SECOND AMENDMENT AGREEMENT This SECOND AMENDMENT AGREEMENT (this “Amendment”) is made as of the 10th day of June, 2025 among: (a) DMC GLOBAL INC., a Delaware corporation (“DMC Global”); (b) each Domestic Subsidiary Borrower, as defined in the Credit Agreement, as hereinafter defined (each such Domestic Subsidiary Borrower, together with DMC Global, collectively, the “Borrowers” and, individually, each a “Borrower”); (c) the Lenders, as defined in the Credit Agreement, party hereto; and (d) KEYBANK NATIONAL ASSOCIATION, a national banking association, as administrative agent for the Lenders under the Credit Agreement (the “Administrative Agent”). WHEREAS, the Borrowers, the Administrative Agent and the Lenders are parties to that certain Amended and Restated Credit and Security Agreement, dated as of December 23, 2021 (as amended and as the same may from time to time be further amended, restated or otherwise modified, the “Credit Agreement”); WHEREAS, the Borrowers, the Administrative Agent and the Lenders desire to amend the Credit Agreement to modify certain provisions thereof and add certain provisions thereto; WHEREAS, each capitalized term used herein and defined in the Credit Agreement, but not otherwise defined herein, shall have the meaning given such term in the Credit Agreement; and WHEREAS, unless otherwise specifically provided herein, the provisions of the Credit Agreement revised herein are amended effective as of the date of this Amendment; NOW, THEREFORE, in consideration of the premises and of the mutual covenants herein and for other valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Borrowers, the Administrative Agent and the Lenders agree as follows: 1. Amendment to Definitions. Section 1.1 of the Credit Agreement is hereby amended to delete the definitions of “Applicable Commitment Fee Rate”, “Applicable Margin”, “Consolidated EBITDA”, and “Debt Service Coverage Ratio” therefrom and to insert in place thereof, respectively, the following: “Applicable Commitment Fee Rate” means: (a) for the period from the Second Amendment Effective Date through August 31, 2025, thirty-five (35.00) basis points; and (b) commencing with the Consolidated financial statements of DMC Global for the fiscal quarter ending June 30, 2025, the number of basis points set forth in the

