UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

MAY 10, 2023 8:30 a.m. Local Time

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021 |

NOTICE of Annual Meeting |

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | |

INTERNET Visit the website on your proxy card |

|

BY TELEPHONE Call the telephone number on your proxy card |

|

BY MAIL Sign, date and return your proxy card in the enclosed envelope |

|

IN PERSON Attend the annual meeting in Broomfield, Colorado See page 5 for instructions on how to attend |

|

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. | |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE FOLLOW THE INSTRUCTIONS PROVIDED TO YOU AND VOTE YOUR SHARES AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM SUCH RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

To the Stockholders of DMC Global Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of DMC Global Inc., a Delaware corporation, will be held on May 10, 2023, at 8:30 a.m. local time at 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021, for the following purposes:

| 1. | To elect the six director nominees identified in the accompanying proxy statement to hold office until the 2024 Annual Meeting of Stockholders; |

| 2. | To approve a non-binding, advisory vote on the compensation of our named executive officers; |

| 3. | To approve a non-binding, advisory vote on the frequency of advisory votes on executive compensation; |

| 4. | To approve an amendment to our Amended and Restated Certificate of Incorporation to allow officer exculpation; |

| 5. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| 6. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

The Board of Directors has fixed the close of business on March 16, 2023 as the record date for the determination of stockholders entitled to notice of, and to vote at, this Annual Meeting and at any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 10, 2023. Similar to last year, we will be using the “Notice and Access” method that allows companies to provide proxy materials to stockholders via the Internet. On or about March 28, 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials which contains specific instructions on how to access Annual Meeting materials via the Internet, as well as instructions on how to request paper copies. We believe this process should provide a convenient way to access your proxy materials and vote. The Proxy Statement and our annual report on Form 10-K for the fiscal year ended December 31, 2022 are available at www.investorvote.com/boom.

| By Order of the Board of Directors, | |

| |

| MICHELLE H. SHEPSTON | |

| Executive Vice President, Chief Legal | |

| March 28, 2023 | Officer and Secretary |

Table of Contents

2023 PROXY SUMMARY | |

| THIS SUMMARY HIGHLIGHTS AND SUPPLEMENTS INFORMATION CONTAINED ELSEWHERE IN THIS PROXY STATEMENT. THE SUMMARY DOES NOT CONTAIN ALL OF THE INFORMATION THAT YOU SHOULD CONSIDER AND THE ENTIRE PROXY STATEMENT SHOULD BE READ CAREFULLY BEFORE VOTING. |

| Time and Date | 8:30 a.m., May 10, 2023 | |

| Place | 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021 | |

| Record Date | March 16, 2023 |

| • | The election of the six director nominees identified in this proxy statement |

| • | An advisory vote on the compensation of our named executive officers |

| • | An advisory vote on the frequency of advisory votes on executive compensation |

| • | Approval of amendment to our Amended and Restated Certificate of Incorporation to allow officer exculpation |

| • | A ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for 2023 |

| • | Such other business as may properly come before the meeting |

| Proposal | Board Recommendation |

Page Reference (for more detail) | ||

| 1. Election of directors | FOR each Nominee | 8 | ||

| 2. Advisory vote on executive compensation | FOR | 22 | ||

| 3. Advisory vote on frequency of vote on executive compensation | EVERY YEAR | 23 | ||

| 4. Amendment to Amended and Restated Certificate of Incorporation | FOR | 24 | ||

| 5. Ratification of appointment of Ernst & Young LLP as auditor for 2023 | FOR | 26 |

DMC Global Inc.’s (“DMC”, “we”, “us”, “our”, or the “Company”) businesses demonstrated the strength of their operating models and differentiated products during 2022. Arcadia, DMC’s architectural building products business, reported sales of $299.5 million in 2022, up 25% from pro forma sales in the prior year. Sales at DynaEnergetics, DMC’s energy products business, increased 51% versus 2021 and benefitted from a continuing rebound in well-completion activity following the COVID-19-related collapse in energy demand during 2020. 2022 marked the first year in DynaEnergetics’ history that sales of its factory-assembled, performance-assured DynaStage perforating systems exceeded 1 million units. At NobelClad, DMC’s composite metals business, sales were up 6% year-over-year, with profitability that was comparable to 2021.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 1

On January 17, 2023, we announced the departure of Chief Executive Officer, Kevin Longe. Our Board of Directors (“Board”) appointed Michael Kuta, our then Chief Financial Officer, who has delayed his previously announced retirement, and former Chairman of the Board and director, David Aldous, as interim co-Presidents and Chief Executive Officers effective as of January 15, 2023. On February 28, 2023, Eric Walter became our Chief Financial Officer. Mr. Aldous, Mr. Kuta and Mr. Walter will oversee implementation of our strategy while a search for a permanent Chief Executive Officer occurs. Additionally, effective January 2, 2023, former Arcadia President, James Schladen retired from his position, and Arcadia appointed James Chilcoff as its new President.

In connection with these changes, our current leadership team is focused on four key near-term priorities: accelerating the integration and capacity expansion of Arcadia, strengthening the profitability of DynaEnergetics, achieving commercial success for new products introduced at NobelClad, and improving the Company’s overall cash flow through more effective working capital management and targeted cost reductions.

Several changes occurred at the Board level to support DMC through this transition. On January 15, 2023, Richard Graff assumed the role of Interim Chairman of the Board while Mr. Aldous serves in the Co-CEO role, and Ruth Dreessen has assumed the role of Chair of the Audit Committee, while Mr. Graff continues on the Audit Committee. Mr. Aldous continues as a director and member of the Risk Committee, but has stepped down from the Audit and Compensation Committees.

The Arcadia acquisition was a milestone transaction for DMC and aligns with our strategy of supporting innovative, asset-light manufacturing businesses that provide differentiated products and engineered solutions to niche segments of the construction, energy, industrial processing and transportation markets. The acquisition significantly increased DMC’s consolidated sales and total addressable market.

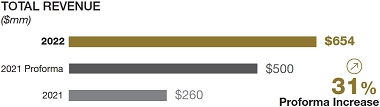

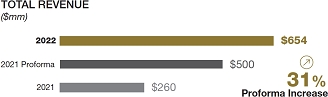

DMC’s consolidated sales increased 151% to $654.1 million from $260.1 million in 2021. Arcadia contributed $299.5 million of sales in 2022. On a pro forma basis, 2022 sales increased 31% versus 2021 sales of $500.5 million, inclusive of Arcadia. At DynaEnergetics, sales increased 51% to $264.3 million from $175.4 million in 2021. Improved oil and gas demand led to an increase in North American drilling and well-completion activity and higher unit sales of DynaEnergetics’ DS perforating systems. DynaEnergetics’ international sales also improved, increasing 35% compared with 2021. Sales at NobelClad increased 6% to $90.2 million from $84.8 million in 2021.

