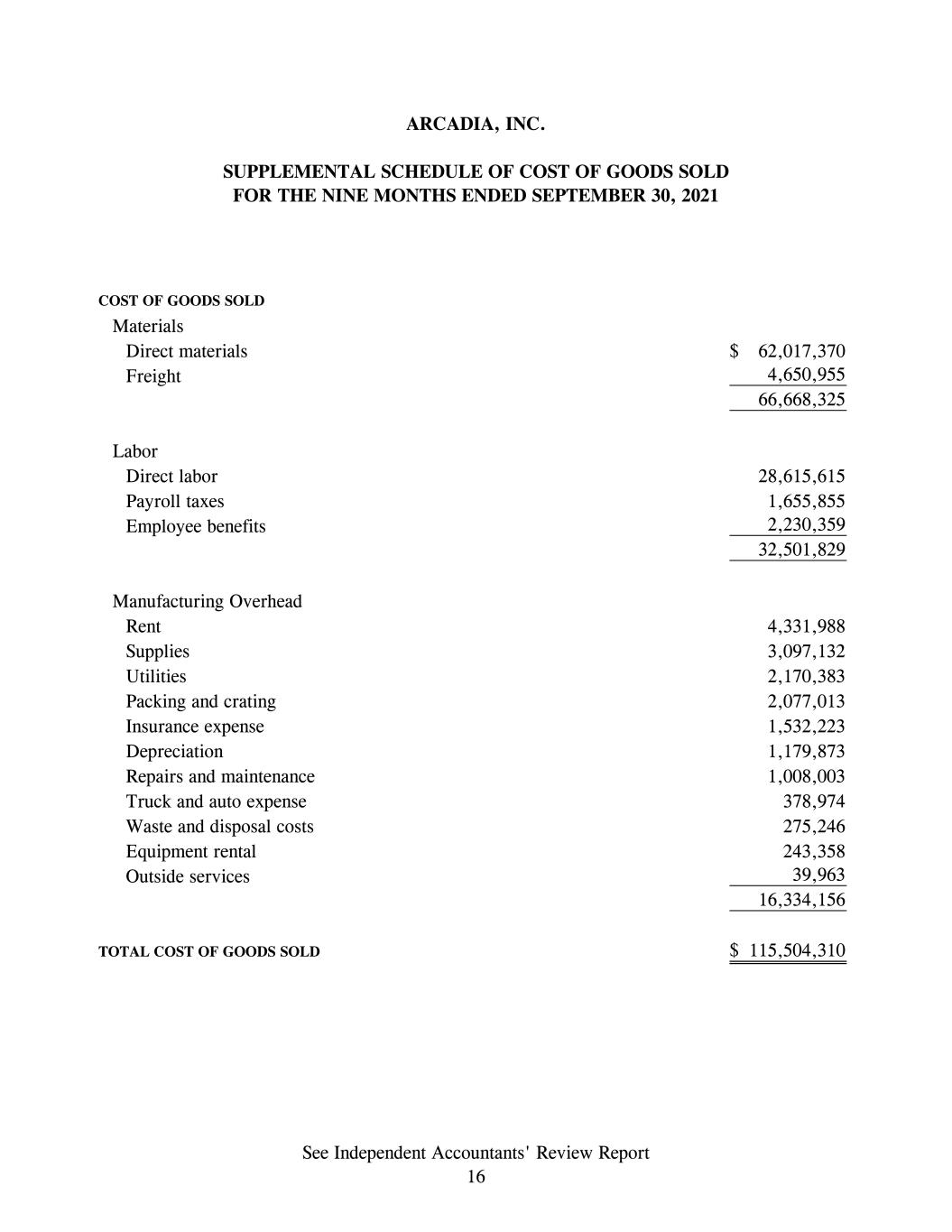

ARCADIA, INC. SUPPLEMENTAL SCHEDULE OF COST OF GOODS SOLD FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021 COST OF GOODS SOLD Materials Direct materials 62,017,370$ Freight 4,650,955 66,668,325 Labor Direct labor 28,615,615 Payroll taxes 1,655,855 Employee benefits 2,230,359 32,501,829 Manufacturing Overhead Rent 4,331,988 Supplies 3,097,132 Utilities 2,170,383 Packing and crating 2,077,013 Insurance expense 1,532,223 Depreciation 1,179,873 Repairs and maintenance 1,008,003 Truck and auto expense 378,974 Waste and disposal costs 275,246 Equipment rental 243,358 Outside services 39,963 16,334,156 TOTAL COST OF GOODS SOLD 115,504,310$ See Independent Accountants' Review Report 16