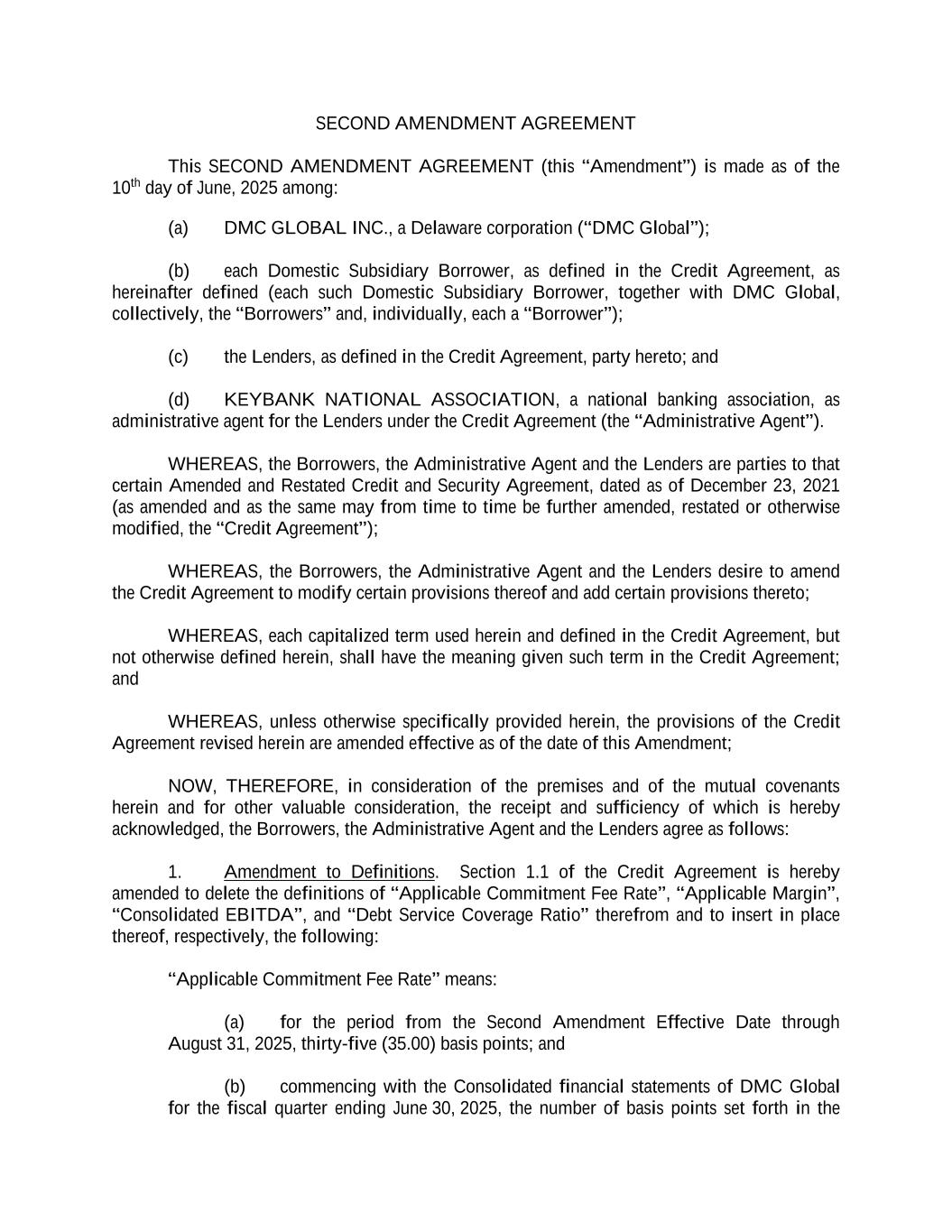

2 following matrix, based upon the result of the computation of the Leverage Ratio as set forth in the Compliance Certificate for such fiscal period and, thereafter, as set forth in each successive Compliance Certificate, as provided below: Leverage Ratio Applicable Commitment Fee Rate Greater than or equal to 3.00 to 1.00 45.00 basis points Greater than or equal to 2.00 to 1.00 but less than 3.00 to 1.00 40.00 basis points Greater than or equal to 1.00 to 1.00 but less than 2.00 to 1.00 35.00 basis points Less than 1.00 to 1.00 30.00 basis points Notwithstanding the language in subsection (b) of the definition of Applicable Commitment Fee Rate, the first date on which the Applicable Commitment Fee Rate is subject to change is September 1, 2025. After September 1, 2025, changes to the Applicable Commitment Fee Rate shall be effective on the first day of the calendar month following each date upon which the Administrative Agent should have received, pursuant to Section 5.3(c) hereof, the Compliance Certificate. The above pricing matrix does not modify or waive, in any respect, the requirements of Section 5.7 hereof, the rights of the Administrative Agent and the Lenders to charge the Default Rate, or the rights and remedies of the Administrative Agent and the Lenders pursuant to Articles VIII and IX hereof. Notwithstanding anything herein to the contrary, (i) during any period when the Borrowers shall have failed to timely deliver the Consolidated financial statements pursuant to Section 5.3(a) or (b) hereof, or the Compliance Certificate pursuant to Section 5.3(c) hereof, until such time as the appropriate Consolidated financial statements and Compliance Certificate are delivered, the Applicable Commitment Fee Rate shall, at the election of the Administrative Agent (which may be retroactively effective), be the highest rate per annum indicated in the above pricing grid regardless of the Leverage Ratio at such time, and (ii) in the event that any financial information or certification provided to the Administrative Agent in the Compliance Certificate is shown to be inaccurate (regardless of whether this Agreement or the Commitment is in effect when such inaccuracy is discovered), and such inaccuracy, if corrected, would have led to the application of a higher Applicable Commitment Fee Rate for any period (an “Applicable Commitment Fee Period”) than the Applicable Commitment Fee Rate applied for such Applicable Commitment Fee Period, then (A) the Borrowers shall promptly deliver to the Administrative Agent a corrected Compliance Certificate for such Applicable Commitment Fee Period, (B) the Applicable Commitment Fee Rate shall be determined based on such corrected Compliance Certificate, and (C) the Borrowers shall promptly pay to the Administrative Agent, for the benefit of the Lenders, the accrued additional fees owing as a result of such increased Applicable Commitment Fee Rate for such Applicable Commitment Fee Period. “Applicable Margin” means:

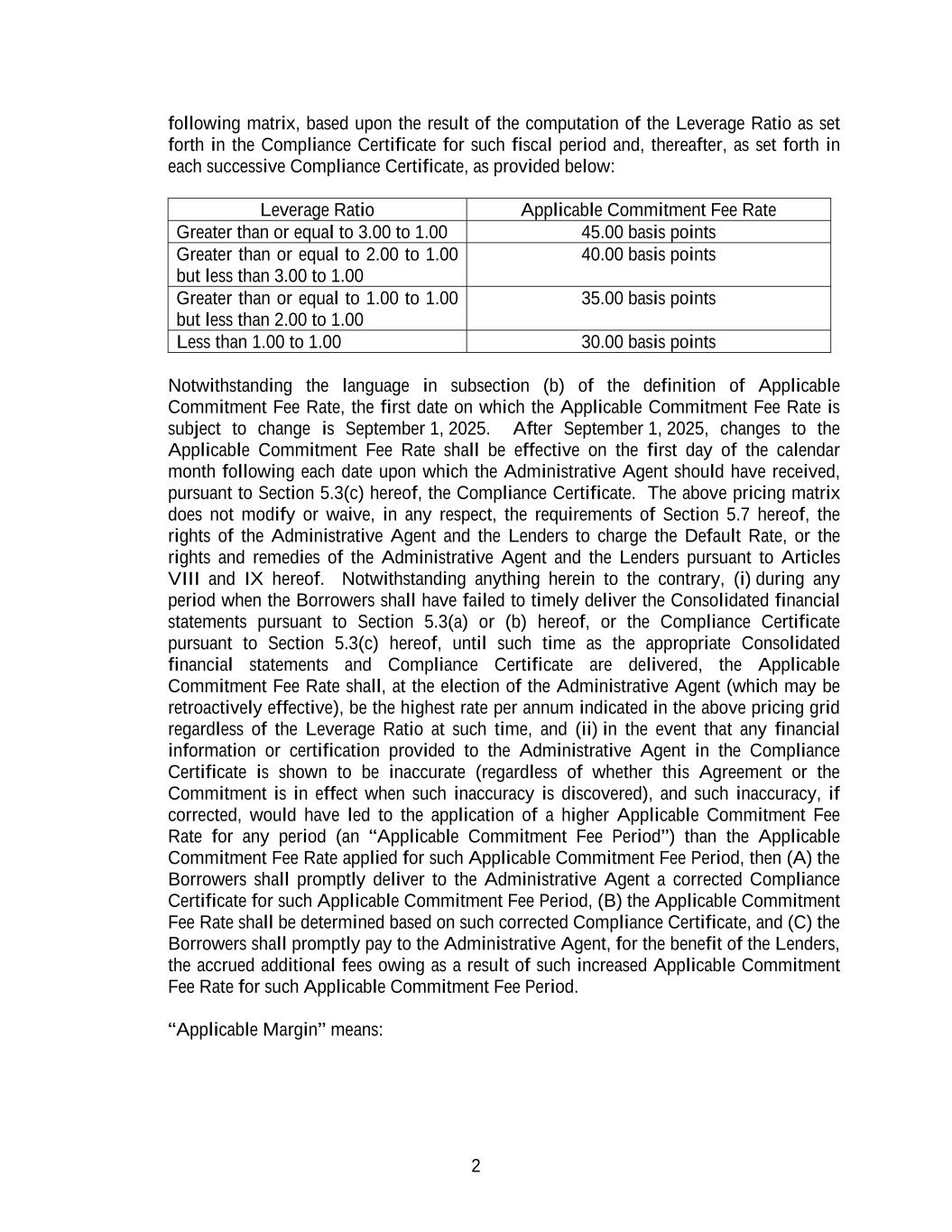

3 (a) for the period from the Second Amendment Effective Date through August 31, 2025, two hundred fifty (250.00) basis points for SOFR Loans and one hundred fifty (150.00) basis points for Base Rate Loans; and (b) commencing with the Consolidated financial statements of DMC Global for the fiscal quarter ending June 30, 2025, the number of basis points (depending upon whether Loans are SOFR Rate Loans or Base Rate Loans) set forth in the following matrix, based upon the result of the computation of the Leverage Ratio as set forth in the Compliance Certificate for such fiscal period and, thereafter, as set forth in each successive Compliance Certificate, as provided below: Leverage Ratio Applicable Basis Points for SOFR Loans Applicable Basis Points for Base Rate Loans Greater than or equal to 3.00 to 1.00 350.00 250.00 Greater than or equal to 2.50 to 1.00 but less than 3.00 to 1.00 325.00 225.00 Greater than or equal to 2.00 to 1.00 but less than 2.50 to 1.00 300.00 200.00 Greater than or equal to 1.50 to 1.00 but less than 2.00 to 1.00 275.00 175.00 Greater than or equal to 1.00 to 1.00 but less than 1.50 to 1.00 250.00 150.00 Less than 1.00 to 1.00 225.00 125.00 Notwithstanding the language in subsection (b) of the definition of Applicable Margin, the first date on which the Applicable Margin is subject to change is September 1, 2025. After September 1, 2025, changes to the Applicable Margin shall be effective on the first day of the calendar month following each date upon which the Administrative Agent should have received, pursuant to Section 5.3(c) hereof, the Compliance Certificate. The above pricing matrix does not modify or waive, in any respect, the requirements of Section 5.7 hereof, the rights of the Administrative Agent and the Lenders to charge the Default Rate, or the rights and remedies of the Administrative Agent and the Lenders pursuant to Articles VIII and IX hereof. Notwithstanding anything herein to the contrary, (i) during any period when the Borrowers shall have failed to timely deliver the Consolidated financial statements pursuant to Section 5.3(a) or (b) hereof, or the Compliance Certificate pursuant to Section 5.3(c) hereof, until such time as the appropriate Consolidated financial statements and Compliance Certificate are delivered, the Applicable Margin shall, at the election of the Administrative Agent (which may be retroactively effective), be the highest rate per annum indicated in the above pricing grid for Loans of that type, regardless of the Leverage Ratio at such time, and (ii) in the event that any financial information or certification provided to the Administrative Agent in the Compliance Certificate is shown to be inaccurate (regardless of whether this Agreement or the Commitment is in effect when such inaccuracy is discovered), and such inaccuracy, if corrected, would have led to the application of a higher Applicable Margin

4 for any period (an “Applicable Margin Period”) than the Applicable Margin applied for such Applicable Margin Period, then (A) the Borrowers shall promptly deliver to the Administrative Agent a corrected Compliance Certificate for such Applicable Margin Period, (B) the Applicable Margin shall be determined based on such corrected Compliance Certificate, and (C) the Borrowers shall promptly pay to the Administrative Agent, for the benefit of the Lenders, the accrued additional interest owing as a result of such increased Applicable Margin for such Applicable Margin Period. “Consolidated EBITDA” means, for any period, as determined on a Consolidated basis, (a) Consolidated Net Earnings for such period plus, without duplication, the aggregate amounts deducted in determining such Consolidated Net Earnings in respect of (i) Consolidated Interest Expense, (ii) Consolidated Income Tax Expense, (iii) Consolidated Depreciation and Amortization Charges, (iv) non-cash charges excluding inventory reserves, (v) non-recurring cash charges not incurred in the ordinary course of business as agreed to by the Administrative Agent in its discretion, (vi) unrealized foreign currency losses, (vii) non-cash stock-based compensation expense, (viii) one time integration expenses incurred in the first twelve months following consummation of an Acquisition permitted hereunder, and (ix) any transaction-related expenses related to (A) an Acquisition permitted hereunder, (B) a disposition of assets permitted hereunder or (C) the consummation of amendments to Loan Documents or other additional Loan Documents entered into on or after the First Amendment Effective Date; provided that, the sum of the amounts added back pursuant to clauses (viii) and (ix) hereof shall not exceed ten percent (10%) of Consolidated EBITDA as calculated pursuant to this definition without reference to clause (viii) or (ix), unless otherwise agreed to by the Administrative Agent in its sole discretion; minus (b) to the extent included in Consolidated Net Earnings for such period, (i) non-cash gains, (ii) non- recurring cash gains not incurred in the ordinary course of business, and (iii) unrealized foreign currency gains. Notwithstanding the foregoing, in connection with an Acquisition or material disposition of assets permitted hereunder, Consolidated EBITDA (and any other applicable financial definitions) shall be calculated for the relevant periods to include the appropriate financial items of the entity or entities that are the target of such Acquisition, or exclude the appropriate financial items attributable to the assets being disposed, to the extent (A) such items are not otherwise included (or excluded) in the financial statements for DMC Global and its Subsidiaries and (B) such items are supported by financial statements or other information reasonably satisfactory to the Administrative Agent, and to include (or exclude) appropriate pro forma adjustments reasonably acceptable to the Administrative Agent and calculated on the same basis as set forth in this definition. “Debt Service Coverage Ratio” means, as determined for the most recently completed four fiscal quarters of DMC Global on a Consolidated basis, the ratio of (a) the sum of (i) Consolidated EBITDA, minus (ii) Capital Distributions paid in cash (other than (A) those made pursuant to Section 5.15(c) hereof, and (B) those made with respect to the Arcadia Equity Repurchase, in each case of subparts (A) and (B), so long as such cash payments are made with balance sheet cash, Revolving Loans or DDTL Loans),

5 minus (iii) Consolidated Unfunded Capital Expenditures, minus (iv) Consolidated Income Tax Expense paid in cash (net of income taxes (1) refunded in cash during such period, and (2) paid in cash in Germany for income taxes incurred during the fiscal year ended December 31, 2022, in an aggregate amount not to exceed Four Million Dollars ($4,000,000) and (y) for income taxes incurred during the fiscal year ended December 31, 2023, in an aggregate amount not to exceed Seven Million Dollars ($7,000,000)), minus (v) cash Restricted Payments pursuant to Section 5.15(d) hereof (except with respect to the portion of such Restricted Payments made with balance sheet cash, Revolving Loans or DDTL Loans); to (b) Consolidated Debt Service. 2. Additions to Definitions. Section 1.1 of the Credit Agreement is hereby amended to add the following new definitions thereto in the appropriate alphabetical order: “Covenant Relief Period” means the period commencing on the first day of the fiscal quarter during which the final payment for the Arcadia Equity Repurchase is made, through the last day of the third full fiscal quarter following such final payment. “Restricted Account” means a commercial Deposit Account designated as the “restricted account” and maintained by a Borrower with the Administrative Agent as set forth in Section 5.18 hereof, subject to a Control Agreement that grants exclusive control (except to the extent such funds are used as permitted by Section 5.18 hereof) of the Deposit Account to the Administrative Agent. “Second Amendment Effective Date” means June 10, 2025. 3. Amendment to Financial Covenants. Section 5.7 of the Credit Agreement is hereby amended to delete subsection (a) therefrom and insert in place thereof the following: (a) Leverage Ratio. The Borrowers shall not suffer or permit at any time the Leverage Ratio to exceed 3.00 to 1.00; provided that, notwithstanding the foregoing, during the Covenant Relief Period, the Borrowers shall not suffer or permit at any time the Leverage Ratio to exceed (i) 3.50 to 1.00 during the first two fiscal quarters ending during the Covenant Relief Period, (ii) 3.25 to 1.00 during the third fiscal quarter ending during the Covenant Relief Period, and (iii) 3.00 to 1.00 during the fourth fiscal quarter ending during the Covenant Relief Period. 4. Amendment to Use of Proceeds Provisions. Article V of the Credit Agreement is hereby amended to delete Section 5.18 therefrom and to insert in place thereof the following: Section 5.18. Use of Proceeds. The Borrowers’ use of the proceeds of the Loans shall be for working capital and other general corporate purposes of the Companies and for the refinancing of existing Indebtedness and for Acquisitions permitted hereunder including the Arcadia Acquisition; provided that (a) the proceeds of the DDTL Loans shall be used solely for the Arcadia Equity Repurchase and (b) the proceeds of the Revolving Loans may be used for the Arcadia Equity Repurchase, so long as, (i) in the case of subpart (a) above, such funds are deposited into a Restricted Account until used