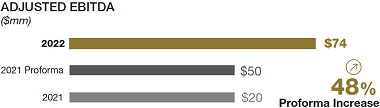

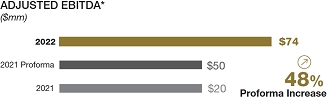

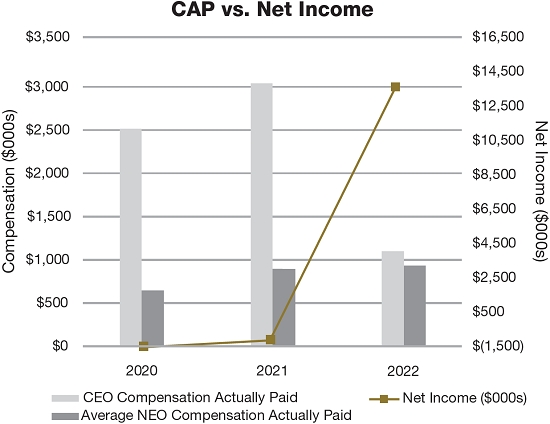

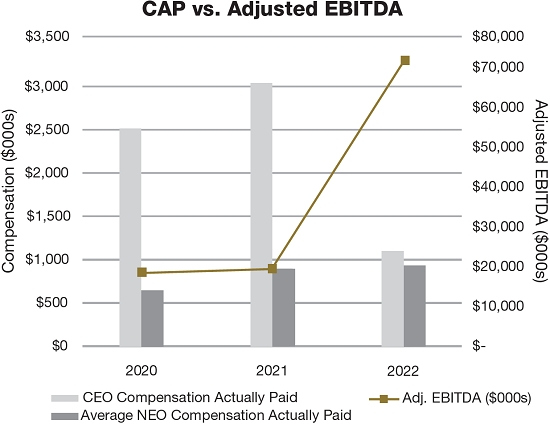

Full year Adjusted EBITDA* attributable to DMC was $74.2 million versus $20.2 million in 2021. Arcadia’s Adjusted EBITDA attributable to DMC was $28.2 million in 2022 versus pro forma Adjusted EBITDA of $30.0 million in 2021. At DynaEnergetics, Adjusted EBITDA was $46.9 million versus $16.4 million 2021; while NobelClad reported Adjusted EBITDA of $11.9 million versus $13.7 million in 2021.

During 2022, Arcadia weathered record-high increases in its input costs for aluminum, the business’s primary raw material. While gross margin performance was negatively impacted by higher input costs which outpaced the increase in net sales from higher average selling prices, we expect Arcadia profitability will improve incrementally throughout 2023. This expectation is driven by decreased volatility observed in input costs in the final months of 2022, as well as the subsequent shipment of a higher priced backlog.

Despite a highly competitive environment during 2022, DynaEnergetics grew its strong market position in North America. DynaEnergetics continued to invest in new technologies which are expected to result in new product innovations during 2023. DynaEnergetics also strengthened its organization with the addition of several key positions and improved manufacturing efficiency and quality at its North American production facilities.

NobelClad continued to pursue new applications for its composite metal plates. In the third quarter of 2021, it introduced DetaPipe™, a high-performance clad-metal pipe product designed for use in corrosive, high-temperature and high-pressure industrial-processing environments. DetaPipe is experiencing increased customer interest and is the result of several years of research and development, and management believes the new product offering will address a broad range of industrial processing applications including the production of monoethylene glycol, a key ingredient in polyester. NobelClad also experienced a significant increase in orders for its Cylindra™ cryogenic transition joints, which are used in liquified nature gas (LNG) processing equipment. We believe the LNG industry is positioned for growth over the near-term as countries strive for energy independence given the war in Ukraine.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 2

* Adjusted EBITDA is a non-GAAP (generally accepted accounting principles) financial measure used by management to measure operating performance and liquidity.

We define EBITDA as net income or loss plus or minus net interest, taxes, depreciation and amortization. Adjusted EBITDA excludes from EBITDA stock-based compensation, restructuring and impairment charges and, when appropriate, other items that management does not utilize in assessing DMC’s operating performance. As a result, internal management reports used during monthly operating reviews feature Adjusted EBITDA and certain management incentive awards are based, in part, on the amount of Adjusted EBITDA achieved during the year.

Adjusted EBITDA for a relevant fiscal year is the same as reported in the Company’s Form 10-K for that period. For a reconciliation of Adjusted EBITDA to the most directly comparable generally accepted accounting principle measure, refer to Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations from our Annual Report on Form 10-K for the year ended December 31, 2022.

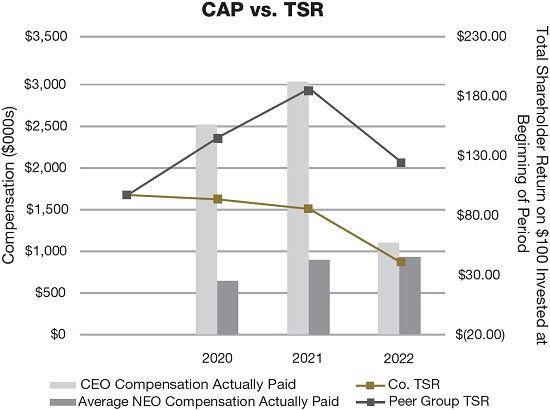

Our total stockholder return (“TSR”) relative to the compensation peer group identified below was lowest over one year, at the 6th percentile over three years and at the 33rd percentile over five years. We believe our December 2021 addition of Arcadia, a commercial and residential building products supplier, led to a transition in our shareholder base during 2022. Multiple large shareholders divested of all or a portion of their DMC shares during the year, and we believe some of these sales were made by energy-focused investors that originally purchased DMC shares based on the oil and gas-related product offerings of DynaEnergetics and NobelClad.

In late 2022, the Compensation Committee adopted a new peer group to better match the consolidated business of DMC and to include building products and a broader range of industrial infrastructure businesses. This peer group will be used for 2023 compensation decisions.

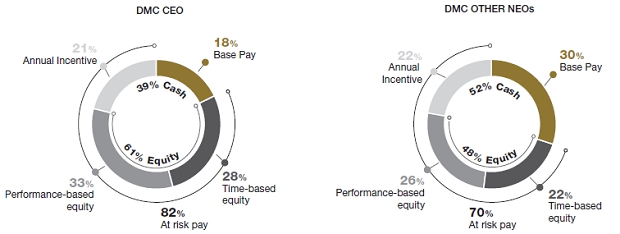

The following pay decisions were made in 2022:

| COMPENSATION ELEMENT | 2022 DESIGN PHILOSOPHY | ||

|

• The Compensation Committee increased salaries by an average of 6% for continuing NEOs. • Mr. Schladen’s compensation was agreed to as part of the Arcadia transaction |

• Changes to base salary consider level of responsibility and complexity of position, peer compensation levels, individual performance, market alignment and other factors | |

|

• No change in target award opportunities for continuing NEOS • Mr. Schladen’s compensation was agreed to as part of the Arcadia transaction • Based on our strong revenue and EBITDA performance, our Compensation Committee approved a payout of 121% of target for DMC executives |

• Target awards set as a percentage of salary for each NEO • Weightings and metrics: • 70% — Company Performance • 30% — Individual Performance • No payout on a metric if performance is below threshold; award capped at 180% of target

| |

|

• The Compensation Committee maintained grants for most continuing NEOs at levels approximating 2021 levels. Our Chief Legal Officer received an increase to more closely reflect market compensation • Mr. Schladen’s compensation was agreed to as part of the Arcadia transaction • PSUs issued in 2019 measuring the 2019-2021 period, vested at 3% of target

|

• Consists of time-based restricted stock or restricted stock units (RSUs) (one-half of target LTI value) and performance-based stock units (PSUs) (one-half of target LTI value) • Restricted stock or RSUs vest over 3-year period based on continued service • PSUs vest at end of 3-year period based on metrics set at time of grant • Actual awards can range from 0% to 200% of target award • Metrics: • Relative TSR (75%) • Adjusted EBITDA (25%) |

DMC GLOBAL INC. • 2023 PROXY STATEMENT 3

The Compensation Committee continually evaluates the Company’s compensation policies and practices to ensure that they are consistent with good governance principles. Below are highlights of our governance practices:

| WHAT WE DO | WHAT WE DON’T DO | |||

|

Provide the majority of compensation in performance-based pay |  |

No “single-trigger” change of control severance benefits | |

|

Maintain robust stock ownership requirements |  |

No hedging transactions or pledging of our common stock by directors, officers or employees | |

|

Maintain a clawback policy |  |

No evergreen provision in the equity incentive plan | |

|

Use an independent compensation consultant engaged by the Compensation Committee |  |

