UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark

One)

|

ý

|

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF

1934

|

|

|

|

|

|

For the fiscal year ended December 31, 2005

|

|

|

|

|

|

o

|

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

|

For the transition period from to

Commission file number 001-14775

DYNAMIC MATERIALS CORPORATION

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

84-0608431

|

|

(State of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

5405 Spine Road, Boulder, Colorado 80301

(Address of principal executive offices, including zip code)

(303) 665-5700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common

Stock, $.05 Par Value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes

o No ý

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate

by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to

this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer.

Large accelerated filer o Accelerated

filer ý Non-accelerated filer o

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

Yes o No ý

The

approximate aggregate market value of the voting stock held by non-affiliates

of the registrant was $105,336,504 as of June 30, 2005.

The

number of shares of Common Stock outstanding was 11,772,420 as of February 28,

2006.

PART I

ITEM 1. Business

Overview

Dynamic

Materials Corporation is a leading provider of explosion-welded clad metal

plates. Explosion-weld cladding uses an explosive charge to bond together

plates of different metals that do not bond easily with traditional welding

techniques. The process of welding the metal plates through an explosion is also

known as “shooting.” We refer to this

part of our business as “DMC Clad” or the “Explosive Metalworking” segment.

Detacladâ is the main trade name under which DMC Clad

markets its explosion-welded clad products. DMC Clad’s products are used in

critical applications in a variety of industries, including upstream oil and

gas, oil refinery, petrochemicals, hydrometallurgy, aluminum production,

shipbuilding, power generation and industrial refrigeration. DMC Clad’s market

leadership for explosion-welded clad metal plates is a result of its

state-of-the-art manufacturing facilities, technological leadership and

production expertise. We believe our customers select us for our high quality

product, speed and reliability of delivery, and cost effectiveness. We have a

global sales force that allows us to access international markets. Our

Explosive Metalworking operations are located in Pennsylvania, France and

Sweden.

Through

our AMK Welding segment (“AMK Welding”), we also provide advanced welding

services, primarily to the power turbine and aircraft engine manufacturing

industries. AMK Welding is a highly specialized welding subcontracting shop for

complex shapes used principally in gas turbines and aircraft engines. AMK

Welding’s operations are conducted at its South Windsor, Connecticut facility.

Clad Metals Industry

Clad

metal plates are used in the construction of heavy, corrosion resistant

pressure vessels and heat exchangers for upstream oil and gas, oil refinery,

petrochemicals, hydrometallurgy, aluminum production, shipbuilding, power

generation, industrial refrigeration and similar industries. Clad metal plates

consist of a thin layer of an expensive, corrosion resistant metal such as

titanium or stainless steel, which is metallurgically combined with a less

expensive, less corrosion resistant, thicker base metal, typically carbon

steel. There are four common ways to use such corrosion resistant metals in

corrosion resistant vessels:

• Solid

metal construction

• Rollbond

clad metals

• Weld

overlay clad metals

• Explosion-welded

clad metals

The

various cladding technologies were developed to produce materials with

properties similar to those of a solid metal, but at a lower cost. The most

appropriate and cost-effective alternative for an end-user depends on both the

type of application and the clad metal thickness required. While explosion-welded,

rollbond and weld overlay are competing cladding technologies, there are

limitations on the product that each can produce. Explosion-welded clad

technology is the only one of these processes suitable for joining titanium,

zirconium or tantalum metals to a base metal.

The

use of a solid metal is frequently the lowest cost alternative for metal

thicknesses of less than 0.75 inch. However, it is generally the most expensive

alternative for greater thicknesses.

The

rollbond technology is performed by several of the world’s heavy plate mills.

In this process, the clad metal and base metal are bonded together during a hot

rolling process in which a slab of metal is converted to plate. Rollbond clad

metals are cost-effective in metal thicknesses up to two inches, depending on

the metal alloy type. Producing clad metals using the rollbond process is

capital intensive, and capacity expansions cannot be achieved quickly if

existing equipment is not already in place, although the machinery at most heavy

plate mills can over time be converted to produce rollbond products. Rollbond

products have lower bond shear strength and corrosion resistance, which limits

their use in certain applications, and rollbonding may only be used for a

relatively small group of metal combinations due to metallurgical compatibility

issues.

2

In

weld overlay cladding, which is typically performed by equipment fabricators,

the cladding layer is deposited on the base metal using arc-welding type

processes. Weld overlay is a cost-effective technology for complicated shapes,

field service jobs and for production of heavy wall pressure vessel reactors.

Due to distortion and dilution concerns, overlay is rarely used for new

construction of equipment that is less than two inches thick. Dilution occurs

when the properties of two bonded metals change at the point of the bond. Weld

overlay clad metals have corrosion resistance that can be compromised by

dilution, which limits their use in certain applications. As with rollbond,

weld overlay may only be used for a specific group of metal combinations due to

metallurgical compatibility issues.

Explosion-welded

clad products retain the properties of the original metals before they were

bonded, such as corrosion resistance and mechanical properties, unlike

materials produced by rollbond or weld overlay. There is no dilution of the

original metals and the alloy chemistry is constant over the full thickness of

the product. When fabricated properly, the two metals will not come apart, even

under the most extreme circumstances. The explosion-welded clad process is

suitable for joining most metals used to construct vessels and equipment used

in corrosive applications, whereas rollbond and weld overlay are limited to

certain compatible metal combinations. Explosion-welded clad metal is used to

create flat plates, concentric cylinders, formed heads and transition joints. Explosion-weld

cladding is suitable for creating a product that has a cladding thickness of

0.04 inch to two inches and a base thickness of 0.25 inch to forty inches.

Depending on alloy type, explosion-welded clad metals are often the most cost

effective solution for metal thicknesses of between one and five inches. While

rollbond most frequently bonds stainless steel or nickel alloy to a steel

plate, welding zirconium, titanium or tantalum to a steel plate or to an alloy

plate can only be done by explosion-weld cladding.

Clad Metals End Use Markets

Explosion-welded

clad metal is primarily used in construction of large industrial equipment

involving high pressures and temperatures, and which need to be

corrosion-resistant. The eight broad industrial sectors discussed below

comprise the bulk of demand for DMC Clad’s business. The demand for clad metal is

driven by the underlying demand for new equipment and facility maintenance in

these primary market sectors. Overall, the market for explosion-welded clad metal

has continuously grown since its inception, with demand dependent upon the

underlying needs of the various market sectors. During the past two years,

there has been significant capital investment in many of these markets. This

current increase in demand is mainly attributable to strong markets for energy,

metals, and petrochemicals.

Upstream Oil and Gas: The

upstream oil and gas industry covers a broad scope of operations related to

recovering oil and/or gas for subsequent processing in refineries. Clad metal is

used in separators, glycol contactors, piping, heat exchangers and other

related equipment. The increase in oil and gas production from deep, hot, and

corrosive fields has significantly increased the demand for clad equipment. At

current energy price levels, many non-traditional energy production methods are

potentially commercially viable. These include liquid fuel production processes

such as coal gasification, oil recovery from tar sands, and ethanol production

from agricultural products. Also methods for transport or transformation of

natural gas become viable, such as natural gas liquification and conversion of

gas to liquid petroleum products. Virtually all of these processes involve

conditions which require clad metal in some of the equipment. The primary clad

metals for this market are stainless steel and nickel alloys clad to steel,

with some use of reactive metals.