6 as designated, and (ii) in the case of subpart (b) above, such funds are used as designated within five (5) Business Days of the making of any such Loan; provided further that, notwithstanding the foregoing, proceeds of the DDTL Loans in the Restricted Account may be used to repay DDTL Loans. The Borrowers will not, directly or indirectly, use the proceeds of the Loans, or lend, contribute or otherwise make available such proceeds to any Subsidiary, joint venture partner or other Person, (i) (A) to fund any activities or business of or with any Person, or in any country or territory, that, at the time of such funding, is, or whose government is, the subject of Sanctions, or (B) in any other manner that would result in a violation of applicable Sanctions by any Person (including any Person participating in the Loans, whether as underwriter, advisor, investor, or otherwise); or (ii) in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of applicable Anti-Corruption Laws. 5. Amendment to Restricted Payments Provisions. Section 5.15 of the Credit Agreement is hereby amended to delete subsections (c) and (d) therefrom and to insert in place thereof, respectively, the following: (c) DMC Global may (i) issue Preferred Stock and/or other capital stock in connection with the Arcadia Equity Repurchase, and (ii) make Capital Distributions (including redemption of such Preferred Stock) thereon in accordance with the terms thereof so long as (A) no Default or Event of Default shall then exist or, after giving pro forma effect to such payment, thereafter shall begin to exist, (B) the Leverage Ratio, calculated on a pro forma basis for the most recently ended trailing four-quarter period giving effect to such Capital Distribution as if it were paid at the commencement of such four-quarter period, is not greater than 2.75 to 1.00 (or 3.25 to 1.00 during the Covenant Relief Period), (C) the Debt Service Coverage Ratio, calculated on a pro forma basis for the most recently ended trailing four-quarter period after giving effect to such Capital Distribution as if it were paid at the commencement of such four-quarter period is not less than 1.25 to 1.00, and (D) the Liquidity Amount is not less than Twenty Million Dollars ($20,000,000); and (d) DMC Global may make Restricted Payments in connection with the Arcadia Equity Repurchase, so long as (i) no Default or Event of Default shall then exist or, after giving pro forma effect to such payment, thereafter shall begin to exist, (ii) the Leverage Ratio, calculated on a pro forma basis for the most recently ended trailing four- quarter period giving effect to such Restricted Payment as if it were paid at the commencement of such four-quarter period, is not greater than 2.75 to 1.00 (or 3.25 to 1.00 during the Covenant Relief Period), (iii) the Debt Service Coverage Ratio, calculated on a pro forma basis for the most recently ended trailing four-quarter period after giving effect to such Restricted Payment as if it were paid at the commencement of such four-quarter period, is not less than 1.25 to 1.00, and (iv) the Liquidity Amount is not less than Twenty Million Dollars ($20,000,000). 6. Closing Deliveries. Concurrently with the execution of this Amendment, the Borrowers shall:

7 (a) upon the request of any Lender made at least five (5) days prior to the date hereof, provide to such Lender (i) the documentation and other information so requested in connection with applicable “know your customer” and anti-money-laundering rules and regulations, including the PATRIOT Act, and (ii) if any Credit Party qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, a Beneficial Ownership Certification, in form and substance satisfactory to the Administrative Agent; (b) pay to the Administrative Agent, for the benefit of each Lender (including KeyBank), an amendment fee in an amount equal to twenty (20) basis points multiplied by each such Lender’s aggregate Revolving Credit Commitment, unused DDTL Commitment, and portion of outstanding DDTL Loans and the Term Loan; (c) execute and deliver to the Administrative Agent the Second Amendment Administrative Agent Fee Letter, and pay to the Administrative Agent, for its sole account, the fees stated therein; (d) cause each Guarantor of Payment to execute the attached Guarantor Acknowledgment and Agreement; and (e) pay all reasonable legal fees and expenses and other reasonable fees and expenses of the Administrative Agent in connection with this Amendment and any other Loan Documents. 7. Representations and Warranties. The Borrowers hereby represent and warrant to the Administrative Agent and the Lenders that (a) the Borrowers have the legal power and authority to execute and deliver this Amendment; (b) the officers executing this Amendment on behalf of the Borrowers have been duly authorized to execute and deliver the same and bind the applicable Borrowers with respect to the provisions hereof; (c) the execution and delivery hereof by the Borrowers and the performance and observance by the Borrowers of the provisions hereof and the Credit Agreement, as amended by this Agreement, do not violate or conflict with the Organizational Documents of the Borrowers or any law applicable to Borrowers or result in a breach of any provision of or constitute a default under any Material Agreement binding upon or enforceable against the Borrowers; (d) no Default or Event of Default exists, nor will any occur immediately after the execution and delivery of this Amendment or by the performance or observance of any provision hereof or of the Credit Agreement, as amended by this Amendment); (e) each of the representations and warranties of the Borrowers contained in the Loan Documents is true and correct in all material respects (or, as to any representations and warranties which are subject to a materiality or Material Adverse Effect qualifier, true and correct in all respects) as of the date hereof as if made on the date hereof, except to the extent that any such representation or warranty expressly states that it relates to an earlier date (in which case such representation or warranty is true and correct in all material respects (or, as to any representations and warranties which are subject to a materiality or Material Adverse Effect qualifier, true and correct in all respects) as of such earlier date); (f) the Borrowers are not aware of any claim or offset against, or defense or counterclaim to, the Borrowers’ obligations or liabilities under the Credit Agreement or any other Related Writing; and (g) this Amendment