No liberal share recycling | |

|

Conduct annual compensation program risk assessment |  |

No liberal definition of change of control | |

|

Limit perquisites |  |

No defined benefit plans for executive officers | |

The Board of Directors gives significant weight to the advisory vote on executive compensation (say on pay) vote, as well as feedback from our stockholders, and responds accordingly. At the 2022 Annual Meeting of Stockholders, approximately 93.5% of stockholders supported our executive compensation program. Following the vote and throughout 2022, the Board and senior management team continued their regular cadence of communications with stockholders, engaging in over 75 in person and virtual meetings with investors during 2022, and no significant compensation matters were raised as a concern by investors. However, the Compensation Committee recognizes the ever-evolving compensation and governance landscape and will continue to review its practices and solicit stakeholder feedback on these issues.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 4

INFORMATION CONCERNING THE ANNUAL MEETING AND VOTING |

The Board of Directors (the “Board”) of DMC Global Inc., a Delaware corporation, is soliciting proxies for use at the Annual Meeting of Stockholders to be held on May 10, 2023, at 8:30 a.m., local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes described in this proxy statement and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021. On or about March 28, 2023, we will mail to all stockholders entitled to vote at the meeting a Notice of Internet Availability of Proxy Materials that contains specific instructions on how to access Annual Meeting materials via the Internet, as well as instructions on how to request paper copies. Unless the context otherwise requires, references to “the Company,” “DMC,” “we,” “us” or “our” refer to DMC Global Inc.

We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of the Notice of Internet Availability of Proxy Materials and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries, and custodians holding in their names shares of our common stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies via the Internet may be supplemented by mail, telephone, or personal solicitation by our directors, officers, or other regular employees. No additional compensation will be paid to directors, officers, or other regular employees for such services.

Only holders of record of common stock at the close of business on March 16, 2023, will be entitled to notice of and to vote at the Annual Meeting. At the close of business on March 16, 2023, we had 19,716,800 shares of common stock outstanding and entitled to vote. Each holder of record of common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

A majority of the outstanding shares of common stock entitled to vote represented in person or by proxy will constitute a quorum at the Annual Meeting. However, if a quorum is not represented at the Annual Meeting, the stockholders entitled to vote at the meeting, present in person or represented by proxy, have the power to adjourn the Annual Meeting from time to time, without notice other than by announcement at the Annual Meeting, until a quorum is present or represented. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the originally scheduled meeting.

Votes cast by proxy or in person will be counted by one or more persons appointed by us to act as inspectors (the “Election Inspectors”) for the Annual Meeting. The Election Inspectors will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. Abstentions will not have any effect on proposals 1, 2, 3 or 5, but will have the same effect as a vote “AGAINST” on proposal 4.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 5

Broker non-votes occur when a broker holding stock on behalf of a beneficial owner (in which case the stock is commonly referred to as being held “in street name”) lacks authority to vote the shares on some matters. Brokers are permitted to vote on “routine” proposals when they have not received voting instructions from the beneficial owner of the stock but are not permitted to vote on non-routine matters in the absence of such instructions. Proposal 5 relating to the ratification of the appointment of Ernst & Young LLP as our independent registered accounting firm for the fiscal year ending December 31, 2023 is considered “routine,” and there will therefore be no broker non-votes for such proposals. However, brokers will not be allowed to vote without instruction on proposals 1, 2, 3 or 4. The Election Inspectors will treat broker non-votes as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. Broker non-votes will have no effect on proposals 1, 2, 3 or 4.

We urge you to give voting instructions to your broker on all proposals.

Directors are elected by a plurality of the votes cast by the holders of shares entitled to vote in the election at a meeting at which a quorum is present; however, pursuant to our Majority Voting Policy, any director who fails to receive a majority of the votes cast (in person or by proxy) for such candidate is required to submit a letter of resignation to the Board. See “Majority Voting Policy” below. Proxies may not be voted for a greater number of persons than there are nominees.

The non-binding advisory vote on the compensation of our named executive officers is subject to approval by the affirmative vote of a majority of votes cast with respect to Proposal 2.

The frequency of non-binding advisory votes on executive compensation is subject to approval by the affirmative vote of a majority of votes cast with respect to Proposal 3. If none of the three alternatives receives such a vote, the Board will consider the alternative that receives the most votes to be the frequency recommended by stockholders.

The approval of the amendment to our Amended and Restated Certificate of Incorporation to allow exculpation of officers is subject to approval by the affirmative vote of holders of a majority in voting power of the outstanding shares of DMC common stock with respect to Proposal 4.

The ratification of our selection of Ernst & Young LLP as our independent registered public accounting firm will be subject to approval by the affirmative vote of a majority of votes cast with respect to Proposal 5.

If no direction is indicated on a proxy card, the shares will be voted FOR each of the proposals set forth in this proxy statement. The persons named in the proxies will have discretionary authority to vote all proxies with respect to additional matters that are properly presented for action at the Annual Meeting.

No action is proposed at the Annual Meeting for which the laws of the state of Delaware or our Bylaws provide a right of our stockholders to dissent and obtain appraisal of or payment for such stockholder’s common stock.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time prior to the Annual Meeting. It may be revoked by filing with our Corporate Secretary a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Stockholder of Record: If you are a stockholder of record, there are several ways for you to vote your shares, as follows:

| • | Via the Internet: If you received a Notice of Internet Availability of Proxy Materials, you can access our proxy materials and vote online. Instructions to vote online are provided in the Notice. |

| • | By Telephone: You may vote your shares by calling the telephone number specified on your proxy card. You will need to follow the instructions on your proxy card and the voice prompts. |

| • | By Written Proxy: If you have received or requested a paper copy of the proxy materials, please date and sign the proxy card and return it promptly in the accompanying envelope. |

| • | In Person: All stockholders of record may vote in person at the Annual Meeting. For those planning to attend in person, we also recommend submitting a proxy card or voting by telephone or via the Internet to ensure that your vote will be counted if you later decide not to attend the meeting. |

Beneficial Owner: If you are a beneficial owner, you should have received voting instructions from your broker, bank or other nominee. Beneficial owners must follow the voting instructions provided by their nominee in order to direct such broker, bank or other nominee as to how to vote their shares. The availability of telephone and Internet voting depends on the voting process of such broker, bank or nominee. Beneficial owners must obtain a legal proxy from their broker, bank or nominee prior to the Annual Meeting in order to vote in person.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 6

Proposals of stockholders that are intended to be presented at our 2024 Annual Meeting of Stockholders and to be included in our proxy materials for the meeting must be received by us no later than November 29, 2023, in order to be included in the proxy statement and proxy relating to that annual meeting.

Notice of any stockholder proposal to be considered at our 2024 Annual Meeting but not included in our proxy materials, must be submitted in writing and received by us in the manner set forth in our Bylaws. In general, the Bylaws provide that such a notice must be delivered not later than 90 days and not earlier than 120 days prior to the first anniversary of this year’s annual meeting date, or between January 11, 2024 and February 12, 2024.

If you have questions or need more information about the Annual Meeting, or if you wish to submit a question or question to be asked at the Annual Meeting, you may write to or call:

Corporate

Secretary

DMC Global Inc.

11800 Ridge Parkway, Suite 300

Broomfield, CO 80021

(303) 665-5700

corpsecretary@dmcglobal.com

You are also invited to visit the Company website at www.dmcglobal.com. The Company’s website materials are not incorporated by reference into this Proxy Statement.