Oil Refinery: Petroleum refining processes

are frequently corrosive, hot, and high pressure. Clad metal is extensively

used in a broad range of equipment including desulfurization hydrotreaters,

coke drums, distillation columns, separators and heat exchangers. In the United

States, refineries are running near full capacity, and adding capacity and

reducing costly down-time are a high priority. The increasing reliance upon low

quality, high sulfur crude further drives demand for new corrosion resistant

equipment. Worldwide trends in regulatory control of sulfur emissions in gas,

diesel and jet fuel are also increasing the need for clad equipment. Like the

oil and gas sector, the metals of construction are primarily stainless steel

and nickel alloys.

Chemical and Petrochemical: Many

common products, ranging from plastics to drugs to electronic materials, are

produced by chemical processes. Because the production of these items is

corrosive and conducted under high pressure or temperature, corrosion-resistant

equipment is needed, which may be produced most cost-effectively using clad

construction. One of the larger applications for titanium-clad equipment is in

the manufacture of Purified Terephthalic Acid (“PTA”), a precursor product for

polyester, which is used in everything from carpets to plastic bottles. This

market requires extensive use of stainless steel and nickel alloy, but also

uses titanium and, to a lesser extent, zirconium and tantalum.

3

Hydrometallurgy: The

conversion of raw ore to metal generally involves high energy and/or corrosive

processes. Traditionally, most metals have been produced by high temperature

smelting. Over the past two decades there has been an increasing trend toward

acid leaching processes. These hydrometallurgy processes are more

environmentally friendly and more energy efficient. The processes for

production of nickel, gold, and copper involve acids, high pressures, and high

temperatures. Titanium is the material of choice. Titanium-clad plate is used

extensively for construction of autoclaves and peripheral equipment. Increasing

demand for metals in the current world market provides the impetus for a

significant number of new mining and hydrometallurgy projects.

Aluminum Production:

Aluminum is reduced from its oxide in large electro-smelter facilities

called potlines. The electric current power is carried via aluminum conductors.

The electricity must be transmitted into steel components for the high

temperature smelting operations. Aluminum cannot be welded to steel

conventionally. Explosion-welded aluminum-steel transition joints provide an

energy efficient and highly durable solution for making these connections.

Modern potlines may use as many as 50,000 to 100,000 transition joints. The

parts are typically replaced when the potlines are refurbished, commonly every

seven years. Although aluminum production is the major electrochemical

application for DMC Clad products, there are a number of other electrochemical

applications including production of magnesium, chlorine and chlorate.

Shipbuilding: The combined problems of

corrosion and top-side weight drive significant demand for our aluminum-steel

transition joints. Top-side weight is often a significant problem with tall

ships, including cruise ships, naval combatants, ferries and yachts. Use of

aluminum in the upper structure and steel in the lower structure provides

stability. Bolted joints between aluminum and steel corrode quickly. Aluminum

cannot be welded directly to steel using traditional welding processes. Welded

joints can only be made using transition joints. DMC Clad products can be found

on many well known ships, including the QE II and modern U.S. Navy aircraft

carriers.

Power Generation:

Fossil fuel power generation plants require extensive use of heat

exchangers, many of which require corrosion resistant alloys to handle low

quality cooling water. Our clad plates are used extensively for heat exchanger

tubesheets. The largest clad tubesheets in conventional steam plants are used

in the final low pressure condensers. For most coastal and brackish water

cooled plants, titanium is the metal of choice technically and titanium-clad

tubesheets are the low cost solution.

Industrial Refrigeration: Heat

exchangers are a core component of refrigeration systems. When the cooling

water is seawater, brackish, or even slightly polluted, corrosion resistant

metals are necessary. Metal selection can range from stainless steel to copper

alloy to titanium, and explosion-welded clad metal is often the low cost

solution for making the necessary components. Applications range from

refrigeration chillers on fishing boats to massive air conditioning units for

skyscrapers metal, airports, and deep underground mines.

AMK Welding End Use Markets

Parts

for power turbines and aircraft engines must be machined to exacting tolerances

and welded according to exacting specifications. Many of those parts have

complex shapes, the welding of which requires significant expertise. AMK Welding

is a specialized operation that welds complex, shaped parts for machining

companies that, in turn, supply the manufacturers of power turbines and

aircraft engines. Some machining companies also have their own welding

facilities, which compete with AMK Welding for business.

Business Segments

We

operate two business segments: Explosive Metalworking (which we also refer to

as DMC Clad) and AMK Welding. The Explosive Metalworking segment uses

proprietary explosive processes to fuse dissimilar metals and alloys and has 40

years of experience. We believe we are the largest explosion-welded clad metal

manufacturer in North America, and our two plants in Europe provide us with a

leadership position in the European market. AMK Welding utilizes various specialized

technologies to weld components for use in commercial and military jet engines

as well as power-generation turbines and has 40 years of experience.

4

Explosive Metalworking

The

Explosive Metalworking segment seeks to build on its leadership position in its

markets. The Explosive Metalworking segment currently represents approximately

95% of our revenue. The three manufacturing plants and their respective

shooting sites in Pennsylvania, France and Sweden provide the production

capacity to address concurrent projects for DMC Clad’s current domestic and

international customer base.

The

primary product of the Explosive Metalworking segment is explosion-welded clad

metal plate. Clad metal plates are used in the construction of heavy, corrosion

resistant pressure vessels and heat exchangers for upstream oil and gas, oil

refinery, petrochemicals, hydrometallurgy, aluminum production, shipbuilding,

power generation, industrial refrigeration and similar industries. The

characteristics of DMC Clad’s explosive metalworking processes may enable the

development of new products in a variety of industries and DMC Clad continues

to explore such development opportunities.