8 constitutes a valid and binding obligation of the Borrowers in every respect, enforceable in accordance with its terms, subject to the effect of any applicable bankruptcy, insolvency, reorganization, moratorium or other Laws affecting creditors’ rights and remedies generally and to the effect of general principles of equity (regardless of whether enforcement is considered in a proceeding at Law or in equity). 8. Waiver and Release. The Borrowers, by signing below, hereby waive and release the Administrative Agent, and each of the Lenders, and their respective directors, officers, employees, attorneys, affiliates and subsidiaries, from any and all claims, offsets, defenses and counterclaims arising on or prior to the date hereof in connection with the Loan Documents or the transactions contemplated thereby, such waiver and release being with full knowledge and understanding of the circumstances and effect thereof and after having consulted legal counsel with respect thereto. 9. References to Credit Agreement and Ratification. Each reference to the Credit Agreement that is made in the Credit Agreement or any other Related Writing shall hereafter be construed as a reference to the Credit Agreement as amended hereby. Except as otherwise specifically provided herein, all terms and provisions of the Credit Agreement and each other Loan Document are confirmed and ratified and shall remain in full force and effect and be unaffected hereby. This Amendment is a Loan Document. 10. Counterparts. This Amendment may be executed in any number of counterparts, by different parties hereto in separate counterparts and by facsimile or other electronic signature, each of which, when so executed and delivered, shall be deemed to be an original and all of which taken together shall constitute but one and the same agreement. 11. Headings. The headings, captions and arrangements used in this Amendment are for convenience only and shall not affect the interpretation of this Amendment. 12. Severability. Any provision of this Amendment that shall be prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof or affecting the validity or enforceability of such provision in any other jurisdiction. 13. Governing Law. The rights and obligations of all parties hereto shall be governed by the laws of the State of New York. [Remainder of page intentionally left blank.] 4894-5543-8070.11

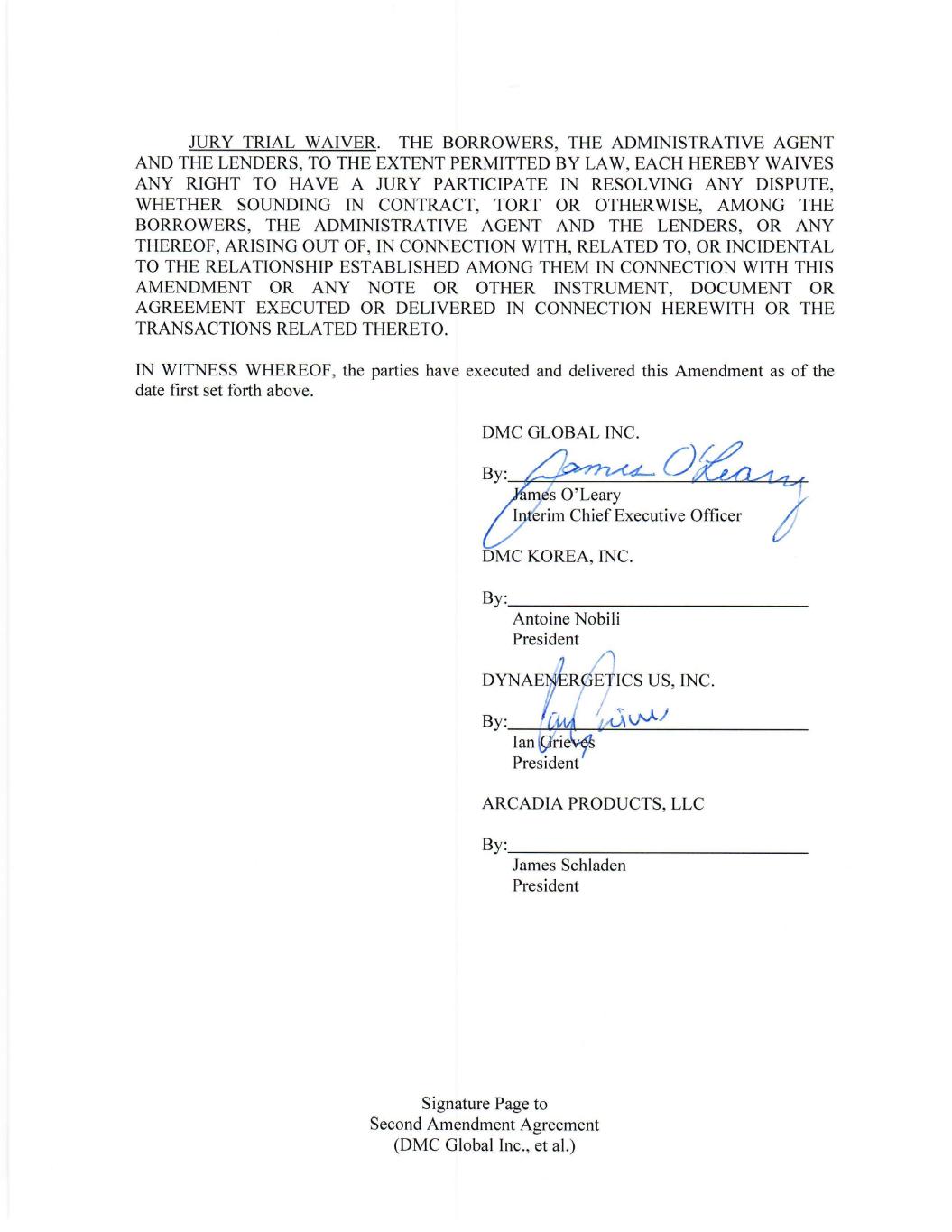

JURY TRIAL WAIVER. THE BORROWERS, THE ADMINISTRATIVE AGENT AND THE LENDERS, TO THE EXTENT PERMITTED BY LAW, EACH HEREBY WAIVES ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, AMONG THE BORROWERS, THE ADMINISTRATIVE AGENT AND THE LENDERS, OR ANY THEREOF, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED AMONG THEM IN CONNECTION WITH THIS AMENDMENT OR ANY NOTE OR OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH OR THE TRANSACTIONS RELATED THERETO. IN WITNESS WHEREOF, the parties have executed and delivered this Amendment as of the date first set forth above. DMC GLOBAL INC. By: s O'Leary erim Chief Executive Officer DMC KOREA, INC. By: Antoine Nobili President DYNAE RSETICS US, INC. By: Ian rie President ARCADIA PRODUCTS, LLC By: James Schladen President Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) Y I L AIVER. E ROWERS, E MINISTRATIVE ENT ND E DERS, O E TENT ITTED Y W, CH EBY AIVES Y HT O VE Y RTICI ATE LVING Y I UTE, HETHER NDING NTRACT, RT R HERWISE, ONG E ROWERS, E MINISTRATIVE ENT ND E DERS, R Y EREOF, RISI G UT F, N NNECTION ITH, TED O, R N TAL O E ATIONSHIP BLISHED ONG EM NECTION ITH HIS ENDMENT R Y OTE R HER N MENT, MENT R EEMENT UTED R LI ERED NECTION EWITH R E NSACTIONS TED ERETO. ITNES HEREOF, e arties ve ecuted d l ered is mendment s f e ate st t rth ove. C BAL C. C REA, C. y: ntoine obil r si ent ra } } AENERGETICS S, C. if y: id WY n Grie r si ent CADIA DUCTS, C y: es hladen resident nature age ond mendment greement D C lobal c., t l