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our near term priorities in 2023, expectations regarding new product innovations in 2023, expectations regarding application development in NobelClad and director compliance with our overboarding policy. Such statements are based on numerous assumptions regarding present and future business strategies, the markets in which we operate, anticipated costs and the ability to achieve goals. Forward-looking information and statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results and performance to be materially different from those expressed or implied by such forward-looking information and statements, including but not limited to the risks detailed from time to time in our SEC reports, including the annual report on Form 10-K for the year ended December 31, 2022. We do not undertake any obligation to release public revisions to any forward-looking statement, including, without limitation, to reflect events or circumstances after the date of this news release, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 7

PROPOSAL 1ELECTION OF DIRECTORS |

There are six nominees for election to the Board. Each director elected will hold office until the 2024 Annual Meeting, or until his or her successor is elected and qualified, or until such director’s earlier death, resignation, or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the six nominees named below. Each of the nominees has consented to be named as a nominee and to serve as a director if elected. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Corporate Governance and Nominating Committee of the Board may propose.

The names of the nominees and certain information about them are set forth below. In addition, we have included information about each nominee’s specific experience, qualifications, attributes and skills that led our Board of Directors to conclude that the nominee should serve as a director of the Company, in light of our business and corporate strategy.

| Name | Position | Age |

| David C. Aldous | Director, Co-President and Chief Executive Officer | 66 |

| Richard P. Graff | Director, Interim Chairman | 76 |

| Robert A. Cohen | Director | 74 |

| Ruth I. Dreessen | Director | 67 |

| Michael A. Kelly | Director | 66 |

| Clifton Peter Rose | Director | 72 |

|

Director since: 2013 Committees: • Risk |

DAVID C. ALDOUS

Skills and Qualifications • Current and practical experience in leadership of global operations, financial analysis, project management, risk management, and health, environment, safety and security matters • Over 35 years of corporate leadership experience in the energy, alternative energy, nanotechnology, chemical and petrochemical industries • Extensive skills in strategic planning and corporate development in the industries in which the Company and its customers operate

Mr. Aldous was appointed by the Board as a director in July 2013 and became Chairman in 2018 before becoming co-CEO on January 15, 2023. He has over 35 years of corporate leadership experience in the energy, alternative energy, chemical and petrochemical industries. Aldous previously served as Chief Executive Officer and Director of Rive Technology Inc., a privately held provider of solutions for diffusion-limited reactions to the refining, chemical, and petrochemical industries. Prior to joining Rive Technology in 2012, Aldous served as Chief Executive Officer and Director of Range Fuels Inc., a clean energy and biofuels company from 2009 to 2012. Aldous also spent more than 20 years employed by Royal Dutch Shell where he held the roles of Executive Vice President of Portfolio and Strategy, President of Shell Canada Products, and President and CEO of CRI/Criterion. Additionally, he served as Director and Chairman of several Shell joint ventures. Aldous holds a B.S. in fuels engineering from the University of Utah and an MBA with distinction from Northwestern University. |

DMC GLOBAL INC. • 2023 PROXY STATEMENT 8

|

Director since: 2007 Independent Committees: • Audit • Risk |

RICHARD P. GRAFF

Skills and Qualifications • Over 35 years of experience in public company accounting and consulting on public company accounting policy and practice in the mining industry • Substantial insight and experience with regard to accounting and financial reporting matters for companies operating internationally • Public company director experience since 2005, with current service on the boards of one other multinational public company Public Company Directorships: • Yamana Gold Inc.

Mr. Graff has served as a director since June 2007 and became interim Chairman of the Board on January 15, 2023. He is a retired partner of PricewaterhouseCoopers LLP, where he served as the audit leader in the United States for the mining industry until his retirement in 2001. Mr. Graff began his career with PricewaterhouseCoopers LLP in 1973. Since his retirement, Mr. Graff has been a consultant to the mining industry and was a member of a Financial Accounting Standards Board task force for establishing accounting and financial reporting guidance in the mining industry. He represents a consortium of international mining companies and has provided recommendations to the International Accounting Standards Board on mining industry issues and to regulators on industry disclosure requirements. Mr. Graff serves on the board of directors of Yamana Gold Inc. as a lead independent director and served as a director of Alacer Gold Corporation from 2008 to September 2020. He received his undergraduate degree in Economics from Boston College and his post-graduate degree in Accounting from Northeastern University. | |

Director since: 2011 Independent Committees: • Compensation (Chair) • Corporate Governance and Nominating |

ROBERT A. COHEN

Skills and Qualifications • Extensive financial background and management experience with multinational companies, bringing depth to the Board in the areas of strategic planning, finance and risk management • Served as Chief Executive Officer of one of the largest banks in Korea while living in Korea and working with many Korean and Asian companies • Substantial expertise in the Korean and Asian markets, which are key growth markets for NobelClad and DynaEnergetics

Mr. Cohen has served as a director since February 2011. He is the managing partner of Joranel LLC, a private investment and consulting firm serving institutional clients. Prior to joining Joranel in 2005, Mr. Cohen spent four years as president and Chief Executive Officer of Korea First Bank. From 1997 to 1999, he was vice Chairman and a member of the executive committee of Republic National Bank, and of its parent company RNB, publicly traded on The New York Stock Exchange (NYSE). Previously, Mr. Cohen worked for 25 years with Credit Lyonnais, including eight years as Chief Executive Officer of Credit Lyonnais USA. He taught economics and finance for 16 years at the Paris Institut Technique de Banque et Finance and the French School of Management (ESSEC). He is a graduate of Ecole Polytechnique in Paris and earned a doctorate in finance from the University Paris Dauphine. |

DMC GLOBAL INC. • 2023 PROXY STATEMENT 9

Director since: 2020 Independent Committees: • Audit (Chair) |

RUTH I. DREESSEN

Skills and Qualifications • Extensive financial and management background in investment banking and private equity firms in the chemical and energy industries • Substantial experience in financial analysis, finance and risk management and strategic planning • Over two decades of financial leadership experience in the chemical, energy and petrochemical industries Public Company Directorships: • Gevo, Inc.

Ms. Dreessen was appointed as a director in October 2020. She has more than 25 years of experience in financial leadership roles, specifically in the chemical industry. Ms. Dreessen currently serves on the board of directors of Gevo, Inc., a renewable technology, chemical products and advanced biofuels company, where she serves as a member of the Audit Committee and the Compensation Committee. Ms. Dreessen has also served as an Operating Partner of Triten Energy Partners, a private equity firm, since May 2020. From 2010 to December 2018, Ms. Dreessen served as Managing Director of Lion Chemical Partners, LLC, a private equity firm focused on chemical and related industries. Prior to joining Lion Chemical Partners, Ms. Dreessen served as the Executive Vice President and Chief Financial Officer of TPC Group Inc. from 2005 to 2010. Before joining TPC Group, Ms. Dreessen served as Senior Vice President, Chief Financial Officer and Director of Westlake Chemical Corporation. Previously she spent 21 years at J.P. Morgan Securities LLC and predecessor companies, ultimately as a Managing Director of chemicals investment banking. Ms. Dreessen received her undergraduate degree from the New College of Florida and holds a master’s degree in International Affairs from Columbia University. | |

Director since: 2020 Independent Committees: • Compensation • Corporate Governance and Nominating • Risk |

MICHAEL A. KELLY

Skills and Qualifications • Diversified background in finance, operations and the life sciences industry • Extensive skills in executive leadership, finance, operations and management • In depth experience with a multinational company operating in global markets Public Company Directorships: • Amicus Therapeutics • HOOKIPA Pharma, Inc. • NeoGenomics, Inc. • Prime Medicine, Inc.