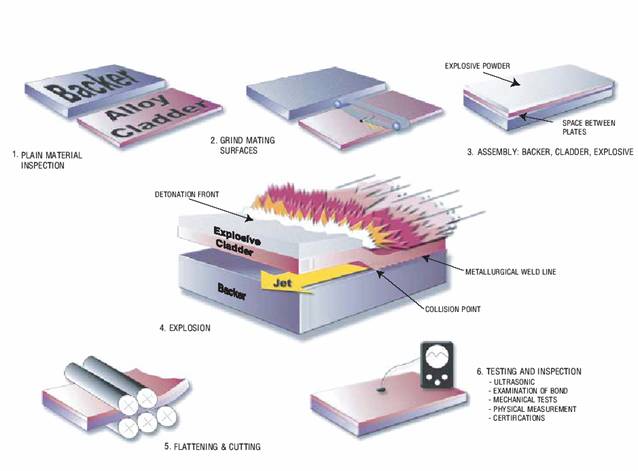

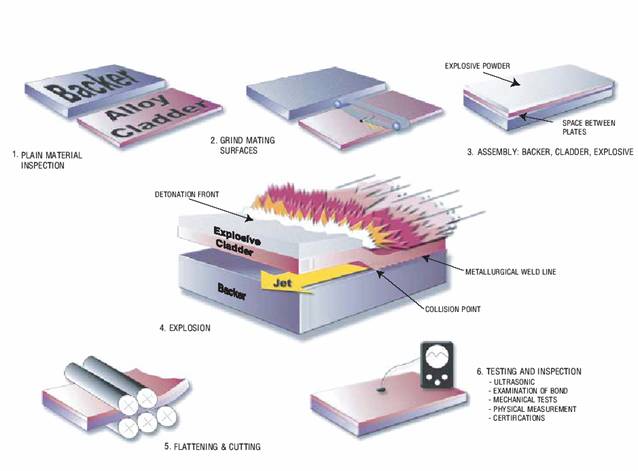

The

principal product of metal cladding, regardless of the process used, is a metal

plate composed of two or more dissimilar metals, usually a corrosion resistant

metal and steel, bonded together. Prior to the explosion-welded clad process,

the materials are inspected, the mating surfaces are ground, and the metal

plates are assembled for cladding. The process involves placing a sheet of the

cladder over a parallel plate of backer material and then covering the cladder

material with a layer of specifically formulated explosive. A small gap or

“standoff space” is maintained between the alloy cladder and the backer

substrate. The explosion is then initiated on one side of the cladder and

travels across the surface of the cladder forcing it down onto the backer. The

explosion happens in approximately one-thousandth of a second. The collision

conditions cause a thin layer of the mating surfaces to be spalled away in a

jet. This action removes oxides and surface contaminants immediately ahead of

the collision point. The extreme pressures force the two metal components

together, creating a metallurgical bond between them. The explosion-welded clad

process produces a strong, ductile, continuous metallurgical weld over the clad

surface. After the explosion is completed, the resulting clad plates are

flattened and cut, and then undergo testing and inspection to assure

conformance with internationally accepted product specifications.

5

EXPLOSION-WELDING PROCESS

Explosion-welded

cladding technology is a method to weld metals that cannot be welded by

conventional processes, such as titanium-steel, aluminum-steel, and

aluminum-copper. It can also be used to weld compatible metals, such as

stainless steels and nickel alloys to steel. The cladding metals are typically

titanium, stainless steel, aluminum, copper alloys, nickel alloys, tantalum,

and zirconium. The base metals are typically carbon steel, alloy steel,

stainless steel and aluminum. Although the patents for the explosion-welded

cladding process have expired, DMC Clad has proprietary knowledge that

distinguishes it from its competitors. The entire explosion-welded process

involves significant precision in all stages, and any errors can be extremely

costly as they result in the discarding of the expensive raw material metals.

DMC Clad’s technological expertise is a significant advantage in preventing

costly waste.

Explosion-welded

clad metal is used in critical applications in a variety of industries,

including upstream oil and gas, oil refinery, petrochemicals, hydrometallurgy,

aluminum production, shipbuilding, power generation, industrial refrigeration

and other industries where corrosion, temperature and pressure combine to

produce demanding environments. Explosion-welded clad metal is also used to

produce bimetal welding transition joints or other components which are used in

ship construction, and in a variety of electrochemical industries including

aluminum production.

DMC

Clad’s metal products are primarily produced on a project-by-project basis

conforming to requirements set forth in customers’ purchase orders. Upon

receipt of an order, DMC Clad obtains the component materials from a variety of

sources based on quality, availability and cost and then produces the order in

one of its three manufacturing plants. Final products are processed to meet

contract specific requirements for product configuration and quality/inspection

level.

6

AMK Welding

AMK

Welding employs a variety of sophisticated processes and equipment to provide

specialized welding services principally to a power turbine manufacturer and

commercial and military aircraft engine manufacturers. AMK Welding is located

in South Windsor, Connecticut.

Welding

services are provided on a project-by-project basis based on specifications set

forth in customers’ purchase orders. Upon receipt of an order for welded

assemblies, AMK Welding performs welding services using customer specific

welding procedures.

AMK

Welding uses a variety of processes and specialized equipment, including

electron beam and gas tungsten arc welding processes. AMK Welding has

considerable expertise in vacuum chamber welding, which is a critical

capability when welding titanium, zirconium, high temperature nickel alloys and

other specialty alloys. These welding techniques are used for the welding of

blades and vanes and other turbine parts typically located in the hot gas path

of aircraft engines. In addition to its welding capabilities, AMK Welding also uses

various heat treatment and non-destructive examination processes, such as

radiographic inspection, in support of its welding operations.

Suppliers, Competition, Customer Profile, Marketing and

Research and Development

DMC Clad

Suppliers and Raw Materials

DMC

Clad uses a range of alloys, steels and other materials for its operations,

such as stainless steel, copper alloys, nickel alloys, titanium, zirconium,

tantalum, aluminum and other metals. DMC Clad sources its raw materials from a

number of different producers and suppliers, minimizing its exposure to any one

particular supplier. DMC Clad holds a limited metal inventory and purchases its

raw materials based on contract specifications. Under most contracts, any raw

material price increases are passed on to DMC Clad’s customers. DMC Clad

closely monitors the quality of its supplies and inspects the type, dimensions,

markings, and certification of all incoming metals to ensure that the materials

will satisfy applicable construction codes. DMC Clad also manufactures its own

explosives from standard raw materials, thus achieving higher quality and lower

cost.

Competition

Metal Cladding. DMC Clad faces competition from alternative

technologies such as rollbond and weld overlay. Usually the three processes do

not compete directly against each other, each having its own preferential

domain of application relating to metal used and thicknesses required. However,

due to specific project considerations such as technical specifications, price

and delivery time, explosion-welding may have the opportunity to compete

successfully against these technologies. Rollbond is only produced by a few

steel mills in the world. The weld overlay process, which is produced among the

many vessel fabricators who are often also DMC Clad customers, is a slow and

labor intensive process that requires a large amount of floor space for the

equipment.

Explosion-Welded Metal Cladding. Competition in the explosion-welded clad

metal business is fragmented. DMC Clad holds a strong market position in the

clad metal industry. DMC Clad is the leading producer of explosion-welded clad

products in North America, and it has a strong position in Europe against

smaller competitors. The main competitor in Asia is a division of Asahi Kasei,

which has competitive technology and a recognized local brand name. There are

several explosion-welded clad producers in China, most of whom are technically

limited and are currently not exporters outside of their domestic market. To

remain competitive, DMC Clad intends to continue developing and providing

technologically advanced manufacturing services, maintain quality levels, offer

flexible delivery schedules, deliver finished products on a reliable basis and

compete favorably on the basis of price.

Customer Profile

DMC

Clad’s products are used in critical applications in a variety of industries,

including upstream oil and gas, oil refinery, petrochemicals, hydrometallurgy,

aluminum production, shipbuilding, power generation, industrial refrigeration

and other similar industries. DMC Clad’s customers in these industries require

metal products that can withstand exposure to corrosive materials, high

temperatures and high pressures. DMC Clad’s customers can be divided

7

into three tiers: the product end-users

(e.g., operators of chemical processing plants), the engineering contractors

who design plants and equipment for end-users, and the metal fabricators who

manufacture the products or equipment that utilize DMC Clad’s metal products.