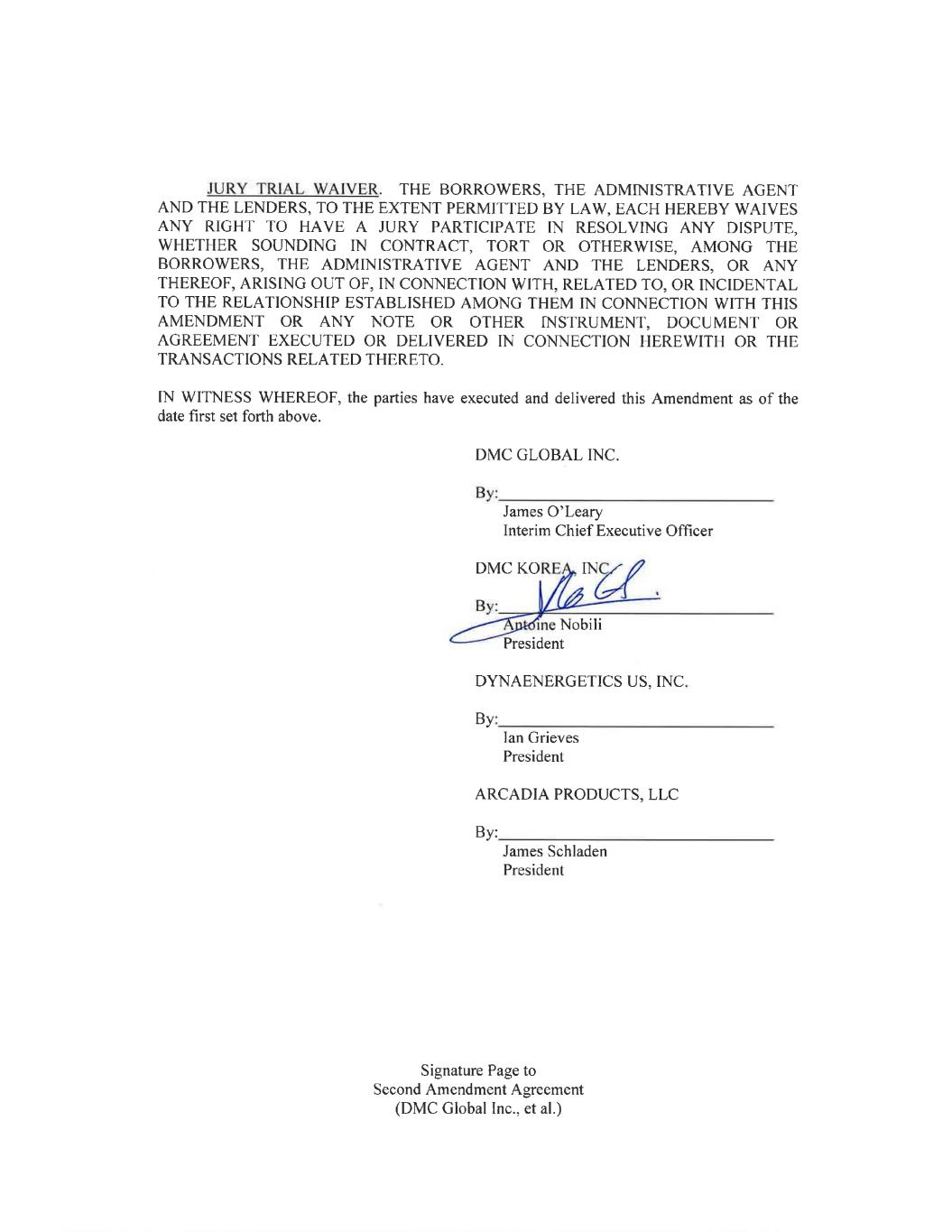

JURY TRIAL WAIVER. THE BORROWERS, THE ADMINISTRATIVE AGENT AND THE LENDERS, TO THE EXTENT PERMITTED BY LAW, EACH HEREBY WAIVES ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, AMONG THE BORROWERS, THE ADMINISTRATIVE AGENT AND THE LENDERS, OR ANY THEREOF, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED AMONG THEM IN CONNECTION WITH THIS AMENDMENT OR ANY NOTE OR OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH OR THE TRANSACTIONS RELATED THERETO. IN WITNESS WHEREOF, the parties have executed and delivered this Amendment as of the date first set forth above. DMC GLOBAL INC. By: James O'Leary Interim Chief Executive Officer DMC KORE %INC By: me Nobili President DYNAENERGETICS US, INC. By: Ian Grieves President ARCADIA PRODUCTS, LLC By: James Schladen President Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) JU T L WAIVER. T E B WERS, T E A INI ATIVE A T A D T E L DERS, TO T E E T PE I ED BY L , E H H Y WAI ES A Y R G T T H E A JU P I I TE IN R I G A D TE, ETHER SO DI G IN C TRACT, T T O O ERWISE, NG T E B WERS, T E A I I ATI E A T A D T E L DERS, O A T REOF, A I O T OF, IN C ECTI N WI H, R ED TO, O INC D L T T E R TI NSHIP E LI ED NG IN C ECTI N WI T IS MENT O Y TE O O ER NST ENT, ENT O ENT TED O ED IN ECTI N ITH O T E SACTIONS ED T RETO. IN I ES HEREOF, the parties have e t d and delivered this A endment as of the date first set forth a ve. C AL INC. By: James O’ Leary Interim Chief Executive Officer ine Nobili President AENERGETICS US, INC. By: Ian Grieves President ADIA DUCTS, LLC By: James Schladen President Signature Page to Second Amendment Agreement D C Global Inc., et al.)