Mr. Kelly was appointed as a director in July 2020. He has more than two decades of executive experience in senior leadership roles in the life sciences industry. He founded and has served as President of Sentry Hill Partners, LLC, a global life sciences transformation and management consulting business, since January 2018. Mr. Kelly worked in various capacities at Amgen, Inc. from 2003 to 2017, most recently as Senior Vice President, Global Business Services from July 2014 to July 2017, and as acting Chief Financial Officer from January to July 2014. Prior to his service at Amgen, he served as Chief Financial Officer of Tanox, Inc. (2000-2003), Vice President, Finance and Corporate Controller of Biogen, Inc. (1998-2000) and Vice President, Finance and Chief Financial Officer of Nutrasweet Kelco Company (1996-1998). He currently serves on the board of directors of HOOKIPA Pharma, Inc., Amicus Therapeutics, NeoGenomics, Inc. and Prime Medicine, Inc., which are each publicly-traded biopharmaceutical companies. Mr. Kelly holds a bachelor’s degree in Business Administration from Florida A&M University. |

DMC GLOBAL INC. • 2023 PROXY STATEMENT 10

Director since: 2016 Independent Committees: • Compensation • Corporate Governance and Nominating (Chair) |

CLIFTON PETER ROSE

Skills and Qualifications • Extensive work with world-leading financial, investment banking and strategic communications firms, which brings depth to the Board in the areas of strategic planning, leadership, risk management, public relations and corporate governance • Substantial experience reviewing and analyzing acquisitions and investments provides unique and valuable perspectives to the Board as it analyzes growth strategies and opportunities

Mr. Rose has served as a director since November 2016. He was a Senior Advisor to Blackstone, the world’s largest alternative asset manager from 2016 to 2022. From 2007 to 2016, he was a Senior Managing Director with Blackstone, and served as its global head of public affairs. Mr. Rose also spent 20 years with Goldman Sachs, where he was a managing director and held a variety of senior positions in government relations and media relations in Washington DC, New York and Hong Kong. Mr. Rose currently is a Senior Advisor to FGS Global, one of the leading strategic communications firms in the United States, Europe and Asia. He was also a Senior Advisor from 2021 to 2023 to The Change Company, a Community Development Financial Institution bringing banking, lending and financial services to Black, Latino and other under banked communities. From 1983 to 1987 he was chief of staff to Congressman Mike Synar (D-Okla) and a partner with the law firm of Williams and Jensen in Washington DC. Mr. Rose is a graduate of The George Washington University and The Yale Law School. He serves on the national board of the NAACP, the oldest and largest civil rights organization in the United States. He is also on the board of the Poetry Society of America. |

Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present; however, pursuant to our Majority Voting Policy, any director who fails to receive a majority of the votes cast (in person or by proxy) “FOR” such candidate is required to submit a letter of resignation to the Board. Abstentions and broker non-votes will not be counted as votes cast for purposes of this proposal and will have no legal effect on this proposal.

|

THE BOARD RECOMMENDS VOTE “FOR” EACH NAMED NOMINEE |

DMC GLOBAL INC. • 2023 PROXY STATEMENT 11

EXECUTIVE OFFICERS |

The following individuals serve as our executive officers. Each executive officer is appointed by the Board and serves at the pleasure of the Board, subject to the terms of applicable employment agreements or arrangements as described under “Employment Agreements.”

| Name | Position | Age |

| David C. Aldous | Co-President and Chief Executive Officer | 66 |

| Michael Kuta | Co-President and Chief Executive Officer | 48 |

| Eric Walter | Chief Financial Officer | 53 |

| Michelle Shepston | Executive Vice President, Chief Legal Officer and Secretary | 48 |

| James Chilcoff | President, Arcadia | 58 |

| Ian Grieves | President and Managing Director, DynaEnergetics | 54 |

| Antoine Nobili | President, NobelClad | 51 |

| Brett Seger | Chief Accounting Officer | 39 |

David C. Aldous. Information regarding Mr. Aldous, our co-President and Chief Executive Officer, is provided under Proposal 1 of this proxy statement under the caption, “Nominees.”

Michael Kuta. Mr. Kuta joined the Company on March 31, 2014 as our Chief Financial Officer and was appointed co-President and Chief Executive Officer on January 15, 2023. Prior to joining DMC, Kuta was Corporate Controller of the Lubrizol Corporation, a global specialty chemicals company owned by Berkshire Hathaway, where he was responsible for corporate accounting, consolidation and financial reporting functions, and oversight of internal controls. Prior to Berkshire Hathaway’s 2011 acquisition of Lubrizol, Kuta held a variety of financial roles at Lubrizol, where he gained extensive experience in business partnering, financial planning and analysis, treasury and capital markets, and leading finance and accounting organizations. Kuta also held several roles of increasing responsibility at other diversified manufacturing companies, including Lincoln Electric. He earned a bachelor’s degree in accounting from Kent State University and an MBA in finance from Case Western Reserve University. He also holds the Certified Public Accountant professional designation.

Michelle Shepston. Ms. Shepston serves as our Executive Vice President, Chief Legal Officer and Secretary, having previously served as Vice President, Chief Legal Officer and Secretary from her appointment in August 2016. She oversees our legal, compliance and human resources functions. Prior to joining the Company, Ms. Shepston was with Denver-based Davis Graham & Stubbs LLP, a leading regional law firm where she was a partner and practiced with the Corporate Finance and Acquisitions Group. Ms. Shepston brings to the Company expertise in corporate and securities law, mergers and acquisitions, equity and debt transactions, compliance, and corporate governance. She has advised public and private company boards on issues of fiduciary duty, risk management and oversight. She earned a J.D. from the University of Denver College of Law and a B.S. from the University of Illinois.

Eric Walter. Mr. Walter was named Chief Financial Officer of the Company on February 28, 2023, after serving as Senior Vice President of Finance since January 23, 2023. Prior to this role, Mr. Walter spent the past five years with Jacobs (NYSE: J), a $15 billion engineering and professional services firm. From 2020 to 2023, he was CFO of the People & Places Solutions business, Jacob’s largest division with annual revenue of $9 billion. Walter also led the creation of Jacobs’ financial planning and analysis organization, enhanced its management reporting processes and oversaw a global finance organization of more than 800 employees. Before joining Jacobs, Mr. Walter worked for 13 years in the industrial distribution sector, first at Unisource Worldwide, Inc. and later at Veritiv Corporation (NYSE: VRTV). While at these firms, Mr. Walter led a variety of financial functions including accounting, FP&A, treasury, shared services, and risk management. Prior to this experience, Mr. Walter worked at Arthur Andersen, Accenture, and a private equity-owned software company. Mr. Walter graduated with a BA in Accounting and Business Administration from Furman University and an MBA from Duke University. He also holds the Certified Public Accountant, Chartered Financial Analyst, and Certified Treasury Professional designations.

James Chilcoff. Mr. Chilcoff joined the Company on January 3, 2023 as the President of Arcadia Products, LLC (“Arcadia”). Mr. Chilcoff joined Arcadia from Mohawk Industries, the world’s largest flooring company, where he was president of Wood and Laminate North America from January 2020 to December 2022. Prior to joining Mohawk, Mr. Chilcoff was President and CEO of Parex USA, a global leader in façade finishing solutions for the construction industry from August 2014 to November 2020. Mr. Chilcoff holds a B.B.A. in Business from Eastern Michigan University and an M.B.A. from Xavier University – Williams College of Business.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 12

Ian Grieves. Mr. Grieves serves as President and Managing Director of DynaEnergetics, having previously served as Senior Vice President and General Manager of DynaEnergetics from his appointment in January 2013. From 2006 until joining the Company, Mr. Grieves was employed by Lydall Inc. as senior vice president of the company’s performance materials division (2010-2013), and as vice president and general manager Europe of the company’s filtration division (2006-2010). From 1995 to 2005, he was employed in various financial and general management positions with AAF International Inc., with his last position being that of vice president and general manager of AAF Europe (2003-2005). Mr. Grieves studied economics and graduated from the University of Sunderland, United Kingdom.