It is typically the fabricator that places the purchase order with DMC Clad and

pays the corresponding invoice. DMC Clad has developed strong relationships

over the years with the engineering contractors (relatively large companies)

who sometimes act as prescriptor to small local fabricators.

Marketing, sales, distribution

DMC

Clad conducts its selling efforts by marketing its services to potential

customers through senior management, direct sales personnel, program managers

and independent sales representatives. Prospective customers in specific

industries are identified through networking in the industry, cooperative

relationships with suppliers, public relations, customer references, inquiries

from technical articles and seminars and trade shows. DMC Clad markets its clad

metal products to three tiers of customers: product end-users, engineering

contractors and metal fabricators. DMC Clad’s sales office in the United States

covers the Americas and Asia, its sales office in France covers Southern

Europe, the Middle East and Africa, while its sales office in Sweden covers

Northern Europe and Germany. In addition, DMC Clad also operates a sales office

in India. Members of the global sales team may be called to work on projects

located outside their territory. By maintaining relationships with its existing

customers, developing new relationship with prospective customers and educating

all its customers as to the technical benefits of DMC Clad’s metal-worked

products, DMC Clad endeavors to have its products specified as early as

possible in the design process.

In

addition to its direct sales office, DMC Clad also works with sales agents

located in Canada, South Africa, the United Kingdom, Germany, Italy, Norway,

Finland, Saudi Arabia, Australia, Indonesia, China, Korea and Japan. DMC Clad

has several exclusive or non-exclusive agreements with agents for sales and

business promotion in specific territories defined by each agreement. These

agency contracts cover additional sales in specific European, Middle Eastern

and Far Eastern countries. Agency agreements are usually one to two years in

duration and, subject to agents meeting DMC Clad’s performance expectations,

are automatically renewed.

DMC

Clad’s sales are generally shipped from the manufacturing locations in the United

States, France and Sweden, and all shipping costs are covered by the customer.

Regardless of where the sale is booked (in Europe or the U.S.), DMC Clad will

produce it, capacity permitting, at the location closest to the delivery place.

In the event that there is a short term capacity issue, DMC Clad produces the

order at any of its production sites, prioritizing timing. The various

production sites allow DMC Clad to meet customer production needs in a timely

manner.

Research and Development

We

prepare a formal research and development plan annually. It is implemented at

the French and at the U.S. cladding sites and is supervised by a Technical

Committee, chaired by the Chief Executive Officer, that reviews progress

quarterly and meets once a year to establish the plan for the following 12

months. The research and development projects concern process support, new

products and special customer-paid projects.

AMK Welding

At

AMK Welding, the materials welded are a function of the type of parts supplied by

the customers and include many steel varieties, various nickel alloys and

customer-created proprietary alloys typically used in the aerospace or ground

turbines industries. Other than the metal wire used in the welding process, AMK

Welding does not purchase metals, and it receives the parts to be welded from

the customer.

AMK

Welding relies on a few key customers for the majority of its business,

including GE Energy, General Electric Aircraft Engines and their first tier

subcontractors, such as Barnes Aerospace, and divisions of United Technology,

such as Hamilton Standard, Sikorsky Aircraft and Pratt and Whitney. In

addition, AMK Welding has entered into a 5-year contract to provide welding

services to the GE Energy Business of General Electric Company for up to six H

System gas turbine engines per year. During the term of this contract, the

customer has agreed to use AMK Welding for welding services for the first six H

System gas turbine engines such customer manufactures each year. In the

aircraft engine business, AMK Welding competes against a few small welding

companies that are typically privately owned. AMK Welding competes successfully

based on a reputation for uncompromising quality and rapid responsiveness to

customer needs.

8

Corporate History & Recent Developments

Company History

Explosive

Fabricators Inc. (“EFI”) was founded in 1965 and incorporated in 1971 as a

Colorado corporation. In 1976, EFI became a licensee of Detacladâ, the explosion-weld clad process discovered by DuPont in 1959. EFI

became a public company in 1977 and was renamed Dynamic Materials Corporation

in 1994. In 1996, we purchased the Detaclad operating business from DuPont. We

reincorporated in 1997 as a Delaware corporation. In 1998, we acquired AMK

Welding, Spin Forge and Precision Machined Products (“PMP”).

In

a series of transactions including open market purchases and a direct purchase

of our common stock pursuant to a stock purchase agreement, SNPE, Inc.

(“SNPE”), which is indirectly wholly owned by the government of France,

acquired shares of our common stock, resulting by June 30, 2000 in its holding

2,763,491 shares of our common stock, or approximately 56% of our outstanding

shares of common stock. On June 8, 2005, SNPE exercised its conversion rights

on a convertible subordinated note it held, and the note was converted into

200,000 shares of our common stock at a conversion rate of $6 per share,

increasing SNPE’s ownership to 2,963,491 shares at that time. A subsequent

stock split increased this amount to the current 5,926,982 shares held by SNPE.

At

the time of its acquisition of our common stock, SNPE’s parent company, Groupe

SNPE, was the indirect owner of Nobelclad, which had been a licensee of the

Detacladâ technology in France since 1966, and had

acquired its Swedish competitor, Nitro Clad, in 1997, as well as its U.K. and

German competitors in 1998. On July 3, 2001, we completed our acquisition of

substantially all of the outstanding stock of Nobelclad from Nobel Explosifs

France (“NEF”). NEF is wholly owned by Groupe SNPE and is a sister company to

SNPE. Nobelclad and its wholly-owned subsidiary, Nitro Metall AB (“Nitro

Metall”) are the primary manufacturers of explosion-welded clad products in

Europe and operate cladding businesses located in Rivesaltes, France and

Likenas, Sweden, respectively, along with sales offices in each country.

Products manufactured by Nobelclad and Nitro Metall are similar to those

produced by DMC Clad’s domestic factory in Mount Braddock, Pennsylvania.

Historically,

our Aerospace segment was comprised of three companies that we acquired in

1998: AMK Welding, Spin Forge and PMP.

Because PMP and Spin Forge were sold in October of 2003 and September of 2004,

respectively, and are reported as discontinued operations, AMK Welding has

become a stand-alone business segment.

Employees

As

of December 31, 2005, we employed approximately 181 permanent employees the

majority of whom were engaged in manufacturing operations, and the remainder

were engaged in sales and marketing or corporate department.

The

majority of our manufacturing employees are not unionized. Of the 181 permanent

employees, 109 are U.S. based, 58 are based in France at the Nobelclad facility

and 14 are based in Sweden at Nitro Metall. Approximately half of Nobelclad’s

employees and all Nitro Metall employees are members of trade unions. In

addition, we also use between 15 and 20 temporary workers at any given time,

depending on the workload.

In

2005, approximately half of the employees of the French facility held a strike

for one week, which was the first in 8 years. The strike was resolved and we

believe that employee relations are good.