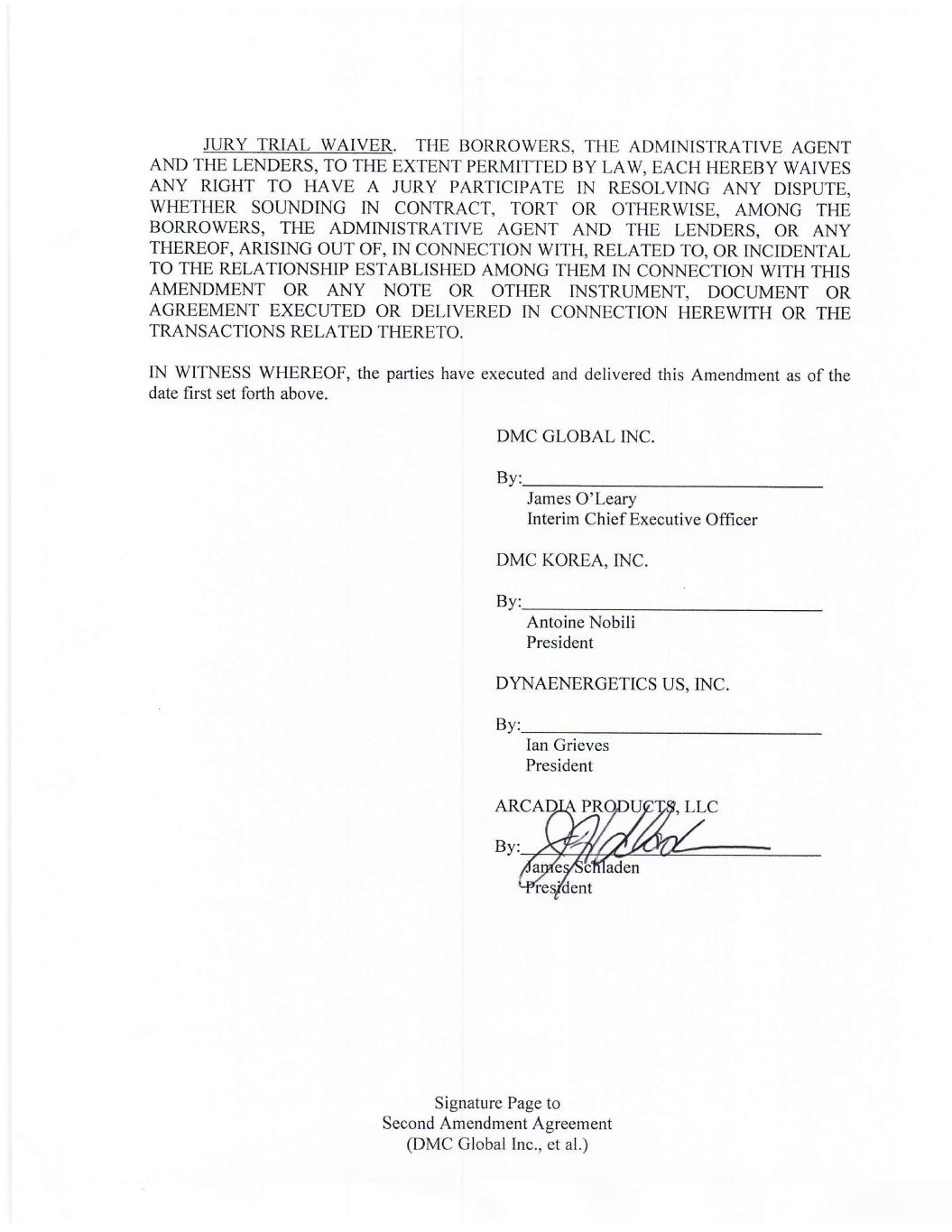

JURY TRIAL WAIVER. THE BORROWERS, THE ADMINISTRATIVE AGENT AND THE LENDERS, TO THE EXTENT PERMITTED BY LAW, EACH HEREBY WAIVES ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, AMONG THE BORROWERS, THE ADMINISTRATIVE AGENT AND THE LENDERS, OR ANY THEREOF, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED AMONG THEM IN CONNECTION WITH THIS AMENDMENT OR ANY NOTE OR OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH OR THE TRANSACTIONS RELATED THERETO. IN WITNESS WHEREOF, the parties have executed and delivered this Amendment as of the date first set forth above. DMC GLOBAL INC. By: James O'Leary Interim Chief Executive Officer DMC KOREA, INC. By: Antoine Nobili President DYNAENERGETICS US, INC. By: Ian Grieves President ARCAD PRI,JU , LLC By: a e c aden re dent Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) JUR TR W I ER. THE BO WERS, THE ADMINISTRATIVE AGENT A TH LE ERS, T TH EX T PER I BY LAW, EACH HEREBY WAIVES A R G T H E A JUR PA CIPATE IN RESOLVING ANY DISPUTE, W ER SOU I IN CO ACT, TORT OR OTHERWISE, AMONG THE BO WERS, TH A I I TI E A T AND THE LENDERS, OR ANY TH EOF, A N O OF, IN CO CTI N WITH, RELATED TO, OR INCIDENTAL T T R I SHIP EST A G THEM IN CONNECTION WITH THIS A ENT O A N E OR O R INSTRUMENT, DOCUMENT OR A ENT EX D OR D V IN CONNECTION HEREWITH OR THE TR CTI NS R D TH ETO. IN W ESS W EREOF, the parties have executed and delivered this Amendment as of the date first set forth above. DMC GLOBAL INC. By: James O’ Leary Interim Chief Executive Officer DMC KOREA, INC. By: Antoine Nobili President DYNAENERGETICS US, INC. By: Ian Grieves President ARCADIA PRODU y LLC By: 7 IM pee Chfaden resident Signature Page to Second Amendment Agreement D C Global Inc., et al.)

KEYBANK NATIONAL ASSOCIATION as the Administrative Agent and as a Lender By: Brian Fox Senior Vice President Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) ANK TI NAL CIATION s e dmin strative gent d s a ender _ By: , rian ox enior ice resident i nature age ond mendment greement D C lobal Inc., et al.)

BOKF, N BA BOK FINANCIAL By: Name: David Anderson Title: Senior Vice President Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) “== K N CIAL By: a ame: avid nderson itle: enior ice resident i nature age ond mendment greement D C lobal c., t

U.S. BANK NATIONAL ASSOCIATION By: Int Name: Eric M. Lough Title: Vice President Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) .S. NK jut y: ame: ric . itle: ice resident i nature age ond mendment greement D C lobal c., t l U fl S

CIBC BANK USA Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) I C NK SA By: NalnLT:- Title: i ature age nd endment gree ent C lobal c., t l

BANK OF AME ICA, N.A. By: Name• Jan Stein Titl Vice President Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) NK F ERICA, .A. AN y: “Yr d ame/Jan tein / ice r sident nature age to ond mendment greement D C lobal c., et l

COMMERCE BANK, a Missouri bank and trust company By: X________—e I Name: /6h z_r--' if - 17 - 0 /41 Title: .S-6-4,4 02 Vi ce fi (zs/.6 c-t4--- Signature Page to Second Amendment Agreement (DMC Global Inc., et al.) C ERCE B NK, a Missouri bank and trust company . By: | ee SS ete, Name. K9i2 tee 4 Title. erwoe Un e “She Signature Page to Second mendment greement D C lobal Inc., et al.) W n : are LCA : _Se Wic K6SIDET G

COMERICA BANK ERICA NK By: Name: Title:

GUARANTOR ACKNOWLEDGMENT AND AGREEMENT The undersigned consent and agree to and acknowledge the terms of the foregoing Second Amendment Agreement dated as of , 2025 (the "Amendment"). The undersigned further agree that the obligations of the undersigned pursuant to the Guaranty of Payment executed by the undersigned in connection with the Credit Agreement (as defined in the Amendment) is hereby ratified and shall remain in full force and effect and be unaffected hereby. The undersigned hereby waive and release the Administrative Agent and the Lenders and their respective directors, officers, employees, attorneys, affiliates and subsidiaries from any and all claims, offsets, defenses and counterclaims in connection with the Loan Documents or the transactions contemplated thereby, of any kind or nature, absolute and contingent, of which the undersigned are aware or should be aware as of the date hereof, such waiver and release being with full knowledge and understanding of the circumstances and effect thereof and after having consulted legal counsel with respect thereto. The undersigned hereby represent and warrant to the Administrative Agent and the Lenders that each of the representations and warranties of the undersigned contained in the Loan Documents is true and correct in all material respects as of the date hereof as if made on the date hereof, except to the extent that any such representation or warranty expressly states that it relates to an earlier date (in which case such representation or warranty is true and correct in all material respects as of such earlier date). JURY TRIAL WAIVER. THE UNDERSIGNED, TO THE EXTENT PERMITTED BY LAW, HEREBY WAIVE ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, AMONG THE BORROWERS, THE ADMINISTRATIVE AGENT, THE LENDERS AND THE UNDERSIGNED, OR ANY THEREOF, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED AMONG THEM IN CONNECTION WITH THIS GUARANTOR ACKNOWLEDGMENT AND AGREEMENT, THE AMENDMENT OR ANY NOTE OR OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH OR THE TRANSACTIONS RELATED THERETO. DYNAEN G TICS CANADA INC. DYNAMIC MATERIALS CORPORATION (HK) LIMITED By: Ian G ves President By: David Mandelbaum Director Signature Page to Guarantor Acknowledgment and Agreement June 10

GUARANTOR ACKNOWLEDGMENT AND AGREEMENT The undersigned consent and agree to and acknowledge the terms of the foregoing Second Amendment Agreement dated as of , 2025 (the "Amendment"). The undersigned further agree that the obligations of the undersigned pursuant to the Guaranty of Payment executed by the undersigned in connection with the Credit Agreement (as defined in the Amendment) is hereby ratified and shall remain in full force and effect and be unaffected hereby. The undersigned hereby waive and release the Administrative Agent and the Lenders and their respective directors, officers, employees, attorneys, affiliates and subsidiaries from any and all claims, offsets, defenses and counterclaims in connection with the Loan Documents or the transactions contemplated thereby, of any kind or nature, absolute and contingent, of which the undersigned are aware or should be aware as of the date hereof, such waiver and release being with full knowledge and understanding of the circumstances and effect thereof and after having consulted legal counsel with respect thereto. The undersigned hereby represent and warrant to the Administrative Agent and the Lenders that each of the representations and warranties of the undersigned contained in the Loan Documents is true and correct in all material respects as of the date hereof as if made on the date hereof, except to the extent that any such representation or warranty expressly states that it relates to an earlier date (in which case such representation or warranty is true and correct in all material respects as of such earlier date). JURY TRIAL WAIVER. THE UNDERSIGNED, TO THE EXTENT PERMITTED BY LAW, HEREBY WAIVE ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, AMONG THE BORROWERS, THE ADMINISTRATIVE AGENT, THE LENDERS AND THE UNDERSIGNED, OR ANY THEREOF, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED AMONG THEM IN CONNECTION WITH THIS GUARANTOR ACKNOWLEDGMENT AND AGREEMENT, THE AMENDMENT OR ANY NOTE OR OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH OR THE TRANSACTIONS RELATED THERETO. DYNAENERGETICS CANADA INC. DYNAMIC MATERIALS CORPORATION (HK) LIMITED By: Ian Grieves President By: David Mandelbaum Director Signature Page to Guarantor Acknowledgment and Agreement June 10

DYNAMIC MATERIALS CORPORATION (SHANGHAI) TRADING CO. LTD. By: (.?.:.„ J son Carter Legal Representative and General Manager DYNAEI R(ETICS EUROPE GMBH By: Ian ieve Managing Director 3225 E. WASHINGTON BLVD., LLC By: Arcadia Products, LLC ice . By: James Schladen President NOBELCLAD EUROPE SAS By: Antoine Nobili Director NOBELCLAD EUROPE GMBH By: Antoine Nobili Managing Director Signature Page to Guarantor Acknowledgment and Agreement NAMIC ATERIALS PORATION BELCLAD ROPE S SH NGHAT) DING O. TD. EE abe ory y: A n arter ntoine obil egal epresentative d eneral anager irector NAENERGETICS ROPE BH BELCLAD ROPE BH By:__ Aw itv» By: T n Gri y - ntoine obil anaging irector anaging irector 25 E. ASHINGTON LVD., C y: rcadia roducts, C y: es hladen resident i nature age uarantor cknowledgment d gr ent

DYNAMIC MATERIALS CORPORATION NOBELCLAD EUROPE SAS (SHANGHAI) TRADING CO. LTD. By: By: Jason Carter Legal Representative and General Manager ine Nobili ector DYNAENERGETICS EUROPE GMBH NOBELCLAD EURO V GMBH By: By: Ian Grieves Managing Director 3225 E. WASHINGTON BLVD., LLC By: Arcadia Products, LLC By: James Schladen President obili anaging Director Signature Page to Guarantor Acknowledgment and Agreement D MIC M TERI LS CO TI N D EU PE SA (SHA HAI) TR I C . L . B : Jaso C r r Legal R r sentati e and G eral Manager D ENERGETICS E PE G H B : Ian G es Managing D t r anaging Director 3225 E. W S I T N B VD., L By: A dia P ucts, L B : James S P nt Signature Page to Guarantor Acknowledgment and Agreement

DYNAMIC MATERIALS CORPORATION (SHANGHAI) TRADING CO. LTD. By: Jason Carter Legal Representative and General Manager DYNAENERGETICS EUROPE GMBH By: Ian Grieves Managing Director 3225 E. WASHINGTON BLVD., LLC By: Arcadia Products, L C By: Ts ch aden est ent NOBELCLAD EUROPE SAS By: Antoine Nobili Director NOBELCLAD EUROPE GMBH By: Antoine Nobili Managing Director Signature Page to Guarantor Acknowledgment and Agreement YNAMIC ATERIALS ORPORATION OBELCLAD UROPE AS NGHAI) RADING O. LTD. By: By: Jason arter ntoine Nobil egal epresenta ive nd eneral anager Director YNAENERGETICS ROPE MBH OBELCLAD UROPE MBH y: y: an rieves ntoine obil anaging irector anaging irector 225 . ASHINGTON LVD., LC WW 7 hod noe si y: rcadia rod i nature age uarantor cknowledgment d gr ent