Antoine Nobili. Mr. Nobili was named president of NobelClad in July 2020. Previously, he spent 11 years as managing director of NobelClad’s European operations. He joined the business in 1995 as a research and development engineer. In 2000, he was promoted to product manager, and led the commercialization of NobelClad’s explosion-welded electrical transition joints (ETJs), which today are used extensively by the global aluminum smelting industry. He was named general manager of operations of NobelClad’s manufacturing facility in Rivesaltes, France in 2003. In 2009, he became managing director of the EMEA region (Europe, Middle-East and Africa), including NobelClad’s manufacturing operations in Germany. Mr. Nobili holds a Master of Business Administration from IFG – the French Institute for Business and Administration and a master’s degree in mechanical engineering from the National School of Engineers of Tarbes.

Brett Seger. Mr. Seger was named Chief Accounting Officer on March 1, 2023. He served as the Company’s Vice President of Finance Integration since January 2022, with the primary responsibility of managing the coordination of significant financial activities relating to the Company’s subsidiary Arcadia Products, LLC. Prior to joining the Company, Mr. Seger spent over a decade as an employee of Ernst & Young LLP, most recently as an Audit Senior Manager. Mr. Seger graduated with a B.S. in Accounting and an MBA from the University of Denver and also holds the Certified Public Accountant professional designation.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 13

BOARD OF DIRECTORS |

Directors are encouraged to attend our Annual Meeting of Stockholders. All of our directors then in office attended the 2022 Annual Meeting of Stockholders.

During the fiscal year ended December 31, 2022, the Board held seven meetings. During the fiscal year ended December 31, 2022, each of our directors attended more than 75% of the aggregate of (i) the number of meetings of the Board held during the period in which he or she was a director and (ii) the number of meetings of the committees on which he or she served.

The Board has determined that six of the seven current directors, Messrs. Graff, Cohen, Kelly and Rose and Mses. Bertone and Dreessen, are “independent” directors under the rules promulgated by the Securities and Exchange Commission (“SEC”) and the applicable rules of the Nasdaq. In making its determinations of independence, the Board considered factors for each director such as other directorships, employment or consulting arrangements, and any relationships with our customers or suppliers. The Board also considered a review of any transactions with entities associated with our directors or members of their immediate family.

The Board determined that there were no related-party transactions or other relationships that needed to be considered in evaluating whether these directors are independent. Mr. Aldous, our Co-President and Chief Executive Officer, is the only Board member nominated for re-election who is not independent based on these criteria.

All current members of the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee are independent directors. Our independent directors hold regularly scheduled meetings in executive session, at which only independent directors are present.

The Board does not have a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined. The Company currently separates the positions of Chairman and Chief Executive Officer. We currently have two Co-President and Chief Executive Officers on an interim basis and both executives are actively working with the Chairman of the Board. Our Chief Executive Officers are responsible for setting the strategic direction for the Company and the day to day leadership and performance of the Company, while our Chairman of the Board oversees the Board, approves Board agendas and schedules, facilitates communication between the Chief Executive Officers and the rest of the Board and provides guidance to the Chief Executive Officers.

We believe our Chief Executive Officers and Chairman have excellent working relationships that allows the Chief Executive Officers to focus the requisite time and energy on the Company’s businesses, people and growth opportunities.

Our Board currently has six independent members and only one non-independent member, David Aldous, a Co-Chief Executive Officer. A number of our independent Board members are currently serving or have served as senior management of other public companies and are currently serving or have served as directors of other public companies. We believe that the number of experienced, independent directors, along with the independent oversight of the Board by our non-executive Chairman, benefits the Company and our stockholders.

The Board assesses our Board leadership structure from time to time and makes changes when appropriate. We recognize that different board leadership structures are appropriate for companies in different situations. We believe the separation of Chairman and Chief Executive Officer roles is the optimal structure for the Company at this time.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 14

In accordance with Nasdaq Rule 5605(f), Nasdaq-listed companies (subject to certain exceptions) must have at least (i) one director who self-identifies as female and (ii) one director who self-identifies as Black or African American, Hispanic of Latinx, Native American or Alaskan Native, Native Hawaiian or Pacific Islander, two or more ethnicities, or as LGBTQ+. In the event a Nasdaq-listed company does not meet the above criteria, it must disclose why. Further, in accordance with Nasdaq Rule 5606, Nasdaq-listed companies, subject to certain exceptions, must disclose this statistical information in a uniform matrix format.

The table below provides certain highlights of the composition of our Board members as of December 31, 2022. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f).

| BOARD DIVERSITY MATRIX AS OF DECEMBER 31, 2022 | |||||||

| Board Size | |||||||

| Total Number of Directors | 8 | ||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | ||||

| Part I: Gender Identity | |||||||

| Directors | 2 | 6 | 0 | 0 | |||

| Part II: Demographic Background | |||||||

| African American or Black | 0 | 1 | 0 | 0 | |||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | |||

| Asian | 0 | 0 | 0 | 0 | |||

| Hispanic or Latinx | 1 | 0 | 0 | 0 | |||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | |||

| White | 1 | 5 | 0 | 0 | |||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | |||

| LGBTQ+ | 0 | 0 | 0 | 0 | |||

| Did Not Disclose Demographic Background | 0 | 0 | 0 | 0 | |||

DMC GLOBAL INC. • 2023 PROXY STATEMENT 15

The Board currently has an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee and a Risk Committee. Each committee operates under a written charter, which sets forth the functions and responsibilities of the committee. A copy of the charter of each committee can be viewed on our website, www.dmcglobal.com.

MEMBERS OF THE COMMITTEES OF THE BOARD OF DIRECTORS

| Audit Committee |

Compensation Committee |

Corporate Governance and Nominating Committee |

Risk Committee |

|||||

| INDEPENDENT DIRECTORS | ||||||||

| Andrea E. Bertone |  |

|

||||||

| Robert A. Cohen |  |

|

||||||

| Ruth I. Dreessen |  |

|||||||

| Richard P. Graff* |  |

|

||||||

| Michael A. Kelly |  |

|

|

|||||

| Clifton Peter Rose |  |

|

||||||

| NON-INDEPENDENT DIRECTORS | ||||||||

| David C. Aldous |  |

|

Member |  |

Chair * Interim Non-Executive Chairman |

The Audit Committee meets with our independent registered public accounting firm at least four times a year to review quarterly financial results and the annual audit, discuss financial statements and related disclosures, and receive and consider the accountants’ comments as to internal control over financial reporting, adequacy of staff and management performance and procedures in connection with the annual audit and internal control over financial reporting. The Audit Committee also appoints the independent registered public accounting firm. The Audit Committee currently consists of three directors, each of whom is a non-employee director that the Board has determined to be “independent” as that concept is defined in Section 10A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the rules promulgated by the SEC thereunder, and the applicable rules of the Nasdaq. The Audit Committee has determined that each of Ms. Dreessen and Mr. Graff qualifiy as an “audit committee financial expert” under the rules of the SEC.

The Charter of the Audit Committee requires the Audit Committee be comprised of three or more independent directors, at least one of whom qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC Regulation S-K. The Charter of the Audit Committee charges the Audit Committee with the primary responsibility of reviewing the Company’s compliance with the Code of Ethics and Business Conduct (“Code of Ethics”) as it relates to financial statement and reporting issues and related party transactions that would be required to be disclosed pursuant to Item 404 of SEC Regulation S-K.

During 2022 the Audit Committee met nine times.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 16

The Compensation Committee makes recommendations concerning salaries, incentive compensation and equity-based awards to employees and non-employee directors under our stock incentive plan and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The Compensation Committee is also responsible for reviewing and approving the Compensation Discussion and Analysis included in the Company’s proxy statement.