Insurance

Our

operations expose us to potential liabilities for personal injury or death as a

result of the failure of a component that has been designed, manufactured or

serviced by us, or the irregularity or failure of metal products we have

processed or distributed. We believe that we maintain liability insurance adequate

to protect us from future product liability claims.

Proprietary Knowledge, Permits and Patents

Protection of Proprietary Information. We hold patents related to the business of

explosive metalworking and metallic processes and also own certain registered

trademarks, including Detaclad®, Detacouple®, Dynalock®,

9

EFTEK®, ETJ 2000® and NOBELCLAD®. Although

the patents for the explosion-welded cladding process have expired, our current

product application patents expire on various dates through 2020. Since

individual patents relate to specific product applications and not to core

technology, we do not believe that such patents are material to our business

and the expiration of any single patent is not expected to have a material

adverse effect on our operations. Much of the manufacturing expertise lies in

the knowledge of the factors that affect the quality of the finished clad

product, including the types of metals to be explosion-welded, the setting of

the explosion, the composition of the explosive and the preparation of the

plates to be bonded. We have developed this specialized knowledge over our 40

years of experience in the explosive metalworking business. We are very careful

in protecting our proprietary know-how and manufacturing expertise, and we have

implemented measures and procedures to ensure that the information remains

confidential.

Permits. Explosive metalworking involves the use of explosives, making safety

a critical factor in our operations. In addition, it is a highly regulated

industry for which detailed permits are required. These permits require renewal

every four years. See “Item 1A – Risk Factors – Risk Factors Related to Our

Industry – We are subject to extensive government regulation and failure to

comply could subject us to future liabilities and could adversely affect our

ability to conduct or to expand our business” for a more detailed discussion of

these permits.

Foreign and Domestic Operations and Export Sales

All

of our sales are shipped from the manufacturing facilities located in the

United States, France and Sweden. The following chart represents our net sales

based on the geographic location of the customer. The sales recorded for each

country are based on the country to which we shipped the product, regardless of

the country of the actual end-user. Products are usually shipped to the

fabricator before being passed on to the end-user.

|

|

|

(Dollars in Thousands)

|

|

|

|

|

For the years ended December 31,

|

|

|

|

|

2005

|

|

2004

|

|

2003

|

|

|

United

States

|

|

$

|

32,126

|

|

$

|

24,528

|

|

$

|

17,879

|

|

|

South Korea

|

|

7,771

|

|

409

|

|

829

|

|

|

Canada

|

|

7,562

|

|

4,924

|

|

4,610

|

|

|

Spain

|

|

5,369

|

|

957

|

|

587

|

|

|

Malaysia

|

|

5,148

|

|

83

|

|

40

|

|

|

China

|

|

3,368

|

|

310

|

|

33

|

|

|

Netherlands

|

|

2,757

|

|

1,218

|

|

749

|

|

|

Belgium

|

|

2,495

|

|

2,591

|

|

795

|

|

|

France

|

|

2,417

|

|

1,662

|

|

1,424

|

|

|

Italy

|

|

2,208

|

|

2,236

|

|

1,617

|

|

|

Australia

|

|

1,940

|

|

5,454

|

|

1,768

|

|

|

Germany

|

|

939

|

|

1,978

|

|

550

|

|

|

Russia

|

|

838

|

|

253

|

|

1,488

|

|

|

Mexico

|

|

664

|

|

1,241

|

|

570

|

|

|

Other

foreign countries

|

|

3,689

|

|

6,321

|

|

2,840

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

79,291

|

|

$

|

54,165

|

|

$

|

35,779

|

|

Company

Information

Our

Internet address is www.dynamicmaterials.com. Information contained on our

website does not constitute part of this Annual Report on Form 10-K.

10

ITEM 1A. Risk Factors

Risk Factors Related to Our Industry

Despite substantial growth in recent years in our existing

markets, growth in such markets may not continue at the same rate indefinitely.

From

2003 to 2004 and from 2004 to 2005, sales by DMC Clad increased by 55% and 47%,

respectively. However, the explosion-weld cladding market is dependent upon

sales of products for use by customers in a limited number of heavy industries,

including upstream oil and gas, oil refinery, petrochemicals, hydrometallurgy,

aluminum production, shipbuilding, power generation and industrial

refrigeration. These industries tend to

be cyclical in nature, and there can be no assurance that the construction and

other needs of those industries for our products will continue to grow at

current rates. An economic slowdown in

one or all of these industries, whether due to cyclicality or other factors,

could impact capital expenditures within the industry. If demand from such industries were to

decline or even grow less quickly, our sales would be expected to be affected

proportionately, which may have a material adverse effect on our business,

financial condition and results of operations.

There is a limited availability of sites suitable for

cladding operations.

Our

cladding process involves the detonation of large amounts of explosives. As a

result, the sites where we perform cladding must meet certain criteria,

including lack of proximity to a densely populated area, the specific

geological characteristics of the site, and the ability to comply with local

noise and vibration abatement regulations in conducting the process. The

process of identifying suitable sites and obtaining permits for using the sites

from local government agencies can be time-consuming and may not be successful.

In addition, we could experience difficulty in obtaining or renewing permits

because of resistance from residents in the vicinity of proposed sites.

The failure to obtain required governmental approvals or permits could limit our

ability to expand our cladding business in the future, and the failure to

maintain such permits would have a material adverse effect on our business,

financial condition and results of operations.

Certain raw materials we use are subject to supply shortages

due to general economic conditions.

Although

we generally use standard metals and other materials in manufacturing our

products, certain materials such as specific grades of carbon steel, titanium,

zirconium and nickel can be subject to supply shortages due to general economic

conditions or problems with individual suppliers. While we seek to maintain

sufficient alternative supply sources for these materials, there can be no

assurance that we will always be able to obtain sufficient supplies or obtain

supplies at acceptable prices without production delays, additional costs or a

loss of product quality. If we were to fail to obtain sufficient supplies on a

timely basis or at acceptable prices, such loss or failure could have a

material adverse effect on our business, financial condition and results of

operations.

Certain raw materials we use are subject to price increases

due to general economic conditions.

The

markets for certain metals and other raw materials used in our business are

highly variable and are characterized by periods of increasing prices. We

generally do not hedge commodity prices or enter into forward supply contracts,

and instead we endeavor to pass along price variations to our customers. We may

see a general downturn in business if the price of raw materials increases

enough for our customers to delay planned projects or use alternative materials

to complete their projects.

11

We are subject to extensive government regulation and failure

to comply could subject us to future liabilities and could adversely affect our

ability to conduct or to expand our business.

We

are subject to extensive government regulation in the United States, France and

Sweden, including guidelines and regulations for the safe manufacture,

handling, transport and storage of explosives provided by the U.S. Bureau of

Alcohol, Tobacco and Firearms, the Federal Motor Carrier Safety Regulations set

forth by the U.S. Department of Transportation and the Safety Library

Publications of the Institute of Makers of Explosive and similar guidelines of

their European counterparts. In Sweden,

the purchase, transport, storage and use of explosives is governed by a permit

issued by the Police Authority of the County of Varmland. (In France, the manufacture and

transportation of explosives is subcontracted to Nobel Explosifs France, an

affiliate of SNPE, which is responsible for compliance with regulations

established by various State and local governmental agencies concerning the

handling and transportation of explosives.)