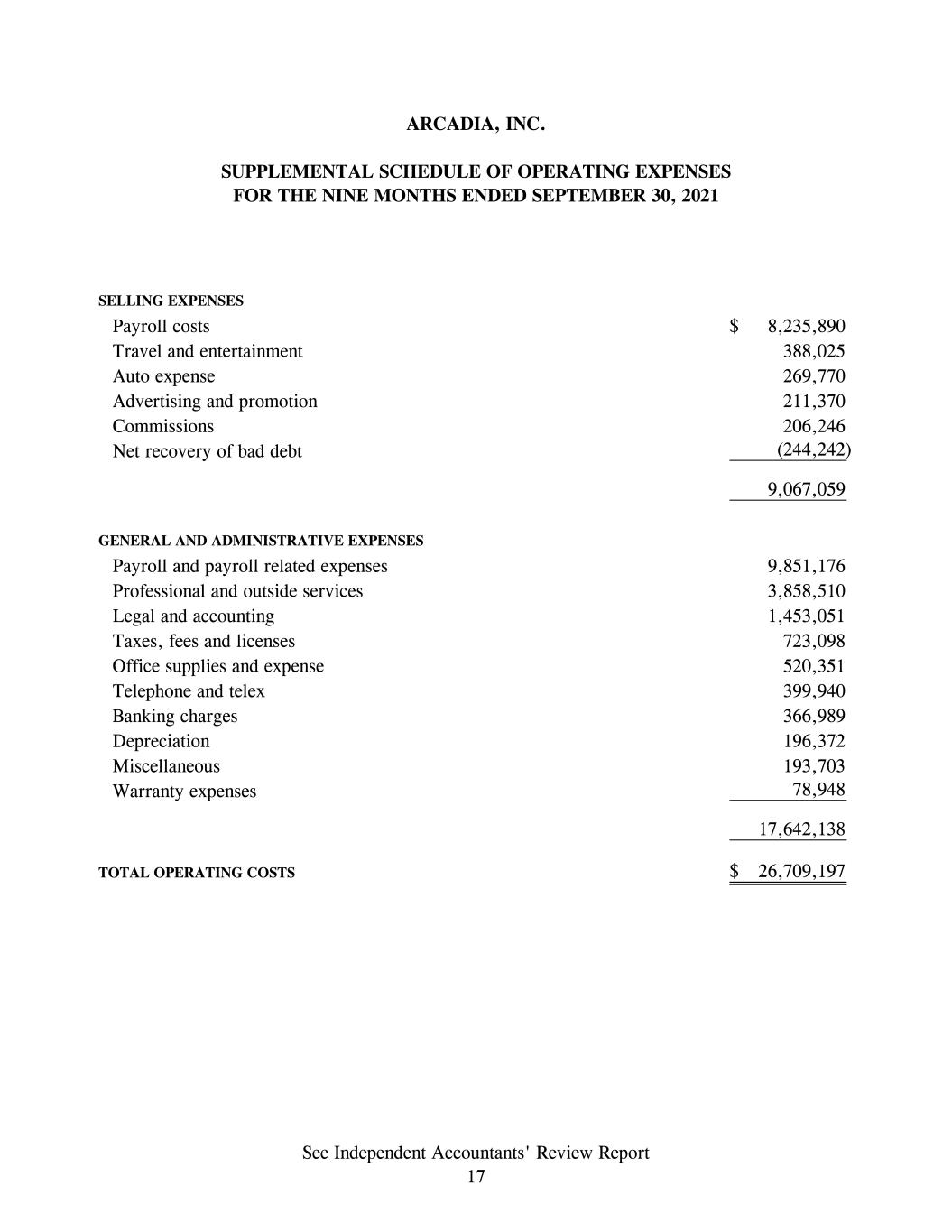

ARCADIA, INC. SUPPLEMENTAL SCHEDULE OF OPERATING EXPENSES FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021 SELLING EXPENSES Payroll costs 8,235,890$ Travel and entertainment 388,025 Auto expense 269,770 Advertising and promotion 211,370 Commissions 206,246 Net recovery of bad debt (244,242) 9,067,059 GENERAL AND ADMINISTRATIVE EXPENSES Payroll and payroll related expenses 9,851,176 Professional and outside services 3,858,510 Legal and accounting 1,453,051 Taxes, fees and licenses 723,098 Office supplies and expense 520,351 Telephone and telex 399,940 Banking charges 366,989 Depreciation 196,372 Miscellaneous 193,703 Warranty expenses 78,948 17,642,138 TOTAL OPERATING COSTS 26,709,197$ See Independent Accountants' Review Report 17