The Compensation Committee has authority to retain such compensation consultants, outside counsel and other advisors as the Compensation Committee in its sole discretion deems appropriate. The Compensation Committee is currently composed of three directors, each of whom is a non-employee director that the Board has determined to be “independent” under SEC and Nasdaq rules.

During 2022 the Compensation Committee met four times.

The Corporate Governance and Nominating Committee recommends director nominees and sets corporate governance policies for the Board and Company. The Corporate Governance and Nominating Committee currently has three directors, each of whom is a non-employee director that the Board has determined to be “independent” under the SEC and Nasdaq rules. The main purposes of this Committee are (i) to identify and recommend individuals to the Board for nomination as members of the Board and its committees; (ii) to develop and recommend to the Board corporate governance principles applicable to the Company; (iii) to oversee the Board’s annual evaluation of its performance; (iv) in coordination with the Audit Committee, review compliance with the Company’s Code of Ethics; and (v) to undertake such other duties as the Board may from time to time delegate to the Committee.

During 2022, the Corporate Governance and Nominating Committee met four times.

The Risk Committee (“Risk Committee”) is responsible for broad oversight of risk, with the primary purpose of assisting the Board with its oversight of the Company’s level of risk, risk assessment and risk management in areas not otherwise addressed by other committees of the Board. This includes review of the health, safety, environmental and sustainability practices and policies of the Company and controls around cybersecurity and cyber incident responses.

The Risk Committee is currently comprised of three non-employee directors whom the Board has determined are “independent” under SEC and Nasdaq rules, and Mr. Aldous, our Co-CEO.

The Risk Committee met four times during 2022.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 17

CORPORATE GOVERNANCE |

DMC is committed to sound principles of corporate governance. Our Board has adopted Corporate Governance Guidelines and other corporate governance policies that supplement certain provisions of our bylaws and relate to the composition, structure, interaction and operation of the Board of Directors. Our Board periodically, and at least annually, reviews and revises the Corporate Governance Guidelines and other policies, as appropriate, to ensure that they reflect our Board’s corporate governance objectives and commitments. Copies of our Corporate Governance Guidelines and other governance documents can be found on the “Board and Governance – Governance” page of the “Investors” section of our website at www.dmcglobal.com. You should review these documents for a complete understanding of these corporate governance practices, but some of the key elements of our strong governance policies and practices are summarized below:

We do not have any interlocking relationships between any director who currently serves or served during 2022 as a member of our Compensation Committee and any of our executive officers that would require disclosure under the applicable rules promulgated under the U.S. federal securities laws.

Our Corporate Governance Guidelines provide that directors should serve no longer than a total of 15 years as a non-employee director or after the director’s 75th birthday. This limitation was waived in 2022 for Mr. Graff due to the then-recent Arcadia acquisition and the desire for Mr. Graff’s extensive accounting expertise and relationship with Ernst & Young during the early stages of the integration of Arcadia. In light of the recent management changes, the unique challenges facing the Company and in order to provide continuity and stability to the Board, the Board has elected to waive the age limit for Mr. Graff in 2023. Mr. Graff is expected to continue as Interim Chairman of the Board and as a member of the Audit Committee through the Annual Meeting.

The Corporate Governance and Nominating Committee considers each director’s ability to dedicate sufficient time, energy and attention to the fulfillment of their duties when it nominates directors each year and when identifying leadership positions on our Board, including committee chairs. Additionally, on March 1, 2023, the Board revised our Corporate Governance Guidelines to reflect limits on board service. Our revised Corporate Governance Guidelines, which will be effective as of the date of the Annual Meeting, state that a director may not serve on the boards of more than four total public companies including the Board, unless the director is the chief executive officer of a public company, in which case the limit is two total boards. No member of the Audit Committee may serve on the audit committees of more than three total public companies, unless the Board determines that such service would not impair the ability of the director to effectively serve on the Audit Committee.

Any DMC directors not currently in compliance with our over-boarding policy have committed to being in compliance by the date of our Annual Meeting.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 18

The Board has adopted a majority voting policy (“the Majority Voting Policy”) as part of its Corporate Governance Guidelines. The policy stipulates that, at any stockholder meeting at which directors are subject to an uncontested election, if the number of shares “withheld” for any nominee exceeds the number of shares voted “FOR” such nominee, then, notwithstanding that such director was duly elected as a matter of corporate law, he or she shall submit to the Board a letter of resignation for consideration by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will consider such offer of resignation and will make a recommendation to the Board concerning the acceptance or rejection of the offer of resignation. In the event that all members of the Corporate Governance and Nominating Committee are among the nominees for director who are offering to resign, the Board shall appoint a special committee of one or more other independent directors to act on behalf of the Corporate Governance and Nominating Committee with respect to this policy. The Board shall act promptly with respect to each such letter of resignation and shall promptly notify the director concerned of its decision.

In order to monitor and improve its effectiveness, and to solicit and act upon feedback received, the Board engages in a formal self-evaluation process. The Board believes that in addition to serving as a tool to evaluate and improve performance, evaluations can serve several other purposes, including the promotion of good governance, integrity of financial reporting, reduction of risk, strengthening of the Board-management partnership, and helping set and oversee Board expectations of management. The Board takes a multi-year perspective to identify and evaluate trends and assure itself that areas identified for improvement are appropriately and timely addressed. As part of the Board’s evaluation process, directors consider various topics related to Board composition, structure, effectiveness and responsibilities and the overall mix of director skills, attributes, experience and backgrounds. While the Board conducts a formal evaluation annually, the Board considers its performance and that of its committees continuously throughout the year and shares feedback with management.

We have stock ownership guidelines applicable to our directors and named executive officers. For a description of these guidelines, please see “Compensation Discussion and Analysis- Stock Ownership Guidelines.”

We maintain an insider trading policy that applies to officers, directors and all other employees of, or consultants or contractors to, the Company. We believe that our insider trading policy helps protect our reputation for integrity and ethical conduct. The insider trading policy prohibits insider trading, tipping or engaging in short sales of DMC securities. Certain DMC associates are subject to blackout periods and pre-clearance requirements under the policy.

Our directors, officers and employees are prohibited from using any strategies or products (such as derivative securities or short-selling techniques) to hedge against potential changes in the value of DMC common stock. In addition, our directors, officers and employees are prohibited from holding DMC securities in a margin account or pledging DMC securities as collateral for a loan.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 19

We have adopted a Code of Ethics that applies to all members of our Board and all of our employees, including our principal executive officers, principal financial officer, principal accounting officer and all other senior members of our finance and accounting departments. We require all employees to adhere to our Code of Ethics in addressing legal and ethical issues encountered in conducting their work. Our Board periodically, and at least annually, reviews and revises our Code of Ethics, as appropriate. A copy of our Code of Ethics is available on our website, www.dmcglobal.com.

Our senior management manages the risks facing the Company under the oversight and supervision of the Board. The Company has a global Enterprise Risk Management (“ERM”) team, which is comprised of senior management in key business areas. The ERM team employs a proactive approach to reviewing and analyzing current and potential risks facing the Company and reports to the Board regarding the ERM process and risk findings on a quarterly basis. While the full Board is ultimately responsible for risk oversight at our Company, our Board committees assist the Board in fulfilling its oversight function in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the areas of financial reporting processes and internal controls around those processes (including cybersecurity related thereto), the Company’s compliance with legal and regulatory requirements and the financial risks of the Company. The Corporate Governance and Nominating Committee oversees governance matters, including primary oversight of the Code of Ethics and Business Conduct. The Compensation Committee oversees the Company’s executive compensation strategy and programs, incentive compensation arrangements and the evaluation of risks related thereto. The Risk Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of the Company’s level of risk, risk assessment and risk management in areas not otherwise addressed by other committees of the Board. Other general business risks such as economic and regulatory risks are monitored by the full Board. The Board and Committees use outside resources to assist them in analyzing and monitoring certain risks, such as cybersecurity, in order to supplement the expertise and experience of the directors and management.