We must comply with licensing and regulations for the purchase,

transport, storage, manufacture, handling and use of explosives. In addition,

while our shooting facilities in France and Sweden are located outdoors, our shooting

facility in Pennsylvania is located in a mine, which subjects us to certain

regulations and oversight of governmental agencies that oversee mines.

We

are also subject to extensive environmental and occupational safety regulation,

as described below under “ – Liabilities under environmental and safety laws

could result in restrictions or prohibitions on our facilities, substantial

civil or criminal liabilities, as well as the assessment of strict liability

and/or joint and several liability” and “ – The use of explosives subjects us

to additional regulation, and any accidents or injuries could subject us to

significant liabilities.”

The

export of certain products from the United States is restricted by U.S. export

regulations. These regulations generally

prevent the export of products that could be used by certain end-users, such as

those in the nuclear or biochemical industries.

In addition, the use and handling of explosives may be subject to increased

regulation due to heightened concerns about security and terrorism. Such

regulations could restrict our ability to access and use explosives and

increase costs associated with the use of such explosives, which could have a

material adverse effect on our business, financial condition and results of

operations.

Any

failure to comply with current and future regulations in the U.S. and Europe

could subject us to future liabilities. In addition, such regulations could

restrict our ability to expand our facilities, construct new facilities, compete

in certain markets or could require us to incur other significant expenses in

order to maintain compliance. Accordingly, our business, results of operations

or financial condition could be adversely affected by our non-compliance with

applicable regulations, by any significant limitations on our business as a

result of our inability to comply with applicable regulations, or by any

requirement that we spend substantial amounts of capital to comply with such

regulations.

Liabilities under environmental

and safety laws could result in restrictions or prohibitions on our facilities,

substantial civil or criminal liabilities, as well as the assessment of strict

liability and/or joint and several liability.

We

are subject to extensive environmental and safety regulation in the United

States and Europe. Any failure to comply with current and future environmental and

safety regulations could subject us to significant liabilities. In particular,

any failure to control the discharge of hazardous materials and wastes could

subject us to significant liabilities, which could adversely affect our

business, results of operations or financial condition.

We

and all our activities in the United States are subject to federal, state and

local environmental and safety laws and regulations, including but not limited

to, noise abatement and air emissions regulations, the Comprehensive

Environmental Response, Compensation and Liability Act of 1980, regulations

issued and laws enforced by the labor and employment departments of the U.S.

and the states in which we conduct business, the U.S. Department of Commerce,

the U.S. Environmental Protection Agency and by state and county health and

safety agencies. In France, we and all our activities are subject to state

environmental and safety regulations established by various departments of the

French Government, including the Ministry of Labor, the Ministry of Ecology and

the Ministry of Industry, and to local environmental and safety regulations and

administrative procedures established by DRIRE (Direction Régionale de

l’Industrie, de la Recherche et de l’Environnement) and the Préfecture des

Pyrénées Orientales. In Sweden, we and

all our activities are subject to various safety and environmental regulations,

including those established by the Work Environment Authority of Sweden in its

Work Environment Act. In addition, our

shooting operations in France and Sweden may be particularly vulnerable to

noise abatement regulations because these operations are primarily conducted

outdoors.

Changes

in, or compliance with, environmental and safety regulations could inhibit or

interrupt our operations, or require modifications to our facilities. Any

actual or alleged violations of environmental and safety laws could result in

restrictions or prohibitions on our facilities, substantial civil or criminal

sanctions, as well as the assessment of strict liability and/or joint and

several liability under applicable law.

Under certain environmental laws, we could be held responsible for all

of the costs relating to any contamination at our or our predecessor’s past or

present facilities and at third party waste disposal sites. We could also be held liable for any and all

consequences arising out of human exposure to hazardous substances or other

environmental damage. Accordingly,

environmental, health or safety matters may result in significant unanticipated

costs or liabilities.

The use of explosives subjects us to additional regulation,

and any accidents or injuries could subject us to significant liabilities.

Our

operations involve the detonation of large amounts of explosives. As a result, we are required to use specific

safety precautions under U.S. Occupational Safety and Health Administration

guidelines and guidelines of similar entities in France and Sweden. These include precautions which must be taken

to protect employees from exposure to sound and ground vibration or falling

debris associated with the detonation of explosives. There is a risk that an accident or death

could occur in one of our facilities.

Any accident could result in significant manufacturing delays,

disruption of operations or claims for damages resulting from death or

injuries, which could result in decreased sales and increased expenses. To

date, we have not incurred any significant delays, disruptions or claims

resulting from accidents at our facilities.

The potential liability resulting from any accident or death, to the

extent not covered by insurance, may require us to use other funds to satisfy

our obligations and could cause our business to suffer. See “ – Our use of explosives is an

inherently dangerous activity that could lead to temporary or permanent closure

of our shooting sites” below.

12

Our use of explosives is an

inherently dangerous activity that could lead to temporary or permanent closure

of our shooting sites.

We

use a large amount of explosives in connection with the creation of clad metals

and the shock synthesis of diamonds. The

use of explosives is an inherently dangerous activity. Explosions, even if occurring as intended,

can lead to damage to the shooting facility or to equipment used at the

facility or injury to persons at the facility. If a person were injured or

killed in connection with such explosives, or if equipment at the mine or

either of the outdoor locations were damaged or destroyed, we might be required

to suspend our operations for a period of time while an investigation is

undertaken or repairs are made. Such a

delay might impact our ability to meet the demand for our products. In addition, if the mine were seriously

damaged, we might not be able to locate a suitable replacement site to continue

our operations.

The

manufacture of industrial grade diamonds utilizing explosive shock synthesis

requires the use of a large quantity of explosives. Although this activity only represents

approximately 1% of revenues, we are required to provide this service pursuant

to a contractual relationship with the landlord of our shooting site in Dunbar,

Pennsylvania. While the production of

diamonds increases the risk of damage to the mine, we are required to continue

this activity, despite its low contribution to revenues.

Risk Factors Related to Dynamic Materials

Corporation

Our operating results fluctuate from quarter to quarter.

We

have experienced, and expect to continue to experience, fluctuations in annual

and quarterly operating results caused by various factors, including the timing

and size of orders by major customers, customer inventory levels, shifts in

product mix, acquisitions and divestitures, and general economic

conditions. The upstream oil and gas, oil refinery, petrochemicals,

hydrometallurgy, aluminum production, shipbuilding, power generation,

industrial refrigeration and other diversified industries to which we sell our

products are, to varying degrees, cyclical and tend to decline in response to

overall declines in industrial production. As a result, our business is also

cyclical, and the demand for our products by these customers depends, in part,

on overall levels of industrial production. Any future material weakness in

demand in any of these industries could materially reduce our revenues and

profitability. In addition, the threat of terrorism and other geopolitical

uncertainty could have a negative impact on the global economy, the industries

we serve and our operating results.