Our Compensation Committee, with the assistance of management, reviews on an annual basis our compensation programs and considers whether they encourage excessive risk-taking by employees at the expense of long-term Company value. The Compensation Committee believes that the design of our compensation program, which includes a mix of annual and long-term incentives (a substantial portion of which are performance based) and cash and equity awards, along with our stock ownership guidelines and clawback policy, provide an appropriate balance between risk and reward and do not motivate imprudent risk-taking. As a result, we do not believe that our compensation policies are reasonably likely to have a material adverse effect on the Company.

The Company does not have a formal policy regarding the consideration of director candidates recommended by stockholders; however, the Corporate Governance and Nominating Committee reviews recommendations and evaluates nominations received from stockholders in the same manner that potential nominees recommended by Board members, management or other parties are evaluated. Any stockholder nominations proposed for Board consideration should include the nominee’s name and qualifications for Board membership and should be mailed to DMC Global Inc., c/o Corporate Secretary, 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021.

Qualifications for consideration as a director nominee may vary according to the particular area of expertise being sought as a complement to the existing Board composition. However, in making its nominations, the Corporate Governance and Nominating Committee considers, among other things, an individual’s skills, attributes and functional, business and industry experience, financial background, breadth of knowledge about issues affecting our business, integrity, independence, diversity of experience, leadership, ability to exercise sound and ethical business judgment and time available for meetings and consultation. Using our director skills matrix as a guide, as well as the results of our annual Board and committee self-assessment process, the Nominating and Corporate Governance Committee evaluates the composition of our Board annually and identifies, for consideration by the full Board, areas of expertise and other qualities that would complement and enhance our current Board. The diverse set of core competencies represented on our current Board is summarized below:

DMC GLOBAL INC. • 2023 PROXY STATEMENT 20

| Director Nominees | Aldous | Bertone | Cohen | Dreessen | Graff | Kelly | Rose | |||||||

| Key Skills & Experience | ||||||||||||||

| Public Company Director (Other than DMC) |  |  |  |  |  |  |  | |||||||

| Executive Leadership |  |  |  |  |  |  |  | |||||||

| Industry Background |  |  |  |  |  |  |  | |||||||

| Financial Literacy/Accounting |  |  |  |  |  |  |  | |||||||

| Environmental, Social & Governance |  |  |  |  |  |  |  | |||||||

| Risk Management |  |  |  |  |  |  |  | |||||||

| Manufacturing |  |  |  |  |  |  |  | |||||||

| Finance/Capital Markets |  |  |  |  |  |  |  | |||||||

| Government, Legel, or Regulatory |  |  |  |  |  |  |  | |||||||

| Humen Capital Management/Executive Compensation |  |  |  |  |  |  |  | |||||||

| International |  |  |  |  |  |  |  | |||||||

| Mergers, Divestures & Acquisitions |  |  |  |  |  |  |  | |||||||

| Technology/Innovation |  |  |  |  |  |  |  | |||||||

| Cybersecurity |  |  |  |  |  |  |  |

Diversity along multiple dimensions is an important element of the Corporate Governance and Nominating Committee’s consideration of nominees. While diversity is evaluated in a broad sense based on experience, background and viewpoint, the Corporate Governance and Nominating Committee recognizes that DMC serves diverse communities and customers and believes that the composition of our Board should appropriately reflect this diversity. Accordingly, the Corporate Governance and Nominating Committee also considers other aspects of diversity, including gender, race and ethnicity. The Corporate Governance and Nominating Committee is committed to seeking highly qualified women and individuals from minority groups to include in the pool of nominees and instructs any third-party search firm to consider these elements accordingly.

For new nominees, the Corporate Governance and Nominating Committee may also consider the results of the nominee’s interviews with directors and/or other members of senior management as the Corporate Governance and Nominating Committee deems appropriate.

The Board believes that it is important for stockholders to have a process to send communications to the Board. Accordingly, stockholders desiring to send a communication to the Board, or to a specific director, may do so by delivering a letter to our Secretary at DMC Global Inc., c/o Corporate Secretary, 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” All such letters must identify the author as a stockholder and clearly state whether the intended recipients of the letter are all members of the Board or specified individual directors. The Secretary will open such communications and make copies and then circulate them to the appropriate director or directors.

DMC GLOBAL INC. • 2023 PROXY STATEMENT 21

PROPOSAL 2NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

Our Board of Directors recognizes stockholders’ interest in our executive compensation program. Pursuant to Section 14A of the Exchange Act and SEC Rule 14a-2(a), we are providing our stockholders the opportunity to vote on a non-binding advisory resolution to approve the compensation of our named executive officers (“Say on Pay”) which is described in this Proxy Statement. Currently, we are providing these advisory votes on an annual basis. In considering your vote on this proposal, we encourage you to review all of the relevant information in this proxy statement, including the Compensation Discussion and Analysis, the compensation tables, and the rest of the narrative disclosures regarding our compensation arrangements.

The Company continued its focus on safety, operational excellence, and the integration of Arcadia in 2022. In considering our executive compensation program for fiscal 2022, we believe it is important to view the Compensation Committee’s decision-making against the backdrop of our 2022 business and financial performance, the performance of our executives and the pay practices of the companies with whom we compete for talent. We have structured our core compensation principles and practices to align executive compensation with the interests of our stockholders and to avoid certain compensation practices that do not serve our stockholders’ interests. We continue to evaluate and modify these principles and practices as necessary in order to achieve these objectives. We believe our executive compensation program has been designed and executed to satisfy these objectives, and that our compensation program is worthy of stockholder support.

Following the 2023 Annual Meeting, the next advisory vote on our executive compensation is anticipated to be at our 2024 Annual Meeting of Stockholders, subject to the resolution of the non-binding, advisory vote in Proposal 3 below.

Our Board strongly endorses the Company’s executive compensation program and recommends that stockholders vote in favor of the following advisory resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in the Company’s proxy statement is hereby APPROVED.”

The advisory vote on the compensation of our named executive officers will be approved by the majority of votes cast on this proposal. Abstentions and broker non-votes will not be counted as votes cast on the proposal. Our Board and our Compensation Committee value the opinions of our stockholders and will consider the outcome of the vote when considering future decisions on the compensation of our named executive officers. However, this say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board.

|

THE BOARD RECOMMENDS VOTE “FOR” APPROVAL OF PROPOSAL 2. |

DMC GLOBAL INC. • 2023 PROXY STATEMENT 22

|

As described in Proposal 2 above, in accordance with the requirements of Section 14A of the Exchange Act and the related rules of the SEC, our stockholders have the opportunity to cast an advisory vote to approve the compensation of our named executive officers. This Proposal 3 affords our stockholders the opportunity to vote, on a non-binding advisory basis, on how frequently we should seek an advisory vote on the compensation of our named executive officers, such as Proposal 2 above. The enclosed proxy card gives our stockholders three choices for voting on this Proposal 3. You can choose whether the say-on-pay vote should be conducted every year, every two years, or every three years.

The results of our advisory vote on the frequency of say-on-pay proposals in 2017 resulted in stockholders favoring a say-on-pay vote on an annual basis, and we have elected to present our say-on-pay proposals on that basis. Our Board has discussed and carefully considered the alternatives regarding the frequency of say-on-pay proposals and believes that continuing annual advisory votes on executive compensation is appropriate for us and our stockholders at this time.

When you vote in response to the resolution below, you may cast your vote on your preferred voting frequency by choosing among the following three options: every year, every two years, or every three years.