We

typically do not obtain long-term volume purchase contracts from our customers.

Quarterly sales and operating results, therefore, depend on the volume and

timing of backlogs as well as bookings received during the quarter. Significant

portions of our operating expenses are fixed, and planned expenditures are

based primarily on sales forecasts and product development programs. If sales

do not meet our expectations in any given period, the adverse impact on

operating results may be magnified by our inability to adjust operating

expenses sufficiently or quickly enough to compensate for such a shortfall.

Results of operations in any period should not be considered indicative of the

results to be expected for any future period. Fluctuations in operating results

may also result in fluctuations in the price of our common stock. See

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations.”

Customers

have the right to change orders until products are completed.

Customers have

the right to change orders after they have been placed. If orders are changed, the extra expenses

associated with the change will be passed on to the customer. However, because a change in an order may

delay completion of the project, recognition of income for the project may also

be delayed.

There is no assurance that we will continue to compete

successfully against other clad and welding companies.

Our

explosion-welded clad products compete with explosion-welded clad products made

by other manufacturers in the clad metal business located throughout the world

and with clad products manufactured using other technologies. Our combined

North American and European operations typically supply explosion-welded clad

to the worldwide market. There is one other well-known explosion-welded clad

supplier worldwide, a division of Asahi-Kasei Corporation of Japan. There are

also a number of smaller companies worldwide with explosion-welded clad

manufacturing capability, including several companies in China. There are

currently no other significant North American based explosion-welded clad

suppliers. We focus strongly on reliability, product quality, on-time delivery

performance, and low cost manufacturing to minimize the potential of future

competitive threats. However, there is no guarantee we will be able to maintain

our competitive position.

Explosion-welded

clad products also compete with those manufactured by rollbond and weld overlay

cladding processes. In rollbond technology, the clad and base metal are bonded

together during a hot rolling process in which slab is converted to plate. In

weld overlay, which is typically performed by our fabricator customers, the

cladding layer is deposited on the base metal through a fusion welding process.

The technical and commercial niches of each cladding

13

process are well understood within the

industry and vary from one world market location to another. Our products

compete with weld overlay clad products manufactured by a significant number of

our fabricator customers.

AMK

Welding competes principally with other domestic companies that provide welding

services to the aircraft engine and power generation industries. Some of these

competitors have established positions in the market and long standing

relationships with customers. To remain competitive, we must continue to

develop and provide technologically advanced welding, heat-treat and inspection

services, maintain quality levels, offer flexible delivery schedules, and

compete favorably on the basis of price. We compete against other welding

companies on the basis of quality, performance and cost. There can be no

assurance that we will continue to compete successfully against these

companies.

We are dependent on a relatively small number of customers

for a significant portion of our net sales.

A

significant portion of our net sales is derived from a relatively small number

of customers. We expect to continue to depend upon our principal customers for

a significant portion of our sales, although there can be no assurance that our

principal customers will continue to purchase products and services from us at current

levels, if at all. The loss of one or more major customers or a change in their

buying patterns could have a material adverse effect on our business, financial

condition and results of operations. In past years, the majority of DMC Clad’s

revenues have been derived from customers in the upstream oil and gas, oil

refinery, petrochemicals, hydrometallurgy, aluminum production, shipbuilding,

power generation and industrial refrigeration industries and the majority of

AMK Welding’s revenues have been derived from customers in the aircraft engine

and power generation industries. Economic downturns in these industries could

have a material adverse effect on our business, financial condition and results

of operations.

AMK

Welding, which contributes approximately 5% to our total sales, continues to

rely primarily on one customer for the majority of its sales. This customer and

AMK Welding have entered into a long-term supply agreement for certain of the

services provided to this customer. Any termination of or significant reduction

in AMK Welding’s business relationship with this customer could have a material

adverse effect on AMK Welding’s business and financial condition.

Failure to attract and retain key personnel could adversely

affect our current operations.

Our

continued success depends to a large extent upon the efforts and abilities of

key managerial and technical employees. The loss of services of certain of

these key personnel could have a material adverse effect on our business,

results of operations and financial condition. There can be no assurance that

we will be able to attract and retain such individuals on acceptable terms, if

at all, and the failure to do so could have a material adverse effect on our

business, financial condition and results of operations.

Work stoppages and other labor relations matters may make it

substantially more difficult or expensive for us to produce our products, which

could result in decreased sales or increased costs, either of which would

negatively impact our financial condition and results of operations.

We

are subject to the risk of work stoppages and other labor relations matters,

particularly in France and Sweden, where some of our employees are unionized.

The employees at our U.S. facility, where the majority of products are

manufactured, are not unionized. While we believe our relations with employees

are satisfactory, any prolonged work stoppage or strike at any one of our

principal facilities could have a negative impact on our business, financial

condition or results of operations. We most recently experienced a one-week

work stoppage in 2005 at our facility in France. This strike did not materially

impact operations, but we cannot assure you that a work stoppage at one or more

of our facilities will not materially impair our ability to operate our

business in the future.

The unsuccessful integration of a business we acquire could

have a material adverse effect on operating results.

We

continue to consider possible acquisitions as part of our growth strategy. Any

potential acquisition may require additional debt or equity financing,

resulting in additional leverage and dilution to existing stockholders. We

14

cannot assure you that any future acquisition

will be consummated, or that if consummated that we will be able to integrate

such acquisition successfully without a material adverse effect on our

financial condition or results of operations.

SNPE has a significant influence

on our company and could take actions that may not be consistent with the

desires of other stockholders.

As

of December 31, 2005, SNPE, Inc., an affiliate of Groupe SNPE of France,

controlled more than 50% of our outstanding common stock. SNPE has significant influence over our management

and affairs and matters requiring stockholder approval, including the election

of directors and approval of significant corporate transactions. This concentration of power may have the

effect of actions being taken or not taken according to the desires of SNPE.

SNPE has indicated that it is

exploring the sale of our common stock.

On

February 28, 2006, SNPE filed a Schedule 13D/A with the Securities and Exchange

Commission in which it stated that it was exploring the sale of up to all of

its shares of our common stock in an underwritten secondary offering, and that

it was evaluating the opportunity and has engaged in discussions with us and

potential underwriters in connection with such a sale. SNPE further disclosed that it intended to

relinquish control over us and fully liquidate its equity interest in

connection with such an offering. While

there can be no assurance that such a sale will occur, sales of substantial

amounts of our common stock in the open market, or the perception that those sales

could occur, could adversely affect prevailing market prices for our common

stock and could impair our ability to raise capital in the future through the

sale of our equity securities.

ITEM 1B. Unresolved Staff Comments

None.

15

ITEM 2. Properties

Our

corporate headquarters are located in Boulder, Colorado. The lease for the

office space is currently set to expire on February 28, 2010, with renewal

options through February 28, 2016.

We

own our principal domestic manufacturing site, which is located in Mount

Braddock, Pennsylvania. We currently lease our only domestic shooting site,

which is located in Dunbar, Pennsylvania. The shooting site in Dunbar

Pennsylvania supports our manufacturing facility in Mount Braddock,

Pennsylvania. The lease for the Dunbar property will expire on December 15,

2010, but we have options to renew the lease that extend through December 15,

2029. Our French subsidiary, Nobelclad, owns the land and the buildings housing

its operations in Rivesaltes, France and Tautavel, France (except for a small

portion in Tautavel that is leased). This lease expires on December 31, 2011

and may be extended. Our Swedish subsidiary, Nitro Metall, owns the land and

buildings housing its manufacturing operations in Likenas, Sweden. Both the

buildings and the land housing the Nitro Metall shooting site and sales office

in Likenas, Sweden and Filipstad, Sweden, respectively, are leased. The leases

in Filipstad are automatically renewed every year. The sites in Pennsylvania,

France and Sweden are part of the Explosive Metalworking segment. In addition,

we own the land and buildings housing the operations of AMK Welding in South

Windsor, Connecticut.

|

Location

|

|

Facility Type

|

|

Facility Size

|

|

Owned/Leased

|

|

Expiration Date of Lease

(if applicable)

|

|

Boulder,

Colorado

|

|

Corporate

and Sales Office

|

|

9,140

sq. ft.

|

|

Leased

|

|

February

28, 2010, with renewal options through February 28, 2016

|

|

Mt.

Braddock, Pennsylvania

|

|

Clad

Plate Manufacturing

|

|

48,000

sq. ft.

|

|

Owned

|

|

|

|

Dunbar,

Pennsylvania

|

|

Clad

Plate Shooting Site

|

|

322

acres

|

|

Leased

|

|

December

15, 2010, with renewal options through December 15, 2029

|

|

Rivesaltes,

France

|

|

Clad

Plate Manufacturing, Nobelclad Europe

Sales and Administration Office

|

|

53,000

sq. ft.

|

|

Owned

|

|

|

|

Tautavel,

France

|

|

Clad

Shooting Site

|

|

114

acres

|

|

107

acres owned,

7 acres leased

|

|

December

31, 2011

|

|

Likenas,

Sweden

|

|

Clad

Plate Manufacturing

|

|

26,000

sq. ft.

|

|

Owned

|

|

|

|

Likenas,

Sweden

|

|

Clad

Plate Shooting Site

|

|

15

acres

|

|

Leased

|

|

January

1, 2016

|

|

Filipstad,

Sweden

|

|

Nitro

Metall Sales Office

|

|

850

sq. ft.

|

|

Leased

|

|

January

1, 2007 (renews annually)

|

|

South

Windsor, Connecticut

|

|

AMK

Welding

|

|

21,000

sq. ft.

|

|

Owned

|

|

|

16

ITEM 3. Legal Proceedings

Although

we may in the future become a party to litigation, there are no pending legal

proceedings against us.

ITEM 4. Submission of Matters to a Vote of

Security Holders

No

matters were submitted to security holders for vote during the fourth quarter

of the fiscal year ended December 31, 2005.

17

PART II

ITEM 5. Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity Securities

Our

common stock is publicly traded on The Nasdaq Capital Market (“Nasdaq”) under

the symbol “BOOM.” The following table

sets forth quarterly high and low bid quotations for the common stock during

our last two fiscal years, as reported by Nasdaq, adjusted to give effect to

the 2-for-1 stock split effective October 13, 2005. The quotations reflect

inter-dealer prices, without retail mark-up, mark-down or commission, and may

not represent actual transactions.

|

|

|

High

|

|

Low

|

|

|

2006

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 1,

2006 to February 28, 2006

|

|

$

|

38.44

|

|

$

|

27.01

|

|

|

|

|

|

|

|

|

|

2005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First

Quarter

|

|

$

|

19.48

|

|

$

|

4.31

|

|

|

Second

Quarter

|

|

$

|

22.59

|

|

$

|

10.99

|

|

|

Third

Quarter

|

|

$

|

26.25

|

|

$

|

17.20

|

|

|

Fourth

Quarter

|

|

$

|

32.56

|

|

$

|

18.25

|

|

|

|

|

|

|

|

|

|

2004

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First

Quarter

|

|

$

|

1.77

|

|

$

|

1.40

|

|

|

Second Quarter

|

|

$

|

2.00

|

|

$

|

1.36

|

|

|

Third

Quarter

|

|

$

|

1.89

|

|

$

|

1.29

|

|

|

Fourth

Quarter

|

|

$

|

8.78

|

|

$

|

1.35

|

|

As

of February 28, 2006, there were approximately 345 holders of record of our common

stock.

We

did not declare dividends in 2004. We declared and paid a $0.10 per share

dividend in 2005. On February 23, 2006, we declared a dividend of $0.15 per

share of common stock payable on March 22, 2006 to stockholders of record on

March 10, 2006. We may pay annual dividends subject to capital availability and

periodic determinations that cash dividends are in the best interests of our

stockholders, but we cannot assure you that such payments will continue. Future

dividends may be affected by, among other items, our views on potential future

capital requirements, future business prospects, changes in federal income tax

law and any other factors that our Board of Directors deems relevant. Any

determination to pay cash dividends will be at the discretion of the Board of

Directors.

18

ITEM 6. Selected Financial Data

The

following selected financial data should be read in conjunction with the

Consolidated Financial Statements, including the related Notes, and

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations.”

(Dollars in Thousands, Except Per Share Data)

|

|

|

Year Ended December 31,

|

|

|

|

|

2005

|

|

2004

|

|

2003

|

|

2002

|

|

2001

|

|

|

Statement

of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

79,291

|

|

$

|

54,165

|

|

$

|

35,779

|

|

$

|

38,880

|

|

$

|

32,073

|

|

|

Cost of

products sold

|

|

55,856

|

|

40,559

|

|

26,802

|

|

26,673

|

|

22,474

|

|

|

Gross profit

|

|

23,435

|

|

13,606

|

|

8,977

|

|

12,207

|

|

9,599

|

|

|

Cost and

expenses

|

|

7,667

|

|

6,718

|

|

5,661

|

|

5,011

|

|

4,736

|

|

|

Income from

operations

|

|

15,768

|

|

6,888

|

|

3,316

|

|

7,196

|

|

4,863

|

|

|

Other

expense, net

|

|

163

|

|

524

|

|

527

|

|

742

|

|

849

|

|

|

Income

before income taxes

|

|

15,605

|

|

6,364

|

|

2,789

|

|

6,454

|

|

4,014

|

|

|

Income tax

provision

|

|

5,233

|

|

1,961

|

|

1,504

|

|

2,528

|

|

723

|

|

|

Income from

continuing operations

|

|

10,372

|

|

4,403

|

|

1,285

|

|

3,926

|

|

3,291

|

|

|

Discontinued operations, net of tax

|

|

—

|

|

(1,570

|

)

|

(1,993

|

)

|

(1,437

|

)

|

(503

|

)

|

|

Cumulative effect of change in accounting

principle, net of tax benefit of $1,482

|

|

—

|

|

—

|

|

—

|

|

(2,318

|

)

|

—

|

|

|

Net income

(loss)

|

|

$

|

10,372

|

|

$

|

2,833

|

|

$

|

(708

|

)

|

$